Market Definition

The market focuses on the development, production, and commercialization of primary batteries that utilize an alkaline electrolyte, typically potassium hydroxide, to facilitate the electrochemical reaction between zinc and manganese dioxide.

These batteries offer high energy density, long shelf life, and reliability, making them widely used in consumer electronics, household devices, and industrial applications. The report provides insights into the core drivers of market growth, along with an in-depth evaluation of industry trends and regulatory frameworks.

Alkaline Battery Market Overview

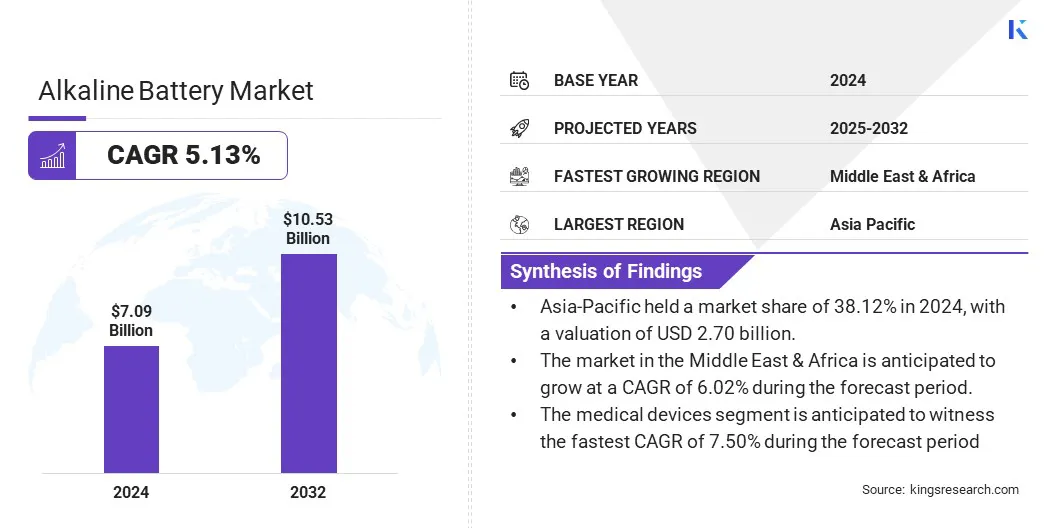

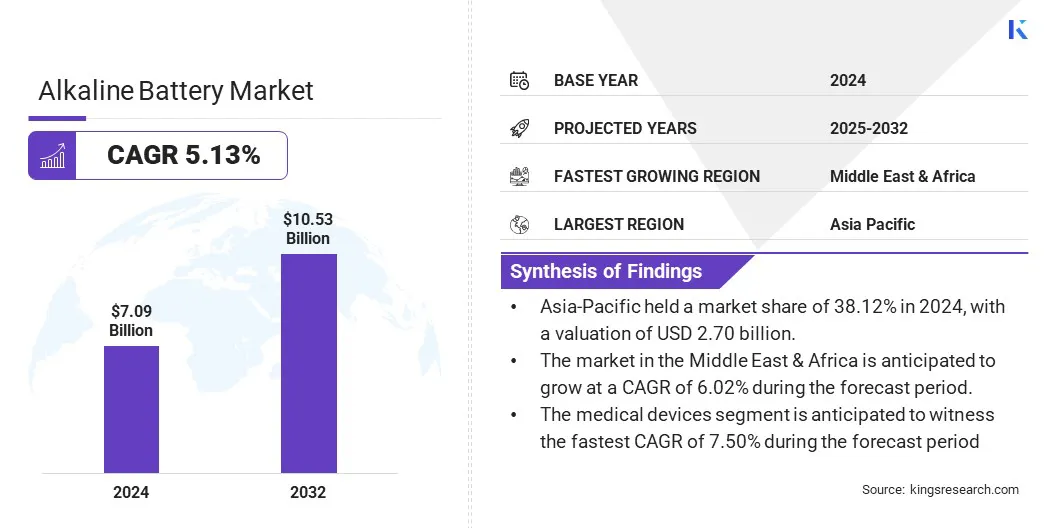

The global alkaline battery market size was valued at USD 7.09 billion in 2024 and is projected to grow from USD 7.42 billion in 2025 to USD 10.53 billion by 2032, exhibiting a CAGR of 5.13% during the forecast period.

This growth is attributed to the increasing demand for reliable and cost-effective power sources across various sectors such as consumer electronics, healthcare, industrial equipment, and household applications. The widespread use of battery-powered devices and the need for long-lasting energy solutions are driving the expansion of the market.

