Market Definition

The market comprises a range of activities related to the development, production, and supply of exhaust components used in vehicles to control emissions and improve efficiency.

It includes various vehicle types such as passenger cars and commercial vehicles and covers original equipment manufacturers (OEMs) and aftermarket segments across diverse geographic regions. The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Automotive Exhaust System Market Overview

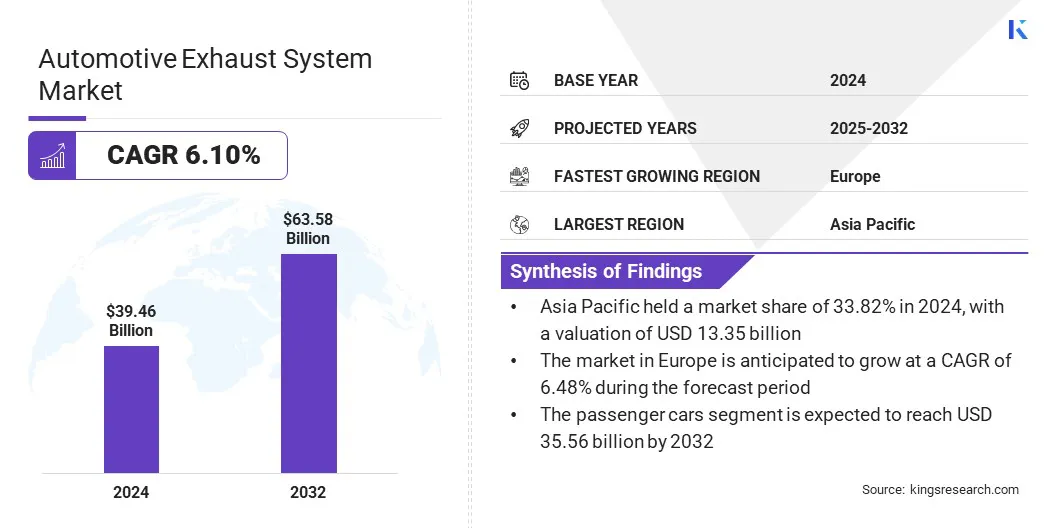

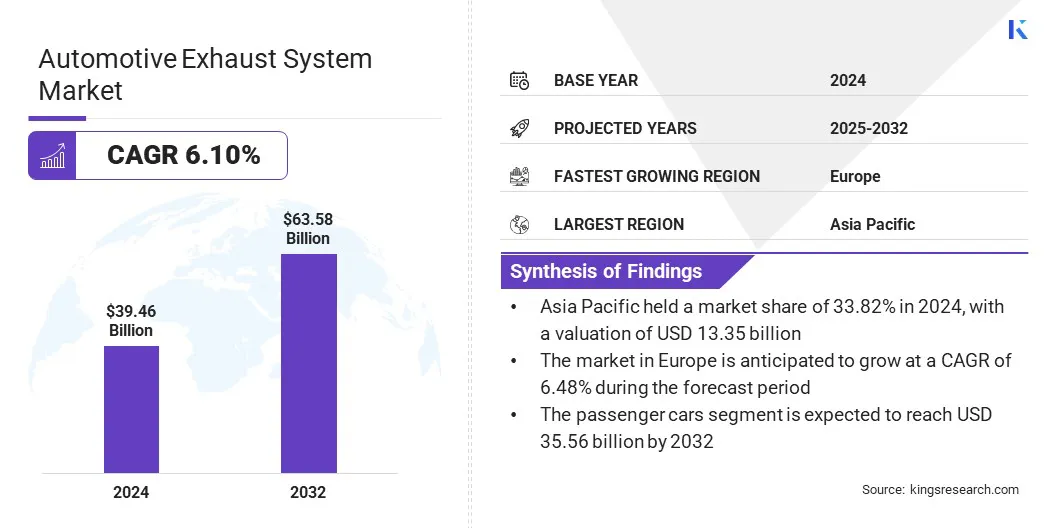

The global automotive exhaust system market size was valued at USD 39.46 billion in 2024 and is projected to grow from USD 41.79 billion in 2025 to USD 63.58 billion by 2032, exhibiting a CAGR of 6.10% during the forecast period.

The market is driven by increasing vehicle production, heightened focus on fuel efficiency, and the enforcement of stringent global emission regulations. The adoption of advanced technologies such as selective catalytic reduction (SCR) and gasoline particulate filters (GPF) is accelerating as automakers aim to comply with evolving standards.

