Market Definition

The market encompasses the production, distribution, and consumption of ammonium sulfate, a chemical compound with the formula (NH₄)₂SO₄. It is a widely used fertilizer with applications in ifood processing, pharmaceuticals, and water treatment.

Ammonium Sulfate Market Overview

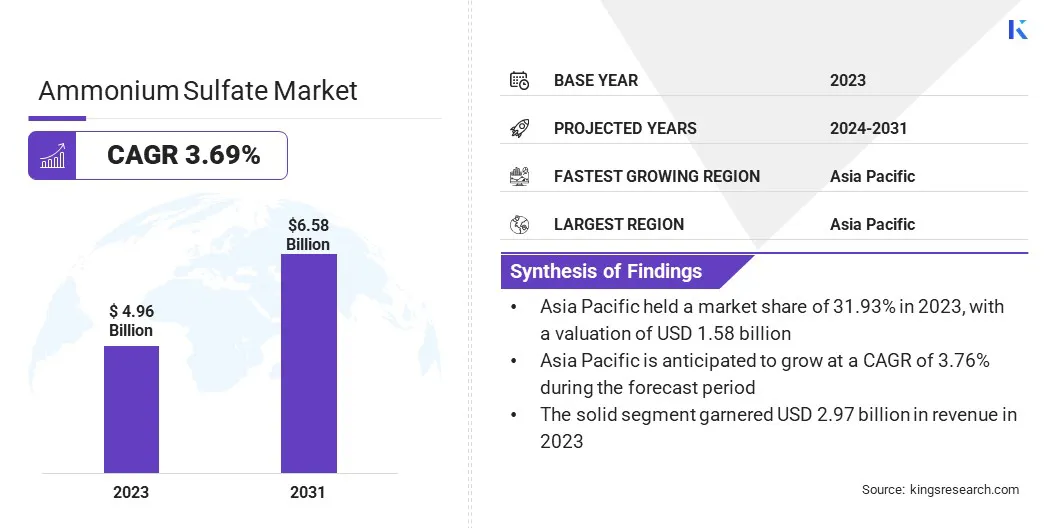

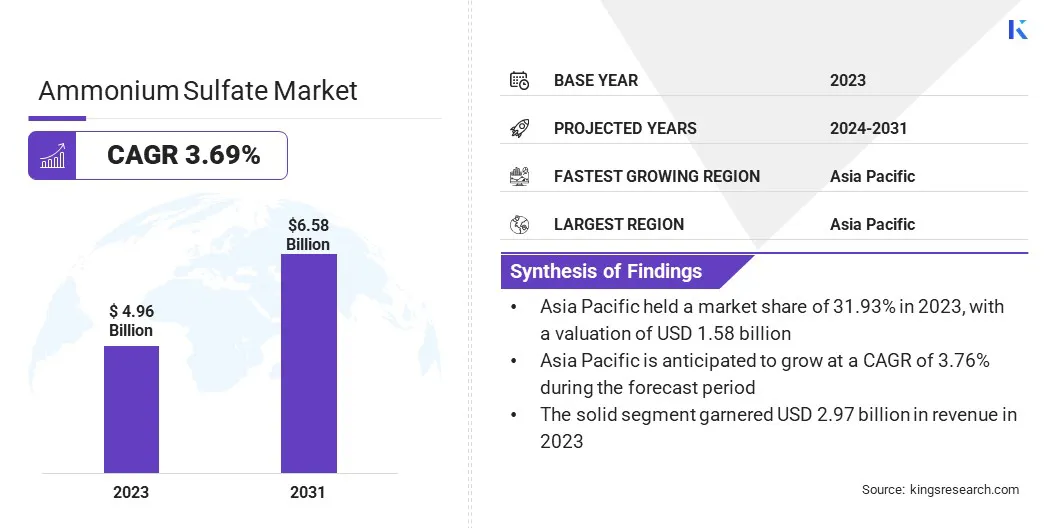

The global ammonium sulfate market size was valued at USD 4.96 billion in 2023, which is estimated to be valued at USD 5.10 billion in 2024 and reach USD 6.58 billion by 2031, growing at a CAGR of 3.69% from 2024 to 2031.

