Market Definition

The aircraft MRO (Maintenance, Repair, and Overhaul) market involves services to maintain, repair, and refurbish aircraft. It ensures that aircraft remain safe, efficient, and compliant with regulatory standards.

The market covers various services like maintenance checks, repairs, and component overhauls, driven by increasing air travel, fleet aging, and technological advancements in the aviation industry.

Aircraft MRO Market Overview

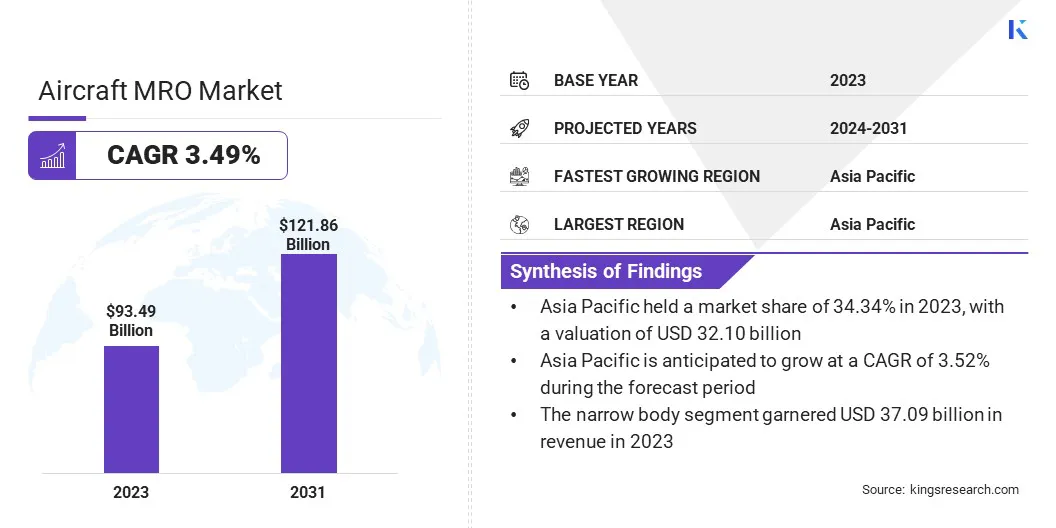

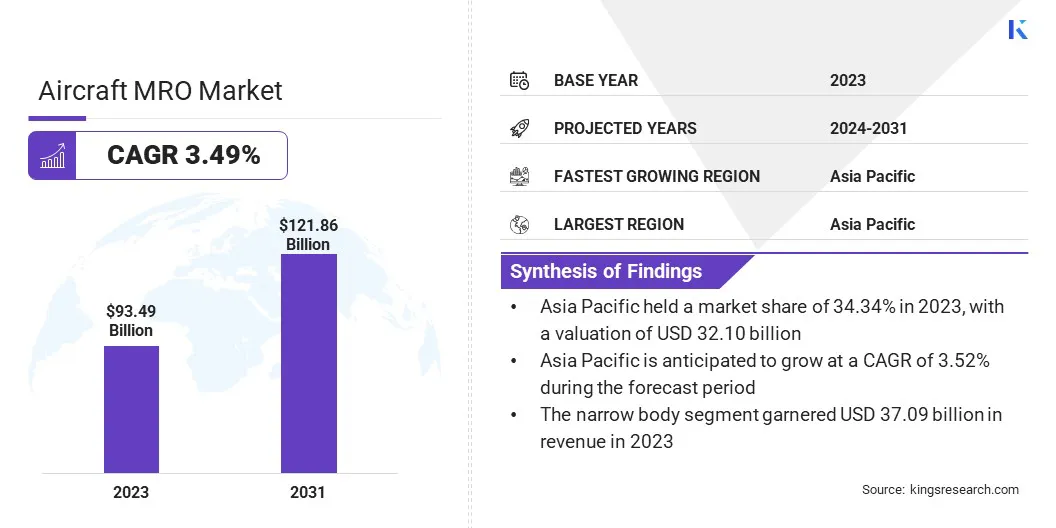

The global aircraft MRO market size was valued at USD 93.49 billion in 2023, which is estimated to be valued at USD 95.86 billion in 2024 and reach USD 121.86 billion by 2031, growing at a CAGR of 3.49% from 2024 to 2031.

