Market Definition

The automotive gears market encompasses the development and distribution of gear systems integral to vehicle performance. It involves innovations to enhance power efficiency, reduce emissions, and improve driving dynamics.

The market is influenced by advancements in automotive technologies, rising demand for fuel-efficient vehicles, and the shift toward electric and hybrid vehicles, highlighting the need for specialized gear solutions.

Automotive Gears Market Overview

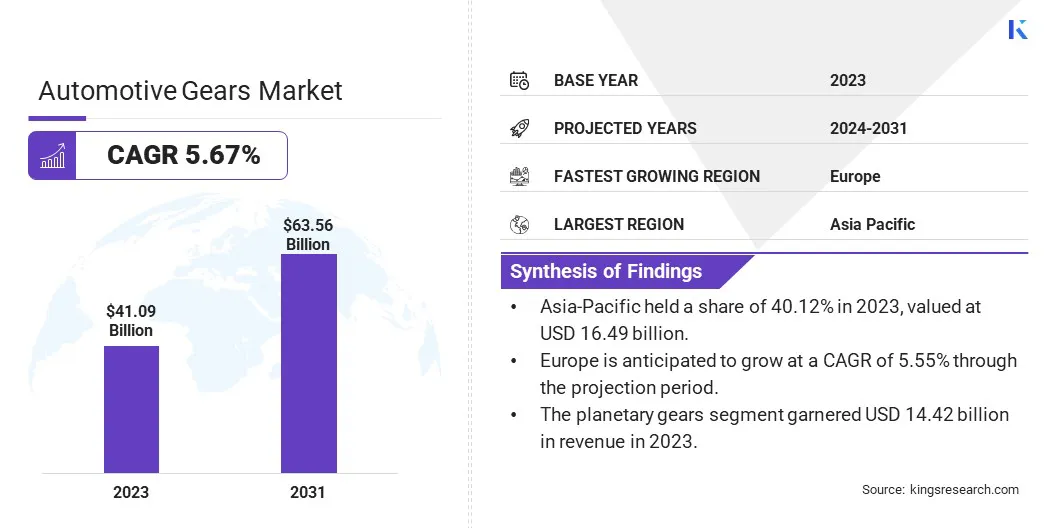

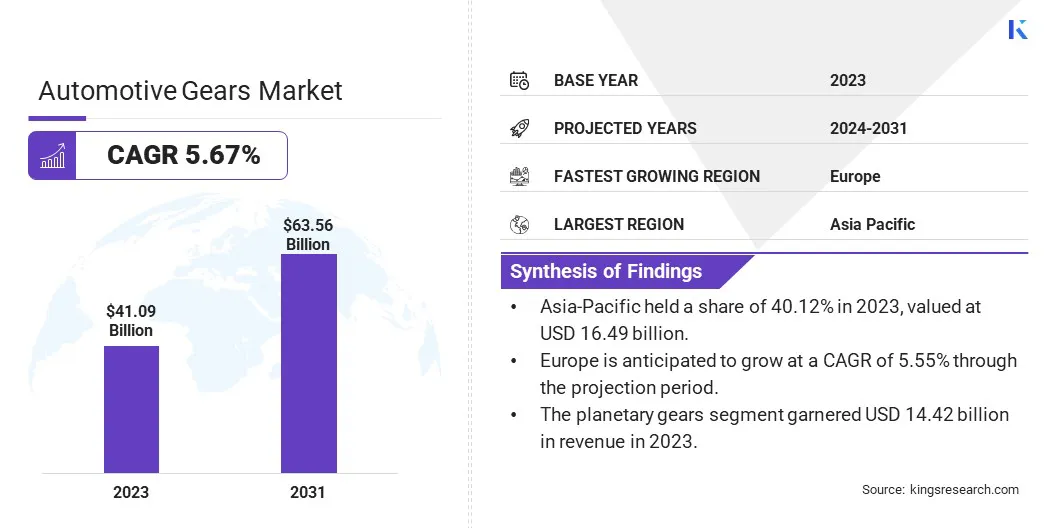

Global automotive gears market size was valued at USD 41.09 billion in 2023, which is estimated to be valued at USD 43.19 billion in 2024 and reach USD 63.56 billion by 2031, growing at a CAGR of 5.67% from 2024 to 2031.

The expansion of the automotive industry, oarticularly in emerging economies, significantly boosts the demand for automotive gears. The increasing vehicle production in these regions is fueling demand for advanced gear systems in both traditional and electric vehicle markets rto enhance performance and efficiency.

