Market Definition

Agricultural micronutrients are essential trace elements required by plants in small quantities to ensure optimal growth, development, and productivity. These include zinc, boron, iron, manganese, copper, molybdenum, and chlorine, which play critical roles in enzyme activation, photosynthesis, and nutrient balance. The market encompasses the production, distribution, and application of these elements through soil, foliar, and fertigation methods across diverse crop types.

Agricultural Micronutrients Market Overview

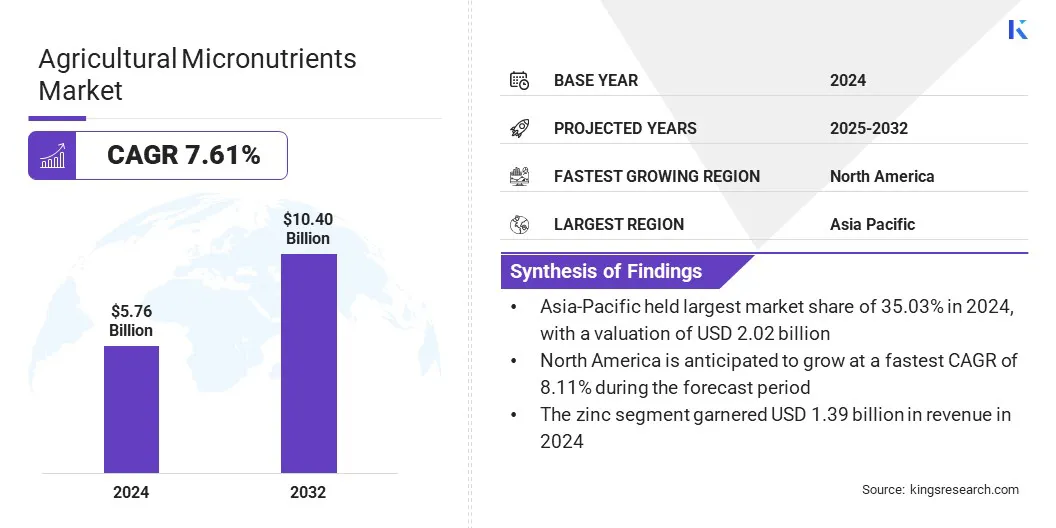

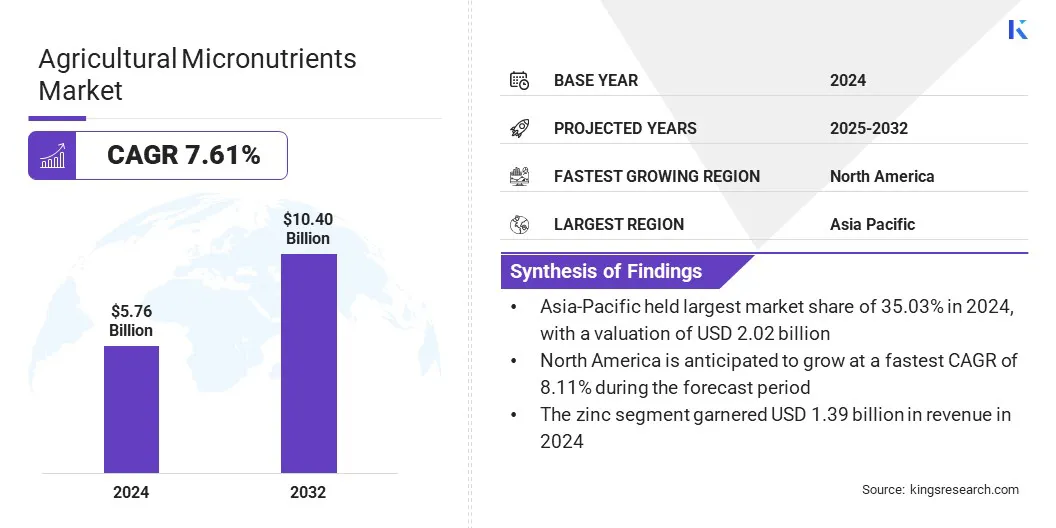

The global agricultural micronutrients market size was valued at USD 5.76 billion in 2024 and is projected to grow from USD 6.18 billion in 2025 to USD 10.40 billion by 2032, exhibiting a CAGR of 7.61% over the forecast period.

