Aeroderivative Sensor Market Size

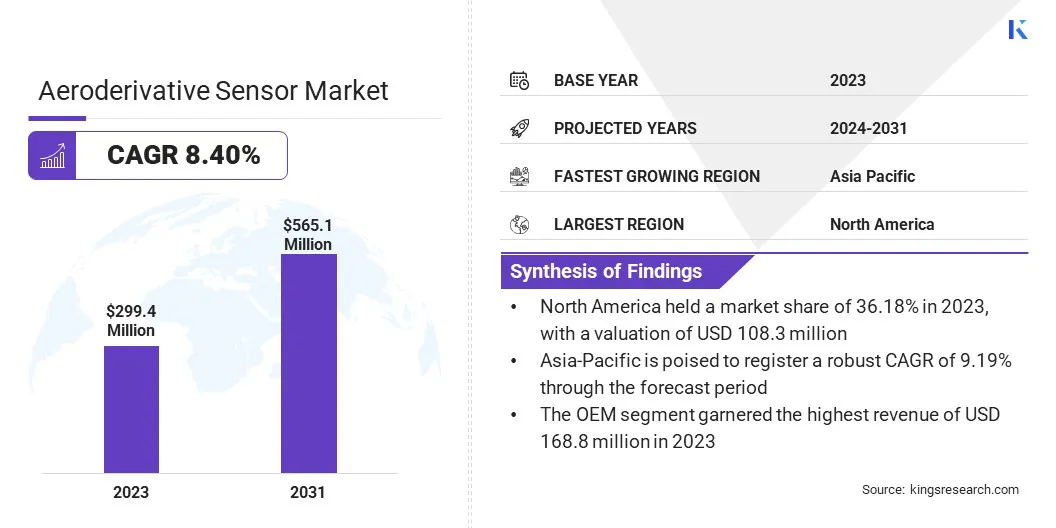

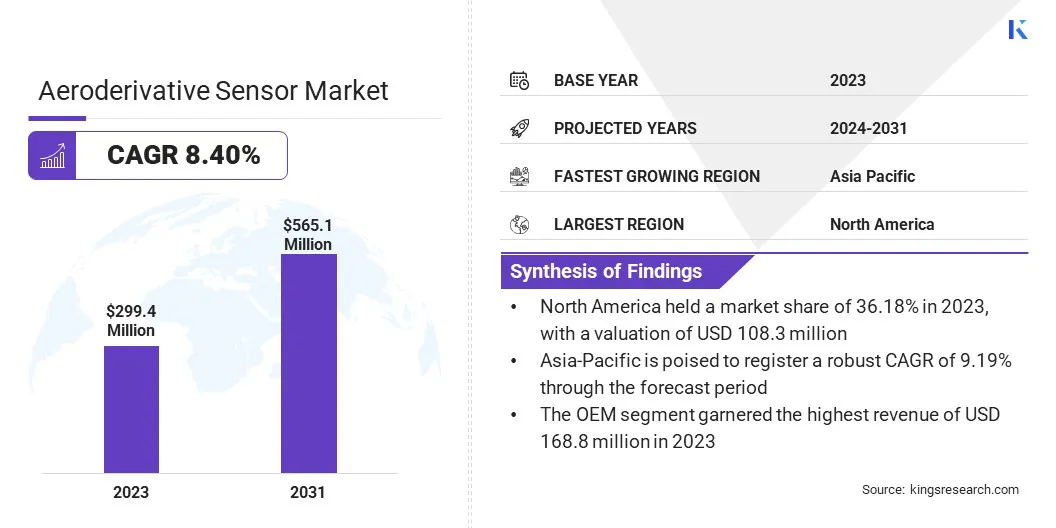

The global Aeroderivative Sensor Market size was valued at USD 299.4 million in 2023 and is projected to grow from USD 321.3 million in 2024 to USD 565.1 million by 2031, exhibiting a CAGR of 8.40% during the forecast period. Rising aircraft production and growing emphasis on energy efficiency in power generation and industrial processes are driving the adoption of aeroderivative sensors.

In the scope of work, the report includes services offered by companies such as Artisan Scientific Corporation, Auxitrol Weston, Baker Hughes Company, Conax Technologies, Gastops Ltd., General Electric, Rockwell Automation, Siemens, AMETEK Power Instruments, MITSUBISHI HEAVY INDUSTRIES, LTD., and others.

