Enquire Now

Adhesion Barrier Market Size, Share, Growth & Industry Analysis, By Product (Synthetic Adhesion Barriers, Natural Adhesion Barriers), By Formulation (Film/ Mesh, Gel, Liquid), By Application (Abdominal/ General Surgeries, Gynecological Surgeries), By End User, and Regional Analysis, 2025-2032

Pages: 200 | Base Year: 2024 | Release: August 2025 | Author: Versha V.

Key strategic points

Adhesion barriers are specialized medical devices that prevent or reduce internal scar tissue formation after surgical procedures. They create a temporary physical separation between tissues or organs during healing to minimize the risk of post-operative adhesions.

They are utilized in a wide range of abdominal, gynecological, orthopedic, cardiovascular, neurological, and urological procedures. Hospitals, ambulatory surgical centers, and specialty clinics use them to enhance recovery outcomes and reduce adhesion-related complications.

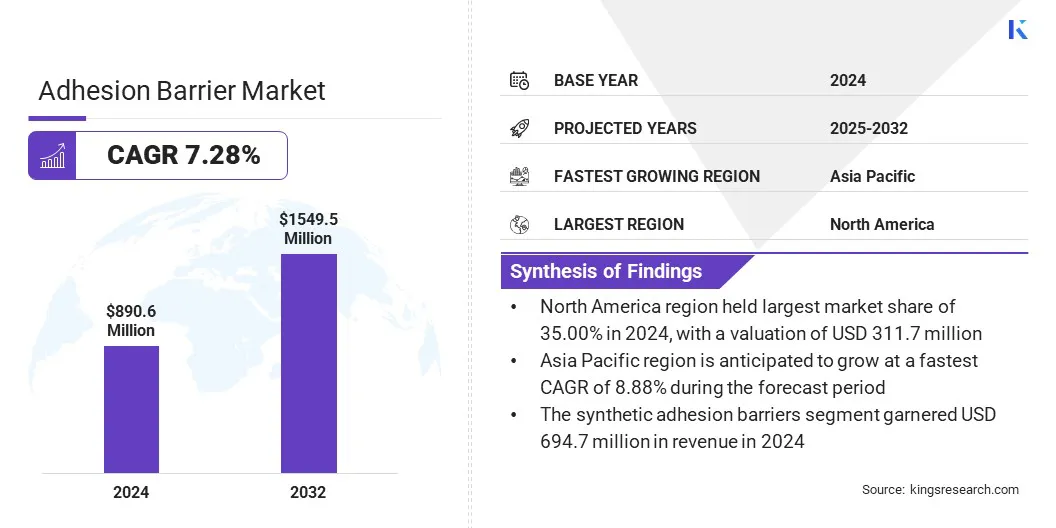

The global adhesion barrier market was valued at USD 890.6 million in 2024 and is projected to grow from USD 947.7 million in 2025 to USD 1,549.5 million by 2032, exhibiting a CAGR of 7.28% over the forecast period.

This growth is attributed to the increasing volume of abdominal, gynecological, orthopedic, and cardiovascular interventions that require effective post-operative adhesion prevention. Moreover, gels are increasingly adopted in spine surgery due to their ability to conform to intricate anatomical structures, provide uniform coverage, and enable precise application in delicate surgical areas.

Major companies operating in the adhesion barrier market are Baxter, Anika Therapeutics, Inc., Medical Device Business Services, Inc., Fziomed, Inc., Medtronic, MAST Biosurgery, PlantTec Medical GmbH, Dongsung, CGbio, SHINPOONG. CO. LTD, LG Chem, BioRegen Biomedical (Changzhou) Co., Ltd., Shanghai Haohai Biological Technology Co., Integra LifeSciences Holdings Corporation, and Becton, Dickinson and Company.

Market growth is propelled by the increasing use of intrauterine adhesion barrier films, especially in gynecological procedures to prevent post-surgical adhesions that can impact fertility and reproductive health. These films provide physical separation between uterine walls during healing, reducing the risk of intrauterine synechiae formation after hysteroscopic surgery or dilation and curettage.

