ATV and UTV Market Size

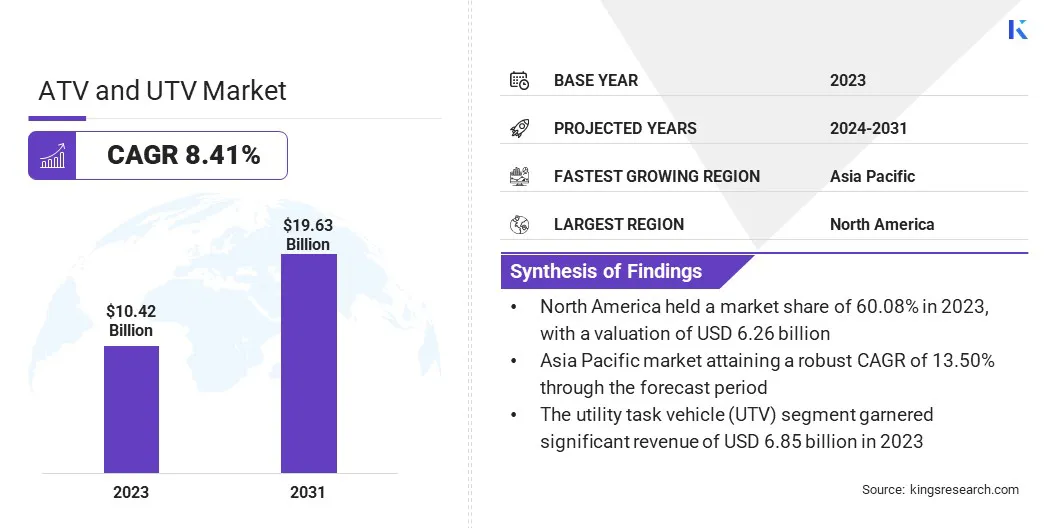

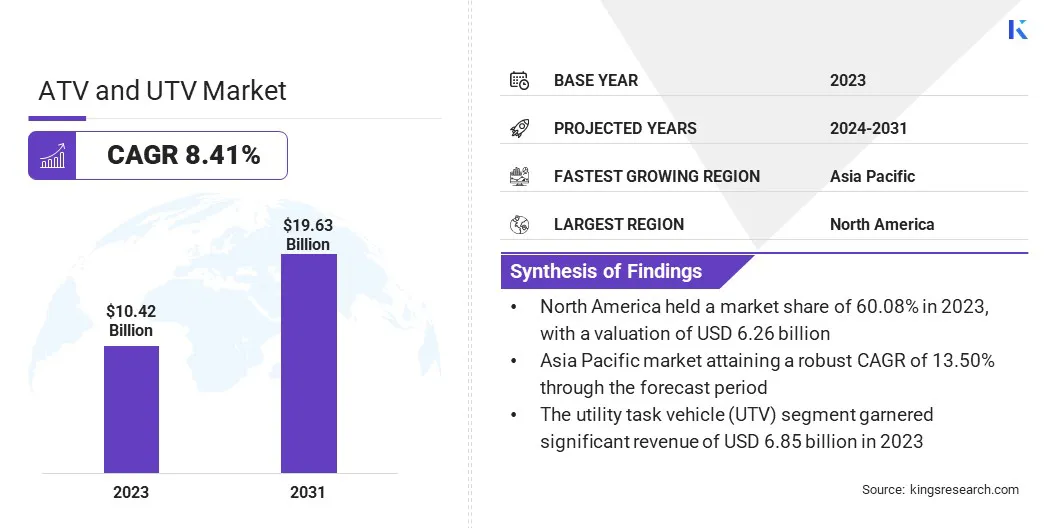

The global ATV and UTV Market size was valued at USD 10.42 billion in 2023 and is projected to reach USD 19.63 billion by 2031, growing at a CAGR of 8.41% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Polaris Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., BRP, Textron Specialized Vehicles, Kubota Corporation, CFMOTO Powersports, Massimo Motor Sports, Deere & Company and Others.

The ATV and UTV market presents a dynamic landscape characterized by evolving consumer preferences, technological advancements, and regulatory measures. The market witnessed steady growth in recent times, mainly driven by several factors such as increasing recreational activities, rising demand for off-road vehicles for agricultural and industrial applications, and the growing popularity of adventure sports.

With the expansion of outdoor recreational activities and the rising need for utility vehicles in various sectors, the market is poised to experience substantial growth over the forecast period.

Furthermore, advancements in electric and hybrid technologies are expected to redefine the market landscape in the upcoming years by offering eco-friendly alternatives to traditional gasoline-powered vehicles. Despite facing challenges such as regulatory uncertainties and economic fluctuations, the market outlook is projected to remain promising, with sustained growth foreseeable through the projection period.

Analyst’s Review

Several key trends are shaping the growth trajectory of the ATV and UTV market. One prominent trend is the increasing adoption of electric vehicles (EVs) in the off-road vehicle segment. The shift toward EVs is driven by various factors such as environmental concerns, government incentives, and advancements in battery technology.

Electric ATVs and UTVs offer benefits such as reduced emissions, lower operating costs, and quieter operation, appealing to environmentally conscious consumers and businesses alike.

Additionally, technological innovations, including enhanced safety features, connectivity, and autonomous capabilities, are expected to drive market growth over the forecast period. Furthermore, the integration of digital platforms for rental and sharing services is presenting new avenues for ATV and UTV market expansion.