The development of smart cities presents a significant opportunity for the growth of the aeroderivative sensor market, as these sensors play a crucial role in the infrastructure of smart urban environments. Smart cities rely heavily on a vast network of connected devices and systems that require constant monitoring and data analysis to function efficiently.

Aeroderivative sensors, known for their precision and reliability, are essential in various applications such as smart grids, environmental monitoring, traffic management, and infrastructure health assessment. These sensors enable real-time data collection and analysis, allowing city planners and administrators make informed decisions and optimize the functionality of urban systems.

- For instance, in April 2024, Baker Hughes, through its Rivit Srl unit, secured a contract to provide gas technology for the expansion of Saudi Aramco’s master gas system. The project includes the supply of 17 pipeline compressors powered by aeroderivative turbines, with the aim of enhancing domestic gas distribution and reducing carbon emissions.

The global shift toward sustainable and energy-efficient urban development further amplifies the demand for advanced sensor technology, including aeroderivative sensors. As more cities adopt smart technologies, the need for sophisticated sensors capable of monitoring and managing complex systems is expected to rise, providing a lucrative opportunity for sensor manufacturers.

Moreover, the integration of aeroderivative sensors with IoT platforms enhances their potential, allowing for seamless communication between devices and contributing to the creation of a truly interconnected urban environment.

Aeroderivative sensors are advanced devices specifically designed to monitor and measure various parameters in systems derived from aerospace technology, with a particular focus on aeroderivative gas turbines. These sensors are engineered to operate under extreme conditions, such as high temperatures and pressures, making them ideal for applications in the aerospace, defense, and energy sectors.

Aeroderivative sensors encompass various types, including pressure sensors, temperature sensors, vibration sensors, and flow sensors, each tailored to monitor specific aspects of a system's performance. In the aerospace industry, these sensors are commonly used in aircraft engines to ensure optimal performance and safety by providing real-time data on engine conditions.

In the energy sector, aeroderivative sensors are employed in power generation systems, particularly in gas turbines, to monitor efficiency, emissions, and overall operational health. Their ability to deliver accurate and reliable data in real-time makes them indispensable in critical applications where precision and safety are paramount.

As industries continue to advance, the demand for aeroderivative sensors is expected to grow, fueled by the surging need for enhanced monitoring and control in high-stakes environments.

Analyst’s Review

The aeroderivative sensor market is witnessing robust growth, propelled by the increasing demand for advanced monitoring solutions across various industries. Key market players are focusing on several strategic imperatives to capitalize on this growth. These include the continuous innovation of sensor technology, with a particular emphasis on improving accuracy, reliability, and miniaturization.

Furthermore, companies are investing heavily in research and development to integrate their sensors with emerging technologies such as the Internet of Things (IoT) and artificial intelligence (AI). These technologies are increasingly becoming essential component of modern industrial and urban systems.

- For instance, in May 2024, GE Vernova received a contract from the Tennessee Valley Authority to replace the Kingston Fossil Plant with a new 1.5-GW complex. The project involves 16 LM6000 VELOX dual-fuel turbines, which are expected to provide 850 MW of power, emphasizing GE’s major role in modern energy infrastructure.

Additionally, strategic partnerships and collaborations are being actively sought to expand market reach and enhance product offerings, particularly in high-growth regions such as Asia-Pacific.

The growth trajectory of the market is supported by the increasing adoption of aeroderivative sensors across sectors such as aerospace, defense, and energy, where precise and reliable monitoring is critical. However, companies must navigate challenges such as high initial costs and the complexity of sensor integration to sustain market competitiveness.

Aeroderivative Sensor Market Growth Factors

The increase in aircraft production is a significant factor fueling the growth of the aeroderivative sensor market. As global air travel continues to rise, driven by commercial and defense sectors, the demand for new aircraft is growing steadily. This surge in aircraft production necessitates the use of advanced aeroderivative sensors to ensure the safety, efficiency, and performance of modern aircraft.

These sensors are crucial in monitoring critical engine parameters, including temperature, pressure, and vibration, which are vital for the optimal operation of aircraft engines, especially those powered by aeroderivative gas turbines. Moreover, the stringent regulatory standards in the aviation industry require the continuous monitoring of these parameters to ensure compliance with safety and emissions standards.

