Market Definition

Automotive plastics are lightweight, durable polymer-based materials used in the manufacturing of various components in vehicles. These materials are engineered to meet a range of mechanical, thermal, and chemical requirements across interior, exterior, and under-the-hood applications.

The market includes plastics such as polypropylene (PP), polyurethane (PU), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), and others. These materials are utilized across different vehicle types including passenger cars, light commercial vehicles (LCVs), and medium & heavy commercial vehicles (M&HCVs).

Their low density helps reduce overall vehicle weight, contributing to better fuel economy and lower emissions. Automotive plastics provide design flexibility, enabling complex shapes and integrated parts that simplify assembly.

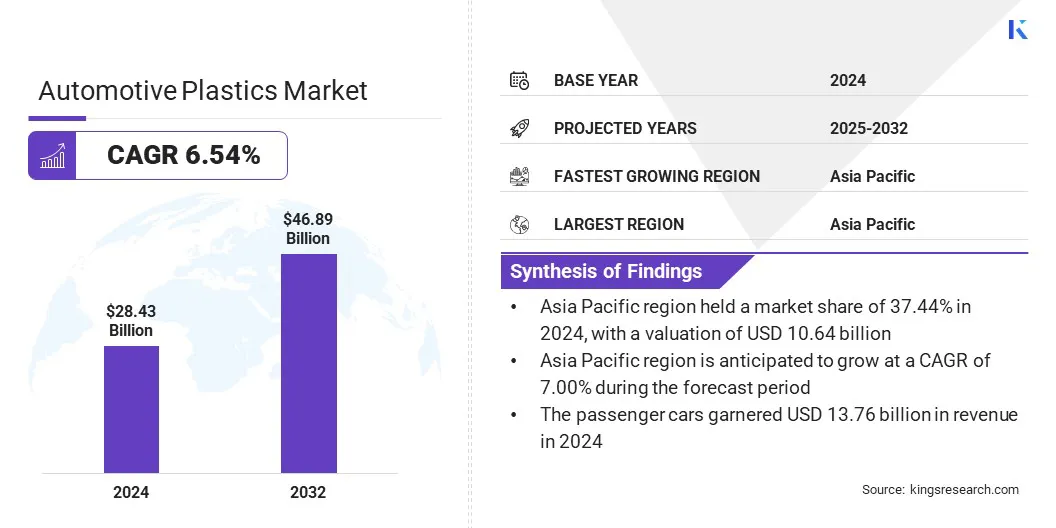

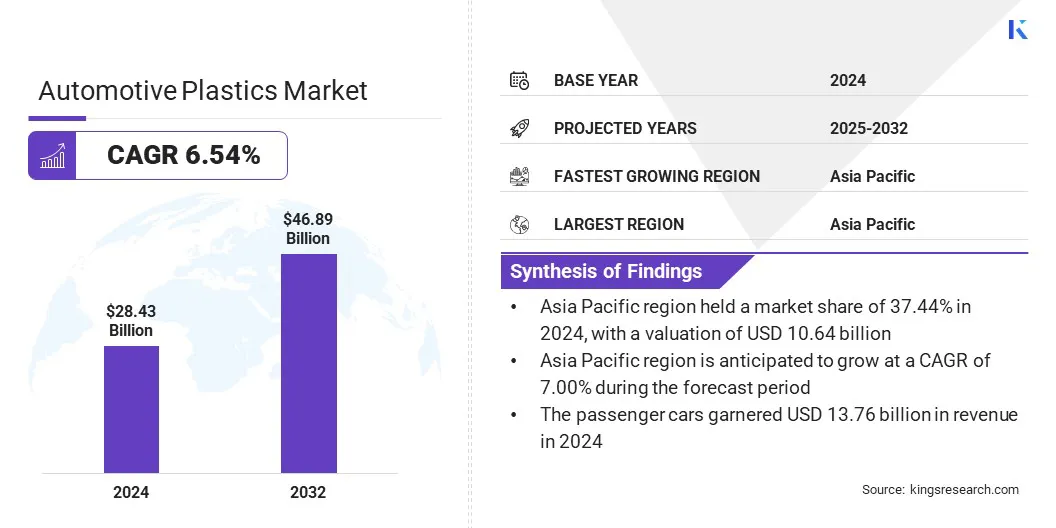

The global automotive plastics market size was valued at USD 28.43 billion in 2024 and is projected to grow from USD 30.09 billion in 2025 to USD 46.89 billion by 2032, exhibiting a CAGR of 6.54% during the forecast period.