Rising air traffic contributes to a growing fleet of aircraft, which, in turn, drives the demand for regular maintenance, repairs, and overhauls. Airlines must ensure that their aircraft remain safe, efficient, and compliant with regulations as more flights operate globally.

Major companies operating in the aircraft MRO market are AAR, AIRBUS, Delta Air Lines, Inc, Hong Kong Aircraft Engineering Company Limited (Swire Group Company), KLM UK ENGINEERING LIMITED, MTU Aero Engines AG, ST Engineering, TAP, Collins Aerospace, FL Technics (Avia Solutions Group), General Electric Company, Safran Group, Honeywell International Inc., Abu Dhabi Aviation, and Barnes Aerospace.

The market is evolving rapidly, driven by the continuous need for safe and reliable air travel. Airlines and operators are increasingly prioritizing efficient maintenance practices to ensure optimal fleet performance. With technological advancements in predictive maintenance and digital tools, MRO providers are enhancing service efficiency.

The market is also shaped by regulatory pressures, an expanding global fleet, and the rising demand for specialized services. As airlines face competitive pressures, they seek cost-effective, high-quality MRO solutions for long-term operational success.

- In October 2024, Safran Aircraft Engines revealed a USD 1.03 billion investment to expand its global MRO network for LEAP engines. This includes new facilities in Europe, India, Mexico, and Morocco, creating 4,000 jobs and supporting the growing demand for LEAP aftersales services.

Key Highlights:

- The global aircraft MRO industry size was valued at USD 49 billion in 2023.

- The market is projected to grow at a CAGR of 3.49% from 2024 to 2031.

- Asia Pacific held a market share of 34.34% in 2023, with a valuation of USD 32.10 billion and is anticipated to grow at a CAGR of 3.52% during the forecast period.

- The engine overhaul segment garnered USD 27.04 billion in revenue in 2023.

- The narrow body segment is expected to reach USD 48.38 billion by 2031.

- The independent MRO segment is anticipated to register the fastest CAGR of 3.52% during the forecast period.

Market Driver

"Rising Air Traffic"

Rising air traffic is a significant growth driver for the aircraft MRO market, as the increasing number of flights globally boosts the demand for regular maintenance, repairs, and overhauls. More passengers and cargo movement result in higher aircraft utilization, accelerating wear and tear.

- According to a September 2024 article by the FAA Air Traffic Organization (ATO), the ATO provides air traffic services for over 45,000 flights and 2.9 million airline passengers. These services cover more than 29 million square miles of airspace.

This necessitates frequent inspections and timely service to ensure operational safety and efficiency. The need for comprehensive MRO services to maintain airworthiness and compliance becomes essential at airports as airlines expand their fleets to meet this demand, fueling the market.

- In February 2025, Teesside further solidified its position as a key aircraft maintenance hub as Willis Aviation secured a long-term agreement with TUI. This deal will see maintenance services for TUI’s Boeing 737NGs conducted at Teesside, significantly enhancing the airport’s MRO offerings and attracting further industry attention.

Market Challenge

"Labor Shortages"

Labor shortages are a significant challenge in the aircraft MRO market, as the demand for skilled technicians and engineers continues to rise, while the supply of qualified personnel remains limited.

This shortage leads to delays in maintenance services and increased operational costs. Thus, MRO providers are focusing on training programs, collaborations with technical schools, and offering attractive career opportunities.

- In January 2024, Magnetic MRO, Estonia’s largest aircraft maintenance company, launched the Magnetic Academy to address labor shortages. The innovative program aims to train 60-100 new aircraft engineers, offering opportunities for those without prior aviation experience, while also providing additional training for existing professionals.

