Market Definition

The alopecia market includes products and treatments designed to prevent, manage, and reverse hair loss caused by various factors, including androgenetic alopecia, alopecia areata, traction alopecia, and telogen effluvium.

It includes pharmaceuticals (oral and topical medications), biologics, hair restoration surgeries, laser therapies, and over-the-counter products like shampoos and supplements.

This market is propelled by the increasing awareness of hair loss conditions, advancement of regenerative medicine, increased adoption of minimally invasive treatments, and growing consumer demand for esthetic solutions. Key market players focus on innovative therapies, such as stem cell and gene-based treatments, to address unmet medical needs and enhance patient outcomes.

Alopecia Market Overview

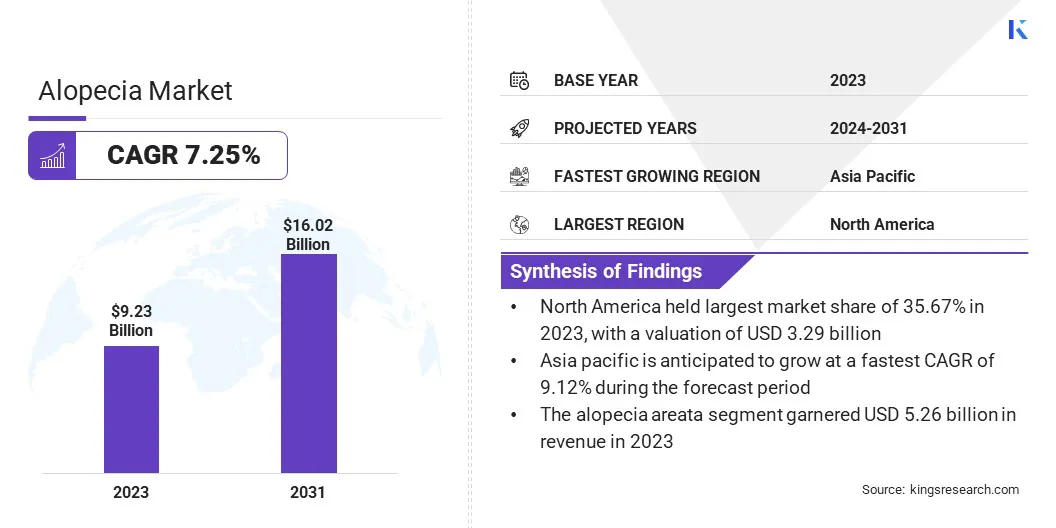

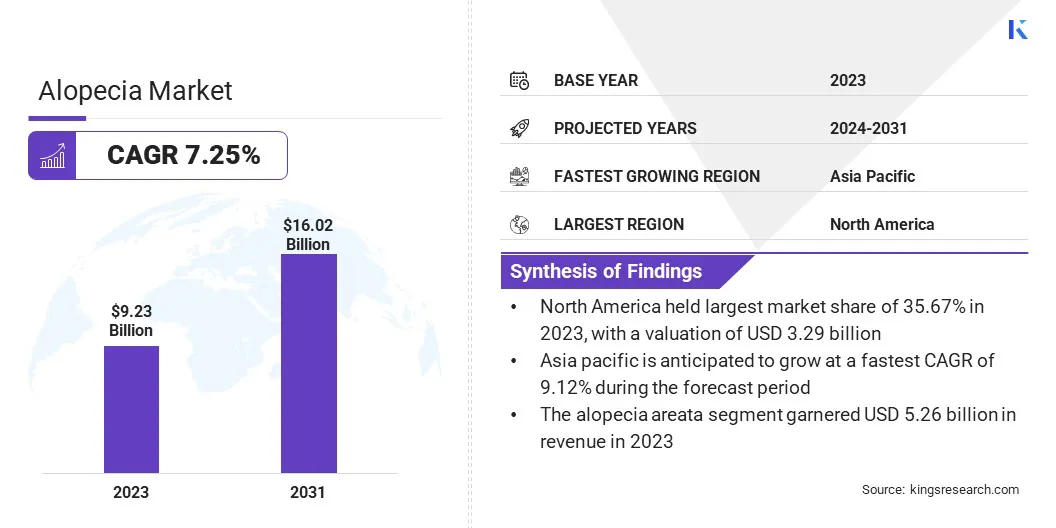

The global alopecia market size was valued at USD 9.23 billion in 2023 and is projected to grow from USD 9.82 billion in 2024 to USD 16.02 billion by 2031, exhibiting a CAGR of 7.25% during the forecast period.

The market is primarily driven by the rising prevalence of hair loss conditions, due to factors like genetics, stress, and aging. Increased awareness about treatment options, including both pharmaceutical and non-pharmaceutical solutions, along with continuous advancements in innovative therapies, are fueling the market.

Additionally, the growing consumer demand for esthetic and cosmetic solutions, along with the increasing focus on self-care and wellness, is further accelerating the market growth globally.

Major companies operating in the alopecia industry are Church & Dwight Co., Inc., Johnson & Johnson Services, Inc., Cipla., Merck KGaA, Sun Pharmaceuticals Industries Ltd, Dr. Reddy’s Laboratories Ltd, Aurobindo Pharma USA, Viatris Inc, Pfizer Inc., Eli Lilly and Company, Freedom Laser Therapy, Inc., iGrow Laser., REVIAN, Inc., Theradome Inc., and Sanofi.

Key Highlights:

- The alopecia industry size was valued at USD 9.23 billion in 2023.

- The market is projected to grow at a CAGR of 7.25% from 2024 to 2031.

- North America held a market share of 35.67% in 2023, with a valuation of USD 3.29 billion.

- The alopecia areata segment garnered USD 5.26 billion in revenue in 2023.

- The pharmaceuticals segment is expected to reach USD 6.30 billion by 2031.

- The online retail segment is anticipated to witness the fastest CAGR of 9.92% over the forecast period