Major companies operating in the alkaline battery industry are Duracell Inc., Panasonic Holdings Corporation, Maxell Ltd, Energizer, VARTA AG., GPIndustrial, Eveready Industries India Ltd, Zhejiang Mustang Battery Co., Ltd, Camelion Batterien GmbH, Geep Industries Pvt. Ltd., Indo National Limited, FDK CORPORATION, Shenzhen Pkcell Battery Co., Ltd, Toshiba International Corporation, and Urban Electric Power.

Furthermore, advancements in battery chemistry and manufacturing processes, along with the growing preference for maintenance-free and disposable power solutions, are further fueling the growth of the market.

In addition, the continued innovation by key market players to improve energy density, reduce environmental impact, and expand distribution networks is expected to create growth opportunities in the coming years.

- In September 2023, Eveready Industries launched a television commercial under the “Khelenge Toh Sikhenge” campaign to introduce its updated Ultima and Ultima Pro alkaline batteries. The initiative emphasizes the enhanced performance of these batteries offering up to 400% and 800% longer life respectively particularly for high-drain devices such as toys, gaming accessories, and medical equipment.

Key Highlights

- The alkaline battery industry size was valued at USD 7.09 billion in 2024.

- The market is projected to grow at a CAGR of 5.13% from 2025 to 2032.

- Asia-Pacific held a market share of 38.12% in 2024, with a valuation of USD 2.70 billion.

- The AA segment garnered USD 2.69 billion in revenue in 2024.

- The manganese dioxide segment is expected to reach USD 3.35 billion by 2032.

- The medical devices segment is anticipated to witness the fastest CAGR of 7.50% during the forecast period

- The market in the Middle East & Africa is anticipated to grow at a CAGR of 6.02% during the forecast period.

What are the major factors driving market growth?

The rising demand for consumer electronics and household devices is fueling the growth of the alkaline battery market. Alkaline batteries provide a reliable and cost-effective power source for a wide range of products, including remote controls, flashlights, toys, clocks, and wireless accessories, making them a staple in everyday use across households.

Increasing reliance on portable and battery-operated devices, combined with the convenience of disposable power solutions, has led to sustained demand for alkaline batteries, particularly in regions experiencing rapid digital adoption and urbanization.

Alkaline batteries offer long shelf life, steady voltage output, and ease of availability, making them an ideal choice for consumers seeking dependable energy solutions for personal and household applications.

How is growing demand for sustainability curtailing market growth?

A significant challenge hindering the growth of the alkaline battery market is the regulatory compliance and recycling challenges associated with battery disposal. With increasing concerns over environmental impact, governments worldwide are implementing stricter regulations governing the disposal and recycling of batteries, particularly single-use types like alkaline batteries.

These regulations require manufacturers to adopt sustainable practices for collection, recycling, and reducing harmful materials, necessitating complex systems for proper waste management.

Recycling alkaline batteries is challenging due to the complex recovery of materials like zinc and manganese dioxide and the lack of recycling infrastructure. These issues raise compliance costs and require investment in technology and collection systems.

To address these challenges, market players are improving recycling systems through partnerships, eco-friendly designs, and advanced technologies. Consumer awareness is also being promoted to support proper disposal.

- In August 2024, Electronic Recyclers International (ERI) opened a state-of-the-art alkaline battery recycling plant in Indiana, U.S., using proprietary clean technology to process millions of pounds annually with zero waste. The facility supports ERI’s sustainability goals and is part of a broader plan to expand recycling capabilities nationwide.

Which technological trends are shaping the market?

Advancements in battery performance through technological innovation are driving significant improvements in the alkaline battery market, enhancing their efficiency and longevity.

New developments in materials and manufacturing processes, such as the integration of carbon-based additives in the cathode and the optimization of electrolytes, are increasing the energy density and shelf life of alkaline batteries.

These innovations are enabling better performance, even in high-drain devices, where traditional batteries lack. This trend is further supported by ongoing research aimed at improving the recyclability and environmental sustainability of alkaline batteries, ensuring that advancements align with growing ecological and regulatory demands.

As a result, these technological innovations are making alkaline batteries a more reliable and competitive choice across various consumer and industrial applications.

- In September 2023, Eveready introduced its Ultima Alkaline batteries, designed to deliver up to 800% longer-lasting power. The launch reflects the company’s commitment to innovation and addressing the rising need for reliable batteries in high-drain applications.

Alkaline Battery Market Report Snapshot

|

Segmentation

|

Details

|

|

By Battery Size

|

AA, AAA, C, D, 9V, and Others

|

|

By Raw Material

|

Zinc Powder, Manganese Dioxide, Potassium Hydroxide, Steel, Graphite, and Others

|

|

By Application

|

Consumer Electronics, Household Items, Medical Devices, Industrial Equipment, Defense & Military

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Battery Size (AA, AAA, C, D, 9V, and Others): The AA segment earned USD 2.69 billion in 2024 due to its widespread use in consumer electronics, household devices, and low-drain applications.

