Anti-Collision Sensor Market Size

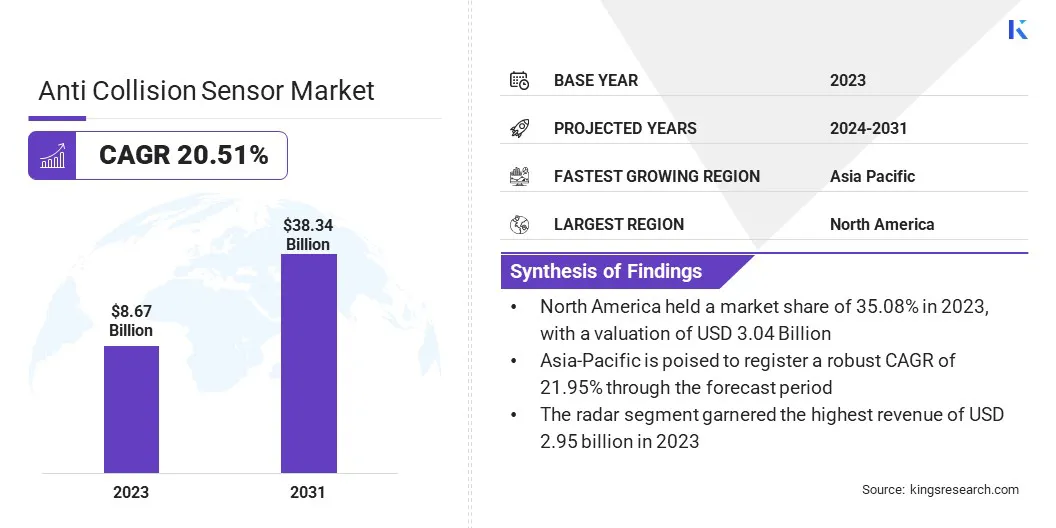

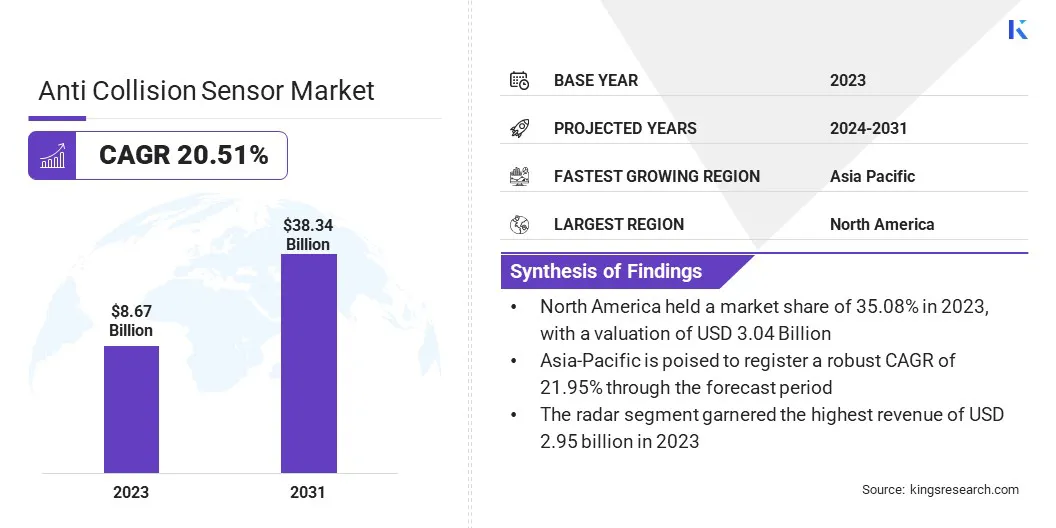

The global Anti-Collision Sensor Market size was valued at USD 8.67 billion in 2023 and is projected to grow from USD 10.39 billion in 2024 to USD 38.34 billion by 2031, exhibiting a CAGR of 20.51% during the forecast period. The increasing implementation of ADAS across the automotive industry is boosting the demand for anti-collision sensors.

Automakers are integrating these systems into vehicles to enhance safety, improve driving experiences, and meet consumer expectations for intelligent features. These sensors enable functions such as automatic emergency braking, lane departure warnings, and adaptive cruise control, which require precise, real-time data to prevent accidents.

