Market Definition

Agricultural packaging refers to the specialized materials and solutions used for storing, protecting, handling, and transporting agricultural products such as seeds, crops, fertilizers, pesticides, and harvested produce.

It is designed to maintain product quality, extend shelf life, ensure safety, and support efficient logistics from farm to market. Agricultural packaging includes bags, pouches, bottles, crates, silos, wraps, and bulk containers made from materials like plastic, paper, jute, or metal.

Agricultural Packaging Market Overview

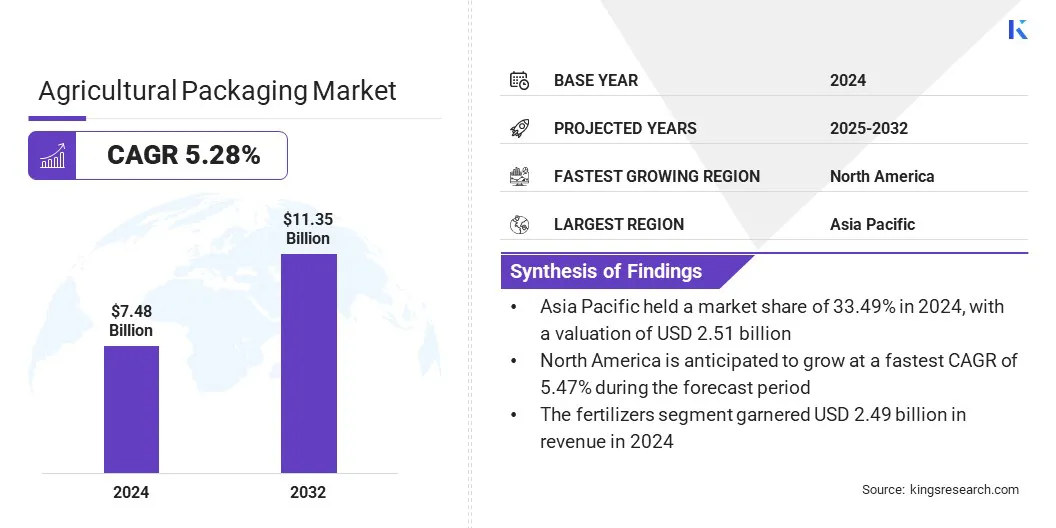

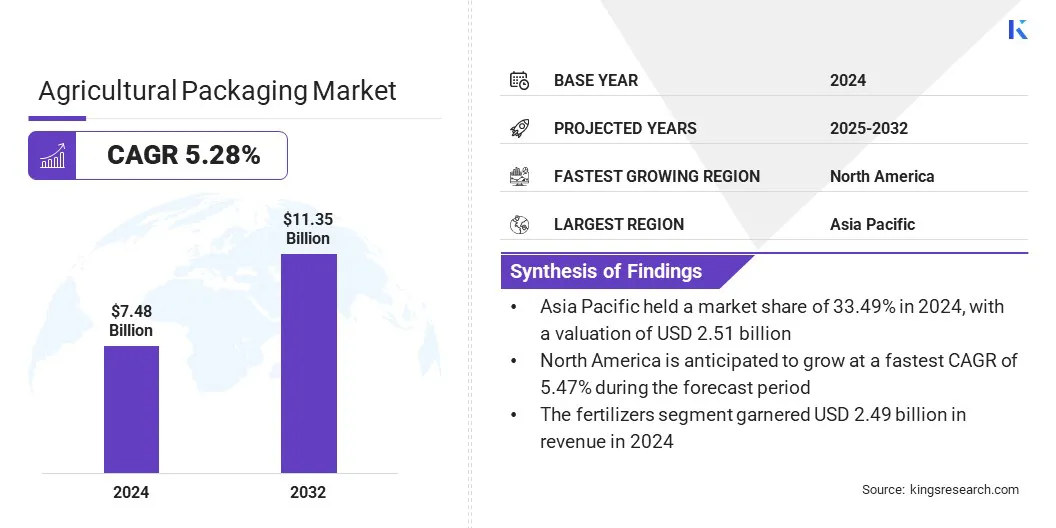

The global agricultural packaging market size was valued at USD 7.48 billion in 2024 and is projected to grow from USD 7.85 billion in 2025 to USD 11.35 billion by 2032, exhibiting a CAGR of 5.28% over the forecast period.

Rising global food demand is driving higher adoption of protective and efficient packaging solutions that preserve crop quality, extend shelf life, and minimize post-harvest losses across the supply chain. Growth in organized retail and e-commerce of fresh produce is boosting the need for innovative, convenient, and visually appealing packaging formats that enhance product presentation, brand differentiation, and consumer convenience.

Key Highlights:

- The agricultural packaging industry size was recorded at USD 7.48 billion in 2024.

- The market is projected to grow at a CAGR of 5.28% from 2025 to 2032.

- Asia Pacific held a market share of 33.49% in 2024, with a valuation of USD 2.51 billion.

- The pouches segment garnered USD 2.10 billion in revenue in 2024.

