Market Definition

Aluminum extrusion is a manufacturing process where aluminum material is forced through a shaped die to create long, continuous shapes with a consistent cross-section. This process allows for the creation of complex and custom shapes, and is widely used in industries like construction, transportation, and electronics, due to aluminum’s light weight and strength.

Aluminum Extrusion Market Overview

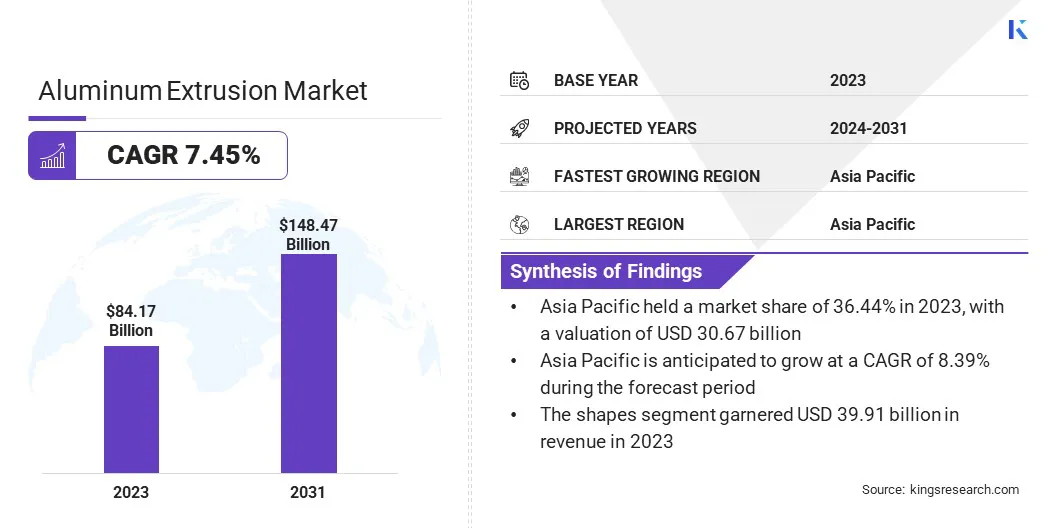

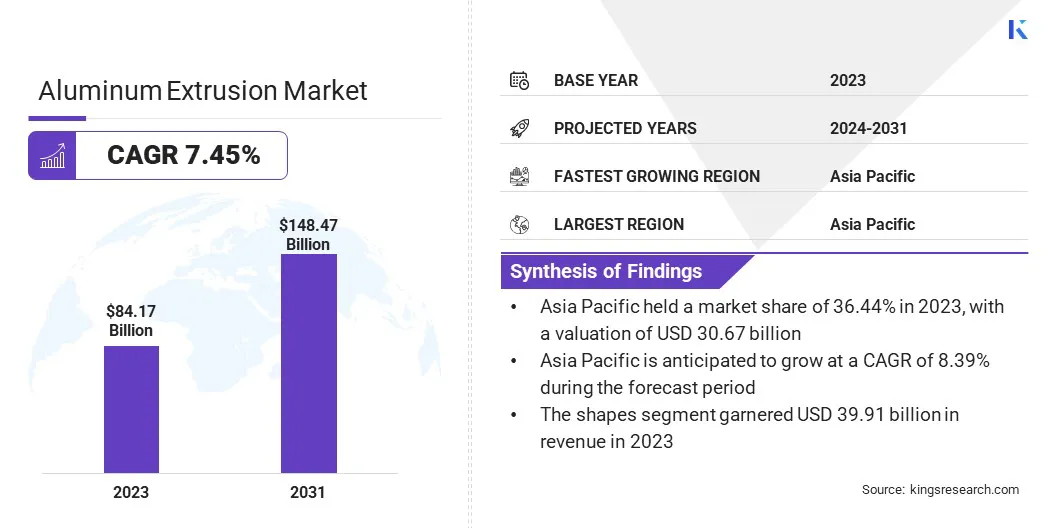

The global aluminum extrusion market size was valued at USD 84.17 billion in 2023 and is projected to grow from USD 89.78 billion in 2024 to USD 148.47 billion by 2031, exhibiting a CAGR of 7.45% during the forecast period.

This market is registering steady growth, due to the increasing demand across various industries such as automotive, construction, aerospace, and electronics. The primary drivers include the demand for lightweight materials that offer both strength and efficiency, particularly in sectors focused on improving fuel economy and reducing carbon emissions.

Major companies operating in the aluminum extrusion market are Norsk Hydro ASA, Constellium, Apollo Global Management, Inc., Aditya Birla Management Corporation Pvt. Ltd., CHINA ZHONGWANG HOLDINGS LIMITED, Kaiser Aluminum, Al Ghurair Group., Balexco BAHRAIN ALUMINIUM EXTRUSION COMPANY, Century Extrusions Limited., Jindal Aluminium Limited, Alcoa Corporation, QatarEnergy, Aluminium Products Company (ALUPCO), and Emirates Global Aluminium PJSC.

