Market Definition

The market encompasses the process of diagnosing, managing, and treating AML across various disease subtypes, including acute myeloblastic leukemia, acute myelomonocytic leukemia, acute promyelocytic leukemia, and acute monocytic leukemia.

This market includes a range of treatment modalities such as chemotherapy, targeted therapies, and immunotherapy approaches, which are administered through injectable and oral routes.

The report provides insights into the fundamental drivers steering market growth, complemented by a thorough evaluation of market trends and the regulatory frameworks governing industry operations.

Acute Myeloid Leukemia Treatment Market Overview

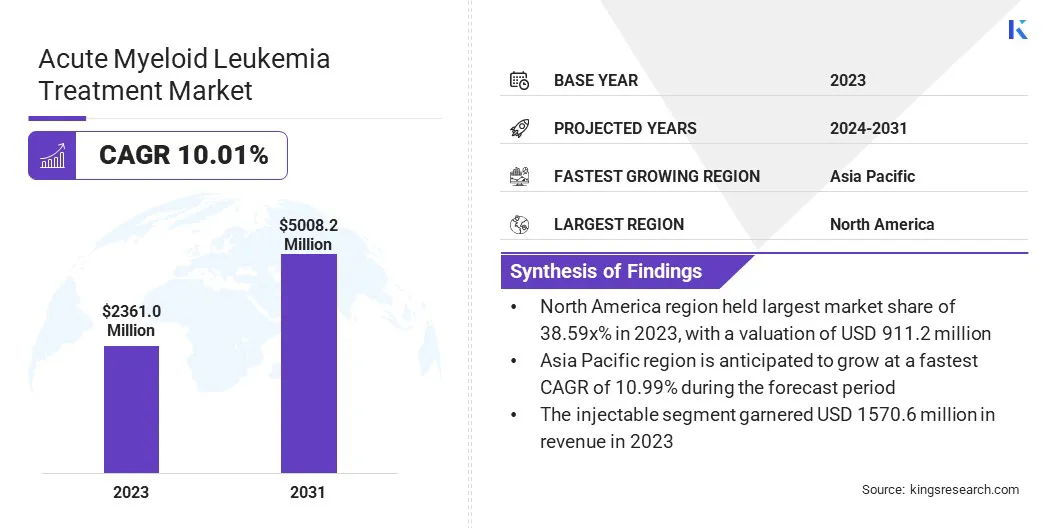

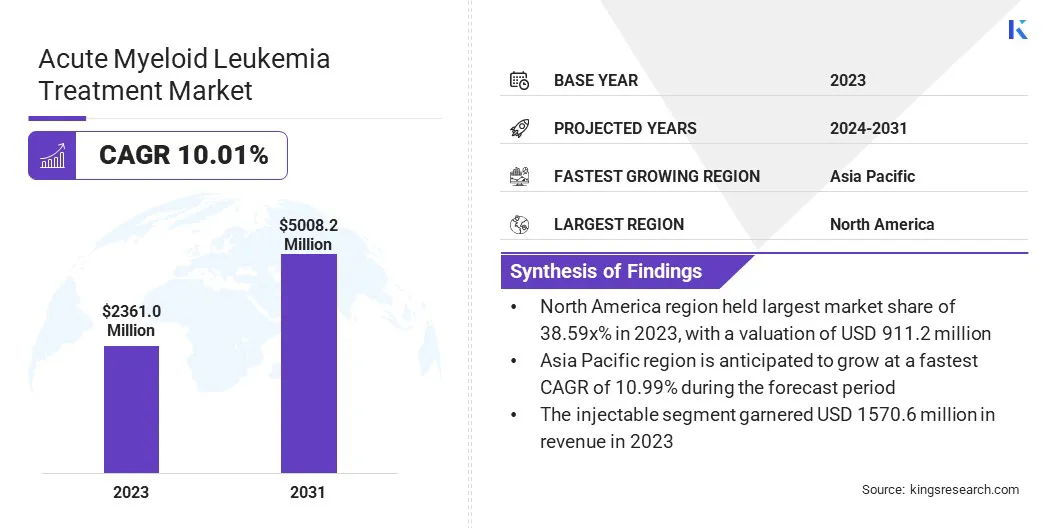

The global acute myeloid leukemia treatment market size was valued at USD 2361.0 million in 2023 and is projected to grow from USD 2568.3 million in 2024 to USD 5008.2 million by 2031, exhibiting a CAGR of 10.01% during the forecast period.

The market is driven by the rising prevalence of AML and advancements in therapeutic approaches. Increasing Research and Development (R&D) efforts have led to the introduction of novel targeted therapies and immunotherapies, enhancing treatment efficacy and patient survival rates.

