Market Definition

Automotive collision repair involves the professional restoration of damaged vehicle components and structures by skilled workforce. This process addresses damages caused by accidents, weather conditions, or other external factors. It includes services such as auto glass replacement, paint matching, scratch repair, dent removal, auto detailing, frame straightening, and panel or door restoration.

Automotive Collision Repair Market Overview

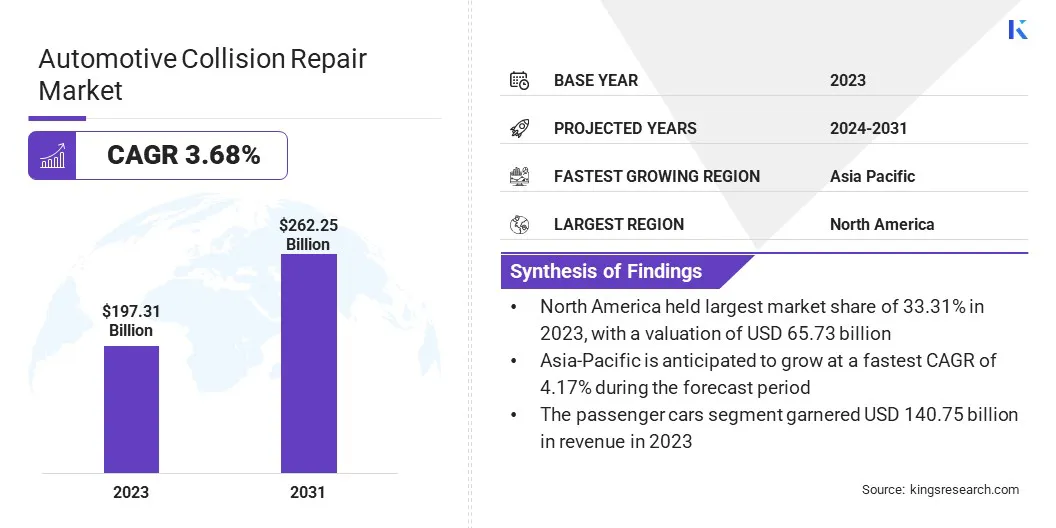

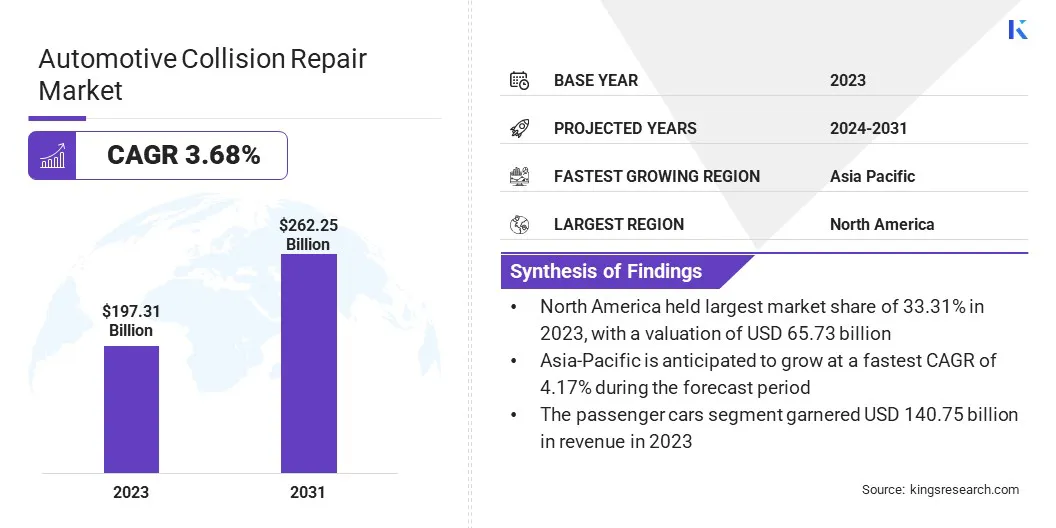

The global automotive collision repair market size was valued at USD 197.31 billion in 2023, which is estimated to be valued at USD 203.65 billion in 2024 and reach USD 262.25 billion by 2031, growing at a CAGR of 3.68% from 2024 to 2031.

The market is expanding due to an increase in road accidents and deaths, rising automotive insurance subscriptions, and technological advancements in the industry.

In addition, enhanced regulatory frameworks, such as Occupational Safety and Health Administration (OSHA) regulations, which address safety concerns in automotive body repair, including protocols for spray finishing, appropriate handling of flammable liquids, and utilization of respiratory protection against hazardous fumes, are fueling market growth.