Additionally, automation and advanced technologies like predictive maintenance are being integrated to reduce reliance on manual labor, improving efficiency and minimizing service delays.

Market Trend

"Technological Advancements"

Technological advancements, particularly in predictive maintenance and automation, are transforming the aircraft MRO market. Predictive maintenance uses data analytics and sensors to anticipate potential issues before they occur, reducing downtime and repair costs.

- In January 2025, Tata Consultancy Services (TCS) opened a new delivery center in Toulouse, France. The facility will leverage Artificial Intelligence (AI), Machine Learning (ML), and data analytics to drive innovation in aerospace, improving aircraft design, manufacturing, and maintenance for European clients.

Automation is streamlining maintenance processes, improving efficiency, and reducing human error. These innovations create demand for specialized MRO services that can support the integration of advanced technologies. As airlines and MRO providers adopt these technologies, they can enhance operational performance, increase safety, and meet growing customer expectations.

- In August 2024, Tech Mahindra signed a Memorandum of Understanding (MoU) with Marshall Group to combine their advanced engineering capabilities and digital solutions. The partnership will enhance Marshall’s aerospace engineering programs, focusing on aircraft design, MRO technologies, and sustainability through hydrogen fuel systems.

Aircraft MRO Market Report Snapshot

| Segmentation |

Details |

| By Service |

Engine Overhaul, Airframe Maintenance, Line Maintenance, Modification, Components |

| By Aircraft |

Narrow Body, Wide Body, Regional Aircraft |

| By Type |

Airline/Operator MRO, Independent MRO, Original Equipment Manufacturer (OEM) MRO |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Service (Engine Overhaul, Airframe Maintenance, Line Maintenance, Modification, Components): The engine overhaul segment earned USD 27.04 billion in 2023, due to the rising demand for high-performance engines and frequent maintenance requirements for modern aircraft fleets.

- By Aircraft (Narrow Body, Wide Body, Regional Aircraft): The narrow body segment held 39.68% share of the market in 2023, due to the increasing number of short-haul flights and the widespread adoption of narrow-body aircraft by low-cost carriers globally.

- By Type [Airline/Operator MRO, Independent MRO, Original Equipment Manufacturer (OEM) MRO]: The airline/operator MRO segment is projected to reach USD 44.68 billion by 2031, as airlines increasingly outsource maintenance services to improve cost efficiency and minimize downtime.

Aircraft MRO Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 34.34% share of the aircraft MRO market in 2023, with a valuation of USD 32.10 billion. Asia Pacific is emerging as the dominant region in the market, due to rapid growth in air travel, an expanding fleet, and increasing demand for maintenance services.

The region's booming aviation industry, especially in countries like China, India, and Japan, drives the need for more frequent and complex MRO services.

Additionally, lower labor costs, strategic location advantages, and infrastructure development further contribute to the growth of the market in the region. As a result, the region is expected to lead the market in the coming years.

- In December 2024, AAR Corp. and Air France Industries KLM Engineering & Maintenance (AFI KLM E&M) announced a joint venture in Asia Pacific to provide nacelle MRO services for next-generation aircraft, strengthening their positions in the region.

The market in Europe is poised for significant growth at a robust CAGR of 3.50% over the forecast period. Europe will emerge as a fast-growing region in the aircraft MRO industry, driven by the continuous expansion of its aviation sector and increasing fleet size.

Major aviation hubs in countries like the UK, Germany, and France are boosting the demand for advanced MRO services. The region is also registering significant investments in technology, such as predictive maintenance and automation, which enhance operational efficiency.

Additionally, the strong presence of MRO providers further propels the market in Europe, positioning it as a key player in the global market.