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.12% over the forecast period.

Market Driver

"Increased Awareness and Global Hair Loss Prevalence"

The alopecia market is registering significant growth, primarily driven by the rising global prevalence of hair loss, which can be attributed to factors such as genetics, aging, hormonal imbalances, and increasing stress levels. Consumers are becoming more informed about the variety of treatment options available as awareness about the causes of alopecia grows.

This has led to greater demand for both medical and cosmetic solutions, including oral medications. The increasing focus on self-care and improving one's physical appearance is further driving the demand for alopecia treatments, as individuals seek solutions that restore not only hair growth but also confidence and overall quality of life.

Regulatory support, with approvals from agencies such as the FDA and EMA, further accelerates the market growth by providing patients with more effective and accessible treatment options.

- For instance, in November 2024, the FDA approved LEQSELVI for adults with severe alopecia areata. The approval of LEQSELVI not only highlights the increasing availability of effective treatments but also boosts consumer confidence in seeking solutions for hair restoration, improving both hair growth and quality of life.

Market Challenge

"High Costs, Limited Effectiveness, and Consumer Skepticism"

The alopecia market faces several challenges, including high treatment costs and limited insurance coverage for non-medical and cosmetic solutions, which can restrict access for many consumers. The lack of universally effective treatments, as well as variability in treatment efficacy across different individuals, contributes to consumer skepticism.

Additionally, side effects associated with certain therapies, such as medications and surgical procedures, may deter potential users. The market also grapples with misinformation and confusion surrounding the effectiveness of various products, impacting consumer confidence.

Market Trend

"Growth in Personalized, Non-invasive, and Natural Treatment Solutions"

The alopecia market is undergoing significant transformation driven by several key trends. Personalized treatments, powered by genetic testing and precision medicine, are becoming more prevalent, offering tailored solutions for individual hair loss causes.