The growing global population and the need for higher crop yields are contributing significantly to the growth of the market. As demand for food increases, farmers turn to nitrogen-rich fertilizers such as ammonium sulfate to enhance crop productivity and support food security.

Major companies operating in the ammonium sulfate market are BASF, Evonik Industries AG, Sumitomo Chemical Co., Ltd., Envalior, Arkema, Fibrant, Advansix, OCI, Martin Midstream Partners L.P. , Fertiberia, Gujarat State Fertilizers & Chemicals Limited (GSFC), OSTCHEM, Jost Chemical Co, American Plant Food, The Dallas Group of America, and others.

The market is characterized by a steady demand across various industries, driven by its versatility as a nitrogen-rich fertilizer. It plays a crucial role in enhancing soil quality and crop productivity, aiding its widespread use in agriculture. The market is influenced by factors such as the availability of raw materials, production methods, and distribution networks.

The industry's dynamics are shaped by the balance of supply and demand, with key players focusing on improving efficiency, introducing sustainable products, and maintaining product quality in a competitive environment.

- In October 2024, BASF and Evonik began supplying ammonia with a reduced carbon footprint, marking a significant step toward sustainable production. This collaboration, leveraging biomass-balanced ammonia, indirectly influences the market by promoting eco-friendly practices in related chemical industries.

Key Highlights:

- The ammonium sulfate industry size was recorded at USD 4.96 billion in 2023.

- The market is projected to grow at a CAGR of 3.69% from 2024 to 2031.

- Asia Pacific held a share of 31.93% in 2023, valued at USD 1.58 billion, and is anticipated to grow at a CAGR of 3.76% through the forecast period.

- The solid technology segment garnered USD 2.97 billion in revenue in 2023.

- The fertilizers segment is expected to reach USD 2.13 billion by 2031.

Market Driver

"Increasing Agricultural Demand"

The growing global population and increasing food demand are fueling the expansion of the ammonium sulfate market. With growing populations, the demand for higher crop yields increasing, compelling farmers to adopt efficient fertilizers such as ammonium sulfate.

- According to the United Nations, the global population is projected to grow to approximately 9.7 billion by 2050, reaching nearly 10.4 billion around the mid-2080s.

This nitrogen-rich compound supports enhanced crop productivity, improving soil quality and ensuring food security. The growing need for efficient fertilizers in modern agriculture is driving the demand for ammonium sulfate, contributing to market expansion.

Market Challenge

"Competition from Alternative Fertilizers"

A significant challenge hindering the expansion of the ammonium sulfate market is the growing competition from alternative fertilizers, including organic options such as herbicides. These alternatives, often more cost-effective or environmentally sustainable, are leading to a decline in ammonium sulfate demand.

- In October 2024, FMC launched Ambriva herbicide for wheat farmers in India, offering a new tool to tackle Phalaris minor. The growing adoption of organic fertilizers and herbicides may impact the ammonium sulpfate market.

To address this challenge, producers are focusing on improving the efficiency and environmental sustainability of ammonium sulfate production while highlighting its benefits for soil health and crop yield. Additionally, educating farmers about the long-term advantages of ammonium sulfate, such as soil acidification control, could support sustained demand.

Market Trend

"Integration of Technology"

A key trend in the ammonium sulfate market is the integration of technology, particularly digital tools and data analytics, to optimize fertilizer application. These technologies help farmers apply ammonium sulfate more efficiently, ensuring precise use based on soil and crop needs.

By improving fertilizer application efficiency, farmers can maximize crop yields while minimizing waste and environmental impact. This trend enhances ammonium sulfate’s role in modern farming practices, contributing to higher productivity and more sustainable agricultural outcomes.

- In March 2023, Bayer and Microsoft launched cloud-based solutions for agriculture, enabling precision farming through data-driven insights. This digital shift enhances crop yield optimization, positively impacting the ammonium sulfate industry by improving fertilizer application efficiency and sustainability.