- The plastic segment is expected to reach USD 2.98 billion by 2032.

- The pesticides segment is anticipated to witness the fastest CAGR of 5.58% over the forecast period.

- North America is anticipated to grow at a CAGR of 5.47% over the forecast period.

Major companies operating in the agricultural packaging market are Amcor plc, Greif Inc, ProAmpac LLC, LC Packaging International BV, NNZ Group, Mondi Group, Pactiv Evergreen Inc, Sonoco Products Company, Bag Supply Company, Flexpack FIBC, Western Packaging LLC, Novolex, H.B. Fuller Company, R. R. Flexipack Pvt. Ltd, ePac Holdings, LLC.

The growing production of bioplastics is driving the market by providing sustainable alternatives to conventional plastics. These materials support eco-friendly practices, reduce dependence on fossil-based inputs, and help companies meet stricter environmental regulations. Rising demand for biodegradable and compostable solutions is accelerating their adoption across agricultural packaging applications.

- In December 2024, European Bioplastics (EUBP) reported that global bioplastics production capacity is set to increase to approximately 5.73 million tonnes by 2029. This growth is driving the market by offering sustainable alternatives to conventional plastics.

Market Driver

Rising Global Agricultural Production

A key driver propelling the growth of the agricultural packaging market is the rising global agricultural production, which is creating strong demand for packaging solutions that preserve crop quality, prevent spoilage, and enable efficient transport across long supply chains.

Growing food output is prompting farmers and agribusinesses to adopt advanced packaging that reduces post-harvest losses and supports safe distribution. This expansion in agricultural production is further encouraging innovation in sustainable, smart, and cost-effective packaging technologies to meet the evolving needs of producers and consumers.

- In July 2025, the Organisation for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization (FAO) projected that global agricultural production will reach USD 3.96 trillion by 2034. This is expected to drive the demand for advanced agricultural packaging solutions that ensure quality, reduce post-harvest losses, and support efficient global distribution.

Market Challenge

High Cost of Sustainable and Eco-Friendly Packaging Materials

A key challenge in the agricultural packaging market is the high cost of sustainable and eco-friendly packaging materials such as biodegradable films, compostable plastics, and bio-based polymers.

These materials require advanced processing technologies and costly raw inputs, making them significantly more expensive than conventional plastic packaging. Small and mid-sized farmers face increased financial pressure from these higher costs, which restricts their ability to adopt sustainable packaging solutions.

To address this challenge, market players are investing in scaling up production of bio-based and compostable packaging to achieve cost efficiencies. They are developing hybrid solutions that blend recycled plastics with biodegradable materials to balance performance and affordability.

Companies are also collaborating with governments and NGOs to access subsidies, promote circular economy initiatives, and expand recycling infrastructure. Additionally, packaging manufacturers are offering lightweight designs and modular formats that reduce material usage and help farmers manage costs more effectively.

Market Trend

Increasing Adoption of Biodegradable Packaging Materials

A key trend influencing the agricultural packaging market is the increasing adoption of biodegradable, compostable, and recyclable materials. Manufacturers and researchers are developing packaging solutions using agricultural residues and bio-based polymers to replace conventional plastics.

These materials reduce environmental impact, support circular economy initiatives, and ensure safe storage and transport of crops, seeds, and agrochemicals. This shift promotes eco-friendly practices, regulatory compliance, and sustainability in agricultural packaging solutions.

- In August 2025, researchers at IIT Madras developed a biodegradable packaging material using agricultural waste and mycelium, offering a sustainable alternative to traditional plastic foams. This innovation aims to address plastic pollution and agricultural waste management by converting residues into compostable packaging solutions.

Agricultural Packaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Pouches, Bags, Drums, Bottles & Cans, Others

|

|

By Material

|

Plastic, Metal, Paper & Paperboard, Composite Materials, Others

|

|

By Application

|

Fertilizers, Pesticides, Seeds & Traits, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Pouches, Bags, Drums, Bottles & Cans, and Others): The pouches segment earned USD 2.10 billion in 2024, due to their convenience, portability, and increasing adoption for seeds, agrochemicals, and processed agricultural products.

- By Material (Plastic, Metal, Paper & Paperboard, Composite Materials, and Others): The plastic segment held 26.23% of the market in 2024, due to its durability, lightweight nature, cost-effectiveness, and widespread use in agricultural packaging.

- By Application (Fertilizers, Pesticides, Seeds & Traits, and Others): The fertilizers segment is projected to reach USD 3.74 billion by 2032, owing to rising fertilizer consumption, mechanized farming, and the need for safe and efficient bulk packaging.

Agricultural Packaging Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific agricultural packaging market share stood at 33.49% in 2024 in the global market, with a valuation of USD 2.51 billion. Rapid population growth and rising food demand are increasing the need for efficient packaging solutions that preserve crop quality and extend shelf life.

Growing awareness of food safety and stringent regulatory standards is prompting adoption of high-quality, compliant packaging. The shift toward sustainable and biodegradable materials is driving innovation and eco-friendly solutions across the region.

