Market Definition

The market encompasses high-performance circuit board materials designed that support complex semiconductor packaging, enabling enhanced electrical performance, miniaturization, and heat dissipation. These substrates feature multilayer interconnect structures for high-speed signal transmission.

Key applications span artificial intelligence (AI), high-performance computing (HPC), 5G infrastructure, and automotive electronics, positioning advanced IC substrates as essential for chiplet architectures, system-in-package (SiP) solutions, and next-generation semiconductor devices.

Advanced IC Substrate Market Overview

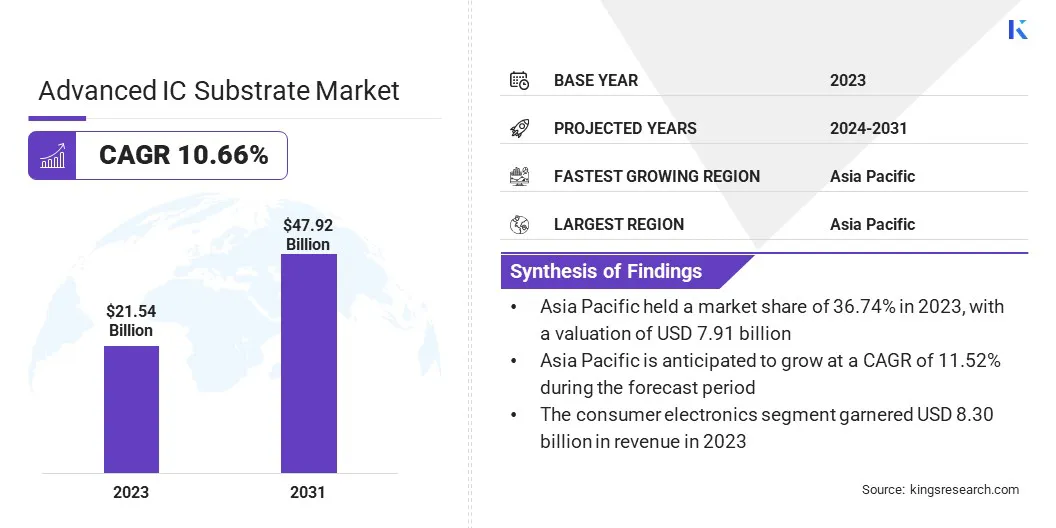

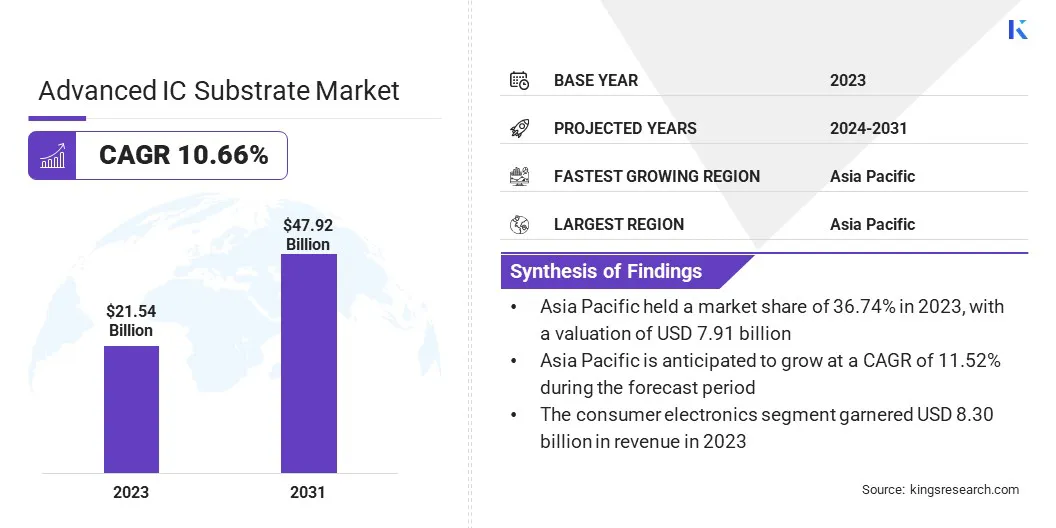

The global advanced IC substrate market size was valued at USD 21.54 billion in 2023 and is projected to grow from USD 23.59 billion in 2024 to USD 47.92 billion by 2031, exhibiting a CAGR of 10.66% during the forecast period. Market growth is driven by the expansion of 5G infrastructure and telecommunications, which demand high-performance, low-latency semiconductor solutions.

Additionally, the increasing adoption of chiplet and heterogeneous integration architectures is accelerating the need for advanced substrates capable of supporting complex, high-density interconnects and enhanced power efficiency.

