Market Definition

The market encompasses technologies that enable real-time identification and analysis of video, audio, and images. ACR technology recognizes content by matching patterns, fingerprints, or metadata, facilitating the identification of TV shows, advertisements, music, movies, or even images across different platforms and devices.

Automatic Content Recognition Market Overview

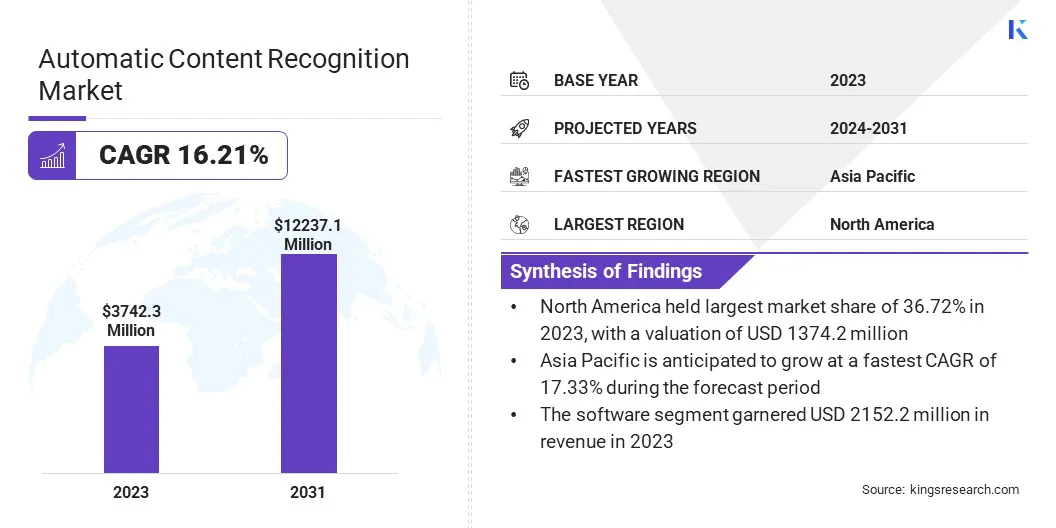

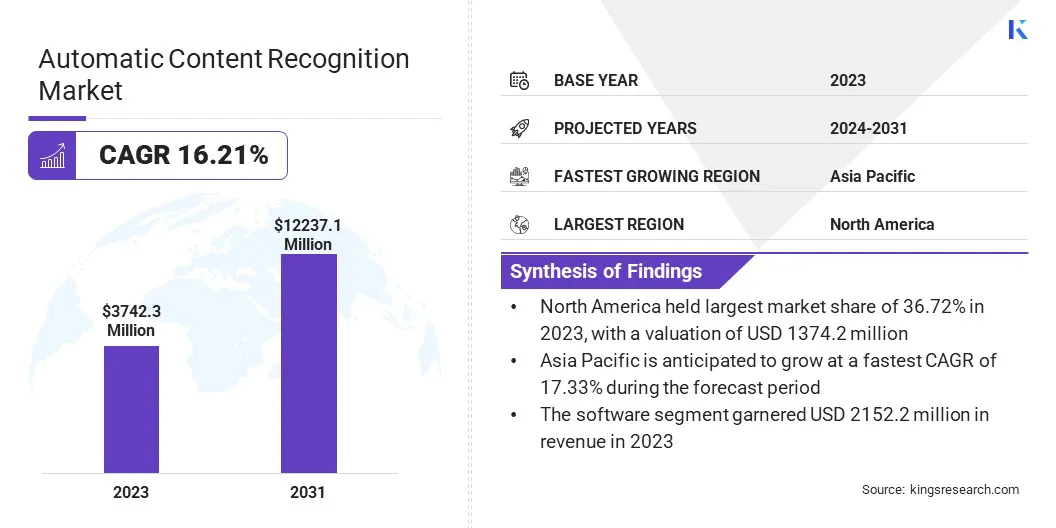

Global automatic content recognition market size was valued at USD 3,742.3 million in 2023, which is estimated to be valued at USD 4,276.2 million in 2024 and reach USD 12,237.1 million by 2031, growing at a CAGR of 16.21% from 2024 to 2031.

