Automotive Brake Pad Market Size

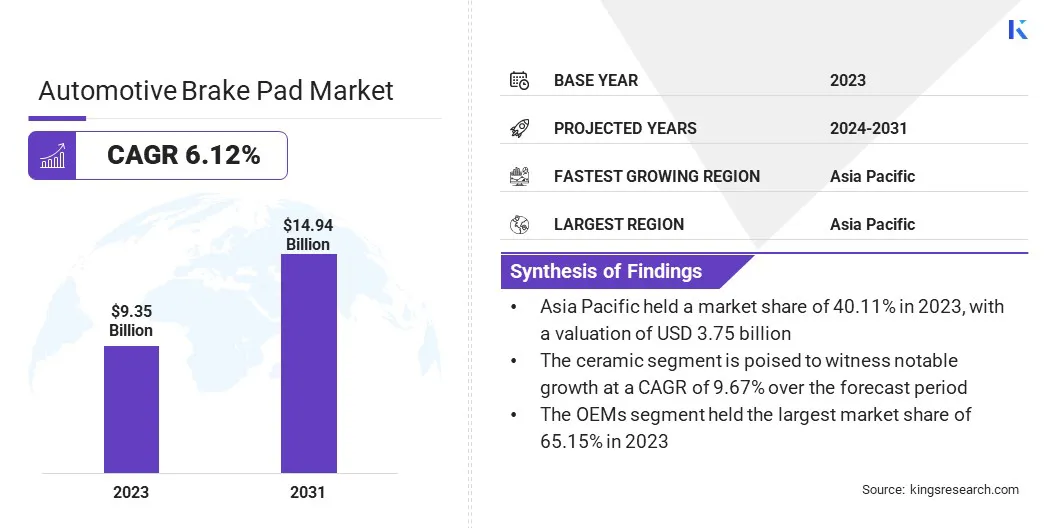

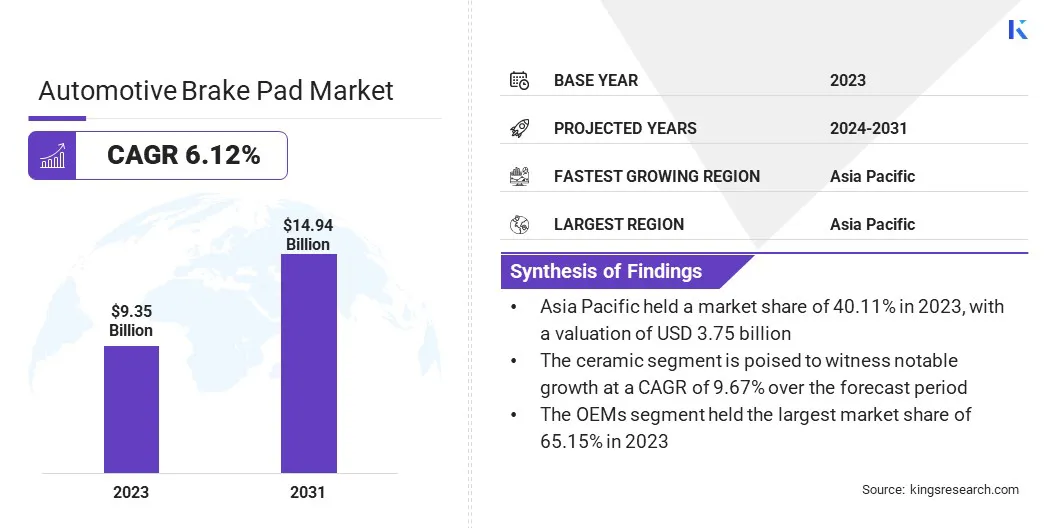

The global Automotive Brake Pad Market size was valued at USD 9.35 billion in 2023 and is projected to reach USD 14.94 billion by 2031, growing at a CAGR of 6.12% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Robert Bosch GmbH, Continental AG, Akebono Brake Industry Co., Ltd., Tenneco Inc., Brembo S.p.A., Nisshinbo Holdings Inc., Delphi Technologies, TBC Corporation, MIBA AG, Aisin Seiki Co., Ltd. and Others.

The global market experiences a dynamic landscape driven by technological advancements, regulatory changes, and evolving consumer preferences. The market is witnessing steady growth attributed to the increasing production and sales of vehicles globally, coupled with a rising focus on vehicle safety standards. Moreover, the growing awareness regarding the importance of brake system maintenance among consumers is fueling the demand for automotive brake pads.

The market is poised to expand further in the upcoming years, driven by several factors such as the introduction of advanced materials in brake pad manufacturing, the integration of electronic brake systems, and the growing demand for electric and hybrid vehicles.

Analyst’s Review

Several key trends are influencing the growth trajectory of the automotive brake pad market. One such trend is the growing shift toward environmentally friendly materials in brake pad manufacturing, driven by regulations and consumer preferences for sustainable products. Manufacturers are increasingly focusing on developing brake pads with low or zero copper content to minimize environmental impact.

Additionally, advancements in brake pad technology, such as the development of ceramic and composite materials, are enhancing performance and durability while reducing noise and dust emissions. Furthermore, the growing adoption of electric vehicles (EVs) and autonomous driving technologies is expected to drive the demand for brake pads possessing higher thermal stability and reliability. These trends indicate a positive market outlook for the forecast years, with continuous innovation and product development driving the growth of the automotive brake pad market.