Major companies operating in the automotive exhaust system industry are Tenneco Inc., HELLA GmbH & Co. KGaA, ContiTech Deutschland GmbH, Eberspächer, Robert Bosch Stiftung GmbH, Johnson Matthey, FUTABA INDUSTRIAL CO., LTD., BENTELER Group, ElringKlinger AG, Borla Performance Industries Inc., MagnaFlow, FLOWMASTER MUFFLERS, INC., MBRP LTD., Corsa Performance, and Gibson Performance Exhaust.

Additionally, automakers are increasingly prioritizing the optimization of exhaust manifolds to boost engine efficiency and power output. Advanced designs enhance gas flow and minimize energy loss during combustion, resulting in improved performance.

The use of lightweight materials and refined manufacturing processes supports these advancements. These innovations not only help meet emission regulations but also maintain competitive engine capabilities.

- In March 2025, Škoda Motorsport introduced ‘Packet 25’, a comprehensive upgrade package for the Fabia RS Rally2 rally car. The package features a newly optimized exhaust system that reduces the energy required for in-cylinder gas exchange by 27%, enhancing power output. Along with exhaust improvements, the update includes suspension, durability, and comfort enhancements.

Key Highlights

- The automotive exhaust system market size was valued at USD 39.46 billion in 2024.

- The market is projected to grow at a CAGR of 6.10% from 2025 to 2032.

- Asia Pacific held a market share of 33.82% in 2024, with a valuation of USD 13.35 billion.

- The exhaust manifold segment garnered USD 11.08 billion in revenue in 2024.

- The gasoline segment is expected to reach USD 26.53 billion by 2032.

- The passenger cars segment is expected to reach USD 35.56 billion by 2032.

- The market in Europe is anticipated to grow at a CAGR of 6.48% during the forecast period.

Market Driver

Rising Demand for Advanced Exhaust Solutions and Emission Compliance

The market is propelled by the rising demand for advanced exhaust solutions. These systems improve engine performance and ensure compliance with strict emission regulations. Key innovations include optimized exhaust manifolds and lightweight composite materials.

These features reduce energy loss enhance fuel efficiency, and lower harmful emissions such as NOx and CO2. Automakers are adopting these technologies across passenger and commercial vehicles. The growing use of hybrid and mild-hybrid powertrains is further driving the need for sophisticated exhaust systems.

Manufacturers are investing heavily in research and development (R&D) to deliver next-generation exhaust technologies to meet regulatory requirements while improving vehicle efficiency and lowering operational costs.

- In May 2025, BorgWarner extended four exhaust gas recirculation (EGR) system contracts with a major North American OEM for passenger and light commercial vehicles with combustion and hybrid engines. The EGR components, including valves, coolers, and modules, will be produced through 2029 to help reduce NOx emissions and improve fuel economy.

Market Challenge

Sensor Calibration Complexities in Exhaust Systems

A major challenge in the automotive exhaust system market is the complexity involved in the precise installation, configuration, and calibration of NOx sensors. These sensors require accurate software coordination with engine control units to ensure effective emission monitoring and compliance with regulatory standards such as Euro 5 and Euro 6.

Incorrect calibration can result in inaccurate emissions data, increased pollutant output, and potential regulatory penalties. To address this, companies are developing advanced remote diagnostic and calibration technologies that enable independent workshops to efficiently teach, code, and calibrate NOx sensors.

This innovation streamlines repair processes and reduces vehicle downtime while supporting regulatory compliance and enhancing overall emission control.

- In May 2025, FORVIA HELLA expanded its spare parts portfolio to include nearly 150 NOx sensors for trucks and passenger cars worldwide. The company introduced the macsRemote Service from Hella Gutmann Solutions, enabling independent workshops to remotely teach, code, and calibrate NOx sensors efficiently. This innovation supports compliance with Euro 5 and Euro 6 emission standards and improves repair processes.

Market Trend

Innovations in Sound Simulation Enhancing EV Driving Experience

The market is increasingly adopting advanced technologies that enhance the driving experience in electric vehicles (EVs). A prominent development is the implementation of exhaust sound simulation systems, designed to replicate traditional engine acoustics and provide auditory feedback for drivers and passengers.

This addresses the silent nature of EVs, boosting greater driver engagement and satisfaction. As the electric mobility sector expands, manufacturers are prioritizing the integration of these sound solutions to meet evolving consumer expectations and create distinctive vehicle experiences.

- In August 2024, Dodge introduced the Fratzonic Chambered Exhaust system for its electric Charger Daytona, that simulates traditional exhaust sound using transducers, passive radiators, and a dedicated amplifier to enhance driving feedback.