As manufacturers progressively strive to produce more fuel-efficient and environmentally friendly aircraft, the role of aeroderivative sensors becomes increasingly critical. These sensors provide real-time data that is crucial for optimizing engine performance, reducing fuel consumption, and minimizing environmental impact. The expansion of the aerospace industry, particularly in emerging markets, further amplifies the demand for aeroderivative sensors.

High initial costs associated with aeroderivative sensors present a significant challenge to the development of the market, particularly for small and medium-sized enterprises (SMEs). These costs encompass the purchase price of the sensors and the expenses related to installation, integration, and ongoing maintenance.

In industries that rely on aeroderivative sensors for critical applications, such as aerospace and energy, these costs pose a substantial barrier to adoption. This financial burden is further exacerbated by the rising need for specialized training and infrastructure to support the deployment and operation of these sensors. This may deter some potential users from investing in this advanced technology, despite its potential to enhance operational efficiency and safety.

To mitigate this challenge, companies are exploring strategies such as offering flexible financing options, leasing arrangements, or subscription-based models to reduce the upfront financial burden. Additionally, investing in the development of more cost-effective sensor solutions and streamlining the installation process help lower the overall costs, making aeroderivative sensors more accessible to a broader range of users.

Aeroderivative Sensor Market Trends

The integration of IoT and AI technologies is a transformative trend in the aeroderivative sensor market, fostering innovation and expanding the scope of sensor applications. IoT enables the integration of aeroderivative sensors within a network, thereby allowing for seamless communication between devices and the central monitoring system.

This connectivity facilitates real-time data collection and analysis, enabling industries to monitor their operations continuously and respond swiftly to any anomalies. AI, on the other hand, enhances the capabilities of these sensors by processing the vast amounts of data they generate and extracting actionable insights.

- For instance, in November 2023, GE Vernova’s Gas Power business secured a contract to build a 150 MW temporary power plant at SSE's Tarbert site in Ireland. Powered by three LM6000PC Sprint turbines, this project strengthens GE's capacity to ensure energy security across Europe.

AI algorithms predict potential failures before they occur, optimizing maintenance schedules and reducing downtime. Furthermore, the combination of IoT and AI enables the automation of complex processes, thus improving efficiency and reducing the likelihood of human error.

As industries increasingly adopt smart technologies, the integration of IoT and AI with aeroderivative sensors is becoming essential for optimizing performance, enhancing safety, and reducing operational costs.

Segmentation Analysis

The global market is segmented based on type, end-use, service provider, and geography.

By Type

Based on type, the market is categorized into temperature sensor, vibration sensor, pressure sensor, and flame sensor. The temperature sensor segment captured the largest aeroderivative sensor market share of 45.21% in 2023, largely attributed to its critical role in various high-demand industries such as aerospace, energy, and manufacturing.

Temperature sensors are essential in monitoring and maintaining optimal operating conditions in systems that involve extreme temperatures, such as aeroderivative gas turbines used in both aircraft and power generation. These sensors ensure that engines and other machinery operate within safe temperature ranges, thus preventing overheating, enhancing efficiency, and reducing the risk of equipment failure.

The widespread application of temperature sensors across multiple sectors is a key factor contributing to the expansion of the segment. Furthermore, advancements in sensor technology, characterized by improved accuracy, durability, and the ability to function in harsh environments, have boosted the adoption of temperature sensors.

The ongoing emphasis on energy efficiency and regulatory compliance in industries that rely on temperature-sensitive processes further supports the growth of the segment. As industries continue to prioritize precision and reliability in temperature monitoring, the demand for advanced temperature sensors is expected to remain strong.

By End-Use

Based on end-use, the market is classified into industrial and marine. The industrial segment is poised to record a staggering CAGR of 8.70% through the forecast period, mainly due to the increasing adoption of advanced sensor technologies in various industrial applications.

Industries such as manufacturing, energy, and process control are increasingly relying on sensors, including aeroderivative sensors, to enhance operational efficiency, ensure safety, and meet stringent regulatory requirements.