Market Definition

All-terrain vehicles, or ATVs, are rugged off-road vehicles designed for recreational and utility purposes. They typically feature handlebar steering and are intended for single-rider use. ATVs are commonly used for outdoor recreational activities such as trail riding, hunting, and racing.

On the other hand, UTVs, or utility task vehicles, are multipurpose vehicles equipped with a steering wheel, seating for multiple passengers, and a cargo bed for hauling. UTVs are widely used in agricultural, construction, and industrial applications due to their versatility and payload capacity. From transporting goods and equipment to navigating challenging terrain, UTVs play a crucial role in various sectors.

In terms of regulations, both ATVs and UTVs are subject to safety standards and restrictions imposed by government agencies to ensure user safety and environmental compliance.

ATV and UTV Market Dynamics

The ATV and UTV market is thriving due to the surging interest in off-road recreational vehicles. As people's disposable income continues to rise and their interest in outdoor activities grows stronger, they are increasingly drawn to investing in ATVs and UTVs for recreational purposes. These vehicles offer a perfect blend of versatility, performance, and exhilaration, making them irresistible to adventure enthusiasts.

ATVs and UTVs offer an incomparable experience, whether navigating challenging terrains or embarking on exhilarating off-road excursions. As more consumers seek the excitement offered by these vehicles, the market is set to expand in the foreseeable future.

Despite growth prospects, there are certain challenges that hinder market progress. The complex regulatory landscape surrounding emissions and safety standards poses a major challenge to market expansion. Government regulations pertaining to vehicle emissions, safety features, and usage restrictions in specific regions present obstacles for manufacturers and could potentially impede ATV and UTV market growth.

These stringent regulations require manufacturers to invest in research and development to ensure compliance with emission norms and safety requirements. Additionally, they may need to modify their products to meet the specific usage restrictions imposed in certain areas. This can lead to increased costs and longer approval processes, which may impact the market growth.

Segmentation Analysis

The global market is segmented based on vehicle type, fuel type, displacement, and geography.

By Vehicle Type

Based on vehicle type, the market is bifurcated into all-terrain vehicle (ATV) and utility task vehicle (UTV). The utility task vehicle (UTV) segment garnered significant revenue of USD 6.85 billion in 2023 due to its versatile applications across various industries such as agriculture, construction, and landscaping.

UTVs are highly valued for their robust design, payload capacity, and ability to navigate challenging terrain, which makes them indispensable tools for utility tasks. Furthermore, the segment's dominance can be attributed to the growing demand for multipurpose vehicles that offer efficiency, reliability, and versatility in meeting diverse business needs.

By Fuel Type

Based on fuel type, the market is bisected into gasoline/petrol and electric. The electric segment is anticipated to witness notable growth over the forecast period, attaining a CAGR of 14.23%. Increasing environmental concerns and a shift toward sustainable transportation solutions are likely to boost segmental growth.

With growing awareness of carbon emissions and the need to reduce environmental impact, there is a rising demand for electric vehicles (EVs) across the globe. Moreover, advancements in battery technology, coupled with government incentives and subsidies for electric vehicles, are driving the adoption of electric ATVs and UTVs, thereby fueling the growth of the segment.

By Displacement

Based on displacement, the market is classified into less than 400 CC, 401 CC to 799 CC, and more than 800 CC. The 401 CC to 799 CC segment led the global ATV and UTV market in 2023, capturing a significant share of 65.26%, mainly due to its optimal balance of power, performance, and affordability. This segment caters to a wide range of consumers, including recreational riders and utility vehicle users who are seeking vehicles that offer adequate horsepower and torque for various applications, all while being cost-effective.

Additionally, vehicles within this displacement range often strike a balance between fuel efficiency and power output, making them popular choices among ATV and UTV enthusiasts.

ATV and UTV Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America ATV and UTV Market share stood around 60.08% in 2023 in the global market, with a valuation of USD 6.26 billion. This dominance can be attributed to several factors, including a strong culture of outdoor recreation, extensive off-road trails, and a thriving agricultural sector. The region's affluent consumer base, coupled with a high demand for recreational vehicles and utility vehicles, further contributed to its leadership in the global marketplace.

Asia Pacific is poised to become the fastest-growing market for ATVs and UTVs, attaining a robust CAGR of 13.50% through the forecast period. The growth of the regional market is likely to be fueled by rapid urbanization, increasing disposable income, and a growing interest in outdoor recreational activities.

Furthermore, burgeoning industries such as agriculture, construction, and tourism are driving the demand for utility vehicles in the region. Government initiatives promoting eco-friendly transportation solutions and infrastructure development further contribute to the favorable market conditions in the region.

Competitive Landscape

The ATV and UTV market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in ATV and UTV Market

Key Industry Developments

- September 2023 (Partnership): Engineering conglomerate Larsen & Toubro (L&T) partnered with BAE Systems to collaborate on manufacturing ATVs for defense and security purposes. The joint venture aimed to leverage BAE Systems' expertise in military-grade vehicles and L&T's manufacturing capabilities.

- July 2023 (Product Announcement): Tesla announced the launch of an electric quad bike for kids in China, inspired by its Cybertruck design. Priced at USD 1,900, the mini ATV featured a durable frame, all-terrain tires, and a top speed of 10 km/h. With pre-orders already underway, Tesla aimed to capitalize on the growing demand for eco-friendly and innovative recreational vehicles in the Chinese market.

The global ATV and UTV Market is segmented as:

By Vehicle Type

- All-Terrain Vehicle (ATV)

- Utility Task Vehicle (UTV)

By Fuel Type

By Displacement

- Less Than 400 CC

- 401 CC to 799 CC

- More Than 800 CC

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America