Major companies operating in the global automotive collision repair market are 3M, Automotive Technology, Abra Auto Body Repair of America, Caliber Holdings LLC, DENSO CORPORATION, AMERICA'S AUTO BODY, Gerber Collision & Glass, Honeywell International Inc., DuPont, Magna International Inc., MAACO FRANCHISING, INC., Fix Auto USA., Axalta, Axalta Coating Systems, PPG Industries, Inc., Mitsuba Corp., and others.

The market is experiencing robust growth, driven by increasing disposable income in developing economies and rising demand for higher service quality. As consumers’ purchasing power grows, they expect better service quality, enhanced customer experience, and advanced repair technologies.

Companies in the automotive sector must meet these expectations by improving service quality, adopting advanced repair equipment, and emplying skilled technicians.

Automotive manufacturers and original equipment manufacturers (OEMs) are partnering with collision repair companies to ensure access to technical support, authentic parts, and accurate repair guidelines. Collaborations with technology providers and suppliers offer access to cutting-edge tools, equipment, and materials essential for modern vehicle repairs, enhancing operational efficiency and repair precision.

Key Highlights:

- The global automotive collision repair market size was recorded at USD 197.31 billion in 2023.

- The market is projected to grow at a CAGR of 3.68% from 2024 to 2031.

- North America held a share of 33.31% in 2023, valued at USD 65.73 billion.

- The passenger cars segment garnered a revenue of USD 140.75 billion in 2023.

- The aftermarket segment is expected to reach USD 167.55 billion by 2031.

- The cosmetic repairs segment is anticipated to grow at a CAGR of 3.94% over the forecast period.

- Asia Pacific is estimated to register a CAGR of 4.17% through the projection period.

Market Driver

Increased Vehicle Ownership

Global vehicle ownership is rising due to rapid urbanization and improved economic conditions, highlighting the need for effective maintenance and repair solutions. The growth of the automotive collision repair market is further supported by technological advancements in automotive systems, particularly in complex electronic and safety components, which have increased repair costs.

Additionally, the growing awareness of vehicle safety standards, coupled with an increase in road traffic and associated accidents, is boosting demand for high-quality collision repair services. The increasing willingness of insurance companies to cover repair costs, along with the growth of advanced repair technologies such as paintless dent repair and automated diagnostics, are propelling market expansion.

- According to the Society of Indian Automobile Manufacturers (SIAM), a total of 23,853,463 vehicles were sold in India during the 2023-24 fiscal year. This substantial sales volume highlights the expanding automotive market, which is expected to drive demand for collision repair services, including maintenance, parts replacement, and refinishing, as the vehicle fleet expands.

Market Challenge

Growing Reliance on Advanced Safety Systems

The automotive collision repair market faces challenges from the rising reliance on advanced safety systems. These systems often rely on sophisticated sensors, cameras, and electronic components that require specialized knowledge and tools for repair and calibration, increasing costs for businesses.

Collision repair companies must invest in state-of-the-art equipment and continuous training for technicians to stay updated with technological advancements. Additionally, the complexity of these systems can lead to extended repair times and increased risk of errors, affecting both customer satisfaction and operational efficiency.

Market Trend

Advancements in Automotive Repair Technology

Advancements in automotive repair technology is emerging as a notable trend in the automotive collision repair market. Modern vehicles integrate advanced safety systems, lightweight materials, and sophisticated electronic components, enhancing vehicle performance and safety while increasing repair complexity.

Consequently, collision repair requires specialized expertise, advanced tools, and advanced diagnostic equipment to restore vehicles effectively. The growing adoption of technologies such as advanced driver-assistance systems (ADAS) and electric vehicle components highlights the need for highly skilled professionals capable of managing complex repairs.

This evolution is fostering significant investments in workforce training, innovative repair methodologies, and advanced technologies, positioning the collision repair industry as a dynamic and rapidly evolving sector.

- For instance, in January 2024, HiRain Technologies, a leading provider of intelligent driving solutions in China, announced the production of its Advanced Driver Assistance System (ADAS) based on the Mobileye EyeQ™6 Lite, launched in China in the second quarter of 2024.

Automotive Collision Repair Market Report Snapshot

| Segmentation |

Details |

| By Product Type |

Paints & Coatings, Adhesives & Sealants, Consumables, Spare Parts |

| By Vehicle Type |

Passenger Cars, LCVs, HCVs |

| By Service Channel |

OEMs, Aftermarket |

| By Repair Type |

Structural Repairs, Cosmetic Repairs, Diagnostic Services, Mechanical Repairs |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Paints & Coatings, Adhesives & Sealants, Consumables, and Spare Parts): The paints & coatings segment generated a revenue of USD 59.82 billion in 2023, mainly due to increasing environmental concerns and the demand for refinishing products and synthetic coating materials.

