Automotive Ignition Coil Market Size

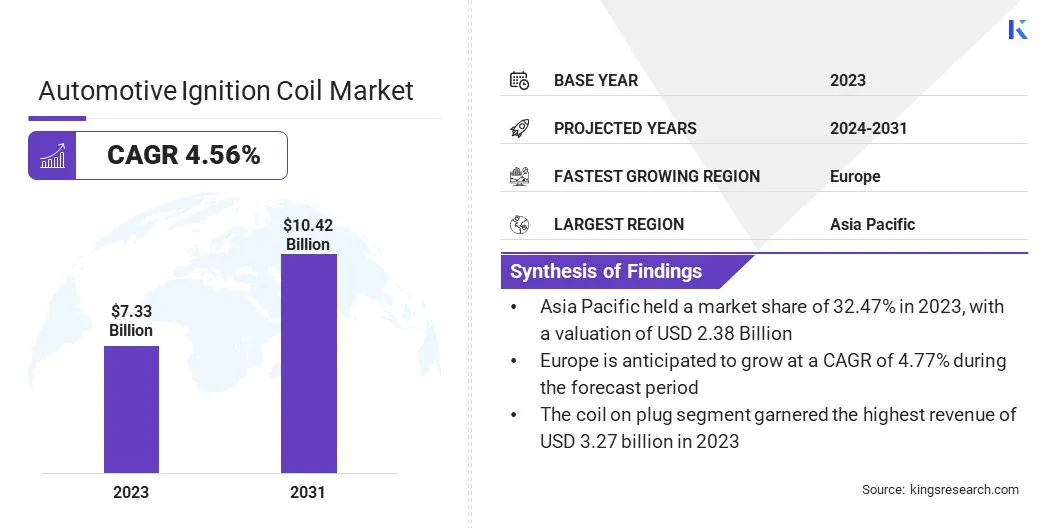

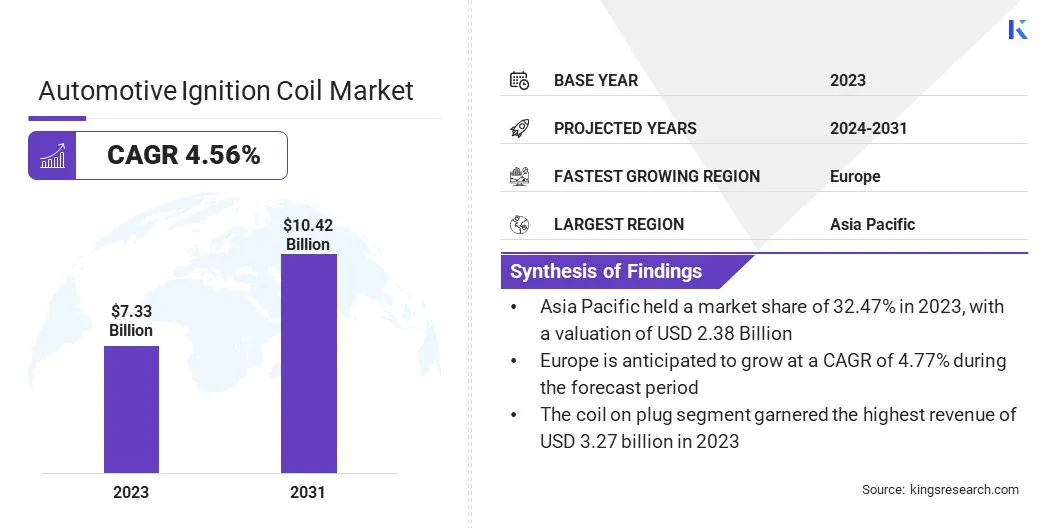

The global Automotive Ignition Coil Market size was valued at USD 7.33 billion in 2023 and is projected to grow from USD 7.63 billion in 2024 to USD 10.42 billion by 2031, exhibiting a CAGR of 4.56% during the forecast period.

In the scope of work, the report includes solutions offered by companies such as BorgWarner Inc., Diamond Electric, MFG, Eldor Corporation, HELLA GmbH & Co. KGaA, Hitachi Astemo Americas, Inc., Niterra North America, Inc., Robert Bosch LLC, Taiwan Ignition System Co., Ltd., FD JAPAN CO., LTD., DENSO CORPORATION., and others.

- The growth of themarket is propelled by several key factors, including increasing global vehicle production, rising demand for fuel-efficient vehicles, and advancements in ignition system technologies.

