Automated Container Terminal Market Size

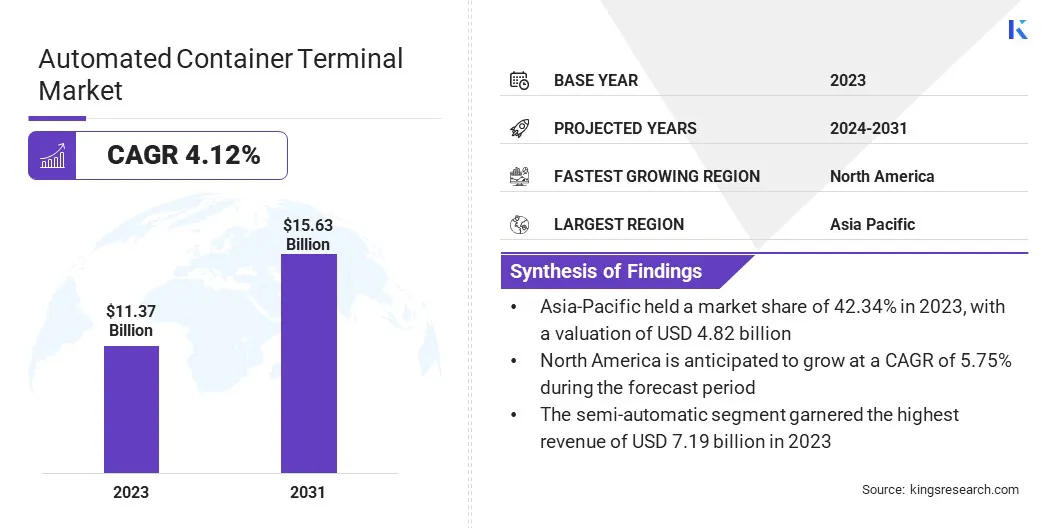

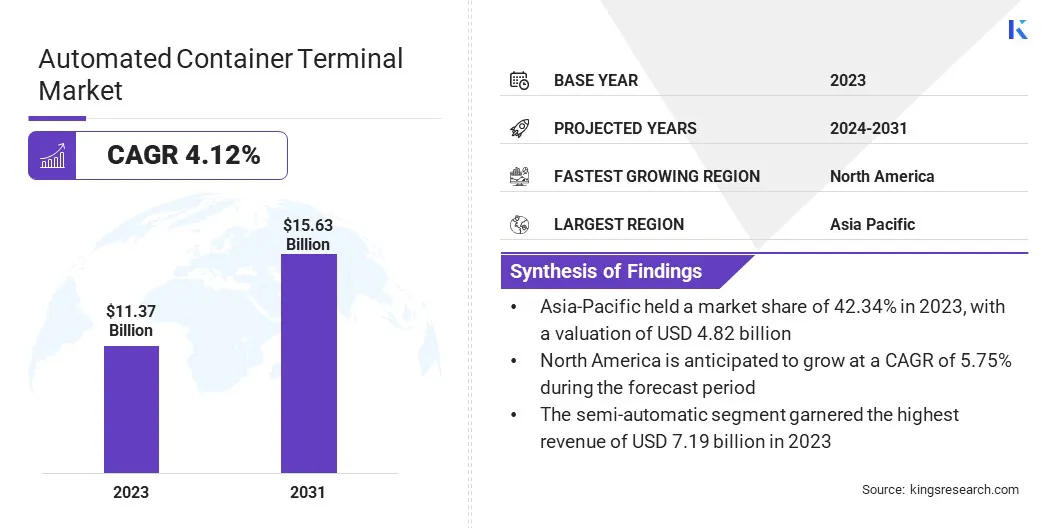

The global Automated Container Terminal Market size was valued at USD 11.37 billion in 2023 and is projected to grow from USD 11.78 billion in 2024 to USD 15.63 billion by 2031, exhibiting a CAGR of 4.12% during the forecast period. The growth of the market is driven by the imperatives such as enhancing operational efficiency, reducing cost, accommodating increasing global trade volumes, addressing labor shortages, emphasizing technological advancements, and complying with environmental regulations.

In the scope of work, the report includes solutions offered by companies such as Camco Technologie, Konecranes, Künz GmbH, Liebherr, ABB, CARGOTEC CORPORATION, CLT, IDENTEC SOLUTIONS AG, ORBCOMM, ZPMC Netherlands B.V. and others.

The expansion of the automated container terminal market is primarily fueled by the need for operational efficiency and cost reduction in port operations. Increasing global trade volumes necessitate enhanced terminal capacity and faster cargo handling. Technological advancements, such as AI and IoT, enable improved productivity and accuracy in terminal operations.