Major companies operating in the acute myeloid leukemia treatment industry are Amgen Inc., Novartis AG, Jazz Pharmaceuticals plc, Ryvu Therapeutics, AbbVie Inc, Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd, Otsuka Pharmaceutical Co., Ltd., Bristol-Myers Squibb Company, Actinium Pharmaceuticals, Inc., Agios Pharmaceuticals, Inc., Kura Oncology, Inc., Pfizer Inc., DAIICHI SANKYO COMPANY, LIMITED, and Astellas Pharma Inc.

The expansion of healthcare infrastructure, increasing access to oncology care, and rising awareness about early diagnosis have contributed to the market growth. The shift toward outpatient and home-based treatment settings, coupled with ongoing clinical trials exploring innovative drug combinations, is also leading to market growth.

Key Highlights:

- The acute myeloid leukemia treatment industry size was valued at USD 2361.0 million in 2023.

- The market is projected to grow at a CAGR of 10.01% from 2024 to 2031.

- North America held a market share of 38.59% in 2023, with a valuation of USD 911.2 million.

- The acute myeloblastic leukemia segment garnered USD 1067.9 million in revenue in 2023.

- The targeted therapies segment is expected to reach USD 2314.3 million by 2031.

- The injectable segment is expected to reach USD 3350.0 million by 2031.

- The hospitals & specialty clinics segment is expected to reach USD 2652.4 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.99% during the forecast period.

Market Driver

"Rising AML Prevalence"

The acute myeloid leukemia treatment market is primarily driven by the rising prevalence of AML, particularly among the aging population. The incidence of AML continues to increase, due to the global rise in the elderly demographic.

Additionally, lifestyle factors, environmental exposures, and genetic predispositions are contributing to a higher number of AML cases. The growing disease burden has intensified the demand for early diagnosis and advanced treatment options, leading to increased investment in research, drug development, and improved healthcare infrastructure to address the expanding patient population.

- In March 2025, according to the American Cancer Society, approximately 22,010 individuals in the U.S. are projected to be diagnosed with AML, reinforcing the rising prevalence of the disease. AML accounts for nearly one-third of adult leukemia cases and 1% of all cancers, which is boosting the demand for innovative and effective treatment solutions.

Market Challenge

"High Treatment Costs"

A major challenge in the acute myeloid leukemia treatment market is the high cost of advanced therapies, particularly targeted treatments and immunotherapies. The expensive nature of novel drugs and prolonged treatment regimens creates financial burdens for patients, limiting access, especially in lower-income regions.

A potential solution lies in expanding insurance coverage, government funding, and patient assistance programs, which can help reduce out-of-pocket expenses.

Market Trend

"Growing Adoption of Precision Medicine"

The acute myeloid leukemia treatment market is increasingly shaped by the growing adoption of precision medicine, which is revolutionizing treatment approaches. Advances in biomarker-driven therapies are enabling the development of targeted treatments that address specific genetic mutations, improving efficacy and reducing toxicity.

The integration of genomic profiling in AML diagnosis is further guiding personalized treatment strategies, allowing for more precise drug selection and better patient outcomes. This shift toward precision medicine is enhancing treatment success rates and driving innovation in AML therapeutics.

- In October 2024, the National Institutes of Health (NIH) launched a proof-of-concept precision medicine clinical trial to evaluate new treatment combinations targeting specific genetic mutations in AML and myelodysplastic syndromes (MDS). Funded by the National Cancer Institute (NCI), the trial aims to accelerate the development of personalized and more effective therapies, reinforcing the growing adoption of precision medicine in oncology.

Acute Myeloid Leukemia Treatment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Disease Type

|

Acute Myeloblastic Leukemia, Acute Myelomonocytic Leukemia, Acute Promyelocytic Leukemia, Acute Monocytic Leukemia, Others

|

|

By Treatment Type

|

Chemotherapy (Anti-Metabolites, Alkylating Agents, Anthracycline-Based Drugs, Additional Chemotherapy Agents), Targeted Therapies (FLT3 Inhibitor Therapies (Midostaurin (Rydapt), Quizartinib (Vanflyta), Gilteritinib (Xospata)) IDH Inhibitor Therapies (Ivosidenib (Tibsovo), Olutasidenib (Rezlidhia), Enasidenib (Idhifa)) Gemtuzumab Ozogamicin (Mylotarg), BCL-2 Inhibitor-Based Treatments, Hedgehog Pathway Blockers), Immunotherapy Approaches (Bispecific Antibody Therapies, Antibody-Drug Conjugates, Immune Checkpoint Inhibitors, CAR T-Cell Therapy), Others

|

|

By Route of Administration

|

Injectable, Oral

|

|

By End User

|

Hospitals & Specialty Clinics, Oncology Treatment Centers, Home-Based Care Settings, Ambulatory Healthcare Facilities

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Disease Type (Acute Myeloblastic Leukemia, Acute Myelomonocytic Leukemia, Acute Promyelocytic Leukemia, Acute Monocytic Leukemia, and Others): The acute myeloblastic leukemia segment earned USD 1067.9 million in 2023, due to its high prevalence and the significant adoption of chemotherapy and targeted therapies for its treatment.

