Market Definition

Agricultural biotechnology is the use of scientific techniques, including genetic engineering, molecular biology, and tissue culture, to enhance plants, animals, and microorganisms. It encompasses genetically modified crops, biopesticides, biofertilizers, and advanced animal breeding, aiming to boost productivity, improve crop resilience, enhance food quality, reduce chemical use, and promote sustainable agriculture.

Agricultural Biotechnology Market Overview

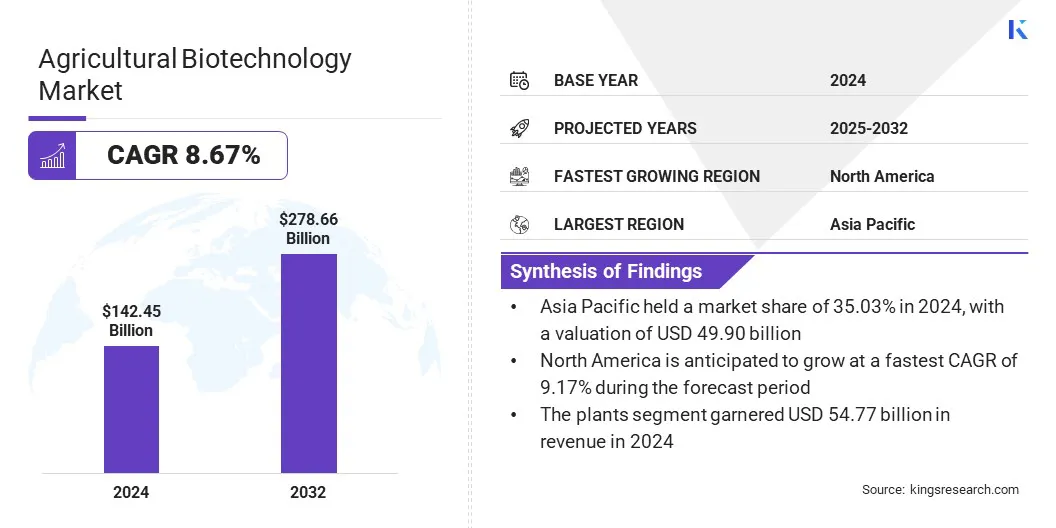

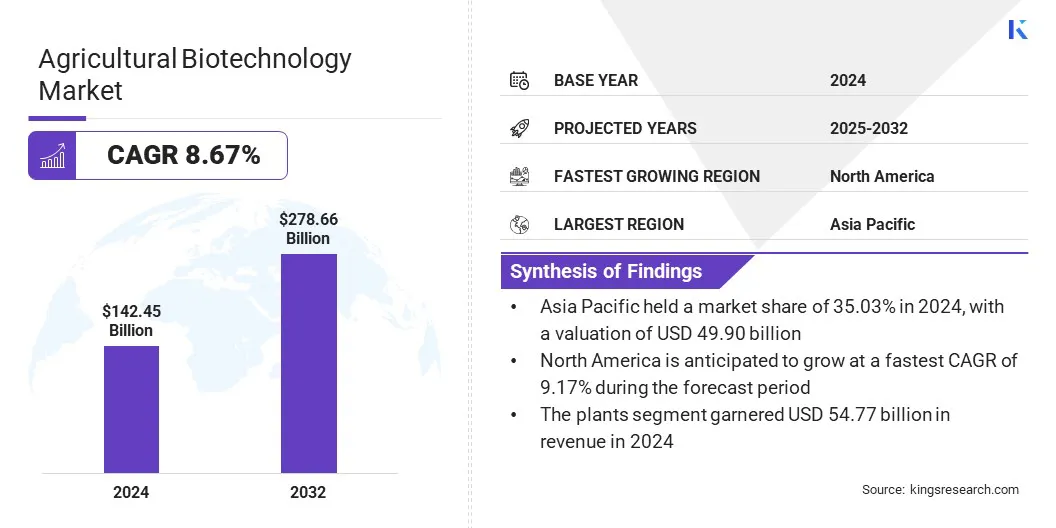

The global agricultural biotechnology market size was valued at USD 142.45 billion in 2024 and is projected to grow from USD 154.32 billion in 2025 to USD 278.66 billion by 2032, exhibiting a CAGR of 8.67% during the forecast period.

Market growth is fueled by the increasing global food demand due to population growth, urbanization, and changing dietary patterns, which are accelerating the adoption of high-yield and climate-resilient crop varieties. Additionally, increasing government initiatives and funding supporting biotechnology research and adoption are fostering the development of sustainable and eco-friendly agricultural solutions.

Key Highlights:

- The agricultural biotechnology industry size was USD 142.45 billion in 2024.

- The market is projected to grow at a CAGR of 8.67% from 2025 to 2032.

- Asia Pacific held a share of 35.03% in 2024, valued at USD 49.90 billion.

- The plants segment garnered USD 54.77 billion in revenue in 2024.