The rising consumption of content across TV, streaming, and social media is creating a strong demand for automatic content recognition (ACR) technologies, enabling advanced content tracking, targeted advertising, and personalized user experiences across platforms.

Major companies operating in the automatic content recognition industry are ACRCloud PTE. LTD, Beatgrid Media B.V., Inscape, Pex, Microsoft, Audible Magic Corporation., Gracenote, Inc., VoiceInteraction, VoiceBase, Inc., mufin GmbH, Clarifai, Inc., ivitec, Valossa Labs Ltd., Verbit, Samba TV, Inc., and others.

The rise of the Automatic Content Recognition (ACR) market is propelled by advancements in AI, increasing demand for targeted advertising, and the expansion of streaming services. The integration of ACR into smart devices enhances user engagement across platforms, while regulatory demands for content transparency further drive market adoption.

These factors contribute to the rapid evolution of ACR technology, creating significant opportunities across industries such as entertainment, advertising, and retail

- In April 2024, Nexxen partnered with The Trade Desk to provide exclusive Automatic Content Recognition (ACR) data for enhanced cross-channel targeting. This collaboration empowers advertisers with more efficient media investment, improving TV viewership insights across linear and streaming platforms.

Key Highlights:

- The automatic content recognition market size was recorded at USD 3,742.3 million in 2023.

- The market is projected to grow at a CAGR of 16.21% from 2024 to 2031.

- North America held a share of 36.72% in 2023, valued at USD 1,374.2 million.

- The software segment garnered USD 2,152.2 million in revenue in 2023.

- The audio and video watermarking segment is expected to reach USD 5,050.2 million by 2031.

- The smart TVs segment held a share of 46.32% in 2023.

- The advertisement targeting segment is anticipated to grow at a CAGR of 17.80% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 17.33% through the projection period.

Market Driver

Rising Content Consumption

The growing consumer engagement across raditional TV, streaming services, and social platforms has highlighted the need for accurate content tracking and recognition, propelling the growth of the market.

Automatic content recognition enables real-time identificationacross diverse platforms, optimizing advertising through personalized experiences, improved viewer engagement, and precise targeting. As digital consumption rises, ACR is essential for enhancing content delivery and maximizing ad efficiency.

- In September 2024, FreeWheel partnered with Samba TV to integrate first-party ACR data into its platform. This collaboration aims to enable real-time audience targeting across linear, streaming, and on-demand content, enhancing ad precision and effectiveness.

Market Challenge

Surging Privacy Concerns

Privacy concerns pose a significant challenge to the development of the automatic content recognition market, as reluctance stems from data tracking and personal information collection fears. These concerns can lead to hesitance in adopting ACR technologies.

To address this, companies can enforce transparent data policies, obtain explicit consumer consent, and implement robust data protection measures. Additionally, offering users control over their data and using anonymized data for content recognition can build trust and foster adoption.

Market Trend

Real-Time Content Recognition

A shift toward real-time content recognition is emerging as a notable trend in the market, particularly for enhancing live experiences in sports and broadcasting. With the rise of streaming and connected TV platforms, real-time ACR enables instant content identification, allowing for more personalized ads and dynamic content recommendations.

This advancement enables advertisers to deliver targeted ads based on real-time viewer behavior, improving user engagement during live events and broadcasts.

- In October 2024, Samba TV partnered with IRIS.TV to enhance contextual advertising using Samba AI. This collaboration provides real-time content recognition, enabling precise targeting and measurement across video content, improving ad effectiveness on both linear and streaming platforms.

Automatic Content Recognition Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

Software, Services

|

|

By Technology

|

Audio and Video Fingerprinting, Audio and Video Watermarking, Speech Recognition, Optical Character Recognition (OCR), Others

|

|

By Platform

|

Smart TVs, Linear TVs, Over-The-Top (OTT), Others

|

|

By Application

|

Audience Measurement, Broadcast Monitoring, Advertisement Targeting, Content Management, Content Filtering, Ad-tracking

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Deployment (Software and Services): The software segment earned USD 2,152.2 million in 2023 due to increasing demand for automated content recognition solutions and content tracking solutions.

