Market Definition

Alginate is a naturally occurring polysaccharide extracted primarily from brown seaweed and is widely recognized for its gelling, thickening, and stabilizing properties. It is commonly available in different forms, including sodium alginate, calcium alginate, potassium alginate, and propylene glycol alginate, each serving specific industrial needs.

In the food industry, alginate is used in dairy products, bakery fillings, and meat substitutes, while in pharmaceuticals, it aids in controlled drug delivery and wound healing. The cosmetic industry utilizes alginate for skincare formulations, leveraging its moisture-retention and film-forming properties. With its broad range of functionalities, alginate remains a critical ingredient in various industrial processes.

Alginate Market Overview

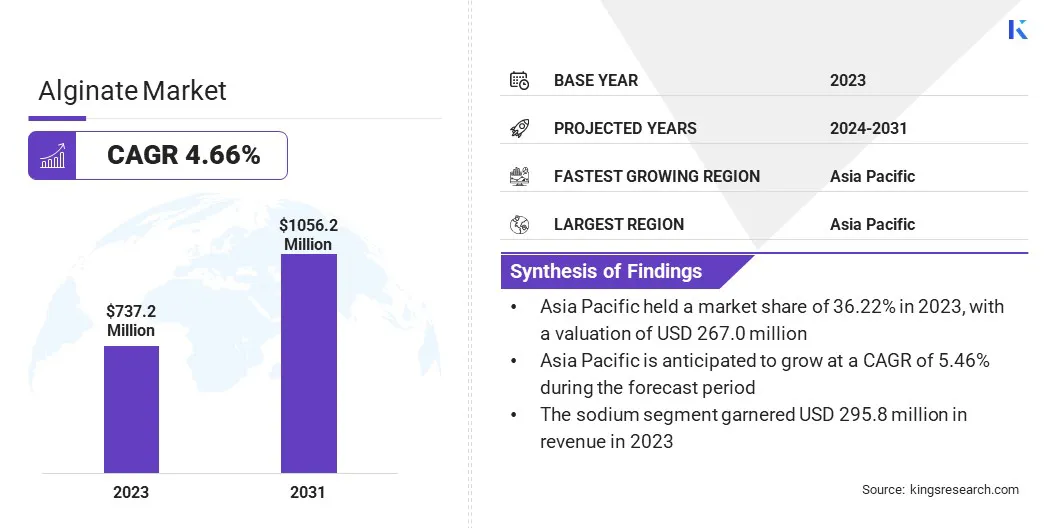

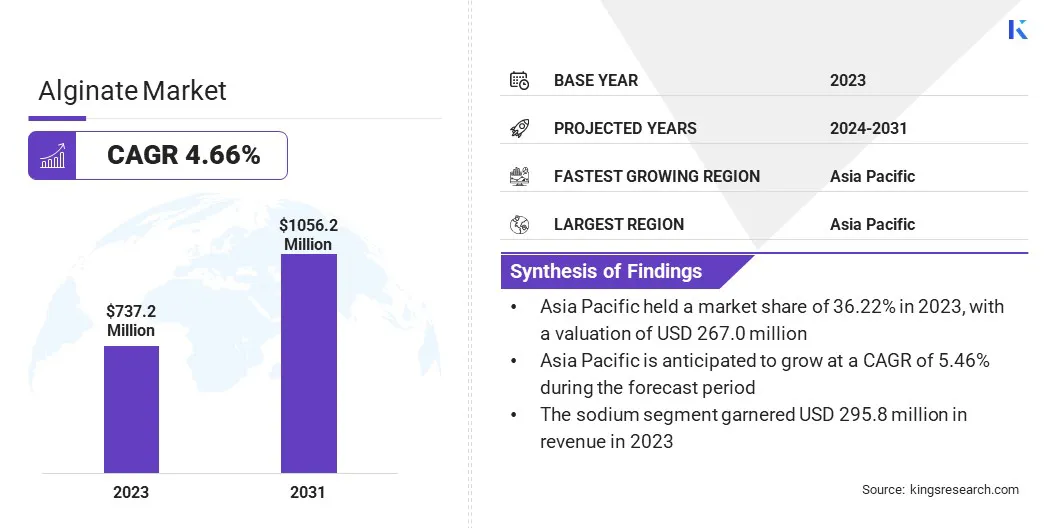

The global alginate market size was valued at USD 737.2 million in 2023 and is projected to grow from USD 768.0 million in 2024 to USD 1,056.2 million by 2031, exhibiting a CAGR of 4.66% during the forecast period.