- By Vehicle Type (Passenger Cars, LCVs, and HCVs): The passenger cars segment held a share of 71.33% in 2023, fueled by the use of high-strength materials and advanced driver-assistance systems (ADAS), which necessitates specialized repair techniques.

- By Service Channel (OEMs, and Aftermarket): The aftermarket segment is projected to reach USD 167.55 billion by 2031, attributed to a significant demand for cost-effective alternatives, particularly in developing countries. Several components are manufactured by third-party manufacturers, providing more affordable options to consumers.

- By Repair Type (Structural Repairs, Cosmetic Repairs, Diagnostic Services, and Mechanical Repairs): The cosmetic repairs segment is likley to reach a valuation of USD 107.92 billion by 2031, propelled by its use in addressing dents, and preventing vehicle paint vehicle from fading.

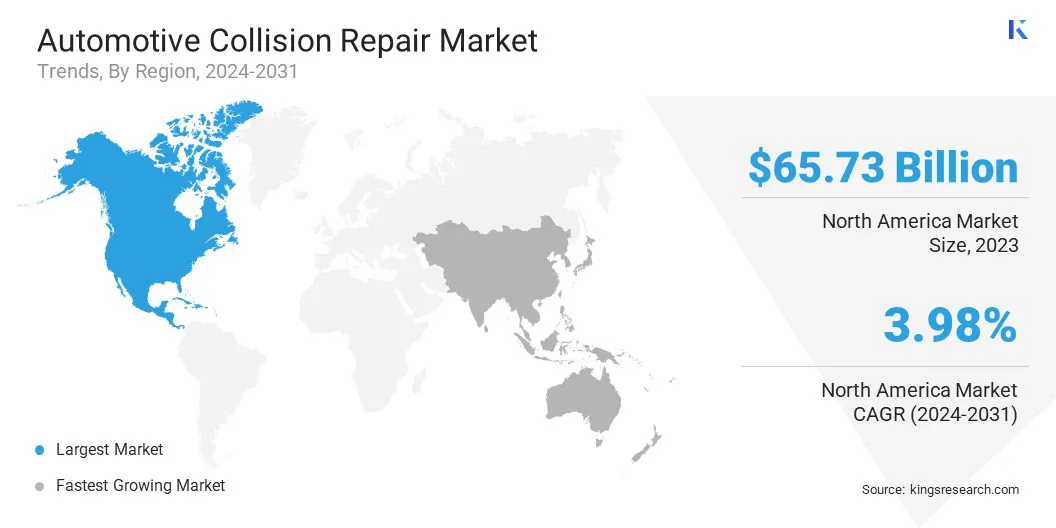

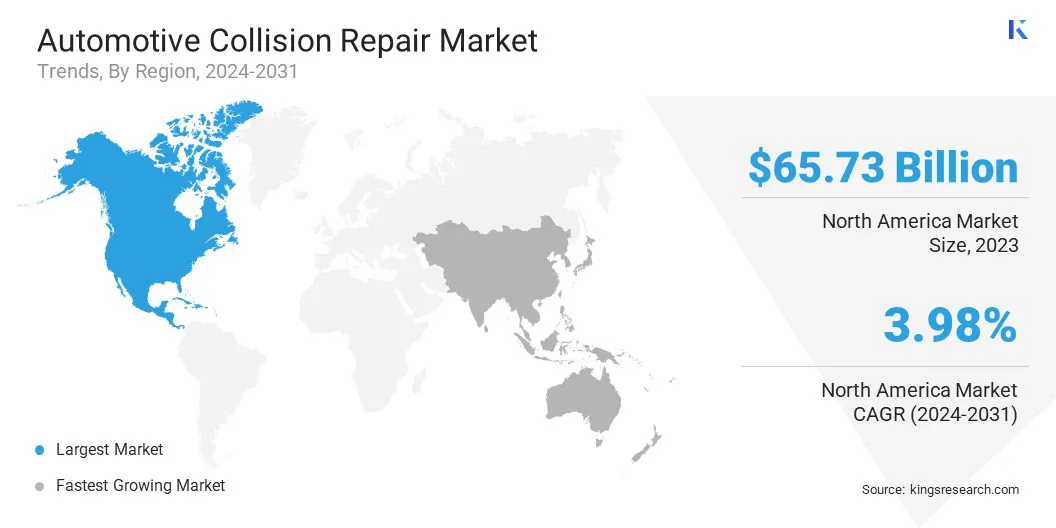

Automotive Collision Repair Market Regional Analysis

North America automotive collision repair market accounted for a significant share of around 33.31% in 2023, valued at USD 65.73 billion. This dominance is reinforced by increasing number of vehicles and rising accident rates.