The continuous advancement of ADAS is accelerating the need for more advanced and reliable anti-collision sensor technologies, thereby fueling the growth of the market.

In the scope of work, the report includes products offered by companies such as Robert Bosch GmbH, Continental AG, Aptiv PLC, DENSO Corporation, ZF Friedrichshafen AG, Valeo S.A., Magna International Inc., Autoliv Inc., Texas Instruments Incorporated, Murata Manufacturing Co., Ltd., and others.

Moreover, rapid urbanization and increasing traffic congestion in cities worldwide are contributing to a growing need for collision avoidance systems. As urban areas experience increased vehicle density, the risk of traffic accidents rises, necessitating advanced safety solutions. Anti-collision sensors are essential for mitigating the risk of accidents in complex urban driving environments, characterized by frequent stops, tight spaces, and unpredictable road conditions.

- In 2023, the World Health Organization reported approximately 1.19 million fatalities from road traffic crashes. Road traffic injuries have emerged as the leading cause of death among children and young adults aged 5 to 29 years.

An anti-collision sensor is a safety device integrated into vehicles to detect and prevent potential collisions by providing real-time alerts and automatic interventions. Utilizing technologies such as radar, LiDAR, cameras, and ultrasonic sensors, these systems monitor the vehicle's surroundings to identify obstacles, other vehicles, and pedestrians.

Upon detecting a potential collision, the sensor activates warnings for the driver or initiates automatic braking and steering adjustments to avoid or mitigate the impact. Anti-collision sensors are crucial for enhancing road safety, reducing accident rates, and supporting advanced driver-assistance systems (ADAS) in both passenger and commercial vehicles.

Analyst’s Review

Stringent safety regulations set by governments and global regulatory bodies are creating a strong demand for anti-collision sensors. Regulatory mandates for collision avoidance systems, particularly in high-risk sectors such as commercial transportation and passenger vehicles, are reshaping the automotive landscape.

These regulations are aimed at reducing road fatalities and accidents, compelling manufacturers to integrate advanced safety technologies. The global shift toward enhanced vehicle safety standards significantly contribute to the growth of the anti-collision sensor market.

- In June 2024, the United Nations General Assembly called for urgent action to reduce global traffic accident deaths and injuries by advancing the Global Plan for the Decade of Action for Road Safety 2021-2030. The Assembly urged Member States, particularly those that have not yet acted, to consider enacting comprehensive legislation addressing key risk factors, including seat belt use, child restraints, and helmets, as well as driving under the influence.

Moreover, continuous advancements in sensor technologies, including LiDAR, radar, cameras, and ultrasonic sensors, are revolutionizing the capabilities of anti-collision systems. Improvements in sensor accuracy, range, and cost-effectiveness are booating broader adoption across various vehicle segments.

Modern sensors offer enhanced reliability in detecting potential hazards, even under challenging environmental conditions such as poor visibility or extreme weather. This ongoing innovation is making anti-collision technologies more sophisticated and accessible, leading to a wider market penetration and expanding application possibilities.

Anti-Collision Sensor Market Growth Factors

The growing focus on improving safety in public transportation systems is boosting the expansion of the anti-collision sensor market. Cities and transit authorities are increasingly adopting advanced safety technologies, such as collision warning systems, to reduce accidents and ensure the safety of passengers, drivers, and other road users.

The integration of anti-collision sensors in buses, trams, and other public transport vehicles, aligns with broader urban safety initiatives and fosters market expansion.

- In May 2023, the Bosch Engineering Center in Cluj installed its Tram Forward Collision Warning (TFCW) system on a tram in the Cluj-Napoca Public Transport Company's (CTP) fleet. This system enhances safety by assisting tram drivers in critical situations, offering both audible and visual alerts to help prevent collisions, thereby improving the safety of drivers, passengers, and other road users.

Furthermore, the rapid expansion of the logistics, transportation, and e-commerce sectors globally is increasing the focus on commercial vehicle safety. Fleet operators are adopting anti-collision systems to prevent accidents, protect drivers, and minimize operational downtime. The demand for these safety technologies is particularly strong in industries reliant on heavy-duty trucks, delivery vehicles, and public transport, thereby contributing to market expansion.