Market Definition

Automotive brake pads are essential components of the braking system, responsible for providing friction to slow or stop the vehicle. Typically, brake pads consist of a friction material bonded to a metal backing plate, which is subsequently installed within the brake caliper assembly. The friction material is usually made from a combination of materials such as metallic fibers, ceramic fibers, and organic compounds, and is chosen for its heat resistance, durability, and performance characteristics.

Automotive brake pads are primarily used in passenger cars, light commercial vehicles, heavy trucks, buses, and coaches. Regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA) in the United States and the European Union's ECE Regulations have established standards and requirements for automotive brake systems, including brake pads, to ensure vehicle safety and performance.

Automotive Brake Pad Market Dynamics

The market is experiencing substantial growth due to the rising emphasis on vehicle safety and regulatory compliance. As regulatory bodies impose stringent safety standards globally, automakers and brake pad manufacturers are compelled to enhance the safety features of vehicles, particularly the braking system. This has resulted in an increased demand for high-quality brake pads that not only meet the regulatory requirements but also offer superior performance and reliability. Consequently, the automotive brake pad market is witnessing significant growth as both automakers and consumers prioritize safety, propelling the need for advanced brake pad technologies.

Despite the growing demand, the market faces a major restraint in the form of volatile raw material prices. The manufacturing process of brake pads relies heavily on various materials, including metals, ceramics, and friction materials. These raw materials are susceptible to price fluctuations caused by supply chain disruptions, geopolitical tensions, and economic conditions. Such fluctuations can significantly impact production costs and profit margins for brake pad manufacturers, presenting challenges to the overall growth of the market.

Segmentation Analysis

The global market is segmented based on vehicle type, material, sales channel, and geography.

By Vehicle Type

Based on vehicle type, the automotive brake pad market is segmented into passenger cars, light commercial vehicles, heavy trucks, buses, coaches, and others. The passenger cars segment dominated the market in 2023, with a valuation of USD 6.37 billion. This expansion is primarily driven by the high volume of passenger car sales worldwide. Passenger cars represent the largest segment in terms of vehicle ownership and usage, driving significant demand for automotive brake pads.

Moreover, advancements in passenger car technology, increasing safety concerns, and consumer preferences for reliable braking systems further contributed to the dominance of this segment in the market.

By Material

Based on material, the automotive brake pad market is classified into non-metallic, semi-metallic, fully metallic, and ceramic. The ceramic segment is poised to witness notable growth at a CAGR of 9.67% over the forecast period. Ceramic brake pads offer numerous advantages, including superior heat resistance, longer lifespan, reduced noise and dust emissions, and enhanced braking performance. With the increasing demand for high-performance brake pads and the growing adoption of electric and hybrid vehicles, which require advanced braking solutions, the ceramic segment is expected to witness robust growth as consumers prioritize durability and safety in their braking systems.

By Sales Channel

Based on sales channel, the automotive brake pad market is bifurcated into aftermarket and OEMs. The OEMs segment held the largest market share of 65.15% in 2023 primarily due to the direct integration of brake pads into new vehicles during manufacturing processes. original equipment manufacturers (OEMs) have established partnerships with automakers, ensuring a steady demand for brake pads.

Additionally, OEMs often prioritize high-quality components to maintain vehicle safety and performance standards, thereby boosting their market share. Moreover, the increasing production of vehicles globally and the growing trend of integrated safety features contribute to the dominance of the OEM segment in the market.

Automotive Brake Pad Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia Pacific Automotive Brake Pad Market share stood around 40.11% in 2023 in the global market, with a valuation of USD 3.75 billion. This dominance can be attributed to several factors such as rapid urbanization, rising disposable incomes, and increasing automotive production. Countries such as China, Japan, India, and South Korea are witnessing significant growth in vehicle sales, which is driving the demand for automotive brake pads. Moreover, the increasing focus on vehicle safety standards and regulatory compliance in the region is encouraging automotive manufacturers to invest in advanced brake systems, thereby fueling market growth.

Additionally, the expansion of the aftermarket sector in the Asia-Pacific region, driven by a large vehicle parc and the need for replacement parts, presents lucrative opportunities for brake pad manufacturers. With the continuous proliferation of the automotive industry and infrastructure development initiatives, the region is expected to maintain its standing as the fastest-growing region, registering a CAGR of 7.93% over the forecast years.

Competitive Landscape

The automotive brake pad market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Automotive Brake Pad Market

- Robert Bosch GmbH

- Continental AG

- Akebono Brake Industry Co., Ltd.

- Tenneco Inc.

- Brembo S.p.A.

- Nisshinbo Holdings Inc.

- Delphi Technologies

- TBC Corporation

- MIBA AG

- Aisin Seiki Co., Ltd.

Key Industry Developments

- June 2023 (Investment): ITT Corporation announced a strategic investment toward expanding its presence in high-performance brake pad applications. The investment aimed to enhance ITT's capabilities in the manufacturing of advanced brake pad solutions catering to the growing demand for high-performance braking systems. This move reflected ITT's commitment to innovation and meeting the evolving needs of the automotive industry for superior braking solutions.

The global Automotive Brake Pad Market is segmented as:

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Trucks

- Buses and Coaches

- Others

By Material

- Non-metallic

- Semi-metallic

- Fully Metallic

- Ceramic

By Sales Channel

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.