- By Technology [Audio and Video Fingerprinting, Audio and Video Watermarking, Speech Recognition, Optical Character Recognition (OCR), and Others]: The audio and video fingerprinting segment held a share of 38.63% in 2023, fueled by its ability to accurately identify and track content across multiple platforms.

- By Platform (Smart TVs, Linear TVs, Over-The-Top (OTT), and Others): The smart TVs segment is projected to reach USD 5,731.1 million by 2031, owing to the growing integration of content recognition technologies for personalized advertising.

- By Application (Audience Measurement, Broadcast Monitoring, Advertisement Targeting, Content Management, Content Filtering, and Ad-tracking): The advertisement targeting segment is anticipated to grow at a CAGR of 17.80% over the forecast period, propelled by the increasing demand for personalized and contextually relevant advertising solutions.

Automatic Content Recognition Market Regional Analysis

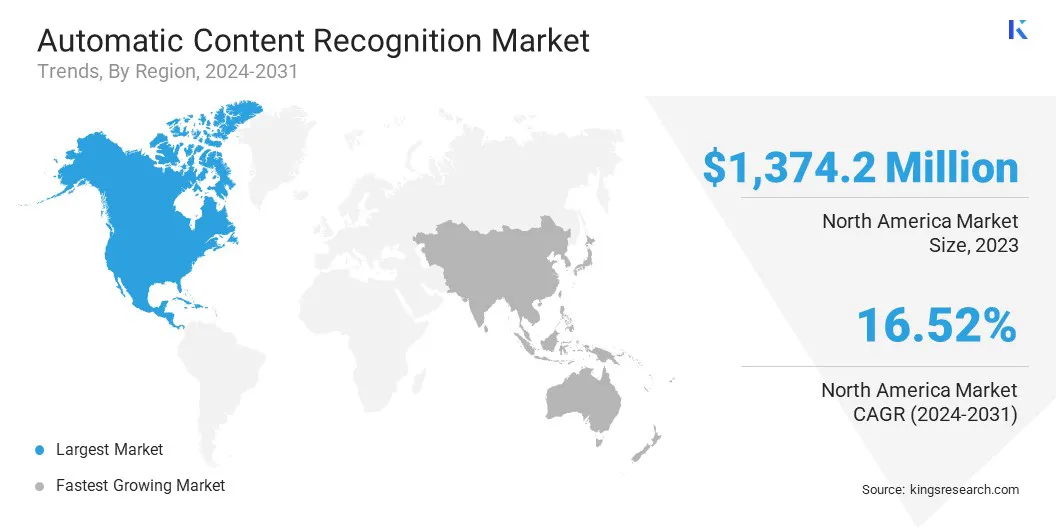

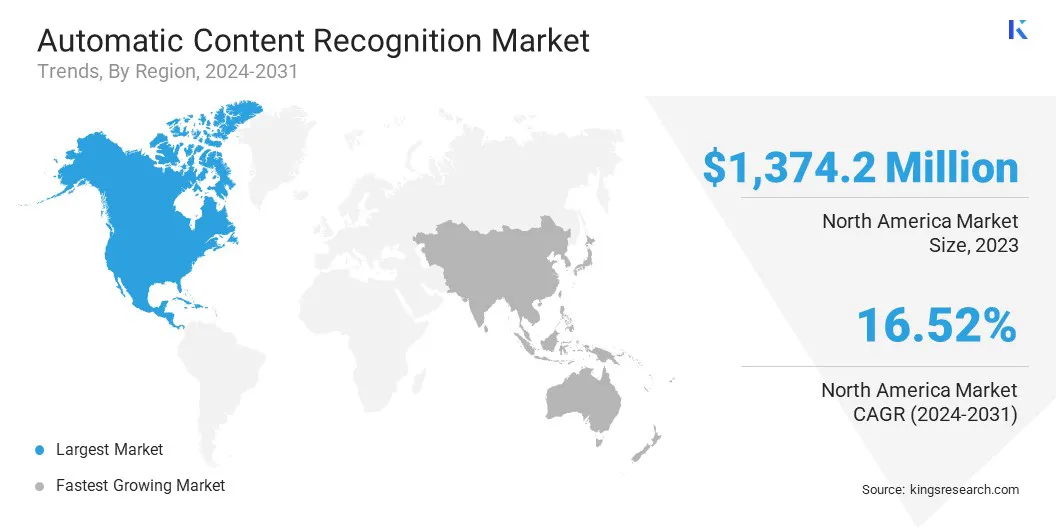

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America automatic content recognition market share stood at around 36.72% in 2023, valued at USD 1,374.2 million. This dominance is facilitated by the region's advanced technological infrastructure. The regional market benefits from a well-established advertising ecosystem, supported by a robust demand for data-driven solutions that enhance viewer engagement and ad precision.

Additionally, the presence of key players and extensive collaborations among media, advertising, and technology companies further strengthens its position. Addiitonally, regulatory frameworks support the development and adoption of ACR technologies.

Asia Pacific automatic content recognition industry is set to grow at a robust CAGR of 17.33% over the forecast period. This expansion is stimulated by rapid digital transformation, increasing adoption of smart TVs, and a surge in over-the-top (OTT) streaming services.

Rising consumer demand for personalized content experiences, coupled with a growing focus on advanced advertising and measurement solutions, is further aiding this growth. Additionally, the region's expanding internet infrastructure, rising disposable incomes, and increasing preference for real-time content tracking and targeted advertising are fueling regional market expansion.