However, high cost associated with anti-collision sensors, particularly those utilizing LiDAR and radar technologies, is restraining market growth. These advanced systems are expensive, limiting their adoption in budget-sensitive markets and economy vehicle segments, where cost-efficiency is prioritized. This price sensitivity creates a significant barrier to market expansion, especially in regions with lower purchasing power.

To mitigate this challenge, companies are focusing on cost optimization strategies such as scaling production, developing more affordable sensor solutions, and improving sensor integration efficiency. By reducing costs and offering tiered safety packages, manufacturers are making these technologies accessible across a broader range of vehicle segments, ensuring sustained market growth.

Anti-Collision Sensor Market Trends

The rapid growth of autonomous and electric vehicles (EVs) has emerged as a major factor bolstering the expansion of the market. Autonomous vehicles rely heavily on sensor technology for navigation and obstacle detection, making anti-collision sensors an essential component for their safe operation.

The transition to electric mobility presents opportunities for equipping EVs with advanced safety features, including collision prevention systems. Both trends align with the global shift toward sustainable and safer transportation, further increasing the demand for high-precision anti-collision sensors.

- According to the International Energy Agency (IEA) in 2023, over 2.3 million electric cars were sold globally in the first quarter, a 25% increase from the same period in 2022. Under the IEA's Stated Policies Scenario (STEPS), the global share of electric car sales, based on current policies and firm commitments, is expected to reach 35% by 2030, up from less than 25% in the previous forecast.

Additionally, the integration of Industry 4.0 technologies, such as IoT, artificial intelligence (AI), and machine learning, is significantly enhancing the functionality of anti-collision sensors.

IoT connectivity allows real-time communication between vehicles and their surroundings, enhancing situational awareness and predictive safety. AI and machine learning further optimize sensor performance by continuously learning from driving patterns and environmental conditions, resulting in smarter and more responsive safety systems.

Segmentation Analysis

The global market has been segmented based on sensor type, technology, vehicle type, application, end-user, and geography.

By Sensor Type

Based on sensor type, the market has been segmented into radar, ultrasonic, LIDAR, camera, and infrared. The radar segment led the anti-collision sensor market in 2023, reaching a valuation of USD 2.95 billion.

The radar segment is further classified into short-range radar, medium-range radar, and long-range radar. Radar sensors are cost-effective compared to technologies such as LiDAR, which makes them more accessible for mass-market vehicle integration. Additionally, radar's reliability in detecting objects through rain, fog, and darkness enhances its appeal, especially in regions with varying climatic conditions.

As automotive manufacturers prioritize advanced driver-assistance systems (ADAS), radar's precise object detection, wide coverage, and adaptability across vehicle types make it essential in collision avoidance technology.

By Technology

Based on technology, the market has been bifurcated into active and passive. The active segment in anti-collision sensor market secured the largest revenue share of 70.52% in 2023, due to its advanced capabilities in real-time detection and intervention.

Active sensors, such as radar, LiDAR, and ultrasonic systems, offer superior performance in identifying potential collisions by constantly scanning the vehicle’s surroundings and providing instant feedback to the driver or vehicle system. This technology is essential for features such as automatic emergency braking and adaptive cruise control, which are increasingly becoming standard in modern vehicles.

By Vehicle Type

Based on vehicle type, the market has been divided into passenger vehicles, commercial vehicles, and specialty vehicles. The commercial vehicles segment in anti-collision sensor is poised to witness significant growth at a staggering CAGR of 21.35% through the forecast period.

The commercial vehicles segment is further categorized into light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs). This growth is further attributed to the increasing focus on safety and operational efficiency in industries such as logistics, transportation, and construction.

Additionally, stringent government regulations mandating the installation of collision avoidance systems in heavy-duty trucks and buses are increasing demand. With the rise of e-commerce and global supply chains, the need for safer, more reliable commercial vehicles is growing, thereby fueling the adoption of anti-collision sensors.

Anti-Collision Sensor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America anti-collision sensor market captured a substantial share of around 35.08% in 2023, with a valuation of USD 3.04 billion. In North America, government regulations play a crucial role in accelerating the adoption of anti-collision sensor technologies.