- The genetic engineering segment is expected to reach USD 91.75 billion by 2032.

- The biofuels segment is anticipated to witness the fastest CAGR of 8.98% through the projection period.

- North America is anticipated to grow at a CAGR of 9.17% over the forecast period.

Major companies operating in the agricultural biotechnology market are BASF, Bayer AG, ADAMA Agricultural Solutions Limited, Corteva, Syngenta Crop Protection AG, Evogene Ltd, Novozymes A/S, UPL LTD, Koppert, Valent BioSciences LLC, Indigo Ag, Inc, De Sangosse, Vilmorin-Mikado, Isagro SPA, and Benson Hill Inc.

Moreover, supportive policies, grants, and funding from governments worldwide are promoting research, development, and adoption of agricultural biotechnology solutions.

- In October 2024, Indian government inaugurated its first bio manufacturing institute, BRIC-National Agri-Food Bio-Manufacturing Institute (BRIC-NABI), aimed at advancing the agri-food sector through biotechnology. The institute focuses on research, innovation, and commercialization of bio-based solutions to support sustainable agriculture and strengthen the country’s agricultural biotechnology capabilities.

Market Driver

Arable Land Depletion Fuels Sustainable Agricultural Biotechnology Solutions

A major factor propelling the expansion of the agricultural biotechnology market is the depletion of arable land caused by overuse, erosion, and unsustainable farming practices.

Farmers and organizations are adopting bio-based solutions, including biofertilizers, biostimulants, and stress-tolerant crop varieties, to maintain productivity on limited or degraded land. This increasing focus on sustainable and resource-efficient agriculture is promoting wider use of agricultural biotechnology solutions to enhance soil health, improve crop yields, and reduce reliance on chemical inputs.

- In June 2025, the Food and Agriculture Organization (FAO) reported that human activities have degraded 1.66 billion hectares of land globally, with over 60% impacting agricultural lands, including croplands and pastures. This degradation is leading to the widespread adoption of sustainable agricultural practices and biotechnological solutions.

Market Challenge

High Research and Development Costs

A key challenge impeding the progress of the agricultural biotechnology market is the high cost of research and development. Developing genetically modified crops, biofertilizers, biopesticides, and other biotech solutions requires significant investment in laboratory research, field trials, and regulatory compliance.

Small and mid-sized companies face financial constraints that limit innovation. These high costs can delay product launches, reduce competitiveness, and deter new entrants from investing in innovative solutions.

To address this challenge, market players are forming strategic partnerships and collaborations with research institutions, universities, and other biotechnology firms. They are also leveraging government grants, subsidies, and public-private funding programs to foster innovation. Additionally, many firms are outsourcing certain R&D activities or adopting advanced technologies such as automation and bioinformatics to reduce costs and accelerate product development.

Market Trend

Increasing Investment in Drought-Tolerant and Stress-Resilient Crop Varieties

A key trend influencing the agricultural biotechnology market is the increasing investment in drought-tolerant and stress-resilient crop varieties. Growing climate variability, water scarcity, and extreme weather events are affecting global food production.

Companies and research institutions are developing crops that withstand drought, heat, salinity, and other environmental stresses while maintaining high yields. Adoption of these resilient varieties enhances food security, reduces crop losses, enhances farm profitability, and supports sustainable agricultural in climate-sensitive regions.

- In September 2024, Elicit Plant, a French agri-biotech company, launched EliZon, a product designed to enhance drought resilience, reduce water consumption, and increase crop productivity. Extensive research and field trials demonstrated its effectiveness, highlighting the role of biotechnology in developing climate-resilient and eco-friendly crop management solutions.

Agricultural Biotechnology Market Report Snapshot

|

Segmentation

|

Details

|

|

By Organism

|

Plants, Animals, Microbes

|

|

By Technology

|

Genetic Engineering, Tissue Culture, Molecular Markers & Diagnostics, Bioinformatics

|

|

By Application

|

Transgenic Crops & Seeds, Vaccine & Antibiotic Development, Nutritional Supplements, Flower Culturing, Biofuels, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Organism (Plants, Animals, and Microbes): The plants segment earned USD 54.77 billion in 2024, mainly due to increasing adoption of genetically modified crops and rising demand for high-yield, climate-resilient varieties.

- By Technology (Genetic Engineering, Tissue Culture, Molecular Markers & Diagnostics, and Bioinformatics): The genetic engineering segment held a share of 33.24% in 2024, largely attributed to its ability to develop pest-resistant, disease-tolerant, and nutritionally enhanced crops.

- By Application (Transgenic Crops & Seeds, Vaccine & Antibiotic Development, Nutritional Supplements, Flower Culturing, Biofuels, and Others): The transgenic crops & seeds segment is projected to reach USD 83.43 billion by 2032, owing to rising demand for improved crop yields and sustainable agricultural practices.

Agricultural Biotechnology Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific agricultural biotechnology market share stood at 35.03% in 2024, valued at USD 49.90 billion. This dominance is reinforced by rapid population growth, which is creating a strong demand for food and high-yield crops.

