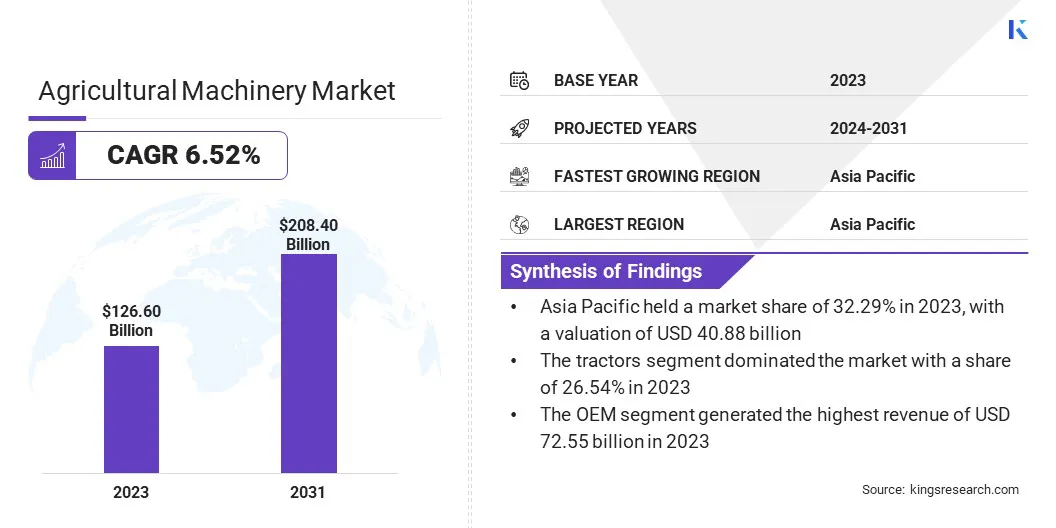

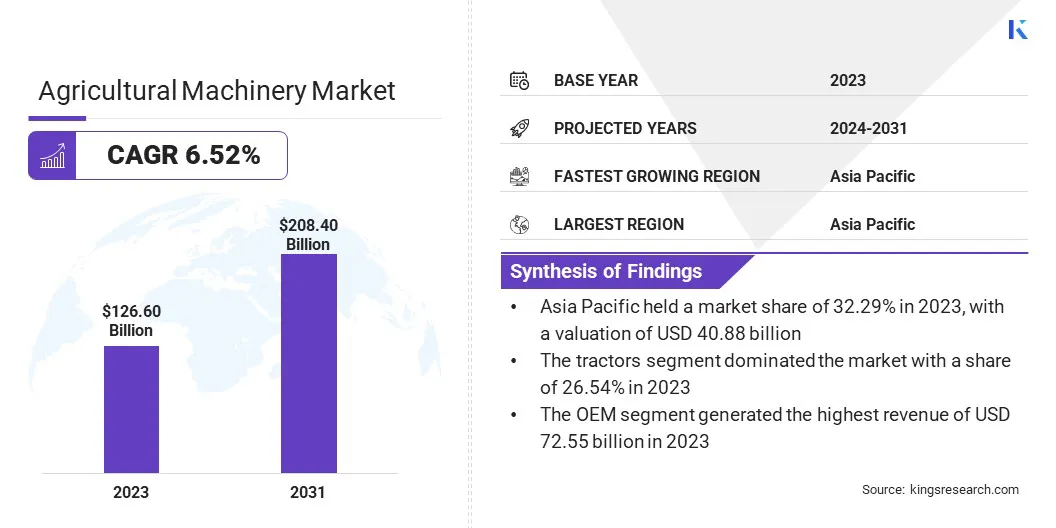

Agricultural Machinery Market Size

The global Agricultural Machinery Market size was valued at USD 126.60 billion in 2023 and is projected to reach USD 208.40 billion by 2031, growing at a CAGR of 6.52% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Bucher Industries AG, Deere & Company, CNH Industrial N.V., AGCO Corporation, Kubota Corporation, J C Bamford Excavators Ltd., ISEKI & CO., LTD., Mahindra&Mahindra Ltd., Lindsay Corporation, CLAAS KGaA mbH and Others.

The agricultural machinery market is experiencing a dynamic phase characterized by robust growth and technological advancements. Additionally, market expansion is driven by the increasing need for mechanization in agriculture to enhance productivity and meet the growing demand for food worldwide.

Numerous factors such as population growth, changing dietary preferences, and the need for efficient farm management practices are driving the adoption of agricultural machinery across various regions. Additionally, the market is benefiting from ongoing technological innovations aimed at improving the performance, precision, and sustainability of agricultural machinery.

Furthermore, the outlook for the market appears promising, with projections indicating continued growth in the coming years. This growth trajectory is expected to be fueled by several factors such as the increasing adoption of precision farming techniques, government initiatives to modernize agriculture, and the rising demand for agricultural machinery in emerging economies.