The market experiences growth through precision farming technologies that enable targeted nutrient delivery. Rising global demand for high-yield, nutrient-rich crops further drives adoption, ensuring improved productivity and crop quality.

Key Highlights:

- The agricultural micronutrients industry was recorded at USD 5.76 billion in 2024.

- The market is projected to grow at a CAGR of 7.61% from 2025 to 2032.

- Asia Pacific held a share of 35.03% in 2024, valued at USD 2.02 billion.

- The iron segment garnered USD 1.21 billion in revenue in 2024.

- The foliar segment is anticipated to witness the fastest CAGR of 7.73% through the forecast period.

- The non-chelated segment is expected to reach USD 4.08 billion by 2032.

- pulses & oilseeds segment is anticipated to witness the fastest CAGR of 7.91% over the forecast period

- The North America is anticipated to grow at a CAGR of 8.11% through the projection period.

Major companies operating in the agricultural micronutrients market are Nutrien Ag Solutions, Inc., Yara International ASA, Haifa Group, The Mosaic Company, Israel Chemicals Ltd., K+S Aktiengesellschaft, ATP Nutrition, BASF SE, Coromandel International Ltd., Nouryon, Syngenta, Agrimin Limited, Compass Minerals International, Inc., FMC Corporation, and Helena Agri-Enterprises, LLC.

The growing shift toward organic and sustainable farming systems is creating opportunities for the agricultural micronutrients market. Micronutrients play a critical role in replenishing trace elements that organic systems often lack due to the absence of synthetic fertilizers.

The use of chelated and naturally derived micronutrient products aligns with organic certification standards while enhancing plant resilience and yield quality. The demand is further supported by consumer preference for chemical-free produce and increasing regulatory encouragement for sustainable agricultural practices.

- In August 2024, the Government of India launched the Clean Plant Programme with an investment of approximately USD 211 million to modernize horticulture across the country. It also aims to enhance organic farming, improve production quality, and strengthen sustainable and resilient agricultural systems, thereby boosting demand for agricultural micronutrients.

Market Driver

Increasing Soil Nutrient Depletion Due to Intensive Farming Practices

Intensive farming practices, including high-frequency cropping, monoculture, and heavy reliance on high-yield crop varieties, have significantly depleted essential micronutrients in agricultural soils.

The removal of large quantities of nutrients during harvest, without adequate replenishment, disrupts soil fertility and crop nutrition balance. Soil testing has revealed widespread deficiencies in zinc, iron, and boron, leading to reduced plant productivity and lower nutritional content in crops.

- In August 2024, according to the World Atlas of Desertification, 75% of global soils are already degraded, affecting 3.2 billion people. Projections indicate this figure could reach 90% by 2050, intensifying the need for micronutrient interventions in the market.

The agricultural micronutrients market benefits from the urgent need to address these deficiencies through targeted supplementation. Manufacturers are developing advanced delivery systems such as foliar sprays and fertigation-compatible formulations to correct deficiencies. Moreover, governments and agricultural extension services are also promoting balanced nutrient management to restore long-term soil health and maintain sustainable crop yields.

- In February 2025, Grupa Azoty introduced FOLIRES, a nitrogen-based foliar fertilizer enriched with sulfur and magnesium, enhancing crop nutrition solutions in agricultural micronutrients.

Market Challenge

Limited Awareness of Micronutrient Deficiency Symptoms Among Farmers

Limited awareness of micronutrient deficiency symptoms among farmers remains a major challenge for the agricultural micronutrients market. Many farmers fail to recognize early signs such as stunted growth, chlorosis, or reduced flowering, leading to delayed corrective actions and yield losses.