- By Treatment Type (Chemotherapy, Targeted Therapies, Immunotherapy Approaches, and Others): The targeted therapies segment held 45.27% share of the market in 2023, due to the increasing adoption of precision medicine and the development of novel targeted drugs with improved efficacy and reduced toxicity.

- By Route of Administration (Injectable, Oral): The injectable segment is projected to reach USD 3350.0 million by 2031, owing to the widespread use of intravenous chemotherapy and biologics as primary treatment modalities for AML.

- By End User (Hospitals & Specialty Clinics, Oncology Treatment Centers, Home-Based Care Settings, and Ambulatory Healthcare Facilities): The hospitals & specialty clinics segment is projected to reach USD 2652.4 million by 2031, owing to the availability of advanced treatment facilities, specialized oncology care, and the growing number of AML treatment centers.

Acute Myeloid Leukemia Treatment Market Regional Analysis

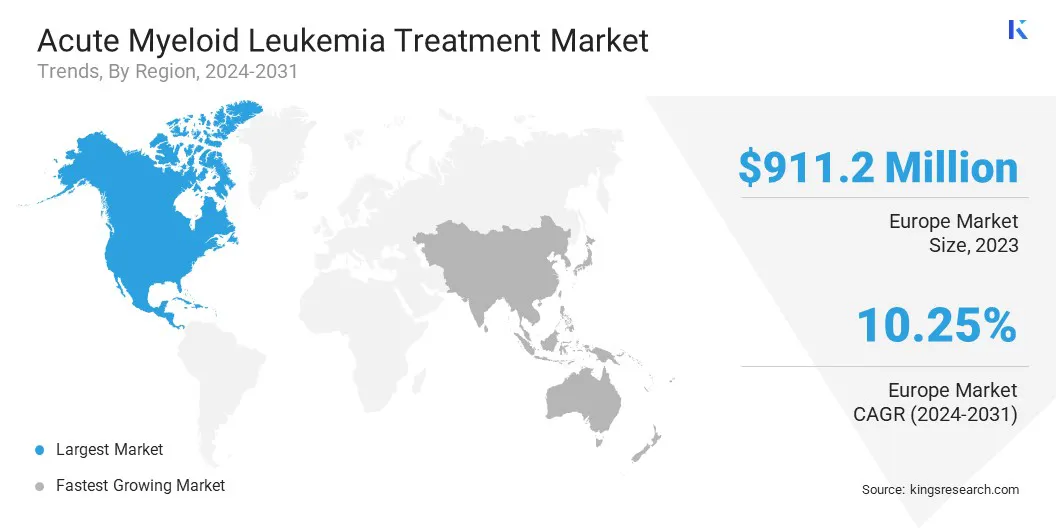

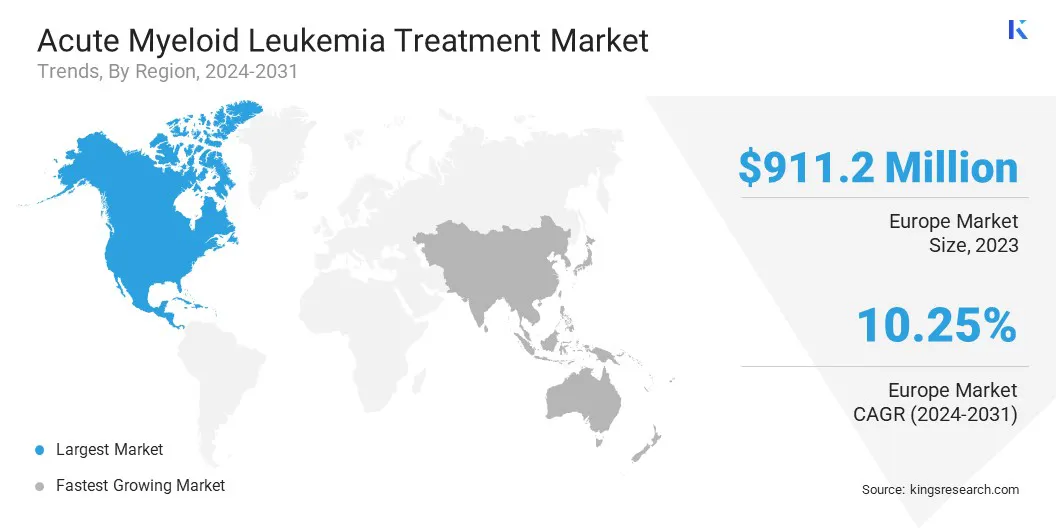

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America acute myeloid leukemia treatment market share stood around 38.59% in 2023, with a valuation of USD 911.2 million. This is attributed to the well-established healthcare infrastructure, high awareness, and early diagnosis rates.