This growth is attributed to the increasing adoption of EVs, which require lightweight materials to improve energy efficiency and extend driving range. The market is also witnessing a shift toward plastics circularity, as manufacturers focus on using recycled and sustainable polymers in automotive production.

Key Market Highlights:

- The automotive plastics industry size was valued at USD 28.43 billion in 2024.

- The market is projected to grow at a CAGR of 6.54% from 2025 to 2032.

- Asia Pacific held a market share of 37.44% in 2024, with a valuation of USD 10.64 billion.

- The polypropylene (PP) segment garnered USD 10.52 billion in revenue in 2024.

- The passenger cars segment is expected to reach USD 24.38 billion by 2032.

- The interior furnishings segment is expected to reach USD 16.22 billion by 2032.

- The market in North America is anticipated to grow at a CAGR of 6.77% during the forecast period.

Major companies operating in the automotive plastics market are Covestro AG, Krauss Plastics Inc., Sunshine Industries, ElringKlinger AG, Veejay Plastic Injection Molding Company, Wabash Plastics, Incorporated, Knauf Industries, Advanced Plastiform, Inc., Celanese Corporation, VEM Tooling Co. Ltd., Plastics Plus Technology, Inc., TORAY INDUSTRIES, INC., Varroc Group, SABIC, and AKF Plastics.

Automotive Plastics Market Report Scope

|

Segmentation

|

Details

|

|

By Type

|

Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), Others

|

|

By Vehicle Type

|

Passenger Cars, Light Commercial Vehicles (LCVs), Medium & Heavy Commercial Vehicles (M&HCVs)

|

|

By Application

|

Interior Furnishings, Electrical Components, Chassis, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Automotive Plastics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific accounted for a market share of 37.44% in 2024, with a valuation of USD 10.64 billion. The dominance is attributed to the high volume of vehicle production across countries such as China, India, Japan, and South Korea, which drives large-scale demand for lightweight materials.

Strong partnerships between automakers and material suppliers, along with continuous technological advancements in polymer engineering and recycling, are supporting the adoption of automotive plastics across the region.

- In October 2024, Kia Corporation launched the world’s first car accessory made using recycled plastic from the Great Pacific Garbage Patch. This initiative, developed in partnership with The Ocean Cleanup, resulted in a limited-edition trunk liner for the Kia EV3. The project reflects Kia’s focus on sustainable mobility and commitment to circular resource systems.

The market in North America is poised to grow at a significant CAGR of 6.77% over the forecast period. This is attributed to the rising production and adoption of Electric Vehicles (EVs), which require high-performance plastics to reduce weight and enhance energy efficiency.

Additionally, supportive regulations and investments in advanced plastic components for next-generation vehicle platforms are contributing to the regional market growth. This strong focus on electrification and material innovation positions North America as the fastest-growing region in the market.

Automotive Plastics Market Overview

The market is propelled by the adoption of horizontal recycling technology, which allows automotive plastics to be reused in similar applications without compromising quality.

This method enables closed-loop production by converting end-of-life vehicle (ELV) plastics into new components within the same product category. Manufacturers are implementing this approach to reduce reliance on virgin materials and improve resource efficiency.

- In May 2025, Toyoda Gosei Co., Ltd. launched a horizontal recycling technology to produce high-quality recycled plastic from ELVs. The development, in collaboration with Isono Co., Ltd., enables the use of 50% ELV polypropylene in interior parts such as glove boxes while maintaining performance equivalent to new materials.

Market Driver

Growing Adoption of EVs

The market is driven by the increasing adoption of EVs, as these vehicles require lightweight materials to extend driving range and optimize battery efficiency. Automakers are replacing metal components with plastics to reduce vehicle weight and improve battery performance.

Lightweight plastics help extend driving range, support thermal management, and enable flexible design integration in electric models. Growing production and adoption of EVs globally continues to raise the demand for advanced automotive plastic solutions.

- In May 2025, the International Energy Agency (IEA) reported that electric car sales exceeded 17 million globally in 2024, achieving a market share of over 20%. The additional 3.5 million units sold in 2024, compared to the previous year, surpassed the total global electric car sales recorded in 2020. In 2025, electric car sales are expected to surpass 20 million, accounting for over a quarter of all cars sold globally.