Non-invasive therapies such as platelet-rich plasma (PRP) treatments and low-level laser therapy (LLLT) are gaining popularity, due to their minimal downtime and effectiveness. Alongside this, there is a growing demand for natural and organic hair restoration products, as consumers seek safer, sustainable alternatives to chemical-based treatments.

Together, these trends are reshaping the market, with consumers increasingly seeking personalized, non-invasive, and holistic approaches to managing alopecia.

- For instance, in August 2024, Pelage Pharmaceuticals, a clinical-stage regenerative medicine firm, initiated a Phase 2a trial for PP405, a topical small molecule targeting androgenetic alopecia by reactivating dormant hair follicle stem cells. The study involves 60 participants. Backed by a USD 14 million Series A-1 led by GV, this follows promising Phase 1 data and February’s USD 16.75 million Series A.

Alopecia Market Report Snapshot

| Segmentation |

Details |

| By Disease Type |

Alopecia areata, Cicatricial alopecia, Traction alopecia, Alopecia totalis, Alopecia universalis, Others |

| By Treatment |

Pharmaceuticals (Oral Medications (Finasteride (Propecia), Dutasteride), Topical Treatments (Minoxidil, Topical Corticosteroids, Others), Devices (Low-level Laser Therapy (LLLT) Devices, Hair Growth Stimulation Devices, Platelet-Rich Plasma (PRP) Therapy), Cosmetic Products (Shampoos and Conditioners, Serums and Oils, Others), Surgical Treatments (Hair Transplantation, Scalp Micropigmentation) |

| By Distribution Channel |

Online Retail, Pharmacies/Clinics, Specialized Dermatology Clinics |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Disease Type (Alopecia areata, Cicatricial alopecia, Traction alopecia, Alopecia totalis, Alopecia universalis, Others): The alopecia areata segment earned USD 5.26 billion in 2023, due to its high prevalence and increasing awareness, driving the demand for effective treatment options.

- By Treatment (Pharmaceuticals, Devices, Cosmetic Products, and Surgical Treatments) The pharmaceuticals segment held 50.12% share of the market in 2023, driven by the growing adoption of FDA-approved medications like finasteride and minoxidil, which are commonly used for hair regrowth.

- By Distribution Channel (Online Retail, Pharmacies/Clinics, Specialized Dermatology Clinics): The pharmacies/clinics segment is projected to reach USD 8.38 billion by 2031, owing to the increasing number of patients seeking professional treatment and consultations for alopecia at healthcare facilities.

Alopecia Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a significant alopecia market share of around 35.67% in 2023, valued at USD 3.29 billion. North America's dominance in the market is driven by factors such as a high prevalence of hair loss, advanced healthcare infrastructure, strong consumer demand for both medical and cosmetic treatments, regulatory support, and growing awareness about alopecia solutions.

The presence of key pharmaceutical companies and a well-established distribution network also contribute to the leading position of the market in the region.

The alopecia industry in Asia Pacific is anticipated to register the fastest growth at a projected CAGR of 9.12%, fueled by increasing hair loss prevalence, rising disposable incomes, and expanding awareness of alopecia treatments.

Urbanization, improved healthcare, and a rise in cosmetic consciousness are driving the demand for both medical and non-medical solutions, further accelerated by the growth of online retail and specialized clinics.

- For instance, in June, 2023, Pfizer Inc. received FDA approval for LITFULO (ritlecitinib), a once-daily oral therapy for severe alopecia areata in patients aged 12 years and above. LITFULO, with a suggested dose of 50 mg, is the very first FDA-approved medication for adolescents with serious alopecia areata.

Rapid growth of the market in Asia Pacific is attributed to the increasing prevalence of hair loss, rising disposable incomes, and growing awareness of alopecia treatments. Urbanization, improved healthcare, and a rise in cosmetic consciousness are boosting the demand for both medical and non-medical solutions. The expansion of online retail and specialized clinics further accelerates the market growth.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., alopecia medicines are regulated by the Food and Drug Administration (FDA). The FDA is responsible for ensuring the safety, efficacy, and quality of pharmaceutical drugs, including those used to treat alopecia, such as minoxidil and finasteride. The FDA also regulates medical devices related to hair restoration, like low-level laser therapy (LLLT) devices.