The presence of key pharmaceutical companies, continuous advancements in targeted therapies and immunotherapies, and robust investment in oncology research have further propelled the market growth.

Additionally, favorable reimbursement policies, increasing adoption of precision medicine, and a rising geriatric population at higher risk for AML have significantly contributed to the region's leadership in the market.

The acute myeloid leukemia treatment industry in Asia Pacific is poised to grow at a significant CAGR of 10.99% over the forecast period, driven by a rapidly expanding healthcare sector, increasing cancer prevalence, and rising government initiatives to improve oncology care.

The growing accessibility of advanced treatment options, coupled with an increasing number of clinical trials and drug approvals in emerging economies such as China, India, and Japan, is accelerating market expansion.

Additionally, improving healthcare infrastructure, rising geriatric population, and increasing investments by global pharmaceutical companies in the region are expected to further drive the adoption of AML treatment.

- In February 2025, the Government of India exempted 36 lifesaving drugs, including cancer treatments, from Basic Customs Duty (BCD) and reduced duty on six medicines to 5% to lower costs. Additionally, the Union Budget 2025-26 announced 200 Day Care Cancer Centres in district hospitals by 2025-26, enhancing cancer care accessibility. These initiatives aim to improve affordability and strengthen oncology infrastructure nationwide.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates AML treatments under the Center for Drug Evaluation and Research (CDER) and the Center for Biologics Evaluation and Research (CBER).

- In Europe, the European Medicines Agency (EMA) oversees AML treatment approvals through the Committee for Medicinal Products for Human Use (CHMP). The EMA’s PRIME (Priority Medicines) scheme supports the development of AML drugs that address unmet medical needs.

Competitive Landscape:

Companies are heavily investing in R&D to introduce novel targeted therapies and immunotherapies that enhance treatment efficacy and reduce side effects. Strategic collaborations and partnerships with biotechnology firms and research institutions are accelerating drug development and expanding clinical trial pipelines.

Market participants are also prioritizing regulatory approvals and fast-track designations to expedite the commercialization of innovative AML treatments. Additionally, mergers and acquisitions are being leveraged to expand product portfolios and strengthen market reach.

The adoption of precision medicine and biomarker-driven treatment approaches is another key strategy, enabling the development of personalized therapies tailored to specific patient subtypes. Furthermore, companies are expanding their geographic footprint by entering emerging markets and enhancing distribution networks to improve accessibility to AML treatments globally.

- In July 2023, Daiichi Sankyo announced that the U.S. Food and Drug Administration (FDA) approved VANFLYTA (quizartinib) for the treatment of adult patients with newly diagnosed FLT3-ITD positive acute myeloid leukemia (AML). The approval, based on QuANTUMFirst results, marks VANFLYTA as the first and only FLT3 inhibitor authorized across three phases of AML treatment, demonstrating improved overall survival when combined with chemotherapy.

List of Key Companies in Acute Myeloid Leukemia Treatment Market:

- Amgen Inc.

- Novartis AG

- Jazz Pharmaceuticals plc

- Ryvu Therapeutics

- AbbVie Inc

- Johnson & Johnson Services, Inc.

- F. Hoffmann-La Roche Ltd

- Otsuka Pharmaceutical Co., Ltd.

- Bristol-Myers Squibb Company

- Actinium Pharmaceuticals, Inc.

- Agios Pharmaceuticals, Inc.

- Kura Oncology, Inc.

- Pfizer Inc.

- DAIICHI SANKYO COMPANY, LIMITED

- Astellas Pharma Inc.

Recent Developments (Partnerships/Product Launches)

- In November 2024, Kura Oncology, Inc. and Kyowa Kirin Co., Ltd. announced a global strategic collaboration to develop and commercialize ziftomenib, a selective oral menin inhibitor for AML and other hematologic malignancies. The agreement includes a USD 330 million upfront payment to Kura, with up to USD 1.2 billion in total milestone payments. The collaboration aims to advance ziftomenib in frontline AML treatment, targeted therapy combinations, and post-transplant maintenance.

- In October 2024, NeoGenomics, Inc. announced the launch of AML Express, a next-generation sequencing assay designed for comprehensive and rapid genetic profiling of AML patients. This new test enhances its hematologic portfolio by addressing the need for faster biomarker testing, enabling physicians to make more informed treatment decisions.