Aluminum's recyclability and sustainability also make it a preferred choice, as more companies aim to meet environmental goals. Additionally, advancements in extrusion technology have allowed for the creation of more complex and custom profiles, further expanding the material’s applications.

- In July 2024, Hydro launched a new 12-inch indirect extrusion press and expanded its recycling facility in Cressona, Pennsylvania. The USD 88 million investments boost recycling capacity to 270,000 tonnes annually, supporting the demand for sustainable aluminium in North America.

Key Highlights:

- The global aluminum extrusion market size was valued at USD 84.17 billion in 2023.

- The market is projected to grow at a CAGR of 7.45% from 2024 to 2031.

- Asia Pacific held a market share of 36.44% in 2023, with a valuation of USD 30.67 billion.

- The shapes segment garnered USD 39.91 billion in revenue in 2023.

- The building & construction segment is expected to reach USD 57.68 billion by 2031.

Market Driver

"Demand for Lightweight Materials and Rapid Growth of Construction Industry"

The growing demand for lightweight materials in industries like automotive and aerospace is a major driver, as aluminum helps reduce vehicle weight, improving fuel efficiency and performance.

Furthermore, the increasing focus on sustainability and the environmental benefits of aluminum, which is highly recyclable, is pushing more industries to adopt aluminum extrusions for eco-friendly solutions.

Additionally, the construction industry's rapid growth, particularly in infrastructure development and green building initiatives, is fueling the demand for aluminum extrusions due to their durability, corrosion resistance, and esthetic appeal.

- In July 2024, Taber Extrusions announced the addition of a 10,000-ton press, one of the largest in North America, set to go live in 2026. The press, designed for the aerospace, defense, and heavy industrial markets, will feature advanced technology for handling hard and soft alloys, improving energy efficiency, and ensuring high-quality production.

Market Challenge

"High Cost of Raw Materials and Competition from Alternative Materials"

One of the key challenges is the high cost of raw materials and the significant energy consumption required for the extrusion process, both of which can negatively impact pricing and profitability.

Companies are exploring ways to improve energy efficiency and reduce waste through innovations in production techniques and by investing in renewable energy sources.

- For instance, in June 2024, Pacific Northwest National Laboratory (PNNL) unveiled its Shear Assisted Processing and Extrusion technique, revolutionizing aluminum manufacturing. The process reduces energy use by 50%, increases extrusion speed, and enables recycling of post-consumer aluminum, supporting sustainability and innovation in industries like automotive and construction.

Another challenge is the increasing competition from alternative materials, such as steel and plastic, which are often cheaper and can be easier to process. However, aluminum’s superior strength-to-weight ratio and recyclability continue to make it a competitive choice, especially as industries move toward more sustainable solutions.

Additionally, fluctuations in global supply chains, such as disruptions in the availability of bauxite or geopolitical tensions, can lead to production delays. Thus, manufacturers are diversifying their supplier networks and adopting more resilient supply chain strategies to ensure a steady flow of materials.

Market Trend

"Rising Demand for Sustainability and Custom Profiles"

There is a noticeable shift toward the use of aluminum in Electric Vehicles (EVs), as automakers seek lighter materials to enhance battery efficiency and overall performance. The demand for custom and complex profiles is increasing, driven by advancements in extrusion technology that allow for more versatile and tailored solutions in industries like construction and electronics.

Additionally, the growing focus on sustainability is spurring the development of recycled aluminum products, as manufacturers work to reduce their environmental impact and meet stricter regulations on material sourcing and waste.

- In November 2023, Hydro Extrusions announced an agreement with Watt Electric Vehicles (WEVC) to supply recycled, low-carbon aluminum extrusions for their upcoming electric commercial vehicle, the eCV1. The vehicle, set to start production in 2025, will be the first in its category to exclusively use recycled aluminum, reducing its carbon footprint by 50%.

Aluminum Extrusion Market Report Snapshot

| Segmentation |

Details |

| By Product |

Shapes, Rods & Bars, Pipes & Tubes |

| By End Use Industry |

Automotive & Transportation, Building & Construction, Electrical and Electronics, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Shapes, Rods & Bars, Pipes & Tubes): The shapes segment earned USD 39.91 billion in 2023, due to the growing demand for customized and complex profiles in industries such as construction, automotive, and aerospace.

- By End Use Industry (Automotive & Transportation, Building & Construction, Electrical and Electronics, and Others): The building & construction segment held 36.51% share of the market in 2023, due to the increasing demand for lightweight, durable, and corrosion-resistant materials.

Aluminum Extrusion Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 36.44% share of the aluminum extrusion market in 2023, with a valuation of USD 30.67 billion. This dominance is driven by the rapid industrialization, infrastructure development, and robust demand from key industries such as automotive, construction, and electronics.