Major companies operating in the advanced IC substrate industry are United Microelectronics Corporation, Nan Ya PCB Co., Ltd., IBIDEN, Samsung, SHINKO ELECTRIC INDUSTRIES CO., LTD., Kinsus Interconnect Technology Corp., LG Innotek, AT&S Austria Technologie & Systemtechnik AG, Daeduck Electronics Co., Ltd., SIMMTECH Co., Ltd., Zhen Ding Tech. Group Technology Holding Limited, TTM Technologies, Inc., NOK CORPORATION, Kyocera Corporation, IBIDEN, and others.

The shift toward panel-level packaging and glass core substrates is fostering market expansion. As semiconductor designs become more complex, manufacturers require high-precision defect detection and metrology solutions to enhance yield, ensure reliability, and reduce production costs.

Increasing adoption of high-density interconnects (HDI) and AI-driven quality control systems in AI, 5G, and high-performance computing applications is further accelerating demand for advanced IC substrates.

- In October 2024, KLA expanded its intelligent solution portfolio for IC substrates with multiple product upgrades. The Lumina inspection and metrology system, designed for advanced IC substrates (including glass core) and panel-based interposers, provides high-sensitivity defect detection and precise scanning metrology. Additionally, it seamlessly integrates with KLA’s copper shaping solutions, ensuring enhanced monitoring and defect management for next-generation semiconductor packaging.

Key Highlights:

- The global advanced IC substrate industry size was recorded at USD 21.54 billion in 2023.

- The market is projected to grow at a CAGR of 10.66% from 2024 to 2031.

- Asia Pacific held a share of 36.74% in 2023, valued at USD 7.91 billion.

- The BGA (Ball Grid Array) segment garnered USD 10.43 billion in revenue in 2023.

- The consumer electronics segment is expected to reach USD 18.48 billion by 2031.

- Europe is anticipated to grow at a CAGR of 11.27% over the forecast period.

Market Driver

Expansion of 5G Infrastructure and Telecommunications

The global expansion of 5G networks and next-generation wireless communication systems is significantly boosting the expansion of the market.

Higher frequencies and increased data transmission rates in 5G networks require low-loss, high-performance substrates with improved signal integrity. Network infrastructure, including 5G base stations, small cells, and high-speed networking devices, depends on advanced IC substrates to support faster processing and reduced latency.

- According to a January 2024 report by the Institute of Electrical and Electronics Engineers (IEEE), global 5G subscribers reached 1.8 billion by the end of 2023, with projections indicating growth to 7.9 billion by 2028. As of now, 296 commercial 5G networks are operational worldwide, expected to rise to 438 by 2025.

Market Challenge

Supply Chain Disruptions and Material Shortages

The growth of the advanced IC substrate market is hindered by supply chain disruptions and shortages of key raw materials, including high-purity copper foils and Ajinomoto Build-up Film (ABF). These constraints lead to increased production costs and delays in meeting demand.

To address this challenge, companies are expanding manufacturing facilities, securing long-term supplier agreements, and investing in material innovation. Strategic partnerships with raw material providers and advancements in alternative substrate materials are also helping mitigate risks, ensuring a stable supply chain and supporting the continuous development of high-performance semiconductor packaging solutions.

Market Trend

Increasing Adoption of Chiplet and Heterogeneous Integration Architectures

Semiconductor manufacturers are shifting toward chiplet-based architectures and heterogeneous integration to overcome traditional scaling limitations, propelling the growth of the market. These technologies require advanced IC substrates capable of supporting multiple chiplets with high interconnect density and enhanced electrical performance.

The adoption of 2.5D and 3D packaging in AI processors, data center chips, and consumer electronics is fostering the demand for IC substrates that facilitate efficient power delivery and optimized thermal dissipation.

- In March 2025, Imec, a leading research and innovation hub in nanoelectronics and digital technologies, partnered with the State Government of Baden-Württemberg, Germany, to establish the Advanced Chip Design Accelerator (ACDA). Located in Baden-Württemberg (Southwest Germany), this new Imec competence center aims to advance chiplet design, packaging, system integration, sensing, and edge AI technologies as part of Imec’s Automotive Chiplet Program (ACP).

Advanced IC Substrate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Substrate Type

|

BGA (Ball Grid Array), CSP (Chip Scale Package), Others

|

|

By Application

|

Consumer Electronics, Automotive, IT and Telecommunications, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Substrate Type (BGA (Ball Grid Array), CSP (Chip Scale Package), and Others): The BGA (Ball Grid Array) segment earned USD 10.43 billion in 2023 due to its superior electrical performance, high-density interconnects, and thermal efficiency.

- By Application (Consumer Electronics, Automotive, IT and Telecommunications, and Others): The consumer electronics segment held a share of 38.54% in 2023, fueled by the increasing demand for high-performance computing, miniaturization, and advanced packaging solutions in smartphones, laptops, wearables, and other smart devices.