A well-developed automotive infrastructure, coupled with advancements in repair technologies, has enhanced service quality and efficiency, fostering regional market growth. The U.S. leads the market due to high vehicle ownership, stringent safety regulations, and a strong network of repair facilities.

Additionally, the adoption of innovative repair techniques, such as paintless dent repair and advanced diagnostic tools, is gaining traction across the region. Canada and Mexico significantly contribute to this growth through expanding automotive production and cross-border trade.

- For instance, in September 2024, PPG Industries Inc., a U.S.-based paints and coatings manufacturer, launched the Performance Abrasives product range to meet the evolving needs of professionals and enhance the efficiency of complex auto collision repair processes.

However, Asia-Pacific automotive collision repair market is anticipated to grow at a CAGR of 4.17% over the forecast period. Rapid urbanization and a growing middle-class population are fueling this growth.

The rexpanding automotive sector, coupled with rising road accidents and aging vehicles, is fueling demand for repair and maintenance services. Additionally, a strong manufacturing base and supply chain ensures the availability of spare parts and advanced repair technologies. Technological advancements, including AI-powered diagnostic tools and eco-friendly repair materials, further enhance service quality and efficiency.

- For instance, in September 2023, Solera Inc., a leading provider of vehicle lifecycle management solutions launched its collision repair estimating platforms and AI-powered digital triage (digital FNOL) in Australia.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Federal Motor Vehicle Safety Standards (FMVSS) are U.S. federal vehicle regulations governing the design, construction, performance, and durability requirements for motor vehicles and safety -related components.

- Regulation (EU) 2024/1257 of the European Parliament and the Council, efective April 24, 2024, outlines the type-approval requirements for motor vehicles, engines, systems, and related components, focusing on emissions and battery durability (Euro 7). It amends Regulation (EU) 2018/858 and repeals several previous regulations, including EC Regulations No. 715/2007 and No. 595/2009, as well as Commission Regulations (EU) No. 582/2011, (EU) 2017/1151, (EU) 2017/2400, and Commission Implementing Regulation (EU) 2022/1362.

- In APAC, the Ministry of Road Transport and Highways (MoRTH&H) oversees the automotive industry, including collision repair and is responsible for safety and emission standards.

- The Government of Japan will initiate deregulation measures in the auto parts aftermarket to improve market access for competitive foreign suppliers while ensuring automotive safety and environmental standards are maintained.

Competitive Landscape

The global automotive collision repair market is characterized by a large number of participants, including both established corporations and rising organisations. Market players are investing in research and development to broaden product offerings.

They are actively engaging in strategic initiatives to increase their global presence, with a focus on product launches, mergers and acquisitions, agreements, increased investment, and collaborations with other companies. These companies are further offering subscriptions for maintenance services to their customers. Companies are launching fund support activities and training to reduce training gaps.

- For instance, in July 2023, BMW North America joined I-CAR’s Sustaining Partner Program, a strategic initiative aimed at funding collision repair education, streamlining training processes, and reducing redundancies.

List of Key Companies:

- 3M

- Automotive Technology

- Abra Auto Body Repair of America

- Caliber Holdings LLC

- DENSO CORPORATION

- AMERICA'S AUTO BODY

- Gerber Collision & Glass

- Honeywell International Inc.

- DuPont

- Magna International Inc.

- MAACO FRANCHISING, INC.

- Fix Auto USA.

- Axalta, Axalta Coating Systems

- PPG Industries, Inc.

- Mitsuba Corp.

Recent Developments (M&A/Expansion/Product Launch)

- In May 2024, Foxconn acquired a 50% stake in ZF Chassis Modules GmbH, forming an equal partnership to foster collaboration, business growth, and customer base expansion.

- In March 2024, DRiV expanded its product offering in the Americas, adding 181 new part numbers across brands such as Monroe, MOOG, Walker, Wagner, and Beck-Arnley,. These additions enhance coverage for an estimated 97 million vehicles,reflecting DRiV’s commitment to delivering high-quality components for automotive repair.

- In July 2023, Classic Collision acquired Dayton Collision Center in Dayton, Tennessee, further strengthening its market presence following expansion into Colorado, Georgia, Florida, Minnesota, and Texas.

- In March 2023, DENSO Products and Services Americas, Inc. expanded its aftermarket ignition coil portfolio with nine new part numbers, covering more than 9 million vehicles. This expansion enhances DENSO’s range of premium replacement ignition coils for a variety of vehicle models, including those from Buick, BMW, Cadillac, GMC, Infiniti, Lincoln, Ford, Nissan, Chevrolet, and Volvo.