This lack of knowledge is more pronounced in developing regions, where access to soil testing and agronomic advisory services is limited. As a result, farmers may underutilize micronutrients or rely on ineffective general fertilizer blends.

To overcome this challenge, it involves expanding farmer education programs, integrating micronutrient guidance into agricultural extension services, and promoting affordable soil testing kits. Collaborative efforts between governments, agribusinesses, and cooperatives can improve awareness, ensuring timely and targeted micronutrient application.

Market Trend

Growing Adoption of Precision Farming Technologies

The increasing adoption of precision farming technologies is reshaping the agricultural micronutrients market. GPS-enabled equipment, remote sensing, and data analytics allow farmers to monitor soil nutrient status and crop health in real time.

This enables site-specific application of micronutrients, reducing waste and maximizing crop response. Variable rate technology ensures precise dosing based on soil variability, enhancing nutrient uptake efficiency and lowering environmental impact.

Farmers using precision tools can identify micronutrient deficiencies earlier and correct them before they impact yield quality. The integration of digital platforms with nutrient management systems streamlines record-keeping and compliance with sustainability standards. This trend is driving demand for micronutrient products compatible with automated application systems and adaptable to different farm scales.

- In May 2025, Syngenta partnered with Al Dahra to deploy its digital farm management solutions across over 220,000 acres in Romania, Serbia, Egypt, and Morocco, enhancing productivity and promoting large-scale sustainable agricultural practices in the market.

Agricultural Micronutrients Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Zinc, Boron, Iron, Molybdenum, Copper, Manganese, Others

|

|

By Form

|

Chelated, Non-chelated

|

|

By Crop

|

Cereals, Pulses & Oilseeds, Fruits & Vegetables, Others

|

|

By Application

|

Soil, Foliar, Fertigation

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Zinc, Boron, Iron, Molybdenum, Copper, Manganese, and Others): The zinc segment held 24.20% of the market in 2024, due to its critical role in enzyme activation, protein synthesis, and crop growth regulation, combined with widespread zinc deficiencies in soils across major agricultural regions.

- By Form (Chelated and Non-chelated): The foliar segment is anticipated to grow at a CAGR of 7.73% over the forecast period owing to its rapid nutrient absorption efficiency, ability to correct deficiencies during critical growth stages, and compatibility with precision farming application methods.

- By Crop (Cereals, Pulses & Oilseeds, Fruits & Vegetables, and Others): The chelated segment is projected to reach USD 6.32 billion by 2032, owing to its superior nutrient stability, higher bioavailability, and enhanced uptake efficiency in diverse soil pH conditions compared to non-chelated forms.

- By Application (Soil, Foliar, and Fertigation): The pulses & oilseeds segment is poised to record a staggering CAGR of 7.91% through the forecast period due to their increasing cultivation in micronutrient-deficient soils and the need for targeted nutrition to improve yield and oil content quality.

Agricultural Micronutrients Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia-Pacific dominated the agricultural micronutrients market in 2024, accounting for 35.03% of the market share and reaching a value of USD 2.02 billion. This dominance is driven by the region’s large agricultural base, including high production of cereals, rice, pulses, and horticultural crops.

Countries such as China, India, and Australia are implementing government-supported programs promoting balanced fertilization and micronutrient enrichment to address severe soil deficiencies.

Increasing adoption of modern farming practices, rising population, and strong export demand for high-quality produce are further boosting product usage. Moreover, expanding awareness among farmers through agricultural extension services and rising investments in advanced micronutrient formulations have also contributed to market growth.

- In February 2025, Yamaha Motor acquired New Zealand’s Robotics Plus, specializing in agricultural automation, after purchasing assets from The Yield Technology Solutions. Both will operate under Yamaha Agriculture, Inc., advancing precision agriculture technologies that support sustainable and profitable farming, aligning with the market’s efficiency and productivity goals.