Expanding organized retail and e-commerce platforms are further fueling demand for protective and convenient packaging formats. Additionally, the increasing integration of advanced seed processing and packaging technologies is enhancing efficiency, quality control, and crop protection, further supporting market growth in countries like China.

- In August 2025, Origin Agritech Ltd. launched full-scale seed processing at its Xinjiang production facility, integrating cleaning, drying, threshing, sorting, coating, and packaging in a fully automated system. The facility enhances seed quality, crop protection, and logistics efficiency, supporting high-performance seed distribution and advancing modern agricultural practices in China.

North America is set to grow at a CAGR of 5.47% over the forecast period. Rising agricultural production across the region is increasing demand for packaging solutions that preserve crop quality, reduce post-harvest losses, and enable efficient transport. Growing consumer preference for sustainable and eco-friendly materials is accelerating the adoption of biodegradable and recyclable packaging.

Increasing regulatory focus on food safety and packaging standards is prompting manufacturers to implement high-quality, compliant solutions. Moreover, key players in the region are increasingly integrating seed processing and packaging operations to enhance efficiency, maintain product quality, and provide farmers with more reliable, ready-to-use agricultural products, further fueling market growth.

- In November 2024, Bayer CropScience acquired HyTech’s canola treating and packaging facility in Coaldale, Canada, enabling greater control over seed processing, treatment, and packaging. The acquisition strengthens Bayer’s integrated supply chain, improves efficiency, and enhances seed quality, directly supporting farmers with treated and packaged canola seeds that boost crop health and performance.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates agricultural packaging primarily for pesticides, fertilizers, and agrochemicals. It oversees container standards, labeling, and recycling programs under the Resource Conservation and Recovery Act. EPA ensures packaging prevents leaks, resists degradation, protects users and the environment, and complies with sustainability initiatives in agricultural supply chains.

- In the UK, the Food Standards Agency (FSA) regulates agricultural packaging to safeguard public health. It oversees compliance with food contact material standards, labeling, and contamination prevention in packaging for produce, grains, and agro-inputs. The FSA enforces traceability, ensures materials are safe for food contact, and aligns packaging with EU-derived sustainability regulations.

- In China, the State Administration for Market Regulation (SAMR) governs agricultural packaging by enforcing quality, labeling, and safety standards for fertilizers, pesticides, and packaged produce. It oversees compliance with environmental policies, restricts harmful packaging materials, and ensures products meet traceability requirements. SAMR plays a critical role in aligning agricultural packaging with national food safety laws.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates agricultural packaging by setting standards for food-grade materials, labeling, and safety. It oversees packaging used in fresh produce, grains, and agrochemicals to prevent contamination and ensure consumer safety. FSSAI also promotes eco-friendly materials in line with India’s plastic waste reduction policies.

Competitive Landscape

Major players operating in the agricultural packaging industry are expanding their manufacturing footprints across multiple regions to increase production capacity and strengthen market presence. They are focusing on developing reusable, returnable, and eco-friendly packaging solutions to meet rising sustainability demands.

Additionally, players are focusing on strategic collaborations and mergers to improve operational efficiency, integrate complementary capabilities, and broaden sustainable packaging offerings for agricultural products.

- In April 2025, International Plastics Limited (IPL) merged with Schoeller Allibert to create a USD 1.4 billion international reusable plastic packaging company, expanding its manufacturing footprint across North America and Europe. The merger strengthens sustainable packaging capabilities, enhances operational efficiency, and supports the adoption of eco-friendly, returnable packaging solutions across food, agriculture, and other sectors.

Key Companies in Agricultural Packaging Market:

- Amcor plc

- Greif Inc

- ProAmpac LLC

- LC Packaging International BV

- NNZ Group

- Mondi Group

- Pactiv Evergreen Inc

- Sonoco Products Company

- Bag Supply Company

- Flexpack FIBC

- Western Packaging LLC

- Novolex

- B. Fuller Company

- R. Flexipack Pvt. Ltd

- ePac Holdings, LLC.

Recent Developments (M&A)

- In April 2025, Amcor plc completed its all-stock combination with Berry Global, creating a global leader in sustainable and innovative packaging solutions. The merger enhances material science and eco-friendly capabilities, expands global reach, and supports the development of high-performance, reusable, and recyclable packaging for food, seeds, fertilizers, and other agricultural products.

- In December 2024, TOPPAN Holdings Inc. announced the acquisition of Sonoco’s Thermoformed & Flexible Packaging (TFP) business, strengthening its sustainable packaging portfolio across North and South America. The acquisition aims to enhance innovation, manufacturing, and distribution capabilities of eco-friendly packaging solutions for food, fresh produce, and other agricultural products.

- In December 2024, Sonoco Products Company completed the acquisition of Eviosys, Europe’s leading manufacturer of food cans, ends, and closures. The acquisition enhances Sonoco’s sustainable metal packaging capabilities, improves supply chain efficiency, and supports the development of durable, high-value packaging solutions for food and agricultural products.

robust