Major companies operating in the global automotive gears industry are AmTech OEM, GKN Automotive Limited, Robert Bosch LLC, JTEKT Corporation, GKN Powder Metallurgy, Bharat Gears Ltd, Bonfiglioli Riduttori S.p.A, Circle & Gear Machine Co., Inc., Eaton, Gear Motions , CIE Automotive, Precipart, Renold Chain India Private Limited, IMS Gear, United Gear, and others.

The market is a critical component of the global automotive industry, focused on providing efficient power transmission systems for vehicles. It encompasses a variety of gear types, including those used in manual, automatic, and electric vehicles.

With increasing emphasis on vehicle performance, fuel efficiency, and emission reduction, the market is seeing steady demand. Manufacturers are innovating with advanced gear solutions to meet evolving consumer and regulatory standards. The market remains highly competitive, with continuous advancements in materials and technology.

- In June 2024, Schaeffler India introduced its Planetary Gear System (PGS) at the Hosur Plant, specifically designed for Dedicated Hybrid Transmission (DHT) vehicles. This development aligns with the 'Make in India' initiative, contributing to the growth of hybrid vehicles by improving performance, lowering emissions, and providing efficient, adaptable solutions for OEMs in India.

Key Highlights:

- The global automotive gears market size was recorded at USD 41.09 billion in 2023.

- The market is projected to grow at a CAGR of 5.67% from 2024 to 2031.

- Asia-Pacific held a share of 40.12% in 2023, valued at USD 16.49 billion.

- The planetary gears segment garnered USD 14.42 billion in revenue in 2023.

- The metallic segment is expected to reach USD 55.77 billion by 2031.

- The Electric Vehicles (EVs) segment is anticipated to register a CAGR of 7.34% over the forecast period.

- Europe is anticipated to grow at a CAGR of 5.55% through the projection period.

Market Driver

"Increase in Vehicle Production"

The global surge in vehicle production is fueling the growth of the automotive gear market, as rising demand for automobiles necessitates advanced, high-performance gear systems.

- According to the Society of Indian Automobile Manufacturers (SIAM), India's automotive industry produced 2.84 crore vehicles in FY 2023-24, up from 2.59 crore vehicles in FY 2022-23, reflecting significant year-over-year growth.

This expansion encompasses both traditional and electric vehicles, requiring innovative gear technologies to meet evolving performance and efficiency standards. As manufacturers focus on producing more vehicles to meet consumer needs, the demand for reliable, efficient, and cost-effective gear solutions is rising, supporting market growth.

- In October 2024, Nidec Machine Tool Corporation unveiled its ZFA160 and ZFA260 gear grinders at JIMTOF2024. These high-precision, high-speed machines are designed to meet the growing demand for automotive gears, particularly in electric vehicle transmissions and robotics.

Market Challenge

"Addressing the Skilled Labor Shortage"

The growth of the automotive gear market is impeded by the shortage of skilled labor, particularly in gear manufacturing and precision engineering. This gap hinders production efficiency and innovation.

To address this challenge, companies can invest in training programs, collaborate with educational institutions to develop specialized curricula, and implement automation to reduce dependency on manual labor. Additionally, offering competitive wages, career development opportunities, and advanced technology integration can help help attract and retain skilled workers.

Market Trend

"Surging Use of Lightweight Material"

A significant trend in the automotive gear market is the growing use of lightweight materials such as aluminum and composites to reduce vehicle weight and improve fuel efficiency .

By incorporating these materials into gear systems, manufacturers can enhance vehicle dynamics while meeting stringent fuel economy standards. The move toward lightweight, durable materials further helps reduce carbon emissions, support the industry’s shift toward more sustainable and energy-efficient vehicles, particularly in electric and hybrid models.

- In June 2023, ZF showcased the EVbeat concept vehicle, featuring its ultra-compact, lightweight driveline optimized for electric vehicles. With advanced technologies such as Braided Winding and a coaxial reduction gearbox, ZF’s innovations enhance performance, efficiency, and sustainability in EV drivetrains.

Automotive Gears Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Bevel Gears, Helical Gears, Spur Gears, Planetary Gears, Worm Gears, Hypoid Gears

|

|

By Material Type

|

Metallic, Non-Metallic

|

|

By Vehicle Type

|

Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), Two-Wheelers

|

|

By Application

|

Powertrain, Differential Gears, Steering Systems, Transmission Systems

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Bevel Gears, Helical Gears, Spur Gears, Planetary Gears, Worm Gears, and Hypoid Gears): The planetary gears segment earned USD 14.42 billion in 2023, mainly due to their efficiency in torque distribution and compact design, making them ideal for electric vehicle (EV) applications.