Agencies such as the National Highway Traffic Safety Administration (NHTSA) are implementing policies that mandate advanced safety features, including automatic emergency braking systems, in both passenger and commercial vehicles.

- In May 2024, the National Highway Traffic Safety Administration (NHTSA) established a new Federal Motor Vehicle Safety Standard, FMVSS No. 127, requiring automatic emergency braking (AEB) to be standard in passenger cars and light trucks (under 10,000 lb. GVWR) by September 2029. This regulation aims to reduce fatalities and injuries from roadway collisions. The AEB systems must also be capable of detecting pedestrians in both during the day and at night.

Additionally, government-backed safety initiatives and programs incentivize automakers to prioritize the development and deployment of advanced sensor technologies, ensuring sustained long-term market growth. These regulatory measures are solidifying anti-collision sensors as a critical component of the North American automotive landscape.

The Anti-Collision Sensor industry in Asia-Pacific is forest to witness significant growth at a robust CAGR of 21.95% over the forecast period. Rapid technological advancements in sensor technology and automotive safety systems are significantly fueling the growth of the Asia-Pacific market.

Leading automotive companies in the region, including Toyota, Honda, and Hyundai, are increasingly adopting these cutting-edge technologies to enhance vehicle safety and sustain competitiveness. This acceleration in technological development and adoption is fostering the expansion of the Asia-Pacific anti-collision sensors market.

- In November 2023, Honda Motor Co., Ltd. introduced the new Honda SENSING 360+*1, an advanced omnidirectional safety and driver-assist system. This system enhances collision avoidance, eliminates blind spots around the vehicle, and reduces the driver's workload, contributing to a safer and more comfortable driving experience.

Moreover, Asia-Pacific is at the forefront of developing smart mobility solutions, including autonomous vehicles and connected car technologies. The integration of anti-collision sensors is critical for the successful deployment of these smart mobility solutions. The transition to autonomous driving and connected infrastructure is boosting the demand for advanced safety technologies in the region.

Competitive Landscape

The global anti-collision sensor market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Anti-Collision Sensor Market

- Robert Bosch GmbH

- Continental AG

- Aptiv PLC

- DENSO Corporation

- ZF Friedrichshafen AG

- Valeo S.A.

- Magna International Inc.

- Autoliv Inc.

- Texas Instruments Incorporated

- Murata Manufacturing Co., Ltd.

Key Industry Developments

- September 2024 (Product Launch): Continental expanded its aftermarket product range to include cameras and radar sensors for driver assistance systems, which are integral to anti-collision technologies. The expansion aims to support automotive workshops in providing high-quality repairs for vehicles equipped with advanced driver assistance systems (ADAS), which includes features designed to prevent collisions.

- July 2024 (Technological Advancements): ZF Friedrichshafen AG announced significant advancements in safety technologies for commercial vehicles, with a major focus on advanced driver-assistance systems (ADAS). Key innovations include a highway assist system that facilitates automatic lane changes and a friction-adapted ADAS that uses sensors and cloud data to assess road conditions, thereby enhancing vehicle control. Additionally, ZF developed a Truck-Trailer Link for real-time data transfer, improving safety by providing 360° monitoring around the vehicle.

The global anti-collision sensor market has been segmented as:

By Sensor Type

- Radar

- Short-Range Radar

- Medium-Range Radar

- Long-Range Radar

- Ultrasonic

- Lidar

- Camera

- Infrared

By Technology

By Vehicle Type

- Passenger Vehicles

- Compact Cars

- Mid-Size Cars

- Luxury Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Specialty Vehicles

- Industrial Vehicles

- Agricultural Vehicles

- Construction Vehicles

By Application

- Automotive

- Adaptive Cruise Control (ACC)

- Blind Spot Detection (BSD)

- Lane Departure Warning System (LDWS)

- Automatic Emergency Braking (AEB)

- Aerospace

- Aircraft Proximity Warning

- Drone Collision Avoidance

- Railways

- Industrial

- Robotic Navigation

- Material Handling Equipment

- Factory Safety Systems

By End-User

- Automotive

- Aerospace & Defense

- Robotics

- Industrial Manufacturing

- Railways

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America