Market Definition

Aircraft cabin interiors encompass the design, outfitting, and integration of all internal components within an aircraft’s passenger and crew areas. This includes seating, lighting, flooring, galleys, lavatories, in-flight entertainment systems, and cabin panels, with emphasis on comfort, safety, aesthetics, and efficiency.

Aircraft Cabin Interiors Market Overview

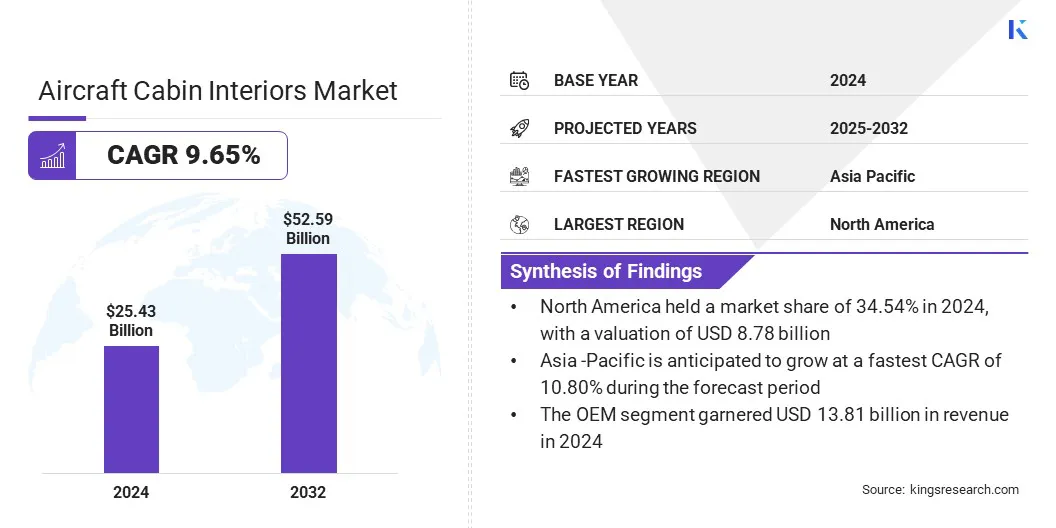

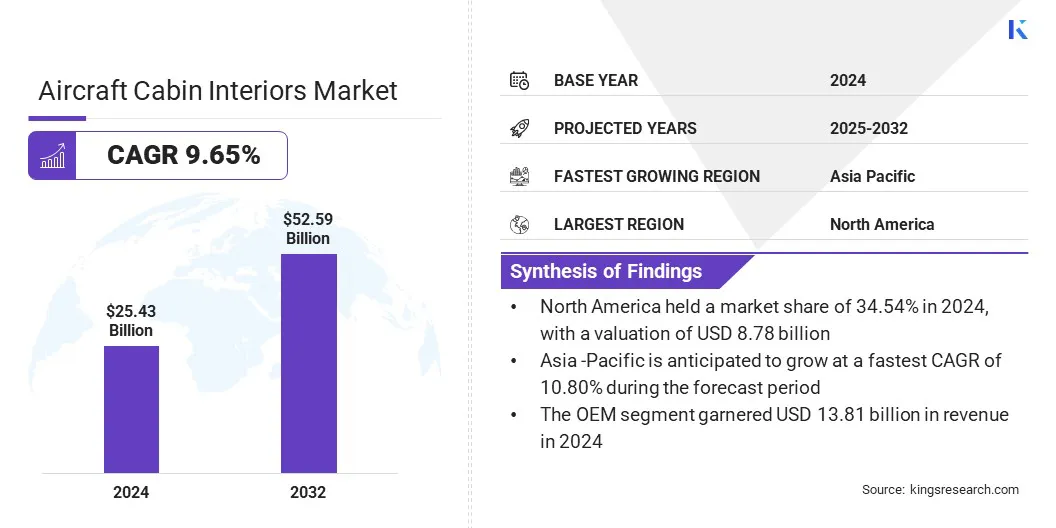

According to Kings Research, the global aircraft cabin interiors market size was valued at USD 25.43 billion in 2024 and is projected to grow from USD 27.60 billion in 2025 to USD 52.59 billion by 2032, exhibiting a CAGR of 9.65% during the forecast period.

Market is driven by increasing focus on passenger comfort, luxury, and in-flight experience, prompting airlines to adopt premium seating, ergonomic designs, advanced lighting. Additionally, rising expectations for comfort, luxury, and personalized in-flight experiences are encouraging significant investments in premium interiors, modern seating designs, and advanced entertainment systems.

Key Highlights:

- The aircraft cabin interiors industry size was recorded at USD 25.43 billion in 2024.

- The market is projected to grow at a CAGR of 9.65% from 2024 to 2032.

- North America held a share of 34.54% in 2024, valued at USD 8.78 billion.

- The seating segment garnered USD 7.03 billion in revenue in 2024.