Advancements in biocompatible materials have enhanced clinical outcomes by improving film flexibility, absorption rates, and ease of placement. Rising awareness among healthcare providers and the expansion of minimally invasive gynecological surgeries are further supporting the adoption of these products.

Increasing Volume of Complex Surgical Procedures

Growth in the adhesion barrier market is driven by the increasing volume of complex surgical procedures across multiple medical specialties. The growing number of abdominal, gynecological, and cardiovascular surgeries has created higher demand for effective adhesion prevention solutions to reduce post-operative complications.

The rise in surgical interventions is linked to an expanding patient base, advancements in medical diagnostics, and improved access to specialized care. These factors are contributing to the consistent adoption of adhesion barriers to enhance recovery outcomes and minimize healthcare costs associated with adhesion-related treatments.

High Cost of Advanced Adhesion Barrier Products

A major challenge for the adhesion barrier market is the high cost of advanced products, which can limit adoption in cost-sensitive healthcare settings, particularly in emerging economies. The premium pricing for bioresorbable and specialized formulations can strain hospital budgets and reduce accessibility for patients. This cost barrier may slow market penetration despite proven clinical benefits.

To overcome this challenge, manufacturers are focusing on optimizing production processes, expanding local manufacturing capabilities, and developing cost-effective formulations. These strategies aim to lower manufacturing expenses, improve affordability, and expand product availability across diverse healthcare markets.

Rising Adoption of Gels for Spine Surgery

The adhesion barrier market is undergoing a notable shift with the rising adoption of gels for spine surgery. Surgeons are increasingly selecting gel formulations due to their ability to conform to complex anatomical structures and provide uniform coverage in delicate surgical areas.

These products are favored for their ease of application, reduced procedural time, and effective performance in preventing post-operative adhesions in spinal procedures. The growing demand for minimally invasive spine surgeries is further accelerating the use of gel-based adhesion barriers.

|

Segmentation |

Details |

|

By Product |

Synthetic Adhesion Barriers (Hyaluronic Acid, Regenerated Cellulose, Polyethylene Glycol, Others), Natural Adhesion Barriers (Collagen & Protein, Fibrin) |

|

By Formulation |

Film/ Mesh, Gel, Liquid |

|

By Application |

Abdominal/ General Surgeries, Gynecological Surgeries, Orthopedic Surgeries, Cardiovascular Surgeries, Neurological Surgeries, Urological Surgeries, Others |

|

By End User |

Hospitals & Clinics, Ambulatory Surgical Centers, Specialty Clinics |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America adhesion barrier market share stood at 35.00% in 2024, with a valuation of USD 311.7 million. This dominance is attributed to advanced surgical infrastructure and a mature healthcare system that facilitates the adoption of adhesion prevention products.

Skilled surgical professionals and reimbursement policies have supported consistent utilization across a broad range of procedures. This strong healthcare framework is expected to maintain North America’s leading position throughout the forecast period.

Asia Pacific adhesion barrier industry is poised to grow at a CAGR of 8.88% over the forecast period. This growth is driven by increased collaborations between healthcare providers and manufacturers, enabling faster product innovation and commercialization.

The availability of domestically produced adhesion barriers has improved accessibility, lowered procurement costs, and encouraged wider adoption across emerging healthcare markets. These developments are anticipated to strengthen Asia Pacific’s position as the fastest-growing regional market over the forecast period.

Key players in the global adhesion barrier industry are heavily investing in the development of advanced solutions for surgical adhesion prevention. Investments are being directed to research and development initiatives aimed at improving bioresorbable material performance, enhancing biocompatibility, and optimizing delivery formats for diverse surgical applications.

Strategic alliances with research organizations and manufacturing partners are enabling the expansion of product portfolios and the integration of innovative polymer technologies. Investments are also being allocated into multicenter clinical studies and regulatory clearance processes across key regions to accelerate market entry and strengthen competitive positioning.

Frequently Asked Questions