Additionally, stringent government regulations regarding emissions and fuel efficiency standards are driving the adoption of efficient ignition systems, thereby boosting market growth. Moreover, the growing trend of vehicle electrification and the shift towards electric and hybrid vehicles are contributing significantly to the rising demand for ignition coils in the automotive sector.

The automotive ignition coil market is observing steady growth, driven by various factors such as technological advancements, regulatory mandates, and shifting consumer preferences toward eco-friendly vehicles. The automotive industry is witnessing a surge in electrification efforts, resulting in the increased demand for efficient ignition systems, including ignition coils.

The market is witnessing intense competition among key players who are striving to offer innovative solutions that enhance vehicle performance while meeting stringent emission standards, thereby shaping the global landscape of the market.

Ignition coils are crucial components of the ignition system in automobiles, responsible for converting low voltage from the battery into high voltage required to ignite the fuel-air mixture in the combustion chamber. The global market refers to the industry segment focused on the manufacturing, distribution, and sales of ignition coils used in vehicles.

These coils play a vital role in ensuring proper engine function, efficient fuel combustion, and overall vehicle performance. The market encompasses various types of ignition coils, including traditional ignition coils and modern coil-on-plug systems, catering to diverse automotive applications and requirements.

Analyst’s Review

Manufacturers are intensifying their efforts to develop lightweight and efficient ignition coils that align with market demands for fuel-efficient vehicles. Continuous innovation in materials and design, such as silicon steel and compact coil-on-plug systems, significantly enhances performance.

Additionally, new products that incorporate smart technologies and sensors are optimizing ignition timing and emissions control. These advancements reflect the industry's commitment to meeting evolving automotive needs sustainably and competitively.

Automotive Ignition Coil Market Growth Factors

The ongoing technological advancement in ignition systems is propelling the growth of the automotive ignition coil market. Manufacturers are continuously developing innovative ignition coil designs and materials to enhance efficiency and performance in modern vehicles.

This includes the integration of advanced materials such as silicon steel, improved insulation materials, and compact designs for better heat dissipation and durability. These technological strides are crucial for meeting the evolving demands of vehicle manufacturers and consumers who seek reliable and high-performance ignition systems.

The increasing complexity of vehicle electronics, along with the integration of ignition coils into sophisticated engine management systems, presents a significant challenge impeding market development. This has prompted heavy investments in research and development by industry players to create smart ignition coil solutions.

These smart coils incorporate advanced sensors and electronic controls that optimize ignition timing, fuel efficiency, and emissions control. Additionally, collaborations between automotive manufacturers and ignition coil suppliers facilitate the co-development of tailored solutions that seamlessly integrate with modern engine architectures, thereby ensuring optimal performance and reliability.

Automotive Ignition Coil Market Trends

The shift toward lightweight and compact designs is a significant trend impacting the automotive ignition coil sector. Manufacturers are leveraging advanced materials and manufacturing techniques to develop ignition coils that are lighter, smaller, and highly efficient.

This trend is further driven by the automotive industry's focus on reducing vehicle weight to improve fuel efficiency and comply with stringent emissions standards. Lightweight ignition coils contribute to overall vehicle weight reduction and enhance engine performance and reliability, making them a preferred choice for modern vehicle designs.

The increasing adoption of electric and hybrid vehicles has led to an increased demand for specialized ignition coil solutions. The transition of the automotive industry toward electrification is resulting in the prominence of ignition coils specifically designed for electric and hybrid powertrains.

These specialized coils are engineered to meet the unique requirements of electric propulsion systems, such as high voltage compatibility, rapid response times, and enhanced durability. This underscores the importance of innovation in ignition coil technologies to cater to the evolving needs of electric and hybrid vehicle manufacturers and consumers.

- According to the International Energy Agency, Electric car sales rose in 2023, with over 2.3 million units sold in the first quarter alone, marking a 25% increase from the previous year. By year-end, sales were projected to reach 14 million, representing a substantial 35% year-on-year growth. This acceleration was anticipated to continue in the second half of the year, potentially accounting for 18% of total car sales. National policies and incentives, along with high oil prices, were key factors behind this remarkable growth.

Segmentation Analysis

The global market is segmented based on types, vehicle type, sales channel, and geography.

By Types

Based on types, the market is categorized into coil on plug, distributor based, and others. The coil on plug segment led the automotive ignition coil market in 2023, reaching a valuation of USD 3.27 billion.