Ammonium Sulfate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Solid, Liquid

|

|

By Application

|

Fertilizers, Pharmaceuticals, Food & Feed Additive, Water Treatment, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Solid and Liquid): The solid segment earned USD 2.97 billion in 2023, mainly due to its widespread agriculture use, efficient application, and higher nutrient density, making it the preferred choice for crop fertilization.

- By Application (Fertilizers, Pharmaceuticals, Food & Feed Additive, Water Treatment, and Others): The fertilizers segment held a share of 32.41% in 2023, largely attributed to the rising demand for high-yield crops and ammonium sulfate’s essential role in enhancing soil health and improving nutrient absorption.

Ammonium Sulfate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific ammonium sulfate market captured a substantial share of around 31.93% in 2023, valued at USD 1.58 billion. This dominance is reinforced by its vast agricultural land and the growing demand for fertilizers. The region’s rapid population growth and increasing food requirements highlight the need for fertilizers such as ammonium sulfate to improve crop yields.

- According to the United Nations' Asia-Pacific Population and Development Report 2023, Asia and the Pacific are home to approximately 4.7 billion people, accounting for 60% of the global population. This figure is expected to grow to 5.2 billion by 2050.

Additionally, countries such as China, India, and Japan are key consumers of ammonium sulfate, strenghtheing the leading position of the regional market by boosting agricultural productivity and adopting advanced farming techniques.

Europe ammonium sulfate industry is set to grow at a CAGR of 3.72% over the forecast period. This growth is mainly fueled by the increasing focus on sustainable agriculture. The European Union’s stringent regulations on environmental practices and the shift toward eco-friendly farming methods are promoting the use of ammonium sulfate as a more sustainable fertilizer.

Additionally, innovations in farming technology and an increasing demand for high-quality crops in European markets are supporting the consumption of ammonium sulfate in the region.

Regulatory Framework:

- In the U.S., the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) regulates the distribution, sale, and use of pesticides. All pesticides distributed or sold must be registered with the EPA.

- In India, the Fertilizer Control Order (FCO) defines permissible fertilizer substances, product specifications, sampling and analysis methods, and licensing procedures for manufacturers and dealers. It also outlines conditions for fertilizer trade.

- In Brazil, the Department of Agriculture, Livestock and Food Supply (MAPA) oversees agribusiness development to enhance production, meet domestic demand, and support exports.

Competitive Landscape

The global ammonium sulfate industry is characterized by a large number of participants, including both established corporations and emerging players. The market has witnessed significant growth due to the construction of new facilities and expansions by key players.

These investments are aimed at increasing production capacity, meeting rising agricultural demands, and enhancing sustainability practices. By utilizing advanced technologies and more efficient processes, companies are striving to meet the growing demand for environmentally-friendly fertilizer solutions across various regions.

- In March 2023, Enva commenced constructing a groundbreaking facility in Greenogue, Dublin, to produce agricultural fertiliser pellets from recovered Ammonium Sulphate (AMS) sourced from industrial liquid waste. This USD 5.2 million investment aims to reduce carbon footprint by 98%.

List of Key Companies in Ammonium Sulfate Market:

- BASF

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Envalior

- Arkema

- Fibrant

- Advansix

- OCI

- Martin Midstream Partners L.P.

- Fertiberia

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- OSTCHEM

- Jost Chemical Co

- American Plant Food

- The Dallas Group of America

Recent Developments (Funding/MoU)

- In September 2024, AdvanSix secured a USD 12 million USDA grant to expand ammonium sulfate production, strenghtheing domestic supply chains and supporting sustainable farming practices. This aligns with its SUSTAIN initiative, which focuses on production growth with environmental responsibility.

- In January 2023, Yara Clean Ammonia signed a Memorandum of Understanding with JERA Co. Inc. to decarbonize coal-fired power plants and develop blue ammonia production in the US Gulf, impacting the ammonium sulfate market through increased ammonia demand.