The global market is registering steady growth, driven by its widespread applications across food, pharmaceuticals, cosmetics, and industrial sectors. Alginate, a naturally derived polysaccharide from brown seaweed, is increasingly favored for its biocompatibility, gelling properties, and role as a sustainable ingredient.

Major companies operating in the global alginate Industry are Algaia SA, Marine Biopolymers Limited, DuPont de Nemours, Inc., Ingredi, KIMICA, Ceamsa, Shandong Jiejing Group Corporation, Cargill, Incorporated, BASF SE, Ashland, Brenntag North America, Inc., FMC Corporation, SNP, Inc., and Merck KGaA.

The market benefits from the rising consumer demand for natural and plant-based additives, particularly in the food & beverage industry, where it is used as a thickener, stabilizer, and emulsifier. Additionally, the pharmaceutical and biomedical sectors are leveraging alginate in drug delivery, wound care, and regenerative medicine, further expanding its market potential.

A significant opportunity lies in the increasing adoption of alginate-based biodegradable packaging solutions as industries seek sustainable alternatives to plastic. With ongoing research and technological advancements, alginate’s versatility continues to drive new applications, positioning the market for robust future growth.

- In December 2024, according to an article by Indian Journal of Animal Health (IJAH), the shift toward sustainable packaging solutions is crucial in mitigating the environmental impact of synthetic polymers. In the alginate market, biodegradable packaging derived from natural polymers like alginate, cellulose, and chitosan offers a renewable, eco-friendly alternative with strong functional and technological properties for food packaging applications.

Key Highlights:

- The global alginate market size was valued at USD 737.2 million in 2023.

- The market is projected to grow at a CAGR of 4.66% from 2024 to 2031.

- North America held a market share of 26.33% in 2023, with a valuation of USD 194.1 million.

- The sodium segment garnered USD 295.8 million in revenue in 2023.

- The foods & beverages segment is expected to reach USD 436.9 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.46% during the forecast period.

Market Driver

"Rising Demand in the Food and Beverage Industry"

The food & beverage industry is a key driver of the global alginate market, with increasing demand for natural stabilizers, thickeners, and gelling agents in processed foods. Alginate is widely used in dairy products, bakery fillings, confectionery, and plant-based alternatives, due to its superior texture-enhancing properties.

As consumer preferences shift toward clean-label and plant-derived ingredients, food manufacturers are incorporating alginate to replace synthetic additives. The rising trend of vegan and vegetarian diets is also contributing to higher demand, particularly in meat and dairy alternatives where alginate helps in improving texture and shelf life.

Moreover, the growing consumption of convenience foods and ready-to-eat meals is fueling the need for efficient food stabilizers, making alginate an essential component in food formulation. Additionally, regulatory bodies are approving alginate as a safe food ingredient, further strengthening its adoption.

The increasing awareness regarding food quality and sustainability is expected to propel the demand for alginate in the food & beverage sector, encouraging manufacturers to enhance production capacities and innovate new product applications.

- For instance, in October 2024, Vaess inaugurated a state-of-the-art 5,500 m² alginate gel production facility in Poland, reinforcing its commitment to innovation and sustainability in the market. This expansion enhances global supply capabilities across meat, fish, bakery, pet food, and plant-based sectors.

Market Challenge

"Fluctuations in Raw Material Availability and Pricing"

The alginate market is highly dependent on the availability of brown seaweed, its primary raw material, which is susceptible to supply chain disruptions, seasonal variations, and environmental changes.

Climate change, overharvesting, and regulatory restrictions on seaweed collection in various regions significantly impact the supply, leading to price fluctuations and instability in production costs. Supply chain disruptions caused by geopolitical tensions and transportation constraints also pose a challenge, affecting the consistent sourcing of raw materials.

In response, companies are exploring alternative seaweed cultivation methods, engaging in sustainable harvesting practices, and investing in vertically integrated supply chains to ensure raw material security and cost stability.

Businesses are adopting strategic measures such as sustainable seaweed farming, long-term supplier agreements, and regional diversification in sourcing to counteract raw material fluctuations.