Advanced IC Substrate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific advanced IC substrate market share stood at around 36.74% in 2023, valued at USD 7.91 billion. Asia Pacific is at the forefront of global semiconductor manufacturing. Leading foundries such as TSMC and Samsung Electronics are investing in next-generation packaging technologies, increasing demand for high-performance IC substrates.

The region's dominance in chip fabrication and outsourced semiconductor assembly and test (OSAT) services is prompting local substrate manufacturers to expand production capacity.

- The Asian Development Outlook (April 2024) reports that East Asia and Southeast Asia, comprising both high-income and developing economies, account for over 80% of global semiconductor manufacturing. This underscores the region's role as a critical supplier, with international markets highly reliant on its semiconductor exports.

The growing automotive and consumer electronics sectors in Asia Pacific are creating a strong demand for advanced IC substrates. Leading electronics brands, including Sony and Panasonic, are advancing innovations in AI-driven devices, smart sensors, and imaging technologies, highlighting the need for high-performance semiconductor packaging solutions.

Europe advanced IC substrate industry is likely to grow at a robust CAGR of 11.27% over the forecast period. The European Union’s Chips Act is acceleratingcontributing significantly to this growth by driving investment in semiconductor fabrication and packaging technologies.

The EU, through strong funding initiative, is reducing dependency on Asian semiconductor suppliers by supporting local substrate manufacturing and advanced packaging. Companies such as Infineon, STMicroelectronics, and GlobalFoundries are expanding European operations, increasing demand for high-performance IC substrates to support the region’s growing chip production.

Furthermore, European semiconductor firms are advancing chiplet-based processor designs, panel-level packaging, and high-speed interconnects to meet growing needs in AI, edge computing, and cloud data centers.

Regulatory Frameworks

- The U.S. regulates the semiconductor industry through the CHIPS and Science Act, enacted in August 2022. Additionally, the Bureau of Industry and Security (BIS) enforces export controls on advanced semiconductor technologies to protect national security and maintain technological leadership.

- The European Chips Act, effective since September 2023, provides a regulatory framework to strengthen the region’s semiconductor industry. It promotes R&D, expands production capacity, and introduces mechanisms to address supply chain disruptions, while ensuring compliance with EU competition laws and supporting state-funded initatives.

- China’s semiconductor industry is governed by policies under the Made in China 2025 initiative and the National Integrated Circuit Industry Investment Fund. These policies emphasize self-reliance in semiconductor production, with significant state funding directed toward domestic chip manufacturing and R&D.

- Japan’s Ministry of Economy, Trade, and Industry (METI) oversees semiconductor regulations, focusing on export controls and supply chain security. In July 2023, Japan imposed stricter export controls on 23 types of semiconductor manufacturing equipment, requiring manufacturers to obtain government approval before shipping to specific destinations.

Competitive Landscape

Companies operating in the advanced IC substrate market are expanding production capacity and establishing new manufacturing facilities. These initiatives aim to enhance supply chain resilience, meet the rising demand for high-performance substrates, and support technological advancements.

They are further investing in infrastructure, optimizing production processes, and forming industry collaborations to gain a competitive edge. The establishment of new production facilities in key regions is improving supply efficiency and accelerating innovation.

- In February 2024, Kinsus announced plans to establish a substrate manufacturing facility in Penang, Malaysia, and explore collaborations to strengthen its position in the semiconductor supply chain. The company has secured a rental facility in Penang and initiated substrate testing and quality control as of Q2 2024.

List of Key Companies in Advanced IC Substrate Market:

- United Microelectronics Corporation

- Nan Ya PCB Co., Ltd.

- IBIDEN

- Samsung

- SHINKO ELECTRIC INDUSTRIES CO., LTD.

- Kinsus Interconnect Technology Corp.

- LG Innotek

- AT&S Austria Technologie & Systemtechnik AG

- Daeduck Electronics Co., Ltd.

- SIMMTECH Co., Ltd.

- Zhen Ding Tech. Group Technology Holding Limited

- TTM Technologies, Inc.

- NOK CORPORATION

- Kyocera Corporation

- IBIDEN

Recent Developments (Partnerships/Product Launch)

- In September 2024, Amkor unveiled an advanced packaging solution, S-SWIFT (Substrate Silicon Wafer Integrated Fan-out Technology) to address the growing demand for high-performance devices in AI, high-performance computing (HPC), and data centers. The S-SWIFT package enhances bandwidth and enables efficient die-to-die interconnects for heterogeneous integration, utilizing a high-density interposer.

- In June 2024, Daeduck Electronics announced the successful development of a large-body FCBGA substrate designed for AI servers and data centers. This advanced substrate, measuring 100mm x 100mm with over 20 layers, is engineered for high-performance computing (HPC) chips, which serve as the core processing units in data center infrastructure.

- In June 2024, Siemens partnered with Samsung Foundry to enhance the manufacturing capabilities of multi-die packaged designs at advanced nodes. This collaboration led to multiple new product certifications for Siemens’ cutting-edge IC design and verification technologies.