Automotive Camshaft Market Size

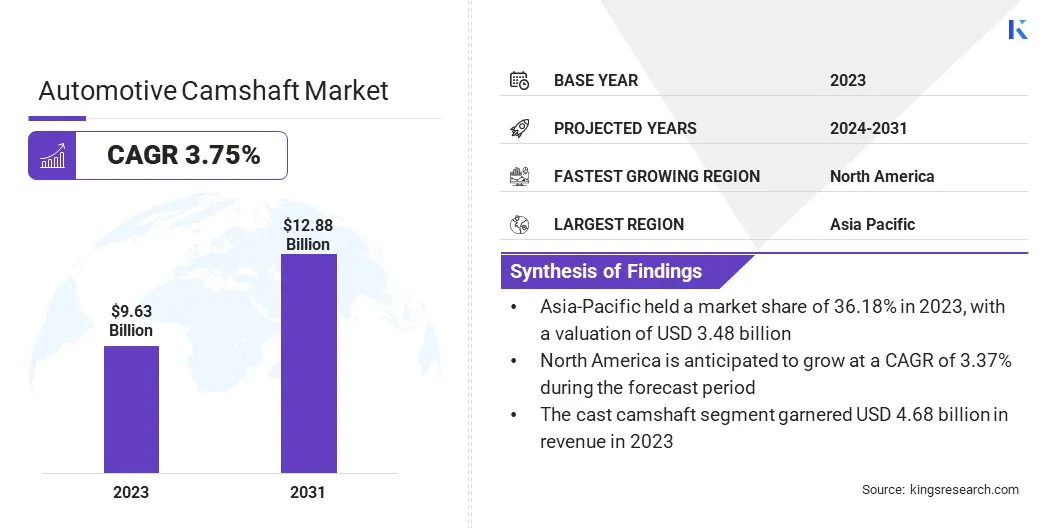

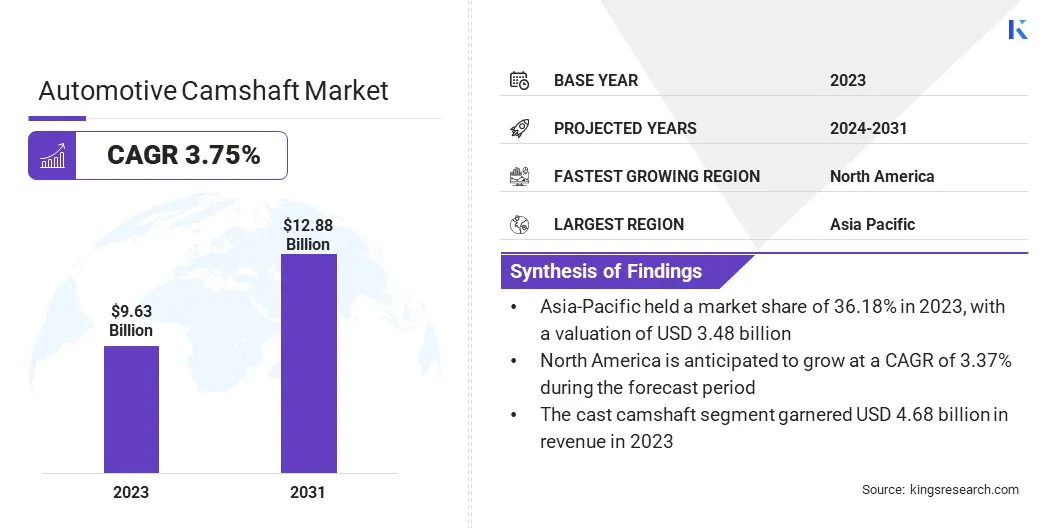

The global Automotive Camshaft Market size was valued at USD 9.63 billion in 2023 and is projected to grow from USD 9.95 billion in 2024 to USD 12.88 billion by 2031, exhibiting a CAGR of 3.75% during the forecast period. The growth of the market is driven by several factors, including ongoing technological advancements, regulatory shifts toward cleaner vehicles, and growing consumer demand for sustainable transportation solutions.

Innovations such as autonomous driving technologies and electric vehicles are reshaping the industry landscape. Additionally, rapid urbanization and rising disposable incomes in emerging markets are boosting vehicle ownership, which is contributing to market expansion.

In the scope of work, the report includes solutions offered by companies such as Mahle GmbH, JD Norman Industries, Inc., Thyssenkrupp AG, Linamar Corporation, ESTAS CAMSHAFT & CHILLED CAST, Aichi Forge USA Inc., Engine Power Components Inc., Hirschvogel Group, KAUTEX, Edelbrock Group, and others.

The automotive camshaft market is poised to witness steady growth, mainly due to increasing vehicle production worldwide and technological advancements in camshaft designs. Emerging markets such as India, China, and Brazil are witnessing robust growth in automotive manufacturing, which is boosting the demand for camshafts.