- In April 2024, Nexxen granted Australian advertisers exclusive access to VIDAA’s ACR data, enhancing audience targeting across TV channels. The platform leverages real-time TV viewership insights to enhance advertising effectiveness while ensuring privacy compliance for linear and streaming platforms.

Regulatory Frameworks

- In the US, the Federal Communications Commission (FCC) regulates cable, radio, television, and streaming, ensuring connectivity, competition, and privacy compliance in broadcast content.

- In the EU, the General Data Protection Regulation (GDPR) governs personal data collection, storage, and processing, including ACR data, mandating explicit user consent.

- In India, the Digital Personal Data Protection Act, 2023, regulates the processing of personal data, including ACR data, ensuring user consent and safeguarding data privacy rights.

Competitive Landscape

Companies operating in the automatic content recognition industry are integrating advanced technologies such as AI and machine learning to enable real-time content recognition across platforms.

These solutions enhance audience targeting, advertising strategies, and content measurement. By leveraging big data and real-time analytics, they optimize ad placements, enhance user experiences, and maximize ROI.

- In July 2024, Disney Star collaborated with Beatgrid to enhance cross-platform video campaign measurement. Utilizing ACR technology, this collaboration assesses campaign effectiveness across Linear TV and digital platforms, offering brands comprehensive insights for data-driven media investments.

List of Key Companies in Automatic Content Recognition Market:

- ACRCloud PTE. LTD

- Beatgrid Media B.V.

- Inscape

- Pex

- Microsoft

- Audible Magic Corporation.

- Gracenote, Inc.

- VoiceInteraction

- VoiceBase, Inc.

- mufin GmbH

- Clarifai, Inc.

- ivitec

- Valossa Labs Ltd.

- Verbit

- Samba TV, Inc.

Recent Developments (Partnerships/New Product Launch)

- In June 2024, Yahoo partnered with VideoAmp to integrate measurement and identity resolution, enhancing targeting across TV and digital platforms. This collaboration leverages Yahoo ConnectID and VideoAmp’s VALID engine to optimzie campaigns, improve measurement, and maximize media spend efficiency.

- In June 2024, Audible Magic introduced Broad Spectrum, an advanced content identification solution designed to detect and attribute manipulated audio. It enhances ACR by identifying pitch and tempo alterations, ensuring accurate rights management across platforms such as TikTok.