- By Material Type (Metallic and Non-Metallic): The metallic segment held a share of 88.23% in 2023, attributed to the superior strength, durability, and heat resistance of metals such as steel and aluminum, which are essential for automotive gear performance.

- By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), and Two-Wheelers): The passenger cars segment is projected to reach USD 35.34 billion by 2031, owing to the increasing global demand for personal transportation and the adoption of advanced gear systems for improved fuel efficiency.

- By Application (Powertrain, Differential Gears, Steering Systems, and Transmission Systems): The steering systems segment is anticipated to grow at a CAGR of 8.29% over the forecast period, attributed to the growing emphasis on vehicle handling and safety, creating demand for advanced steering gear technologies.

Automotive Gears Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific automotive gears market captured a share of around 40.12% in 2023, valued at USD 16.49 billion. This growth is fueled by rapid industrialization, increasing vehicle production, and growing demand for both traditional and electric vehicles (EVs).

Countries such as China, Japan, and India are at the forefront of this growth, with their vast automotive manufacturing capabilities and rising consumer demand for personal vehicles.

Additionally, the region is witnessing significant investments in EV production, highlighting the need for advanced gear systems. The region’s cost-efficient manufacturing and technological advancements strengthen its market position.

Europe automotive gears industry is estimated to grow at a robust CAGR of 5.55% over the forecast period. This growth is facilitated by the shift toward electric vehicles (EVs) and stringent emission regulations. As European manufacturers invest heavily in electric mobility, there is an increasing demand for efficient and high-precision gear technologies.

Countries such as Germany and France are leading the transition to EVs, with the adoption of advanced drivetrain systems. This, coupled with the region's focus on sustainability, positions Europe as a rapidly expanding market for automotive gears.

- According to the Automobile Manufacturers Association ACEA, the European Union's motor vehicle production reached 14.8 million units, accounting for approximately 15.8% of global vehicle production. This underscores Europe's significant role in the global automotive industry and its contribution to the demand for automotive gear systems.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) enforces Corporate Average Fuel Economy (CAFE) standards, which mandate fuel efficiency levels for vehicles, driving demand for high-efficiency automotive gears.

- Society of Automotive Engineers (SAE) International is leading a global association that connects and educates engineers while advancing aerospace, commercial vehicle and automotive engineering.

- The End-of-Life (ELV) Directive sets targets for ELVs and their components while restricting hazardous substances in vehicle manufacturing, except in cases where no suitable alternatives exist.

Competitive Landscape

The global automotive gears market is characterized by a large number of participants, including both established corporations and emerging players. Venture capital investments in automotive gear companies are increasingly focused on supporting innovation and technological advancements, particularly in electric vehicle (EV) and hybrid systems.

These investments aim to accelerate the development of high-performance, energy-efficient gear solutions. By funding startups and established companies, venture capital plays a crucial role in driving progress toward sustainable mobility and next-generation automotive technologies.

- In May 2023, American Axle & Manufacturing Holdings, Inc. (AAM) announced a USD 10 million investment in EnerTech Capital’s Global Strategic Mobility Fund (GSMF). This strategic partnership grants AAM access to cutting-edge technologies and emerging mobility innovations, particularly in electrification, connectivity, and autonomy.

List of Key Companies in Automotive Gears Market:

- AmTech OEM

- GKN Automotive Limited

- Robert Bosch LLC

- JTEKT Corporation

- GKN Powder Metallurgy

- Bharat Gears Ltd

- Bonfiglioli Riduttori S.p.A

- Circle & Gear Machine Co., Inc.

- Eaton

- Gear Motions

- CIE Automotive

- Precipart

- Renold Chain India Private Limited

- IMS Gear

- United Gear

Recent Developments (Launch/Expansion)

- In September 2024, Toyota introduced the 2025 GR Corolla, featuring an available 8-speed GAZOO Racing Direct Automatic Transmission (DAT). This advancement reflects growing trends in the automotive gear market, emphasizing high-performance transmissions, torque improvements, and enhanced cooling for optimal driving experience.

- In February 2024, ZF announced PowerLine commercial vehicle transmissions at its Gray Court facility in the United States. This USD 200 million investment aims to supply U.S. commercial vehicle manufacturers, offering advanced gear technology for improved fuel economy, acceleration, and future hybrid compatibility.