- The composites segment is expected to reach USD 24.98 billion by 2032.

- The narrow-body aircraft segment is anticipated to witness the fastest CAGR of 10.83% over the forecast period.

- The OEM segment held a share of 54.32% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 10.80% through the projection period.

Major companies operating in the aircraft cabin interiors market are RTX Corporation, Safran S.A, Diehl Stiftung & Co. KG, JAMCO Corporation, FACC AG, Airbus, Aviointeriors S.p.A, Astronics Corporation, Honeywell International Inc, Geven S.p.A, Hong Kong Aircraft Engineering Company Limited, AVIC Cabin Systems, The Boeing Company, Bucher Industries AG, and Bruce Aerospace Inc.

The global rise in passenger traffic is fueling demand for aircraft and significant investments in cabin interior upgrades. Airlines are expanding fleets and focusing on advanced seating, in-flight entertainment, and connectivity to enhance passenger comfort. Market players are increasingly prioritizing efficiency and passenger experience in both new and retrofitted aircraft.

- In June 2024, the International Air Transport Association (IATA) projected global passenger traffic to grow at an average annual rate of 3.8% between 2023 and 2043, adding more than 4 billion passenger journeys by 2043.

Market Driver

Growing Air Travel Demand

The expansion of the aircraft cabin interiors market is propelled by the growing demand for air travel. Increasing passenger traffic across domestic and international routes is prompting airlines to expand fleets, upgrade seating capacity, and enhance cabin environments to improve customer satisfaction.

This growth is prompting demand for advanced materials, modular cabin designs, and in-flight connectivity. The surge in air travel is also accelerating retrofits and refurbishments to meet passenger expectations and regulatory standards.

- In May 2024, the International Air Transport Association (IATA) reported an 11.0% year-over-year increase in passenger demand, measured in revenue passenger kilometers (RPKs), reflecting strong global air travel recovery and rising demand for new aircraft and upgraded cabin interiors.

Market Challenge

High Manufacturing and Retrofitting Costs

A key challenge impeding the progress of the aircraft cabin interiors market is the high cost of manufacturing and retrofitting advanced cabin systems. Developing and installing premium seats, panels, lighting, and in-flight entertainment systems requires specialized materials, skilled labor, and compliance with stringent aviation safety standards.

Retrofitting existing aircraft is complex due to limited cabin space, strict weight restrictions, and the requirement to minimize operational downtime during upgrades. These factors increase costs, limiting adoption by smaller airlines and requiring careful investment to balance passenger experience with budget constraints.

To address this challenge, market players are adopting advanced engineering and modular design approaches to simplify installation and reduce labor requirements. Airlines and OEMs are adopting lightweight, cost-effective materials, standardizing interior components, and using digital design and simulation tools to optimize layouts before implementation.

They are investing in in-house retrofitting facilities, developing customizable interior kits, and streamlining project management to accelerate upgrades, reduce costs, and efficiently enhance passenger comfort.

Market Trend

Growing Focus on Premium & Custom Cabin Materials

A key trend influencing the aircraft cabin interiors market is the growing focus on premium and custom cabin materials to enhance passenger experience in business and first-class cabins.

Airlines and OEMs are incorporating lightweight, durable, and aviation-certified veneers, leathers, and surface finishes into seats, panels, countertops, and bulkheads. This trend is fostering the development of highly customizable interiors with refined aesthetics, ergonomic designs, and luxury features that enhance passenger comfort.

- In April 2025, Austrian cabin design specialist F/List unveiled F/Lab Stone Inlay and other innovative materials at AIX 2025, providing lightweight, durable, and customizable solutions to enhance aesthetics, luxury, and passenger experience in premium and first-class aircraft cabins.

Aircraft Cabin Interiors Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Seating, Cabin Lighting, In-flight Entertainment & Connectivity, Lavatories, Galley Equipment, Windows & Windshields, Others

|

|

By Material

|

Composites, Metals & Alloys, Others

|

|

By Aircraft Type

|

Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, Business Jets

|

|

By End-User

|

OEM, MRO, Aftermarket

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Seating, Cabin Lighting, In-flight Entertainment & Connectivity, Lavatories, Galley Equipment, Windows & Windshields, and Others): The seating segment earned USD 7.03 billion in 2024, mainly due to increasing demand for passenger comfort and ergonomic, lightweight seating solutions.

- By Material (Composites, Metals & Alloys, and Others): The composites segment held a share of 43.45% in 2024, fueled by their lightweight, durable, and fuel-efficient properties, enhancing cabin performance and efficiency.

- By Aircraft Type (Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, and Business Jets): The narrow-body aircraft segment is projected to reach USD 25.46 billion by 2032, owing to rising short-haul travel demand and fleet expansions by low-cost carriers.