This dominance is largely attributed to the widespread adoption of modern engine designs in passenger vehicles, which are increasingly favoring coil-on-plug systems due to their compactness and efficiency in delivering high-voltage pulses directly to individual spark plugs. This design minimizes energy losses and enhances engine performance.

Additionally, advancements in ignition technologies have led to the development of reliable and durable coil-on-plug units, which has spurred their adoption across a wide range of vehicle models.

By Vehicle Type

Based on vehicle type, the market is segmented into passenger vehicles and heavy vehicles. The passenger vehicles secured the largest automotive ignition coil industry share of 65.44% in 2023. This expansion within the market is due to the increasing consumer preference for passenger vehicles, including sedans, hatchbacks, and SUVs. This is creating a strong demand for ignition coils in passenger vehicles.

Additionally, advancements in passenger vehicle designs, along with the incorporation of advanced engine management systems and electronic controls, necessitate efficient ignition systems such as coil-on-plug units, thereby boosting the growth of the segment.

Moreover, stringent emission regulations worldwide are prompting automakers to adopt advanced ignition technologies in passenger vehicles, contributing to the progress of the segment.

By Sales Channel

Based on sales channel, the automotive ignition coil market is classified into OEM and aftermarket. The aftermarket segment is poised to witness significant growth, registering a CAGR of 4.85% through the forecast period (2024-2031). This notable growth is mainly propelled by the inherent need for replacement parts due to vehicle aging, notably including ignition coils.

This demand is further fueled by the increasing vehicle sales globally, especially in emerging economies experiencing a consistent rise in vehicle ownership.

Moreover, aftermarket ignition coils offer consumers a cost-effective alternative to OEM replacements, thereby attracting budget-conscious vehicle owners and independent repair shops. Additionally, advancements in aftermarket product quality, along with compatibility across a wide range of vehicle models, contribute significantly to the growth of the segment.

- In March 2023, DENSO Products and Services Americas, Inc., an affiliate of a major mobility supplier, expanded its aftermarket offerings by introducing nine new part numbers for ignition coils. These additions extended the company's coverage to encompass over 9 million vehicles, thereby enhancing DENSO's high-performance coil portfolio to cater to the needs of over 218 million vehicles currently in operation.