- In October 2024, GE Aerospace announced a USD 130 million investment in its MRO and component repair facilities in Europe by 2026, enhancing capacity and technology to meet the growing demand for services, especially for CFM LEAP engines, ensuring fleet readiness.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., The Federal Aviation Administration that comes under the United States Department of Transportation, works toward providing safety and efficiency and how to safely integrate new technologies into the aviation system.

- In Canada, Transport Canada is responsible for transportation policies and programs. It promotes safe, secure, efficient and environmentally-responsible transportation.

- The European Union Aviation Safety Agency (EASA), ensures safety and environmental protection in civil aviation in Europe.

- In India, the Directorate General of Civil Aviation (DGCA) is the regulatory body in the field of civil aviation, primarily dealing with safety issues. It is responsible for regulation of air transport services to/from/within India and for enforcement of civil air regulations, air safety, and airworthiness standards. The DGCA also co-ordinates all regulatory functions with the International Civil Aviation Organisation (ICAO).

Competitive Landscape:

The global market is characterized by a large number of participants, including both established corporations and rising organizations.

The development of AI and software solutions in the aircraft MRO market is rapidly transforming maintenance processes. Innovations focus on predictive maintenance, real-time diagnostics, and enhanced inspection techniques, significantly improving operational efficiency.

Competitors are continuously launching advanced AI-driven platforms that optimize workflow, reduce downtime, and increase safety, driving the industry's shift toward more automated, data-driven solutions for improved service delivery and cost reduction.

- In September 2024, Ramco Systems launched its Aviation Software 6.0, incorporating AI-driven insights, automation, and integration to transform M&E and MRO operations. Key features include engine MRO management, predictive analytics, and automated workflows, enhancing efficiency, compliance, and decision-making in aircraft maintenance.

List of Key Companies in Aircraft MRO Market:

- AAR

- AIRBUS

- Delta Air Lines, Inc

- Hong Kong Aircraft Engineering Company Limited (Swire Group Company)

- KLM UK ENGINEERING LIMITED

- MTU Aero Engines AG

- ST Engineering

- TAP

- Collins Aerospace

- FL Technics (Avia Solutions Group)

- General Electric Company

- Safran Group

- Honeywell International Inc.

- Abu Dhabi Aviation

- Barnes Aerospace

Recent Developments (Launch/Expansion/Partnership)

- In September 2024, Dassault Aviation launched Dassault Aviation MRO India (DAMROI), a subsidiary in Noida, India, to support the Indian Air Force’s Mirage 2000 fleet. This move aligns with India's "Atmanirbhar Bharat" and "Make in India" policies, promoting self-reliance and indigenous aerospace services.

- In November 2024, Air India announced the establishment of a Basic Maintenance Training Organization (BMTO) in Bengaluru to offer a 2+2 year Aircraft Maintenance Engineering program. The facility, expected by mid-2026, aims to address Air India's fleet expansion and enhance the aviation workforce.

- In September 2024, Air India began the construction of a mega MRO facility at Bengaluru International Airport to support fleet maintenance. The facility will create over 1,200 jobs, enhance local economic growth, and bolster Air India's self-reliance in aircraft maintenance.

- In September 2024, Lockheed Martin and Tata Advanced Systems entered a teaming agreement to expand collaboration on the C-130J Super Hercules. The agreement includes establishing an MRO facility in India, enhancing India-U.S. strategic ties, and supporting future aircraft manufacturing.

- In July 2024, Magellan Aerospace and Aequs Private Limited signed a Memorandum of Understanding (MOU) to explore a joint engine MRO venture at Aequs SEZ in Belagavi, Karnataka, India. This initiative aims to address the growing demand in India's aerospace and aviation market, expanding the existing partnership into the MRO sector.

- In November 2024, GE Aerospace signed an MRO offload agreement with United Aerospace Maintenance Company (UAMCO) in Cyprus, focusing on quick-turn workscopes for LEAP engines. This agreement supports GE’s capacity commitments within an open MRO ecosystem for LEAP engine maintenance across Europe, the Middle East, and Africa.