Overall, the market is poised to experience sustained expansion, driven by the imperative to enhance agricultural productivity and address the challenges of feeding the burgeoning global population.

Analyst’s Review

The growing demand for farm mechanization in developing countries is significantly contributing to increasing agricultural productivity. As developing regions undergo rapid population growth and urbanization, there is a pressing need to modernize agricultural practices to meet the escalating demand for food.

Farm mechanization offers solutions to labor shortages, enhances efficiency, and improves yield outcomes, thereby boosting agricultural productivity. With governments in developing countries increasingly recognizing the importance of mechanization in agriculture and implementing supportive policies and initiatives, the market outlook for farm mechanization in these regions looks promising.

Furthermore, advancements in agricultural machinery technology, such as the development of affordable and adaptable equipment tailored to smallholder farmers, are expected to drive agricultural machinery market growth.

Over the forecast years, the demand for farm mechanization in developing countries is anticipated to continue to increase, fostered by the need to achieve food security, improve livelihoods, and sustainably intensify agricultural production to meet the demands of a growing population.

Market Definition

Agricultural machinery encompasses a wide range of equipment and devices designed to aid various agricultural activities, from land preparation and planting to harvesting and post-harvest processing. These machines are essential for modern farming operations, as they help increase efficiency, reduce labor requirements, and improve overall productivity. Types of agricultural machinery include tractors, combines, plows, seeders, sprayers, irrigation systems, and harvesting equipment, among others.

In recent years, there has been a notable trend towards automation and precision agriculture in the market. Automation technologies such as GPS-guided tractors, drones for crop monitoring, and robotic harvesting systems are becoming increasingly prevalent, offering farmers greater precision, efficiency, and control over their operations.

Factors driving market growth include the need to meet the growing demand for food due to population growth, the increasing adoption of mechanized farming practices to improve productivity and reduce labor costs, and government initiatives aimed at modernizing agricultural infrastructure.

Additionally, advancements in technology, such as the integration of Internet of Things (IoT) sensors and artificial intelligence (AI) algorithms into agricultural machinery, are supporting market growth by enabling data-driven decision-making and enhancing operational efficiency.

Overall, the agricultural machinery market is driven by a combination of factors that support the adoption of advanced machinery and equipment to meet the evolving needs of modern agriculture.

Agricultural Machinery Market Dynamics

The rising demand for autonomous farming machinery is reshaping the agricultural industry by introducing cutting-edge technology to enhance efficiency and productivity. Autonomous farming machinery, such as self-driving tractors, drones, and robotic harvesters, are gaining significant traction due to their ability to perform various tasks without direct human intervention.

One of the primary factors supporting this growing demand is the increasing focus on precision agriculture and the need to optimize resource usage, including labor, water, fertilizers, and pesticides. Autonomous machinery offers farmers greater precision and control over their operations, allowing for more targeted application of inputs and reducing waste.

Moreover, the rising labor costs and shortage of skilled agricultural workers in numerous regions are prompting farmers to turn to autonomous machinery as a solution to labor challenges. Additionally, advancements in technology, such as artificial intelligence, GPS guidance systems, and sensors, have enabled the development of sophisticated autonomous farming machinery that can navigate fields, monitor crops, and perform tasks with high accuracy and efficiency.

As a result, the demand for autonomous farming machinery is expected to continue rising as farmers seek innovative solutions to improve their operations and increase yields in a sustainable manner.

Concerns pertaining to the costs of raw materials are hampering the growth of the agricultural machinery market. Raw materials such as steel, aluminum, and plastics are essential components in the manufacturing of agricultural machinery, and fluctuations in their prices directly impact production costs for manufacturers.

Volatility in raw material prices, driven by various factors such as changes in global demand, supply chain disruptions, and geopolitical tensions, poses a significant challenge for manufacturers in terms of cost management and pricing strategies.

Additionally, the increasing cost of energy and transportation further exacerbates the financial burden on manufacturers, impacting their profit margins and pricing competitiveness in the market. These challenges not only affect the profitability of manufacturers but also influence purchasing decisions for farmers.

They may choose to delay or defer investments in agricultural machinery due to concerns about rising costs. As a result, addressing the issue of raw material costs and implementing strategies to mitigate their impact is crucial for sustaining growth and competitiveness in the market.

Segmentation Analysis

The global market is segmented based on type, automation, sales channel, and geography.

By Type

Based on type, the agricultural machinery market is segmented into tractors, harvesting, planting, irrigation, haying and forage, and others. The tractors segment dominated the market with a share of 26.54% in 2023 owing to its versatility and indispensability in modern agricultural operations. Tractors serve as the backbone of mechanized farming, facilitating tasks such as plowing, planting, cultivating, and hauling with efficiency and power.