- By Raw Material (Zinc Powder, Manganese Dioxide, Potassium Hydroxide, Steel, Graphite, and Others): The zinc powder segment held 30.77% of the market in 2024, due to its role in providing the primary electrochemical reaction in alkaline batteries, offering cost-effectiveness and reliable performance.

- By Application (Consumer Electronics, Household Items, Medical Devices, Industrial Equipment, Defense & Military): The consumer electronics segment is projected to reach USD 3.88 billion by 2032, owing to the increasing demand for portable, battery-operated devices such as remote controls, wireless peripherals, and personal electronics.

What is the market scenario in Asia-Pacific and Middle East region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific alkaline battery market share stood at around 38.12% in 2024, with a valuation of USD 2.70 billion. Asia Pacific's dominance in the market is attributed to the region's expanding electronics industry, rapid urbanization, and increasing consumer demand for portable devices and household applications.

Additionally, significant investments in manufacturing capabilities, along with government initiatives supporting energy-efficient technologies, are driving market growth. The region's focus on improving recycling infrastructure and advancing battery technologies further fuels the market growth.

- In November 2023, Panasonic Energy commenced full-scale production at its Nishikinohama Factory in Osaka, one of Japan’s largest dry battery plants. Powered by renewable energy, the facility can produce up to 48 million alkaline batteries monthly, supporting Panasonic’s sustainability and clean energy goals.

The alkaline battery industry in the Middle East & Africa is poised for significant growth at a robust CAGR of 6.02% over the forecast period. This growth is due to the increasing demand for reliable and cost-effective power solutions in consumer electronics, industrial applications, and off-grid power systems.

The Middle East & Africa's expanding infrastructure, along with the rise in disposable incomes and urbanization, is expected to accelerate the adoption of alkaline batteries. Additionally, the region’s focus on renewable energy projects and energy storage solutions is projected to further fuel market expansion.

Regulatory Frameworks

- In the European Union, the Battery Directive (2006/66/EC) regulates the production, disposal, and recycling of batteries and accumulators. It aims to minimize the environmental impact of batteries by ensuring proper collection, treatment, and recycling, as well as reducing hazardous substances in battery production to protect human health and the environment.

- In China, the "Emission Standard of Pollutants for the Battery Industry" establishes limits for water and air pollutant discharge from battery manufacturing.

- In India, the Central Pollution Control Board (CPCB) manages the Battery Waste Management (BWM) Rules, 2022, which enforce Extended Producer Responsibility (EPR) for battery producers, recyclers, and refurbishers. It enhances accountability and transparency by allowing producers, recyclers, and refurbishers to manage their obligations.

Competitive Landscape

Companies in the alkaline battery industry are focusing on technological innovations to enhance the performance, efficiency, and sustainability of their products. They are investing in the development of advanced battery materials and designs to improve energy density, shelf life, and overall performance, while also addressing environmental concerns through eco-friendly production methods and better recycling practices.

Strategic partnerships, acquisitions, and collaborations with research institutions and technology providers are utilized to strengthen R&D capabilities, streamline manufacturing processes, and stay ahead of market trends.

These efforts enable companies to meet the increasing demand for high-performance, cost-effective, and sustainable battery solutions across industries. Additionally, companies are expanding their portfolios to include more environmentally friendly battery options, catering to the growing consumer preference for sustainable and recyclable energy solutions.

- In August 2023, Better Battery Co. launched its carbon-neutral alkaline batteries at over 100 Wegmans stores across the U.S. This retail partnership promotes sustainability, offering eco-friendly batteries with recyclable packaging and a fully offset carbon footprint, making green energy solutions more accessible to consumers.

List of Key Companies in Alkaline Battery Market:

- Duracell Inc.

- Panasonic Holdings Corporation

- Maxell Ltd

- Energizer

- VARTA AG.

- GPIndustrial

- Eveready Industries India Ltd

- Zhejiang Mustang Battery Co., Ltd

- Camelion Batterien GmbH

- Geep Industries Pvt. Ltd.

- Indo National Limited

- FDK CORPORATION

- Shenzhen Pkcell Battery Co., Ltd

- Toshiba International Corporation

- Urban Electric Power

Recent Developments (Launch)

- In July 2024, Call2Recycle Canada and EVSX launched a battery processing facility in Thorold, Ontario, capable of recycling 4,200 tons of alkaline batteries annually. The facility supports the circular economy, recovering valuable materials, and plans to expand to handle lithium-ion batteries, enhancing recycling capacity and sustainability.