- In May 2024, Taoping Inc. unveiled an upgraded AI-powered smart terminal that combined AI Generative Artificial Intelligence (AIGC) with its cloud platform. The terminals featured high-end video displays, allowing advertisers to create diverse content such as text-to-image, posters, and video ads autonomously. This innovation supported rapid interaction, data collection, and analysis, thereby enhancing user experience and optimizing advertising within Taoping's ecosystem.

Additionally, labor shortages and rising labor costs prompt terminals to adopt automation solutions. Environmental regulations further play a significant role, as automated terminals often produce lower emissions compared to traditional ones. Investments in port infrastructure by governments and private entities further boost market growth, ensuring the scalability and sustainability of port operations in the face of growing demands.

The automated container terminal market has experienced substantial growth due to the widespread adoption of advanced technologies and the increasing need for efficient cargo handling solutions. Automated terminals improve the overall throughput of ports, thereby reducing congestion and turnaround times. Asia-Pacific holds a significant market share due to its large port operations and increased investments in automation.

Europe and North America contribute significantly to market development, supported by ongoing modernization efforts. The market is characterized by collaborations between technology providers and port operators to streamline terminal processes and enhance competitiveness.

An automated container terminal refers to a port facility where container handling operations are managed and executed through automated systems and equipment. These terminals aim to optimize efficiency, reduce operational costs, and enhance safety by minimizing human intervention.

Automation in container terminals covers various processes such as container loading and unloading, transportation within the terminal, and storage management. The integration of AI, IoT, and machine learning technologies plays a crucial role in achieving fully automated and smart terminal operations.

Analyst’s Review

Manufacturers are focusing on advancing technology integration and enhancing operational efficiencies. This includes the development of AI-driven terminal operating systems (TOS) and the deployment of next-generation automated guided vehicles (AGVs) and stacking cranes.

- In April 2024, INFORM enhanced Duisburg Gateway Terminal (DGT) operations with AI-based solutions, thereby supporting the terminal'sinitiation and expansion. INFORM implemented its Intermodal terminal operated system (TOS) at DGT, with a particular focus on barge handling, train loading, crane optimization, billing module integration, stack optimization, and a booking platform interface.

These innovations aim to optimize cargo handling, minimize downtime, and improve overall terminal productivity. Manufacturers are further expanding their service offerings to include comprehensive maintenance and support packages, thus addressing the complex needs of automated terminal operators. Stakeholders are recommended to prioritize strategic partnerships for technology integration and investments in R&D to innovate sustainable and scalable solutions.

Emphasizing cybersecurity measures and regulatory compliance is anticipated to be crucial in the face of increasing digitalization. Additionally, fostering talent development in automation and data analytics is likely to ensure sustainable growth and provide a competitive advantage in the evolving market landscape.

Automated Container Terminal Market Growth Factors

A key factor propelling the growth of the automated container terminal market is the increasing need for scalability and flexibility in port operations. As global trade volumes continue to rise, ports face pressure to handle larger quantities of cargo efficiently. Automated terminals offer the capability to quickly scale operations up or down in response to fluctuating demand, thereby maintaining consistent throughput without compromising efficiency.

By leveraging advanced technologies such as AI and robotics, terminals are optimizing resource allocation and streamlining workflows, thereby enhancing overall operational flexibility. This capability is crucial in meeting the dynamic demands of global supply chains and maintaining competitiveness in the market.

The adoption of automated container terminals faces challenges due to the initial high capital investment required for implementing automation systems. The cost associated with installing automated equipment such as AGVs and ASCs, along with integrating sophisticated TOS, is often substantial.

To overcome this challenge, stakeholders are exploring financing options such as leasing arrangements and public-private partnerships (PPP) to distribute costs over an extended period. Additionally, focusing on long-term cost savings and operational efficiencies enabled by automation justifies the initial investment. Collaborations with technology providers for customized solutions and phased implementation strategies help mitigate financial risks and ensure smooth integration of automated systems.

Automated Container Terminal Market Trends

The market is growing due to the integration of digital twins for enhanced operational efficiency. Digital twins are virtual replicas of physical assets and processes that enable real-time monitoring, simulation, and optimization of terminal operations.

By leveraging IoT sensors and data analytics, port operators are creating digital twins that provide insights into equipment performance, maintenance needs, and operational workflows. This technology facilitates predictive maintenance, reduces downtime, and improves overall terminal productivity.

Port authorities are increasingly adopting digital twins to visualize and simulate scenarios, thereby optimizing resource allocation and improving decision-making processes in terminal management. Another significant trend shaping the automated container terminal market landscape is the rising focus on sustainability and environmental responsibility. Port operators are implementing green initiatives and technologies to reduce carbon emissions and minimize environmental impact.

Automated terminals inherently contribute to sustainability by optimizing energy usage, reducing fuel consumption through efficient routing of AGVs and ASCs, and implementing smart energy management systems.