- According to SIAM (Society of Indian Automobile Manufacturers), India's automotive industry saw robust production growth in FY-2022-23, with total vehicle production reaching 2,59,31,867 units, up from 2,30,40,066 units the previous year. Commercial Vehicles sales surged from 7,16,566 units to 9,62,468 units, driven by Medium and Heavy Commercial Vehicles increasing from 2,40,577 to 3,59,003 units, and Light Commercial Vehicles rising from 4,75,989 to 6,03,465 units.

The substantial increase in vehicle production and sales, particularly in commercial vehicles, is bolstering robust growth in the automotive market. This expansion reflects increased demand across various vehicle segments, contributing to market expansion and industry advancement.

Innovations such as variable valve timing (VVT) systems are enhancing engine performance and fuel efficiency, thereby fueling market expansion. Moreover, the industry's shift toward lightweight materials in camshaft manufacturing to improve vehicle efficiency and emissions aligns with environmental regulations and consumer preferences.

As automotive manufacturers continue to innovate and expand their production capabilities, the automotive camshaft market is expected to witness sustained growth in the coming years.

An automotive camshaft is an essential component in internal combustion engines, responsible for both the timing and duration of valve operations. It converts the rotational motion of the engine's crankshaft into precise movements that control the opening and closing of the intake and exhaust valves.

This process governs the crucial functions of air intake, fuel injection, and exhaust gas expulsion, thereby optimizing engine performance across various speeds and conditions. Camshafts typically feature lobes or cams that engage with valve lifters or followers, ensuring synchronized valve timing to maximize power output, fuel efficiency, and overall engine reliability in modern automotive applications.

Analyst’s Review

The rise in passenger car production is a significant factor propelling the growth of the market. Increasing demand for vehicles leads to the pressing need for camshafts, which are integral to engine function. According to our analysis, the passenger car segment is projected to grow at a CAGR of 4.41% from 2024 to 2031, indicating sustained market expansion.

- The significant increase in total passenger vehicle sales, as reported by SIAM, results in the surging demand for automotive camshafts. Sales of passenger cars surged from 14,67,039 to 17,47,376 units, utility vehicles rose from 14,89,219 to 20,03,718 units, and vans increased from 1,13,265 to 1,39,020 units in FY-2022-23 compared to the previous year.

This rise reflects the growing consumer demand and highlights the crucial role of camshafts in meeting the increasing production needs of these vehicles, thus fostering market expansion. Key players in the automotive camshaft market could capitalize on the surge in passenger vehicle sales by investing in innovation and improving efficiency.

By exploring advanced manufacturing processes and developing lightweight, durable camshafts, they are meeting this growing demand while enhancing performance and fuel efficiency. This approach is anticipated to strengthen their market position and competitiveness in the evolving automotive industry landscape.

Automotive Camshaft Market Growth Factors

The rising global demand for vehicles is propelling the expansion of the market. As automotive production is increasing, the need for camshafts, essential components in internal combustion engines is on the rise.

Emerging markets such as India, China, and Brazil are experiencing substantial growth in vehicle production due to rapid economic expansion, improved infrastructure, and rising disposable incomes.

For instance, China, the world's largest automotive market, continues to grow significantly, while India's automotive sector is expanding rapidly due to a burgeoning middle-class population. Furthermore, Brazil is seeing a resurgence in its automotive industry. This growth in vehicle production in key markets is propelling the development of the automotive camshaft market.

A major factor hindering market growth include the ongoing shift toward electric vehicles (EVs). Unlike traditional internal combustion engines, EVs do not require camshafts. This transition potentially reduces long-term demand for camshafts.

However, key players are actively mitigating this challenge by diversifying into hybrid vehicle technologies and continuously investing in research and development for advanced camshaft applications in hybrid powertrains. By adapting to these evolving trends and technologies, they aim to sustain market relevance and mainatain a competitive edge in the dynamic automotive industry landscape.

Automotive Camshaft IndustryTrends

Innovations in camshaft technology, particularly the development of variable valve timing (VVT) systems, are significantly fueling market growth. VVT systems enhance engine efficiency, performance, and fuel economy, making them highly sought after in the automotive industry.

As automakers strive to meet stringent emission standards and cater to rising consumer demands for high-performance vehicles, they are increasingly adopting these advanced technologies. This surge in adoption is leading to increased demand for sophisticated camshafts, which are essential for the functionality of VVT systems. The camshaft market is witnessing robust expansion, as manufacturers integrate these innovations to improve vehicle performance and efficiency.

The automotive industry's shift toward enhancing fuel efficiency and reducing emissions through vehicle weight reduction is fostering innovation in camshaft manufacturing. Lightweight materials such as aluminum and composites are increasingly replacing traditional steel in camshaft production.

