Market Definition

AdTech refers to the tools, software, and platforms used to plan, manage, and analyze digital advertising campaigns. The market includes systems that support the buying, selling, delivery, and measurement of ads. It covers demand-side platforms, supply-side platforms, ad exchanges, data management platforms, and ad servers.

These operate across formats such as display, video, mobile, connected TV, and social media. The market enables advertisers, agencies, and publishers to run targeted campaigns and measure performance across digital channels.

AdTech Market Overview

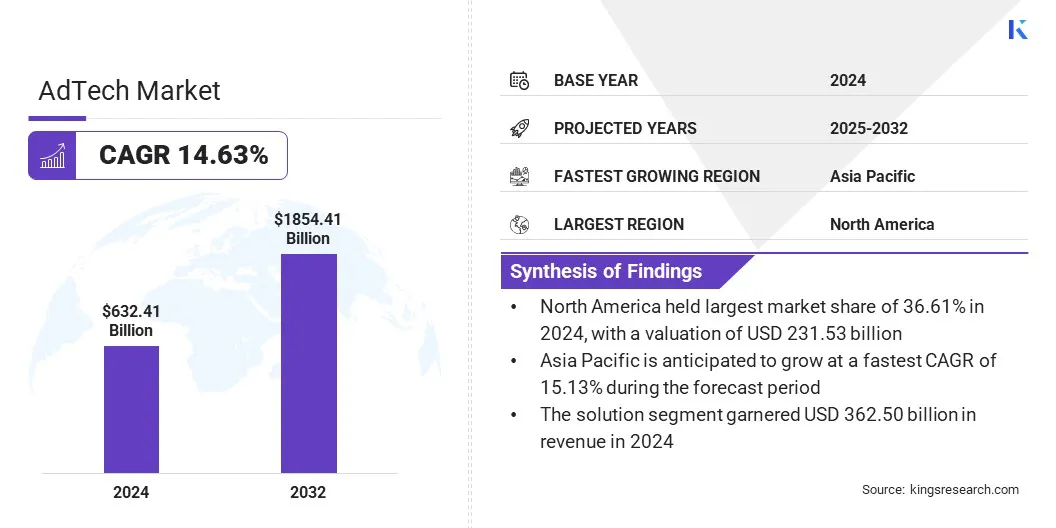

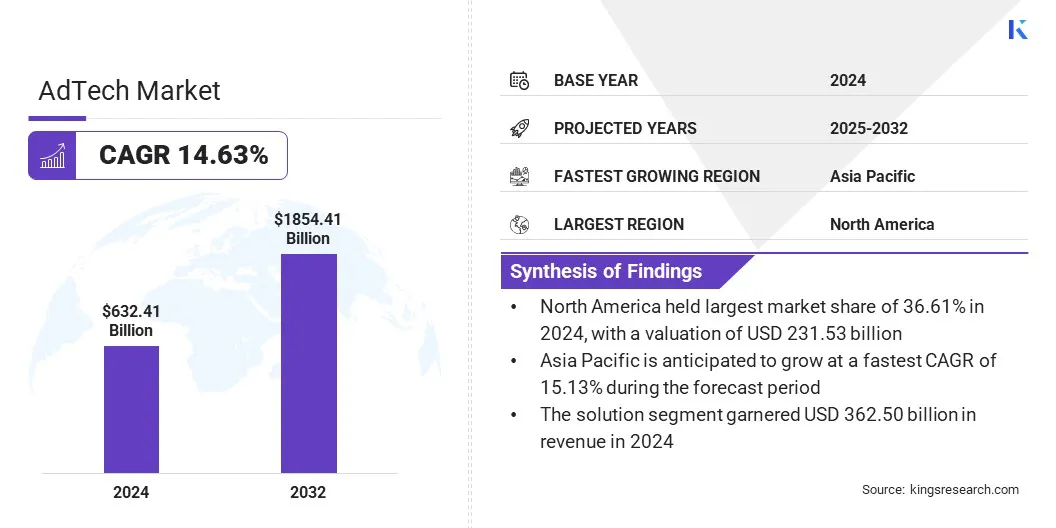

The global AdTech market size was valued at USD 632.41 billion in 2024 and is projected to grow from USD 712.90 billion in 2025 to USD 1,854.41 billion by 2032, exhibiting a CAGR of 14.63% during the forecast period.

The market is experiencing steady expansion as businesses increasingly prioritize data-driven advertising to enhance customer engagement and campaign performance. Advertisers are optimizing audience segmentation and enhancing conversion performance through automation, real-time bidding, and cross-channel targeting.

Key Highlights

- The AdTech industry size was valued at USD 632.41 billion in 2024.

- The market is projected to grow at a CAGR of 14.63% from 2025 to 2032.

- North America held a market share of 36.61% in 2024, with a valuation of USD 231.53 billion.

- The solution segment garnered USD 362.50 billion in revenue in 2024.