Vertical integration is gaining traction, allowing companies to have greater control over the supply chain while reducing dependency on external suppliers. Technological advancements in seaweed processing and alternative extraction techniques are also being explored to improve yield efficiency.

Market Trend

"Growing Demand for Natural and Clean-label Ingredients"

The increasing consumer preference for natural, organic, and clean-label ingredients is driving significant demand for alginate in various industries, particularly in food and personal care. Health-conscious consumers actively avoid synthetic additives, artificial stabilizers, and chemical preservatives, hence, manufacturers are replacing them with plant-based alternatives like alginate.

In the food sector, alginate is widely used as a thickening and gelling agent in dairy, confectionery, and meat substitutes, enhancing product quality while maintaining clean-label status. In cosmetics, alginate is increasingly incorporated into skincare formulations due to its natural origin, moisture retention properties, and ability to create a smooth, protective film.

Regulatory agencies and clean-label certification bodies are further promoting the use of naturally sourced ingredients, compelling brands to reformulate their products with sustainable and consumer-friendly components.

Additionally, the growing environmental consciousness is encouraging companies to invest in alginate as a biodegradable and renewable ingredient, reinforcing its long-term market potential. The demand for alginate is set to register robust growth across multiple sectors as the clean-label movement continues to reshape consumer preferences.

- Ashland expanded its alginate market presence by offering plant-based solutions like Benecel MX and the new Benecel MX 100 methylcellulose, specifically designed for meat and seafood alternatives. These innovations enhance texture, stability, and functionality in plant-based food applications, driving the market.

Alginate Market Report Snapshot

| Segmentation |

Details |

| By Type |

Sodium, Calcium, Potassium, Others |

| By Application |

Food & Beverages (Dairy Products, Bakery Products, Sauces & Dressings, Others), Pharmaceuticals (Drug Delivery, Wound Dressings, Tablet Coatings, Dental Impressions), Industrial (Textile Printing, Paper Production, Coatings & Films), Personal Care & Cosmetics (Thickeners, Film Formers, Emulsifiers), Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Sodium, Calcium, Potassium, Others): The sodium segment earned USD 295.8 million in 2023, due to its extensive use as a thickener, stabilizer, and emulsifier in food, pharmaceuticals, and cosmetics. Its superior solubility, high gelling capacity, and cost-effectiveness make it the preferred choice across industries.

- By Application (Food & Beverages, Pharmaceuticals, Industrial, Personal Care & Cosmetics, Others): The food & beverages segment held 38.55% share of the market in 2023, due to the rising demand for natural and clean-label ingredients. Alginate's role as a plant-based thickening and gelling agent is driving its adoption in dairy products, meat substitutes, and bakery applications.

Alginate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 36.22% share of the global alginate market in 2023, with a valuation of USD 267.0 million. The region’s leadership is primarily driven by abundant seaweed resources in countries like China, India, Indonesia, and Japan, ensuring a steady and cost-effective raw material supply.

Additionally, the rising demand for alginate in food processing, pharmaceuticals, and cosmetics is fueling the market. The food industry in the region is registering rapid expansion, due to the increased consumption of convenience foods, dairy products, and plant-based alternatives, where alginate is widely used as a thickener and stabilizer.

Moreover, the pharmaceutical sector in Asia Pacific is registering robust growth, particularly in wound care and drug delivery applications, further boosting the demand for alginate. Government support for sustainable seaweed farming and technological advancements in alginate extraction are also contributing to the market growth.

Additionally, the increasing adoption of alginate-based biodegradable packaging solutions in response to stringent environmental regulations is driving the market. The market in Asia Pacific is poised for sustained dominance in the coming years, due to the growing population, rising disposable income, and increasing awareness of natural and clean-label products.

The alginate Industry in Europe is poised for significant growth at a robust CAGR of 5.01% over the forecast period, driven by the increasing demand for natural, plant-based, and sustainable ingredients across industries.

The region’s stringent regulatory framework promoting clean-label and eco-friendly products is pushing manufacturers to replace synthetic additives with alginate in food, pharmaceuticals, and personal care products.

The food industry in Europe is registering a surge in demand for natural stabilizers and texturizers, particularly in dairy, bakery, and plant-based meat alternatives, where alginate plays a crucial role.