These advanced materials offer the dual benefit of reducing overall vehicle weight while maintaining robust strength and performance standards. This shift aligns with regulatory demands for cleaner vehicles and responds to evolving consumer preferences for more efficient and environmentally friendly transportation solutions. As this trend continues, the automotive camshaft market is poised to witness robust growth, supported by ongoing advancements in lightweight material technologies.

Segmentation Analysis

The global market is segmented based on manufacturing technology, application, sales channel, fuel type, and geography.

By Manufacturing Technology

Based on manufacturing technology, the market is categorized into cast camshaft, forged camshaft, and assembled camshaft. The cast camshaft segment garnered the highest revenue of USD 4.68 billion in 2023, mainly due to its cost-effectiveness and suitability for high-volume production.

Cast camshafts, typically made from materials such as iron or steel, are highly favored for their durability and reliability in various automotive applications. They are particularly suited for mass-market vehicle production, where efficiency and scalability are paramount.

By offering robust performance at a competitive cost, the cast camshaft segment meets the demand from automakers who are expanding their production capacities, thereby augmenting segmental growth through increased adoption and integration in modern engine designs.

By Application

Based on application, the market is categorized into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger cars segment captured the largest automotive camshaft market share of 46.21% in 2023. As consumer preferences shift towards personal transportation solutions, automakers are increasing their production of passenger cars.

This trend directly fuels the need for camshafts, which are essential components in internal combustion engines that regulate valve operations to ensure optimal performance.

The growing sales figures in passenger cars, characterized by advancements in engine efficiency and performance, underscore the critical role of camshafts in meeting stringent regulatory standards and consumer expectations. This sustained demand in passenger cars is anticipated to support the growth of the segment.

By Fuel Type

Based on fuel type, the market is categorized into gasoline and diesel. The gasoline segment is expected to garner the highest revenue of USD 7.01 billion by 2031. Gasoline engines continue to be widely used in passenger vehicles and light-duty commercial vehicles globally, which leads to increased demand for camshafts.

As automakers continue to innovate to meet stringent emission regulations and consumer demands for fuel efficiency and performance, there is a continuous need for advanced camshaft technologies. These technologies optimize valve timing and enhance engine efficiency, thereby supporting the growth of the gasoline segment.

Automotive Camshaft Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific automotive camshaft market share stood around 36.18% in 2023 in the global market, with a valuation of USD 3.48 billion. This notable expansion is largely attributed to robust automotive production and expanding vehicle ownership in the region. Countries such as China, India, Japan, and South Korea are witnessing significant growth in vehicle manufacturing, supported by rapid economic development and rising disposable incomes.

- For instance, in September 2022, BorgWarner expanded its facility near Chennai to increase its production and warehousing capabilities. This unit centralizes the assembly of BorgWarner’s variable camshaft timing (VCT) systems and high-performance engine control, reflecting advancements in manufacturing capabilities and technology adoption in the region.

This surge in automotive manufacturing and investments in advanced facilities like BorgWarner's in Chennai underscores the region's pivotal role in the global automotive supply chain, driven by economic growth and technological advancements, is contributing to the market expansion in the region.

North America is anticipated to witness significant growth at a CAGR of 3.37% over the forecast period. The region's advanced automotive manufacturing capabilities and high consumer demand for vehicles are expected to boost regional market growth in the near future.

The United States and Canada, in particular, are at the forefront of this growth, majorly fostered by a strong presence of major automotive manufacturers and a well-established supply chain.

The region's growing focus on innovation and stringent emission regulations is spurring the adoption of advanced camshaft technologies, such as variable valve timing (VVT) systems, to enhance engine performance and efficiency. Additionally, investments in research and development, as well as production facility expansions, are propelling domestic market growth.

Competitive Landscape

The global automotive camshaft market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Automotive Camshaft Market

- Mahle GmbH

- JD Norman Industries, Inc.

- Thyssenkrupp AG

- Linamar Corporation

- ESTAS CAMSHAFT & CHILLED CAST

- Aichi Forge USA Inc.

- Engine Power Components Inc.

- Hirschvogel Group

- KAUTEX

- Edelbrock Group

Key Industry Development

- December 2022 (Expansion): Delphi Technologies broadened its product offerings by adding 142 new components to its primary product line and 21 parts to its specialized Sparta fuel pump range. With over 80 years of experience and a market coverage of 95%, Delphi Technologies, a leading producer of fuel delivery parts, introduced 35 new items to its fuel product lineup. These new additions included fuel pump hangers, fuel pump strainer sets and module assemblies, and fuel transfer units, all of which were subjected to OE-quality testing to ensure reliability and durability. This expansion underscores the company's dedication to innovation and growth in the automotive camshaft industry.

The global automotive camshaft market is segmented as:

By Manufacturing Technology

- Cast Camshaft

- Forged Camshaft

- Assembled Camshaft

By Application

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Sales Channel

- Original Equipment Manufacturers (OEM)

- Aftermarket

By Fuel Type

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America