Automotive Ignition Coil Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

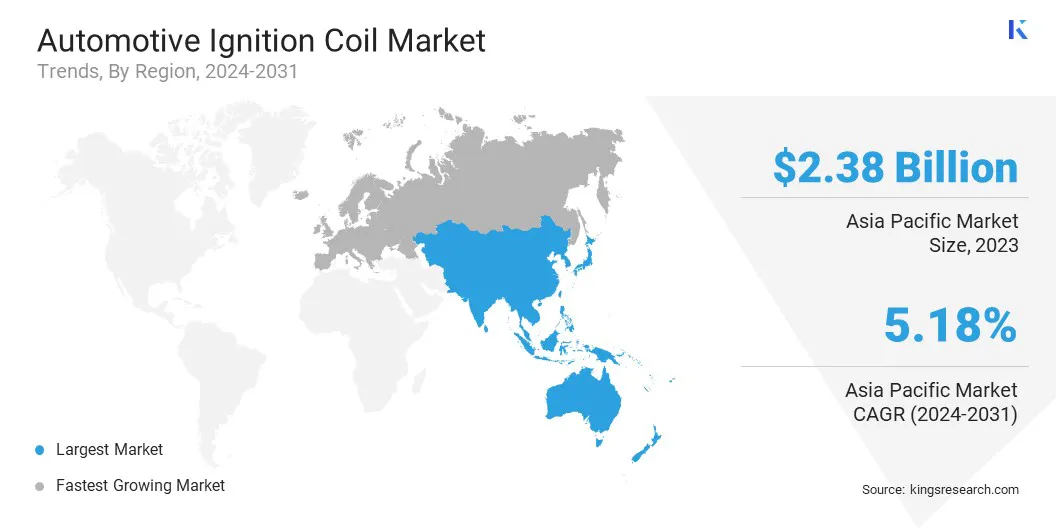

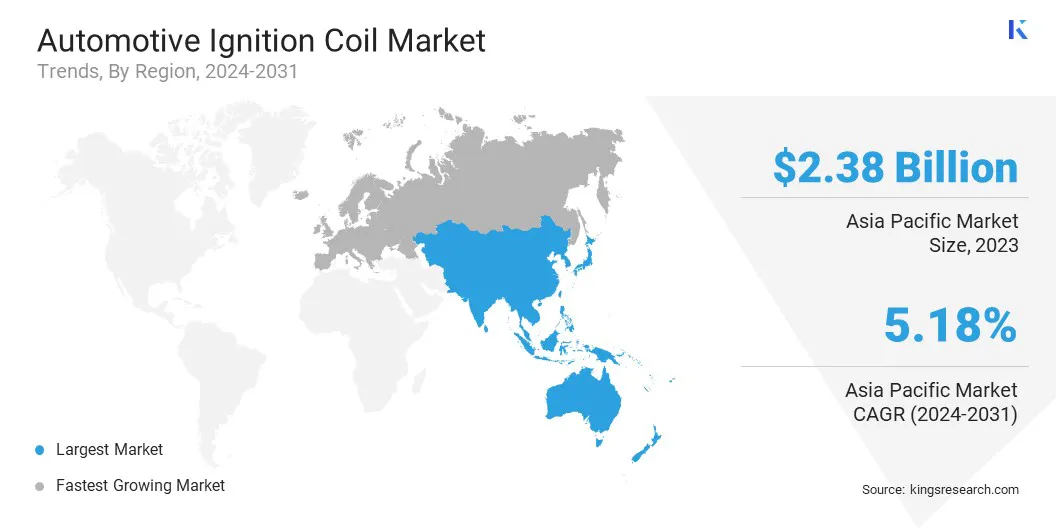

The Asia-Pacific Automotive Ignition Coil Market share stood around 32.47% in 2023 in the global market, with a valuation of USD 2.38 Billion. This dominance is attributed to the region's status as a hub for automotive manufacturing, with countries such as China, Japan, and South Korea leading in vehicle production. This increased manufacturing activity generates significant demand for ignition coils.

Moreover, rapid urbanization and increasing disposable incomes in countries such as China and India are fueling automotive sales, thereby boosting the demand for ignition coils. Additionally, advancements in automotive technology and the presence of key market players in the region contribute to its leading position in the global marketplace.

- As per the Society of Indian Automobile Manufacturers, over 21 million automobiles were sold in India in the year 2022-2023, with passenger and commercial vehicles accounting for almost 23% of total sales.

Europe is poised to experience steady growth, depicting a CAGR of 4.77% over the forecast period. This remarkable growth is fueled by ongoing technological innovation in automotive engineering, which have led to a continuous demand for advanced ignition systems.

Moreover, the implementation of stringent emission regulations in Europe necessitates the utilization of efficient ignition coils, thereby propelling regional market growth.

Additionally, the growing trend toward vehicle electrification and hybridization in Europe propels the demand for specialized ignition coil solutions. These factors, coupled with a mature automotive market and a strong focus on sustainability,bolster Europe market growth.

Competitive Landscape

The automotive ignition coil market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Automotive Ignition Coil Market

- NGK SPARK PLUG Co. Ltd

- Denso Corporation

- Robert Bosch GmbH

- Hitachi Ltd

- HELLA GmbH & Co. KGaA

- Diamond Electric Holdings Co. Ltd

- Taiwan Ignition System Co. Ltd

- BorgWarner Inc.

- Eldor Corporation

- Furuhashi Auto Electric Parts Co. Ltd

Key Industry Developments

- August 2023 (Expansion): Gauss, an automotive electronic components manufacturer, achieved a significant milestone by initiating production of its ignition coils in Brazil for the aftermarket. The new facility, situated within Gauss's expansive industrial park, began operations in 2023 with an initial production capacity of 100,000 units per month, which doubled in 2024 with additional equipment installation. These coils, previously manufactured in China since 2016, bore the 'Made in Brazil' label, catering to both domestic and international markets, with production commencing in September.

- May 2023 (Launch): Niterra, a major player in ignition and vehicle electronics, expanded its Aftermarket lineup with 29 advanced ignition coils for major global automakers such as Kia, Hyundai, Mercedes-Benz, Toyota, Porsche, and Opel. These high-quality products aimed to enhance customer reach in key regions such as South Korea, Japan, and EMEA, targeting a vehicle parc of 22 million by 2025, marking a 19.9% increase in two years.

The Global Automotive Ignition Coil Market is Segmented as:

By Types

- Coil on Plug

- Distributor Based

- Others

By Vehicle Type

- Passenger Vehicles

- Heavy Vehicles

By Sales Channel

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America