Additionally, advancements in renewable energy sources such as solar and wind power for terminal operations enhance sustainability efforts. Regulatory pressures and stakeholder expectations are compelling ports to prioritize greener practices, making sustainability a key consideration in the adoption and development of automated container terminal solutions.

Segmentation Analysis

The global market is segmented based on degree of automation, project type, offering, and geography.

By Degree of Automation

Based on degree of automation, the market is categorized into fully automatic and semi-automatic. The semi-automatic segment led the automated container terminal market in 2023, reaching a valuation of USD 7.19 billion. This dominance is attributed to its balanced approach that combines automation with human oversight to ensure operational flexibility and reliability.

Semi-automatic terminals integrate advanced technologies such as automated stacking cranes (ASCs) and terminal operating systems (TOS), thereby enhancing efficiency without fully replacing human labor. This approach appeals to port operators who seek cost-effective solutions that optimize cargo handling while maintaining control over critical operations.

Additionally, semi-automatic terminals allow for phased implementation, thus minimizing disruption to ongoing operations and enabling smoother transitions to full automation as technology advances.

By Project Type

Based on project type, the market is classified into brownfield projects and greenfield projects. The greenfield projects segment is anticipated to witness significant growth at a CAGR of 4.84% through the forecast period (2024-2031).

Greenfield projects involve the development of new terminal facilities on previously undeveloped land, allowing for the integration of state-of-the-art automated technologies from inception. This segment's expansion is fueled by increasing global trade volumes and the rising need for modern, efficient terminal infrastructure.

Greenfield projects offer advantages such as customizable design for optimized workflows, reduced environmental impact compared to retrofitting existing terminals (brownfield projects), and the opportunity to incorporate sustainable practices from the outset. Governments and private investors are increasingly favoring greenfield developments to meet evolving demands in maritime logistics and to enhance port capacity.

By Offering

Based on offering, the market is segmented into equipment, services, and software. The services segment secured the largest automated container terminal market share of 45.34% in 2023. This notable growth is fueled by the increasing demand for integrated solutions that encompass installation, maintenance, and support services for automated terminal systems.

Service providers offer expertise in managing complex terminal operations, ensuring the seamless integration of automated equipment, and optimizing overall terminal efficiency.

Port operators benefit from comprehensive service packages that include training, consulting, and ongoing technical support, thereby reducing operational risks and enhancing system reliability. As automation technologies evolve, the services segment is expanding due to the pressing need for specialized knowledge and continuous improvement in terminal management practices.

Automated Container Terminal Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific automated container terminal market held a share of around 42.34% in 2023, with a valuation of USD 4.82 billion. This regional dominance is propelled by robust economic growth, extensive maritime trade networks, and significant investments in port infrastructure and automation technologies.

Major economies such as China, Singapore, and South Korea led the adoption of automated terminals to enhance operational efficiency and accommodate escalating trade volumes. Moreover, supportive government policies and initiatives aimed at modernizing port facilities bolster domestic market growth in the Asia-Pacific region, positioning it as a key hub for maritime logistics and container handling operations in the global market.

North America is estimated to experience considerable growth, depicting a CAGR of 5.75%. This growth trajectory is fueled by increasing investments in port modernization, advancements in automation technologies, and strategic initiatives to improve supply chain resilience. Ports in the United States and Canada are prioritizing efficiency gains through automation, aiming to reduce congestion, enhance cargo throughput, and meet evolving customer demands.

Additionally, regulatory frameworks promoting sustainable practices and digitalization initiatives are leading to the widespread adoption of automated terminal solutions across the region. These factors underscore North America's role as a dynamic market for innovative terminal operations, well-positioned to capitalize on technological advancements and operational efficiencies in maritime logistics.

Competitive Landscape

The automated container terminal market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Automated Container Terminal Market

Key Industry Developments

- June 2024 (Launch): Kalmar, a division of Cargotec, unveiled a new electric empty container handler at the TOC Europe 2024 event in Rotterdam on June 11. This addition expanded their eco-efficient product lineup, which included reachstackers, terminal tractors, and forklifts. The electric handler utilized Kalmar's established electrical platform, shared with their electric reachstackers and heavy forklift trucks.

- June 2023 (Partnership): Liebherr Container Cranes a prominent construction machine manufacturer announced the completion of the delivery of a ship-to-shore container crane to Patrick Terminals - Brisbane AutoStrad. The semi-automated crane included an automated arced cycle, landside automation, and manual control for loading and unloading ships. It was equipped with Liebherr's Remote Operator Station (ROS) and it enabled precise control and exception handling of the device from an office setting.

The global automated container terminal market is segmented as:

By Degree of Automation

- Fully Automatic

- Semi-Automatic

By Project Type

- Brownfield Projects

- Greenfield Projects

By Offering

- Equipment

- Services

- Software

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America