Automotive Exhaust System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Exhaust Manifold, Muffler, Catalytic Converter, Oxygen Sensor, Exhaust Pipes

|

|

By Fuel

|

Gasoline, Diesel, LPG/CNG

|

|

By Vehicle

|

Passenger cars, Commercial vehicles

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Exhaust Manifold, Muffler, Catalytic Converter, Oxygen Sensor, and Exhaust Pipes): The exhaust manifold segment earned USD 08 billion in 2024 due to its critical role in collecting exhaust gases efficiently and withstanding high thermal stress in internal combustion engines.

- By Fuel (Gasoline, Diesel, and LPG/CNG): The gasoline segment held 42.17% of the market in 2024, due to the high global production and sales of gasoline-powered vehicles, particularly in developing and developed regions.

- By Vehicle (Passenger cars, Commercial vehicles): The passenger cars segment is projected to reach USD 35.56 billion by 2032, owing to rising personal vehicle ownership, urban mobility trends, and the continuous rollout of emission-compliant technologies.

Automotive Exhaust System Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 33.82% share of the automotive exhaust system market in 2024, with a valuation of USD 13.35 billion. This dominance is primarily driven by the high concentration of automotive manufacturing hubs in countries like China, India, Japan, and South Korea.

The region benefits from cost-effective labor, robust supply chains, and the presence of large-scale production facilities of global and domestic automakers, which boosts the demand for OEM exhaust systems. The region’s favorable manufacturing ecosystem, and increasing domestic demand is driving the market growth.

The automotive exhaust system industry in Europe is expected to register the fastest growth in the market, with a projected CAGR of 6.48% over the forecast period. Europe’s growth is propelled by the increasing penetration of premium and luxury vehicle brands, particularly from Germany, Italy, and the UK, which integrate advanced and performance-focused exhaust systems.

Furthermore, the growing adoption of hybrid and mild-hybrid vehicles across Western Europe is accelerating the development and deployment of innovative exhaust technologies. The presence of leading automotive R&D centers and suppliers in countries such as Germany and France also contributes to technological advancements and rapid product integration.

- In March 2025, Hindustan Petroleum Corporation Ltd. (HPCL) and Tata Motors launched a co-branded Genuine Diesel Exhaust Fluid (DEF). The product is available through HPCL’s network of 23,000 fuel stations across India, aiming to improve commercial vehicle efficiency and support emission compliance.

Regulatory Frameworks

- In Europe, the European Union governs automotive exhaust systems, with the European Commission responsible for establishing and enforcing regulations. Additionally, the United Nations Economic Commission for Europe (UNECE) sets vehicle design standards, including exhaust system requirements, through regulations adopted and implemented by EU member states.

Competitive Landscape

The automotive exhaust system market is characterized by numerous players actively focusing on innovation, strategic partnerships, and expansion initiatives to strengthen their market presence. Companies are increasingly investing in research and development to introduce advanced exhaust technologies that enhance performance, reduce emissions, and support hybrid and alternative fuel vehicles.

Key players are also pursuing collaborations with automotive OEMs to secure long-term supply contracts and ensure the integration of their systems into upcoming vehicle platforms.

Mergers, acquisitions, and joint ventures are being leveraged to access new markets and manufacturing capabilities. Additionally, manufacturers are expanding their production facilities in emerging economies to optimize costs and cater to growing regional demand efficiently.

- In May 2025, Tata AutoComp Systems Ltd. and Katcon Global formed a joint venture in Mexico to manufacture advanced composite materials for the North American automotive market. The partnership leverages Tata AutoComp’s technology and Katcon’s operational expertise to produce lightweight components for vehicles, supporting fuel efficiency and emissions reduction.

List of Key Companies in Automotive Exhaust System Market:

- Tenneco Inc.

- HELLA GmbH & Co. KGaA

- ContiTech Deutschland GmbH

- Eberspächer

- Robert Bosch Stiftung GmbH

- Johnson Matthey

- FUTABA INDUSTRIAL CO.,LTD.

- BENTELER Group

- ElringKlinger AG

- Borla Performance Industries Inc.

- MagnaFlow

- FLOWMASTER MUFFLERS, INC.

- MBRP LTD.

- Corsa Performance

- Gibson Performance Exhaust

Recent Developments (Product Launch)

- In October 2024, Flowmaster, part of Holley Performance Brands, launched the Flowmaster Signature Series, a premium exhaust line for modern trucks. The system offers increased power, improved sound, and easy at-home installation, targeting the growing demand for high-performance exhaust upgrades.

market players are