- By End-User (OEM, MRO, and Aftermarket): The aftermarket segment is anticipated to witness the fastest CAGR of 10.48% over the forecast period, attributed to increasing demand for cabin upgrades, retrofits, and maintenance services across aging and existing aircraft fleets.

Aircraft Cabin Interiors Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America aircraft cabin interiors market share stood at 34.54% in 2024, valued at USD 8.78 billion. This dominance is reinforced by the increasing demand for enhanced passenger comfort and premium cabin experiences, prompting airlines to invest in modern seating, lighting, and cabin layouts. The growing adoption of lightweight and fuel-efficient materials is improving operational efficiency and reducing costs related to fuel, maintenance, and overall aircraft operations.

Additionally. the integration of in-flight entertainment, connectivity, and smart cabin systems is elevating passenger satisfaction and meeting traveler expectations, along with advanced cabin management technologies, is enhancing personalization and overall passenger experience.

- In July 2025, Heads Up Technologies (HUT) acquired Innovative Advantage (IA), a provider of cabin management system (CMS) backbone technology for VVIP and large-cabin jets. The acquisition expands HUT’s cabin technology capabilities by integrating IA’s AVDS platform with its lighting, IFE, safety, and audio systems to enhance passenger and crew experience.

The Asia-Pacific aircraft cabin interiors industry is set to grow at a robust CAGR of 10.80% over the forecast period. This growth is attributed to rising air travel demand in emerging economies, prompting airlines to invest in modern, comfortable, and premium cabin designs. Adoption of lightweight and fuel-efficient materials is enhancing operational efficiency while reducing airline costs of fuel and maintenance.

Technological advancements in cabin management systems are enabling airlines to provide seamless control of lighting, entertainment, safety, and communication features, resulting in enhanced passenger comfort, greater personalization, and improved operational efficiency.

Additionally, strategic collaborations for upgrading cabin interiors are improving design, incorporating lightweight materials, and enhancing functional layouts, thereby contributing to domestic market growth.

- In October 2024, Air India partnered with Tata Technologies to upgrade aircraft interiors, enhancing passenger experience through advanced design, lightweight materials, and functional layouts while improving safety and operational efficiency.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) regulates aircraft cabin interiors, ensuring compliance with safety standards, certification requirements, and operational guidelines.

- In the UK, the Civil Aviation Authority (CAA) oversees aircraft cabin interiors to ensure safety, airworthiness, and passenger welfare. It supervises seating layouts, emergency systems, lighting, material flammability, and ergonomic design, certifying modifications and monitoring maintenance to optimize both operational safety and passenger experience.

- In China, the Civil Aviation Administration of China (CAAC) supervises aircraft cabin interiors by enforcing safety, design, and operational standards. It regulates seating configurations, emergency equipment, material flammability, and cabin ergonomics, certifying modifications and ensuring compliance with airworthiness and environmental regulations.

- In India, the Directorate General of Civil Aviation (DGCA) oversees the design, installation, and certification of aircraft cabin interiors, ensuring passenger safety through regulations on seat belts, emergency systems, fire-resistant materials, lighting, and space allocation, while monitoring compliance with airworthiness standards.

Competitive Landscape

Major players operating in the aircraft cabin interiors industry are strengthening maintenance and refurbishment capabilities through strategic acquisitions of specialized interior providers.

They are investing in in-house retrofitting facilities, standardized interior kits, and advanced project management practices to improve efficiency and reduce turnaround times. Additionally, companies are streamlining operations to accelerate upgrades while ensuring high quality and compliance with strict safety standards.

- In January 2025, Yingling Aviation acquired Wichita-based Global Engineering & Technology to expand its MRO and interior completions capabilities, enhance aircraft interior refurbishment services, reduce turnaround times, and strengthen its position in the business aviation sector.

Key Companies in Aircraft Cabin Interiors Market:

- RTX Corporation

- Safran S.A

- Diehl Stiftung & Co. KG

- JAMCO Corporation

- FACC AG

- Airbus

- Aviointeriors s.p.a

- Astronics Corporation

- Honeywell International Inc

- geven spa

- Hong Kong Aircraft Engineering Company Limited

- AVIC Cabin Systems

- The Boeing Company

- Bucher Industries AG

- Bruce Aerospace Inc

Recent Developments (Product Launches)

- In May 2025, United Airlines introduced its new ‘United Elevated’ interiors on Boeing 787-9 aircraft, featuring Polaris Studio suites, upgraded business class with sliding doors, Starlink connectivity, wireless charging, and 4K OLED seatback screens to deliver a premium passenger experience.

- In April 2025, Riyadh Air unveiled new cabin interiors for its Boeing 787 fleet, showcasing refined craftsmanship and premium design for enhanced passenger comfort.

- In May 2024, JEKTA unveiled the first interiors for its PHA-ZE 100 amphibious aircraft, featuring modular economy and executive cabin configurations focused on sustainability, comfort, and versatile applications, with India’s MEHAIR as the launch customer.