- The search advertising segment is expected to reach USD 591.22 billion by 2032.

- The mobile segment is expected to reach USD 757.04 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 15.13% during the forecast period.

Major companies operating in the AdTech industry are Alphabet Inc., Meta, Amazon.com, Inc., Alibaba Group Holding Limited, The Trade Desk, Comcast, Nexxen International Ltd, Mediaocean, PubMatic, Inc., Teads, Integral Ad Science, Inc., AppLovin, Bidstack Limited, DoubleVerify Inc., and Criteo.

Programmatic advertising is expanding as advertisers require more precise and efficient campaign execution. Data-driven algorithms allow marketers to segment audiences based on behavior, preferences, and demographics. Real-time bidding supports timely delivery of targeted messages, improving engagement and conversion rates. This approach reduces manual intervention, increases efficiency, and enhances return on investment.

- In June 2025, Advertima partnered with One Tech Group to launch audience-based programmatic In-Store Retail Media Advertising across over 1,000 digital screens in Switzerland. The solution uses sensor-based data and Advertima’s Audience AI to enable real-time targeting based on shopper attributes such as age and gender, enhancing precision in retail advertising.

Market Driver

Rising Digital Advertising Spend

The increasing allocation of marketing budgets to digital channels is a key factor driving growth in the AdTech market. Brands are increasingly reallocating budgets from traditional media to digital channels due to the demand for measurable outcomes, targeted reach, and real-time performance insights.

This is reducing reliance on traditional media formats and accelerating the demand for advanced advertising technologies. In response, AdTech companies are scaling up development of programmatic platforms, connected TV solutions, and AI-driven tools that enhance campaign efficiency and targeting precision.

- In February 2025, Taboola launched Realize, a new platform designed to enhance performance advertising capabilities. The platform enables more prominent display ad placements across publisher websites and apps and includes an AI-powered assistant that streamlines campaign setup by uploading creative assets and defining specific outcomes such as increasing website visits, driving purchases, or boosting engagement.

Market Challenge

Advertising Fraud Risks

Advertising fraud poses a major challenge in the AdTech market by undermining campaign effectiveness and depleting advertising budgets. Fraudulent practices such as click fraud, bot traffic, domain spoofing, and impression laundering lead to inaccurate performance metrics and reduce the return on investment for advertisers.

To address this, companies are integrating advanced fraud detection systems powered by artificial intelligence and machine learning. These technologies analyze traffic behavior in real-time to identify suspicious patterns and block invalid interactions.

In addition, many AdTech platforms are partnering with independent verification providers to ensure ad placements are brand-safe and viewable by genuine users. These combined efforts are helping advertisers safeguard their budgets and improve transparency across digital advertising environments.

- In November 2024, AppsFlyer launched an advanced AI layer for its Protect360 fraud prevention product. The new layer uses multiple machine learning models to enhance real-time fraud detection, accuracy, and deterrence. Now adopted across industries, the AI-powered Protect360 delivers faster detection, over 90% efficacy, and improved protection against evolving fraud tactics.

Market Trend

Shift Towards Cookieless Advertising

The AdTech market is experiencing a major transition toward cookieless advertising, which is reshaping how companies target and engage audiences. Unlike third-party cookie-based models that track users across sites, cookieless advertising leverages first-party data, contextual signals, and advanced identity solutions. This approach enhances targeting accuracy by focusing on real user intent and behavior within trusted environments.

It also improves user experience by reducing irrelevant ads and increasing ad relevance based on content or user engagement patterns. This is enabling advertisers to build deeper, trust-based relationships with audiences and improving long-term campaign effectiveness. Additionally, it encourages greater collaboration between publishers and advertisers to share insights and deliver high-quality ad placements.

- In March 2025, Intent IQ partnered with Snowflake to enable cookieless audience activation through Snowflake’s platform. This collaboration allows marketers to target Safari and iOS users via privacy-compliant identity resolution and seamless activation across SSPs using Snowflake’s Native App integration.

AdTech Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Solution (Demand-side Platforms (DSPs), Ad Networks, Data Management Platforms (DMPs), Others), Service (Professional Services, Managed Services, Training & Consulting, Support & Maintenance)

|

|

By Advertising Type

|

Programmatic Advertising, Search Advertising, Display Advertising, Mobile Advertising, Others

|

|

By Platform

|

Mobile, Web, Connected TV, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Solution and Service): The solution segment earned USD 362.50 billion in 2024 due to increasing demand for integrated platforms that streamline ad campaign management, targeting, and performance tracking.

- By Advertising Type (Programmatic Advertising, Search Advertising, Display Advertising, Mobile Advertising, and Others): The search advertising segment held 35.70% of the market in 2024, due to sustained reliance on intent-based targeting and high ROI in keyword-driven campaigns.

- By Platform (Mobile, Web, Connected TV, and Others): The mobile segment is projected to reach USD 757.04 billion by 2032, owing to the rapid adoption of smartphones and rising consumer engagement with in-app and mobile web content.