The region’s growing focus on sustainable solutions and the increasing adoption of aluminum in EVs further contribute to its strong market position. China, India, and Japan are key players, with substantial investments in aluminum extrusion facilities and technology, enhancing production capacity and market growth.

The aluminum extrusion industry in Europe is poised for significant growth at a robust CAGR of 7.39% over the forecast period. The increasing demand for lightweight materials in the automotive sector, particularly in EVs, is driving the market in the region.

Furthermore, Europe’s strong focus on sustainability and green building initiatives, coupled with regulations promoting the use of recyclable materials, is propelling the demand for aluminum extrusions in construction and electrical applications.

Countries like Germany, Italy, and the UK are key contributors to the region’s growth, with manufacturers investing in innovation and capacity expansion to meet the growing need for aluminum products across various industries.

- In May 2024, Emirates Global Aluminium (EGA) completed the acquisition of Leichtmetall Aluminium Giesserei Hannover GmbH. The European specialty foundry uses renewable energy to produce up to 30,000 tonnes of billets per year. This acquisition strengthens EGA's presence in Europe, complementing its existing aluminum business in the region.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In he U.S., the U.S. International Trade Commission (ITC) and the U.S. Department of Commerce are regulatory bodies that oversee aluminum extrusion. The U.S. ITC overturned the US Department of Commerce's decision to impose anti-dumping duties on aluminum extrusions from 14 countries, including India, ruling that these imports do not materially harm the US industry.

- In Europe, the European Union (EU) regulates aluminum extrusions through policies such as anti-dumping rules, the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) Regulation, and the Circular Economy Act. These policies aim to safeguard human health and the environment, prevent unfair trade practices, and mitigate the impact of foreign subsidies.

- In China, the regulatory body governing aluminum extrusion is primarily the Ministry of Industry and Information Technology (MIIT), which oversees standards and quality control within the manufacturing sector, including aluminum extrusion production.

- In Japan, aluminum extrusion is regulated by the Ministry of Economy, Trade and Industry that oversees industrial policies and trade regulations. The Japan Aluminum Association sets voluntary standards and promotes research.

Competitive Landscape:

The aluminum extrusion industry is characterized by a large number of participants, including both established corporations and rising organizations. Established companies typically hold a significant market share, due to their advanced manufacturing capabilities, strong distribution networks, and extensive product portfolios.

These industry leaders continue to innovate, focusing on enhancing extrusion technology, improving product quality, and expanding their global reach. Rising organizations are carving out niches by offering specialized or customized aluminum extrusions for specific end-use industries, such as EVs, aerospace, and green building applications.

Additionally, strategic collaborations, partnerships, and mergers & acquisitions are common, enabling companies to strengthen their market presence, expand product offerings, and improve their technological capabilities.

- In September 2023, Hindalco Industries Limited announced a technology partnership with Italy-based Metra SpA to manufacture high-precision extruded aluminum products for high-speed rail coaches in India. The collaboration aims to bring advanced aluminum extrusion technology to India, supporting the upgradation of trains in the Indian Railways.

List of Key Companies in Aluminum Extrusion Market:

- Norsk Hydro ASA

- Constellium

- Apollo Global Management, Inc.

- Aditya Birla Management Corporation Pvt. Ltd.

- CHINA ZHONGWANG HOLDINGS LIMITED

- Kaiser Aluminum

- Al Ghurair Group.

- Balexco BAHRAIN ALUMINIUM EXTRUSION COMPANY

- Century Extrusions Limited.

- Jindal Aluminium Limited

- Alcoa Corporation

- QatarEnergy

- Aluminium Products Company (ALUPCO)

- Emirates Global Aluminium PJSC.

Recent Developments (M&A/Partnerships/Agreements)

- In October 2024, Ball Corporation acquired Alucan, expanding its sustainable packaging solutions in Europe. The acquisition includes facilities in Spain and Belgium, enhancing Ball’s capabilities in aluminum aerosol and bottle technology.

- In October 2024, Novelis and TSR Recycling announced a 3-year strategic partnership to supply 75,000 tonnes of pre-sorted end-of-life aluminum for Novelis' low-carbon automotive products. The collaboration supports the transition to a circular economy, advancing sustainability and decarbonization efforts in the aluminum industry.

- In September 2024, Fairfax India Holdings Corporation announced an agreement to acquire a 65% stake in Global Aluminium Private Limited for approximately USD 83 million. Global Aluminium is India’s third-largest aluminum extrusions manufacturer, serving industries like architecture, renewable energy, and automotive.

- In September 2024, Alumex PLC opened its ‘Ascend’ facility in Sri Lanka, featuring advanced technologies like Aluminium High Pressure Die Casting (HPDC) to enhance production efficiency and cater to global markets.