North America is projected to record the highest CAGR of 7.71% in the agricultural micronutrients industry during the upcoming years, supported by advanced agricultural infrastructure and strong adoption of precision farming technologies. Farmers in the U.S. and Canada increasingly rely on soil testing, GIS mapping, and variable rate technology to optimize micronutrient application, improving crop quality and profitability.

The region’s diverse crop portfolio, including cereals, oilseeds, fruits, and specialty crops, demands targeted nutrient management. Rising awareness of micronutrient deficiencies, coupled with stringent quality standards for both domestic consumption and exports, encourages the adoption of innovative chelated and nano-formulated products.

Additionally, ongoing R&D investments, favorable government support for sustainable farming, and the high purchasing capacity of farmers position North America as the fastest-growing regional market.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) and individual state fertilizer laws regulate micronutrient fertilizers. They ensure product safety, labeling accuracy, and compliance with nutrient content standards, which supports consistent quality in the market.

- In the European Union, the EU Fertilizing Products Regulation (Regulation (EU) 2019/1009) regulates fertilizer products, including micronutrients. It sets harmonized requirements for composition, safety, and CE marking, facilitating cross-border trade and quality assurance in the market.

- In India, the Fertilizer Control Order (FCO) regulates the manufacture, sale, and quality of micronutrient fertilizers. It specifies permissible nutrient levels, labeling norms, and product approval processes to ensure effective and safe use in Indian agriculture.

- In China, the Ministry of Agriculture and Rural Affairs regulates micronutrient fertilizer standards. It defines quality parameters and application guidelines to maintain soil health and crop productivity, supporting sustainable use in the market.

- In Japan, the Fertilizer Regulation Act regulates the production and distribution of micronutrient fertilizers. It ensures grading accuracy and application safety, which promotes reliable supply and efficient usage in Japanese farming systems.

Competitive Landscape

Key players in the agricultural micronutrients industry are focusing on expanding their product portfolios and strengthening their geographical presence to capture a larger market share. They are investing in research and development to introduce advanced formulations such as chelated, nano-structured, and controlled-release micronutrients that offer higher bioavailability and compatibility with modern farming systems.

Companies are entering into strategic collaborations with agricultural cooperatives, research institutions, and distribution partners to enhance market penetration. Moreover, market players are adopting digital platforms and precision agriculture tools to integrate micronutrient application guidance with crop management systems.

Additionally, mergers and acquisitions are being pursued to access new technologies, diversify nutrient offerings, and enter emerging markets with high agricultural growth potential.

- In March 2025, Haifa Group invested USD 32.7 million to build a new Multicote production facility in South France near its Lunel plant. The facility will produce controlled-release fertilizers with biodegradable coatings, meeting upcoming EU regulations banning microplastic-residue fertilizer coatings and supporting sustainable agricultural micronutrient solutions.

Key Companies in Agricultural Micronutrients Market:

- Nutrien Ag Solutions, Inc.

- Yara International ASA

- Haifa Group

- The Mosaic Company

- Israel Chemicals Ltd.

- K+S Aktiengesellschaft

- ATP Nutrition

- BASF SE

- Coromandel International Ltd.

- Nouryon

- Syngenta

- Agrimin Limited

- Compass Minerals International, Inc.

- FMC Corporation

- Helena Agri-Enterprises, LLC

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In August 2025, Coromandel International Limited, part of the Murugappa Group, completed the Share Purchase Agreement to acquire a 53% controlling stake in NACL Industries Ltd.. This is aimed at strengthening its strategic position and expanding capabilities in the agricultural micronutrients and broader agri-solutions sector.

- In July 2024, Yara entered a long-term partnership PepsiCo Europe to implement advanced crop nutrition programs in Europe. The collaboration focuses on reducing agricultural greenhouse gas emissions through lower-carbon fertilizers, agronomic guidance, and digital tools that enhance nutrient efficiency, improve yields, and lower the carbon footprint in the market.