- In Europe, the European Medicines Agency (EMA) is responsible for evaluating and supervising the safety, efficacy, and quality of medicinal products, including those used to treat alopecia, such as minoxidil and finasteride. The agency works in collaboration with national regulatory authorities from individual EU member states to ensure that drugs meet the required standards before they are authorized for sale across Europe.

- In China, alopecia medicines are regulated by the National Medical Products Administration (NMPA). The NMPA is responsible for the approval, supervision, and regulation of pharmaceutical drugs, including those used to treat alopecia, such as minoxidil and finasteride. The NMPA ensures that these treatments meet safety, efficacy, and quality standards before they are made available in the Chinese market. Additionally, medical devices related to alopecia treatments, such as hair restoration devices, are also regulated by the NMPA.

- In Japan, alopecia medicines are regulated by the Pharmaceuticals and Medical Devices Agency (PMDA), which operates under the Ministry of Health, Labour and Welfare (MHLW). The PMDA is responsible for evaluating and approving pharmaceutical products, including those for alopecia treatment, such as minoxidil and finasteride. It ensures that these medications meet strict safety, efficacy, and quality standards before they are authorized for sale in Japan. Additionally, medical devices, including those used for hair restoration, are also regulated by the PMDA to ensure that they comply with relevant health and safety regulations.

Competitive Landscape:

The global alopecia industry is characterized by a number of participants, including both established corporations and rising organizations. Growing biotechnology firms are developing novel therapies, such as JAK inhibitors, which are creating opportunities within the market.

Companies are focusing on product innovation, expanding their portfolios with both medical and cosmetic solutions, and leveraging digital platforms for distribution.

Increased investment in research and development, strategic partnerships, and mergers and acquisitions are also shaping the competitive landscape, with players striving to meet the rising consumer demand for more effective and non-invasive alopecia treatments.

Furthermore, the expansion of online retail channels has intensified competition, providing consumers with more access to a wide range of products and treatment options.

- In February 2024, Curology launched Hair FormulaRx, a personalized prescription treatment for androgenetic alopecia (pattern hair loss). Containing clinically proven ingredients, this leave-on topical solution helps regrow hair in as little as three months, addressing multiple causes of hair thinning for visibly thicker, stronger hair.

List of Key Companies in Alopecia Market:

- Church & Dwight Co., Inc.

- Johnson & Johnson Services, Inc.

- Cipla.

- Merck KGaA

- Sun Pharmaceuticals Industries Ltd

- Reddy’s Laboratories Ltd

- Aurobindo Pharma USA

- Viatris Inc.

- Pfizer Inc.

- Eli Lilly and Company

- Freedom Laser Therapy, Inc.

- iGrow Laser

- REVIAN, Inc.

- Theradome Inc.

- Sanofi

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2024, Pelage Pharmaceuticals secured USD 16.75 million in Series A funding, led by GV, to advance its first-in-class treatment for androgenetic alopecia, pattern baldness, and chemotherapy-induced hair loss, addressing key unmet needs in the market.

- In March 2023, Sun Pharmaceutical Industries Limited announced the completion of its acquisition of Concert Pharmaceuticals. This acquisition strengthens Sun Pharma’s portfolio with deuruxolitinib, a novel oral JAK1 inhibitor currently in development for treating alopecia and other autoimmune conditions.

- In January, 2024, Eli Lilly Canada Inc. announced that OLUMIANT (baricitinib) received regulatory approval from Health Canada for the treatment of severe alopecia areata in adults. This once-daily oral treatment offers a systemic solution for individuals with severe alopecia areata, marking a significant advancement in alopecia care.