Additionally, advancements in tractor technology, such as the integration of GPS guidance systems, precision agriculture features, and automated controls, have enhanced their utility and appeal to farmers. The continuous innovation and development of tractors by leading manufacturers have further contributed to their dominance in the market, offering a wide range of models with varying horsepower, capabilities, and features to cater to diverse farming needs.

By Automation

Based on automation, the agricultural machinery market is classified into automatic, semi-automatic, and manual. The semi-automatic segment is expected to witness considerable growth, acquiring a CAGR of 7.16% over the forecast period due to the increasing adoption of advanced agricultural machinery with partial automation features.

Semi-automatic machinery offers farmers a balance between manual control and automation, allowing for greater precision and efficiency in farming operations while still retaining some level of human oversight and intervention. This segment is witnessing rapid growth as farmers aim to optimize their productivity and operational efficiency through the adoption of technologies that streamline tasks such as planting, spraying, and harvesting.

Moreover, advancements in semi-automatic machinery, such as improved sensors, connectivity, and data analytics capabilities, are enabling smarter and more informed decision-making in farm management, thereby supporting segment uptake.

By Sales Channel

Based on sales channel, the agricultural machinery market is classified into OEM and aftermarket. The OEM segment garnered the highest valuation of USD 72.55 billion in 2023 as a result of the increasing demand for original equipment manufacturer (OEM) agricultural machinery from farmers and agricultural businesses worldwide.

OEM machinery offers several advantages, including reliability, quality assurance, and access to manufacturer warranties, service, and support networks. Additionally, OEM manufacturers are investing in research and development to offer innovative features and technologies that enhance the performance, efficiency, and durability of their products, thereby driving demand.

The OEM segment encompasses a wide range of agricultural machinery, including tractors, combines, planters, sprayers, and harvesters, catering to diverse farming needs across different regions and crop types.

Agricultural Machinery Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific Agricultural Machinery Market share stood around 32.29% in 2023 in the global market, with a valuation of USD 40.88 billion, mainly driven by a rapidly expanding population, coupled with increasing urbanization and changing dietary preferences. Moreover, government initiatives aimed at modernizing agricultural practices and improving farm productivity are accelerating market growth in the region.

Additionally, favorable economic conditions, rising disposable incomes, and a shift toward mechanized farming methods are contributing to the increased adoption of agricultural machinery in countries across the Asia Pacific. With the agricultural sector playing a vital role in the region's economy, the demand for efficient and technologically advanced agricultural machinery is expected to persist, positioning it as a key region in the market.

Competitive Landscape

The agricultural machinery market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Agricultural Machinery Market

- Bucher Industries AG

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- J C Bamford Excavators Ltd.

- ISEKI & CO., LTD.

- Mahindra&Mahindra Ltd.

- Lindsay Corporation

- CLAAS KGaA mbH

Key Industry Developments

- February 2024 (Expansion): John Deere enhanced its W200 Windrower Series by introducing the new W260M model, along with an optional mounted-merger, providing customers with improved productivity and efficiency in their agricultural operations.

- October 2023 (Launch): KUHN introduced a selection of mechanical weed management tools, including ROWLINER row-crop cultivators and TINELINER tine weeders, offering agricultural professionals effective solutions for weed control in crop cultivation.

- September 2023 (Launch): Swaraj Tractors, a brand under the Mahindra Group, unveiled its latest lineup of tractors within the 40 to 50 HP category, catering to the evolving needs of the agricultural industry.

- September 2023 (Partnership): CLAAS, AgXeed, and Amazone strengthened their partnership in the field of highly automated and autonomous agricultural machinery and operational procedures by establishing the first multi-manufacturer autonomy consortium.

- August 2023 (Launch): JCB introduced the latest 530-60 AGRISUPER telehandler, featuring a compact design with a 3-tonne lift capacity and a 6.0m lift height, catering to the specific needs of the agricultural sector.

- February 2023 (Acquisition): Kverneland AS, a subsidiary of Kubota Corporation, acquired B.C. TECHNIQUE AGRO-ORGANIQUE SAS (BCT) is a fully-owned subsidiary. BCT specializes in the manufacturing of agricultural implements and machinery equipment.

- July 2023 (Acquisition): Deere & Company acquired Smart Apply, Inc., an American precision spraying equipment firm. Smart Apply is renowned for its Smart Apply Intelligent Spray Control System, an advanced upgrade kit enhancing precision and efficacy in orchard, vineyard, and tree nursery spraying applications.

The global Agricultural Machinery Market is segmented as:

By Type

- Tractors

- Harvesting

- Planting

- Irrigation

- Haying and Forage

- Others

By Automation

- Automatic

- Semi-automatic

- Manual

By Sales Channel

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.