Additionally, the region is at the forefront of sustainable packaging solutions, with alginate emerging as a promising biodegradable alternative to plastic. The pharmaceutical and biomedical industries are also propelling demand, as alginate is widely used in wound dressings, drug encapsulation, and tissue engineering.

- In January 2025, PBC Biomed is strengthening its collaboration with Mochida Pharmaceutical Ltd. to advance alginate-based technologies in tendon protection, cavernous nerve repair, and cartilage treatment. With a clear vision, the company aims to develop innovative medical solutions that enhance global patient well-being.

Several European nations, including France, the UK, Germany, and Spain, are investing in sustainable seaweed harvesting to ensure a stable alginate supply, reducing dependency on imports. Furthermore, the increasing consumer awareness regarding health benefits and environmental sustainability is encouraging companies to develop innovative alginate-based formulations.

With continuous advancements in alginate applications and growing sustainability initiatives, the market in Europe is set for steady expansion in the coming years.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Food and Drug Administration (FDA) classifies alginates as Generally Recognized As Safe (GRAS) for use in food products. They are also approved for pharmaceutical applications, including wound dressings and drug delivery systems.

- In Europe, the European Food Safety Authority (EFSA) evaluates and approves alginates as food additives under specific E-numbers (E400–E405), subject to purity criteria and usage limits. The European Medicines Agency (EMA) oversees their use in pharmaceuticals, ensuring compliance with the European Pharmacopoeia.

- In India, the Food Safety and Standards Authority of India (FSSAI) approves alginates for use in food products, and the Central Drugs Standard Control Organization (CDSCO) oversees their use in pharmaceuticals.

Competitive Landscape:

The alginate Industry is characterized by a number of participants, including both established corporations and rising organizations. The global market is highly competitive, with key players focusing on capacity expansion, strategic partnerships, and product innovation to strengthen their market presence.

Companies are investing in sustainable seaweed sourcing and advanced extraction technologies to enhance production efficiency. Mergers and acquisitions are shaping the market, enabling firms to expand their geographical reach and product portfolios.

Additionally, players are emphasizing research and development to introduce high-performance alginate derivatives for food, pharmaceuticals, and biomedical applications.

Regulatory compliance and sustainability initiatives are also central to corporate strategies, as firms seek to meet evolving consumer preferences for clean-label, plant-based, and biodegradable solutions across various industries.

- In November 2024, Bay Area startups Umaro and Sway secured a USD 1.5 million Department of Energy (DOE) Mixed Algae Conversion Research Opportunity (MACRO) grant. The funding will support the development of innovative processing techniques to upcycle alginate sidestreams into sustainable seaweed-based bioplastics.

List of Key Companies in Alginate Market:

- Algaia SA

- Marine Biopolymers Limited

- DuPont de Nemours, Inc.

- Ingredi

- KIMICA

- Ceamsa

- Shandong Jiejing Group Corporation

- Cargill, Incorporated

- BASF SE

- Ashland

- Brenntag North America, Inc.

- FMC Corporation

- SNP, Inc.

- Merck KGaA

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, Klaria Pharma Holding AB entered into a licensing agreement with CNX Therapeutics for its Sumatriptan Alginate Film, an innovative migraine treatment utilizing patented alginate-based oral films. The deal grants CNX exclusive marketing rights in Europe and the UK, with an initial launch planned for Germany, Spain, and Italy in H2 2025, followed by further expansion in 2026. This agreement highlights the growing pharmaceutical applications of alginate, reinforcing its market potential in drug delivery solutions due to its fast-acting and reliable administration via oral mucosa. The partnership strengthens Klaria’s position in the alginate-based pharmaceutical sector while expanding CNX Therapeutics’ neurological treatment portfolio.

- In May 2024, IFF is set to present groundbreaking research at major biomedical conferences. Its NovaMatrix ultrapure alginate biopolymers showcase potential in regenerative medicine and 3D cell culture. IFF unveiled a pioneering self-gelling alginate hydrogel system, enabling minimally invasive therapeutic delivery. These developments reinforce IFF’s commitment to innovation and expanding alginate’s role in high-growth biomedical sectors.

- In April 2024, Bonyf NV, a publicly listed company on Euronext Paris, moved to Phase 2 to develop its innovative Alginate-Organic Denture Fixative Cream. Following promising results in Phase 1, the company is focused on optimizing and validating the product's effectiveness for the oral care market.