Market Challenge

Low Heat Resistance

A major challenge in the automotive plastics market is the limited heat resistance of certain polymers used in vehicle components. High temperatures in engine compartments and powertrain systems can cause thermal degradation, leading to reduced performance and safety concerns.

This limitation prevents the wider use of plastics in critical applications, increasing dependence on heavier metal parts. Manufacturers are developing heat-resistant polymer formulations with improved thermal stability. Research and development efforts focus on enhancing material properties to support lightweight design without compromising performance.

Automotive Plastics Market Trends to watch in 2025

Shift Toward Plastics Circularity

The market is registering a shift toward plastics circularity as manufacturers adopt sustainable production methods. Companies are replacing virgin materials with recycled and recyclable plastics to reduce environmental impact. Closed-loop systems are being implemented to recover and reuse plastics from ELVs.

Chemical recycling technologies are converting discarded plastics into high-quality inputs for new components. This shift supports compliance with environmental regulations and contributes to sustainability goals across the automotive sector.

- In February 2025, the Global Impact Coalition (GIC) launched the world’s first Automotive Plastics Circularity pilot in collaboration with BASF, LG Chem, LyondellBasell, Covestro, Mitsubishi Chemical Group, SUEZ, SABIC, and Syensqo. The initiative aims to recycle plastics from ELVs and transform over 800,000 metric tons of annual ELV plastic waste in the EU into closed-loop recycled materials.

Market Segmentation:

- By Type (Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), and Others): The polypropylene (PP) segment earned USD 10.52 billion in 2024, due to its high impact resistance, low cost, and wide use in automotive interiors and exteriors.

- By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), and Medium & Heavy Commercial Vehicles (M&HCVs)): The passenger cars segment held 48.41% share of the market in 2024, due to rising vehicle production and increased use of lightweight plastics for fuel efficiency.

- By Application (Interior Furnishings, Electrical Components, Chassis, and Others): The interior furnishings segment is projected to reach USD 16.22 billion by 2032, owing to the growing demand for enhanced cabin esthetics and comfort features.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates automotive plastics through the Clean Air Act and Toxic Substances Control Act (TSCA), focusing on emissions, chemical safety, and recyclability.

- In Europe, the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation and the End-of-Life Vehicles (ELV) Directive guide the use, labeling, and recyclability of plastics in vehicles.

- In India, the Central Pollution Control Board (CPCB) regulates plastic use in vehicles under the Plastic Waste Management Rules and promotes recyclability through the Automotive Industry Standards (AIS-129).

Competitive Landscape

Key players in the global automotive plastics market are focusing on strategic initiatives to expand their presence and support sustainable production. Leading manufacturers are entering new ventures through joint development agreements and technology partnerships aimed at producing advanced lightweight materials for automotive applications.

These efforts are enhancing product portfolios and supporting compliance with evolving safety and efficiency standards. Several companies are investing in fossil-free plastics production by integrating bio-based feedstocks and renewable energy into their operations.

Major investments are being directed toward chemical recycling technologies to convert used plastics into high-quality raw materials. Additionally, the dedicated recycling systems are being established to enable closed-loop production and reduce landfill dependency. These strategies are helping improve environmental performance while maintaining material reliability in vehicle systems.

- In September 2024, A.P. Moller Holding launched Vioneo, a new venture focused on manufacturing fossil-free polypropylene and polyethylene using green methanol. The initiative aims to reduce the carbon footprint of plastics production through a fully traceable, ISCC Plus certified supply chain powered by renewable electricity.

Key Companies in Automotive Plastics Market:

- Covestro AG

- Krauss Plastics Inc.

- Sunshine Industries

- ElringKlinger AG

- Veejay Plastic Injection Molding Company

- Wabash Plastics, Incorporated

- Knauf Industries

- Advanced Plastiform, Inc.

- Celanese Corporation

- VEM Tooling Co. Ltd.

- Plastics Plus Technology, Inc.

- TORAY INDUSTRIES, INC.

- Varroc Group

- SABIC

- AKF Plastics

Recent Developments (Product Launch)

- In June 2024, Borealis introduced Borcycle GD3600SY, a glass-fiber reinforced polypropylene compound containing 65% post-consumer recycled content. The material will be used in center console carriers for the new Peugeot 3008, developed in partnership with Plastivaloire and Stellantis. The launch supports upcoming EU ELV regulations and advances circularity in automotive plastics.