The growing trend toward automation and smart manufacturing is further propelling the demand for sensors that provide real-time data and facilitate predictive maintenance, thus reducing downtime and improving overall productivity. Moreover, the integration of IoT and AI technologies in industrial processes is enabling more sophisticated monitoring and control systems, which is expected to boost the adoption of sensors across industrial settings.

The rising emphasis on energy efficiency and sustainability within the industrial sector is further contributing to the expansion of the segment, as companies seek to optimize their operations and reduce their environmental footprint. The industrial segment is set to experience robust growth, reflecting the broader trend of digital transformation in the industry.

By Service Provider

Based on service provider, the aeroderivative sensor market is divided into OEM and aftermarket. The OEM segment garnered the highest revenue of USD 168.8 million in 2023, propelled by the strong demand for original equipment manufacturers (OEMs) to provide high-quality, reliable components and systems, including aeroderivative sensors.

OEMs play a critical role in ensuring that the sensors used in various applications, particularly in aerospace, energy, and industrial sectors, meet stringent performance standards and are integrated seamlessly into complex systems. The growth of the segment is largely fostered by the increasing production of aircraft and industrial machinery, where OEMs are the primary suppliers of sensors and related components.

Additionally, the ongoing trend toward customization and the pressing need for advanced, application-specific sensors have led OEMs to invest in research and development to deliver innovative solutions that meet the evolving needs of their customers.

The rising emphasis on quality assurance, coupled with the growing complexity of modern machinery and systems, has further solidified the OEM segment's position. This trend is expected to continue as OEMs remain integral to the supply chain, providing critical components that ensure the reliability and efficiency of advanced technologies.