Growing adoption of genetically modified crops improves tolerance to pests, diseases, and environmental stresses, leading to higher yields and reduced crop losses. Rising demand for sustainable and eco-friendly farming practices is promoting the use of biological crop protection and soil health management solutions to enhance crop productivity.

Moreover, the expansion of peptide-based and microbial bio-fungicides enhances plant defense mechanisms, complements conventional treatments, and pomotes environmentally safe crop protection. This is boosting the adoption of advanced biotechnology solutions, contributing to regional market expansion.

- In August 2024, ADAMA partnered with U.S.-based Elemental Enzymes to introduce a peptide-based bio-fungicide in Australia. The product targets foliar diseases in cereals, canola, and turf by stimulating plants’ natural defenses, complementing chemical fungicides, managing resistance, and promoting sustainable crop protection.

The North America agricultural biotechnology industry is set to grow at a CAGR of 9.17% over the forecast period. This growth is attributed to rising demand for high-yield and climate-resilient crops that enhance agricultural productivity and support food security. The increasing adoption of genetically modified crops improves resistance to pests and diseases and reduces losses in farming.

Rising consumer interest in nutrient-enriched and functional food products fosters investment in innovative crop varieties. Additionally, the expansion of enzyme-based feed additives strengthens animal nutrition and gut health, enabling more efficient livestock production and aiding domestic market progress.

- In March 2024, Novus International acquired U.S.-based BioResource International (BRI), gaining full control of its enzyme products and facilities. The acquisition expands Novus’ portfolio in protease, xylanase, mannanase, phytase, and direct-fed microbials, facilitating innovation in animal nutrition, gut health, and fermentation-based feed solutions.

Regulatory Frameworks

- In the U.S., the United States Department of Agriculture (USDA) regulates the safe development, field testing, and commercialization of genetically engineered crops and organisms. It oversees plant pest risk assessment, biotechnology research approvals, and compliance with environmental and agricultural safety standards to ensure that biotech products do not harm agriculture, the environment, or public health.

- In the UK, the Department for Environment, Food and Rural Affairs (DEFRA) oversees the regulation and licensing of genetically modified organisms and crops. It manages environmental risk assessments, field trials, and compliance with EU-derived and domestic biosafety legislation to ensure biotech products are safe for human consumption, agriculture, and the environment while supporting sustainable innovation.

- In China, the Ministry of Agriculture and Rural Affairs (MARA) oversees the approval, production, and commercialization of genetically modified crops and related biotechnology products. It regulates biosafety evaluations, field trials, import/export controls, and labeling requirements to ensure food safety, environmental protection, and alignment with national agricultural development policies.

- In India, the Genetic Engineering Appraisal Committee (GEAC), under the Ministry of Environment, Forest and Climate Change, regulates research, field trials, and commercial release of genetically modified crops. It evaluates biosafety, environmental impact, and public health, ensuring compliance with national biotechnology and environmental legislation.

Competitive Landscape

Major players in the agricultural biotechnology industry are increasingly focusing on developing bio-based crop nutrition products to enhance yield, quality, and resilience. They are establishing joint research and development facilities to support innovation in biostimulants and other sustainable solutions.

Companies are integrating advanced technologies to optimize resource utilization and promote eco-friendly farming practices. Additionally, emphasis is placed on sustainable agriculture initiatives to provide environmentally safe solutions while improving crop performance.

- In May 2024, BASF Agricultural Solutions partnered with Anhui Huaheng Biotechnology to develop the agricultural nutrition segment in China. The collaboration focuses on biostimulant development, the establishment of a joint R&D institute, and the promotion of sustainable agriculture by enhancing crop yield, quality, and resilience while supporting efficient resource utilization and eco-friendly farming practices.

Key Companies in Agricultural Biotechnology Market:

- BASF

- Bayer AG

- ADAMA Agricultural Solutions Limited

- Corteva

- Syngenta Crop Protection AG

- Evogene Ltd

- Novozymes A/S

- UPL LTD

- Koppert

- Valent BioSciences LLC

- Indigo Ag, Inc

- De Sangosse

- Vilmorin-Mikado

- Isagro SPA

- Benson Hill Inc.

Recent Developments (Partnerships/Product Launch)

- In June 2024, IPL Biologicals partnered with Punjab Agricultural University to launch Agenor, a bio-fungicide targeting Bakane disease in paddy. It is designed to reduce yield losses, ensure consistent crop quality, and provide an environmentally safe alternative to chemical fungicides, supporting sustainable crop protection.

- In May 2024, Fermbox Bio launched EN3ZYME, a synthetic biology-derived enzyme cocktail that converts pre-treated agricultural residues into fermentable sugars for second-generation ethanol production. It also enables the production of bio-ingredients and biomaterials, including flavors, colors, lipids, and novel proteins, promoting sustainable and circular bio-based solutions in agriculture and related industries.