AdTech Market Regional Analysis

Based on region, market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America AdTech market share stood at around 36.61% in 2024 in the global market, with a valuation of USD 231.53 billion. This dominance is primarily driven by the region's advanced digital infrastructure and high consumer engagement across mobile, social media, and connected TV platforms.

Key companies are investing in AI-based advertising technologies to improve targeting precision and optimize campaign performance. Strategic partnerships are being formed to expand product capabilities and strengthen market positioning. Additionally, the shift toward privacy-compliant advertising has led firms to implement first-party data strategies to ensure regulatory adherence and maintain advertiser trust.

Continued investment by leading advertisers and technology providers in machine learning, data analytics, and cross-channel integration is further enhancing platform scalability and innovation. North America is expected to retain its leading position through sustained technological development and strong industry demand.

- In April 2025, DoubleVerify invested in FirstPartyCapital, an early-stage venture capital firm focused on AdTech, martech, and digital media. The investment aims to accelerate the growth of startups specializing in performance measurement and AI solutions.

The AdTech industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 15.13% over the forecast period. This growth is driven by rising smartphone penetration and mobile-first consumer behavior across the region. A large and digitally engaged population consumes content extensively through mobile apps, social platforms, and short-form videos.

In response, companies are developing in-app advertising solutions, real-time bidding systems, and AI-powered creative formats optimized for mobile engagement. Regional platforms are forming partnerships and expanding operations to capture this demand and enhance targeting effectiveness.

Governments are also improving digital infrastructure and introducing data privacy regulations, which encourage the adoption of compliant and scalable technologies. Continued investment in mobile advertising innovation, platform integration, and audience analytics is expected to support sustained AdTech growth in the region.

- In February 2025, Adjoe expanded into the Asia-Pacific region by opening offices in Singapore and Tokyo. The move targets high-growth mobile gaming and advertising markets across China, Japan, and South Korea.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) regulates advertising practices, ensuring that ads are truthful, non-deceptive, and evidence-based under the FTC Act.

- In Europe, the European Advertising Standards Alliance (EASA) oversees advertising through a coordinated self-regulatory framework. It works with national bodies to ensure advertisements are legal, decent, honest, and truthful.

- In Japan, the Japan Advertising Review Organization (JARO) is the self-regulatory body for advertising. It reviews advertising content, handles consumer complaints, and promotes ethical standards to ensure that advertisements are fair, accurate, and socially responsible.

Competitive Landscape

The AdTech industry is characterized by continuous innovation, with companies adopting key strategies to strengthen their market position. Market players are launching advanced solutions that leverage artificial intelligence and machine learning to improve ad targeting, optimize real-time bidding, and enhance campaign performance.

Companies are also collaborating across sectors such as retail, gaming, and e-commerce to expand access to high-value consumer data. These cross-industry partnerships are supporting broader audience reach and the development of personalized advertising experiences.

- In June 2025, Veylan launched the first AI-native operating system for advertising, unifying data, strategy, creative, and media execution into a single platform. Powered by Veylan Vision, the system automates campaign planning and optimization using enterprise data and AI agents, delivering up to 70% productivity gains for early adopters.

Key Companies in AdTech Market:

- Alphabet Inc.

- Meta

- Amazon.com, Inc.

- Alibaba Group Holding Limited

- The Trade Desk

- Comcast

- Nexxen International Ltd

- Mediaocean

- PubMatic, Inc.

- Teads

- Integral Ad Science, Inc.

- AppLovin

- Bidstack Limited

- DoubleVerify Inc.

- Criteo

Recent Developments (Acquisition/Partnership/Product Launches)

- In April 2025, HUMAN Security launched Ad Click Defense for ad tech platforms to detect and filter invalid clicks using real-time behavioral analysis. The product identifies both SIVT and GIVT, helping platforms ensure accurate performance metrics and protect against click fraud.

- In February 2025, Mediaocean acquired Innovid, combining it with Flashtalking to form a global, independent, omnichannel ad tech platform. The unified entity offers ad serving, creative, measurement, and optimization across CTV, digital, social, and linear channels, enabling advertisers and agencies to gain greater control, transparency, and efficiency across media investments.

- In January 2025, Amazon Ads launched Amazon Retail Ad Service, a new service built on AWS that enables retailers to deliver contextually relevant ads on their online stores. Currently in beta with retailers like iHerb and Tilly’s, the service integrates with Amazon Ads’ console and APIs, offering centralized campaign management, reporting, and privacy-enhanced ad measurement.

- In December 2024, smartclip and M6 Publicité partnered to integrate smartclip’s AdTech solutions into M6 Publicité’s stack. The collaboration supports Groupe M6’s streaming revenue goals and includes unified streaming and Addressable TV setup, programmatic buying, and real-time cross-media measurement through Realytics, enhancing operational efficiency and innovation for the French digital advertising industry.