Aeroderivative Sensor Market Regional Analysis

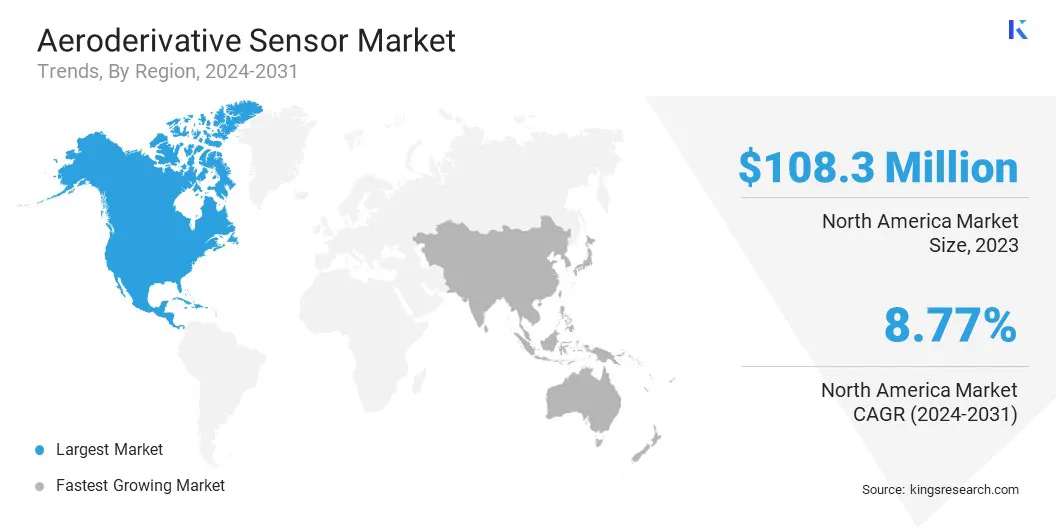

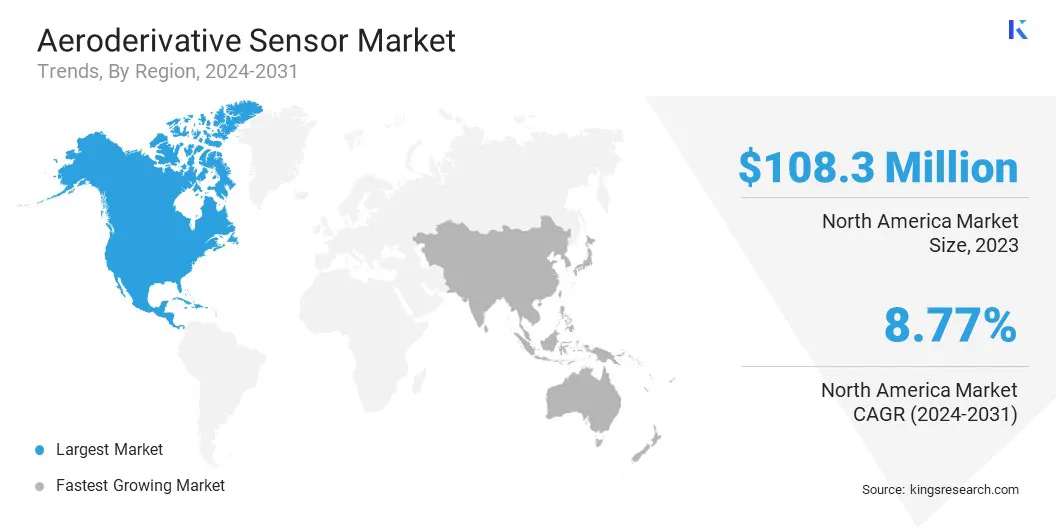

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America aeroderivative sensor market accounted for a major share of 36.18% and was valued at USD 108.3 million in 2023 due to the region's advanced industrial infrastructure, significant investments in aerospace and defense, and the widespread adoption of cutting-edge technologies.

Aa a global leader in aerospace innovation, the United States has generated substantial demand for aeroderivative sensors, particularly in the production and maintenance of aircraft, where these sensors are crucial for monitoring engine performance and ensuring safety.

Additionally, the North American energy sector, with its focus on enhancing the efficiency of power generation and reducing carbon emissions, has increasingly adopted aeroderivative gas turbines that rely on advanced sensor technologies.

Furthermore, the presence of major OEMs and technology companies in the region has spurred continuous innovation and development in sensor technology, thereby supporting regional market growth. The region's growing emphasis on regulatory compliance and stringent safety standards further bolsters the demand for high-precision sensors, solidifying its leading market position.

Asia-Pacific region is poised to grow at a robust CAGR of 9.19% in the forthcoming years, primarily fueled by rapid industrialization, expanding infrastructure, and increasing investments in the aerospace and energy sectors. Countries such as China, India, and Japan are at the forefront of this growth, with their booming manufacturing industries and ambitious energy projects creating substantial demand for advanced sensor technologies, including aeroderivative sensors.

The region's focus on upgrading its energy infrastructure, particularly through the adoption of efficient and environmentally friendly technologies such as aeroderivative gas turbines, is a key factor propelling regional market growth.

- For instance, in July 2023, Bharat Heavy Electricals Limited (BHEL) signed a technical assistance and license agreement with General Electric Switzerland to manufacture gas turbines in India. This partnership has supported India's energy transition by facilitating enabling hybrid configurations utilizing hydrogen and other fuels.

Moreover, the rising middle-class population and increased air travel in Asia-Pacific are fueling the expansion of the aerospace industry, where aeroderivative sensors are essential for ensuring the safety and efficiency of aircraft. The growing emphasis on smart manufacturing and the integration of IoT and AI technologies in industrial processes further supports the demand for sophisticated sensor solutions.

Competitive Landscape

The global aeroderivative sensor market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Aeroderivative Sensor Market

- Artisan Scientific Corporation

- Auxitrol Weston

- Baker Hughes Company

- Conax Technologies

- Gastops Ltd.

- General Electric

- Rockwell Automation

- Siemens

- AMETEK Power Instruments

- MITSUBISHI HEAVY INDUSTRIES, LTD.

Key Industry Developments

- June 2024 (Launch): Baker Hughes launched three advanced gas, flow, and moisture measurement sensors to enhance safety and productivity in hydrogen and other energy sectors. These Panametrics solutions are specifically designed for harsh environments, delivering superior accuracy, reliability, and long-term stability to meet critical measurement demands in industrial applications.

- January 2024 (Launch): GE Vernova’s Gas Power business secured an order from Queensland's CS Energy to supply 12 LM2500XPRESS aeroderivative gas turbines for a new power station in Western Downs, Australia. This project underlines GE’s expanding presence in advanced energy solutions within the region.

The global aeroderivative sensor market is segmented as:

By Type

- Temperature Sensor

- Vibration Sensor

- Pressure Sensor

- Flame Sensor

By End-Use

By Service Provider

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America