Market Definition

The market involves the production and distribution of paper products designed to absorb liquids, with applications spanning across various sectors.

These papers, which are highly porous, are primarily used in consumer goods like paper towels, napkins, and tissues, as well as in industrial and healthcare settings for cleaning, medical use, and spill control.

Absorbent Paper Market Overview

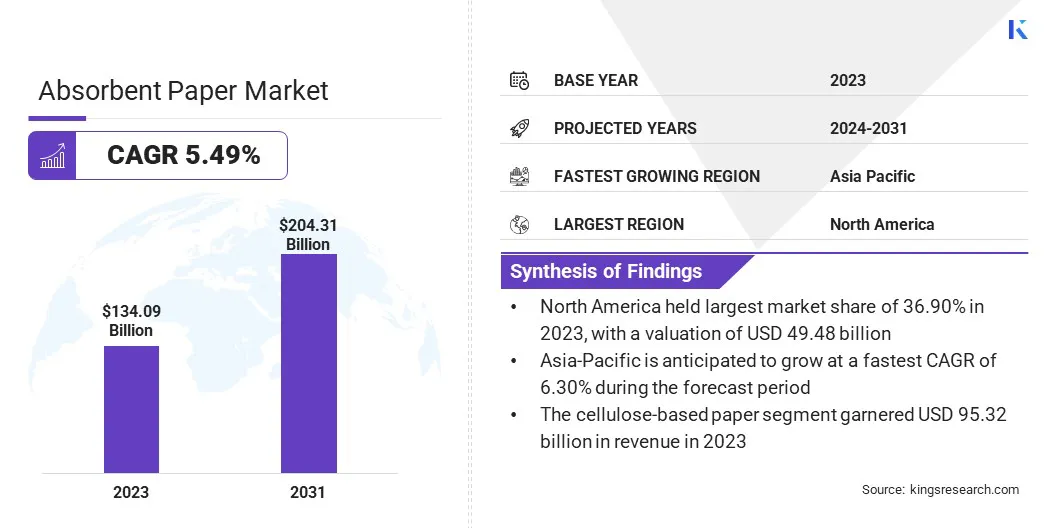

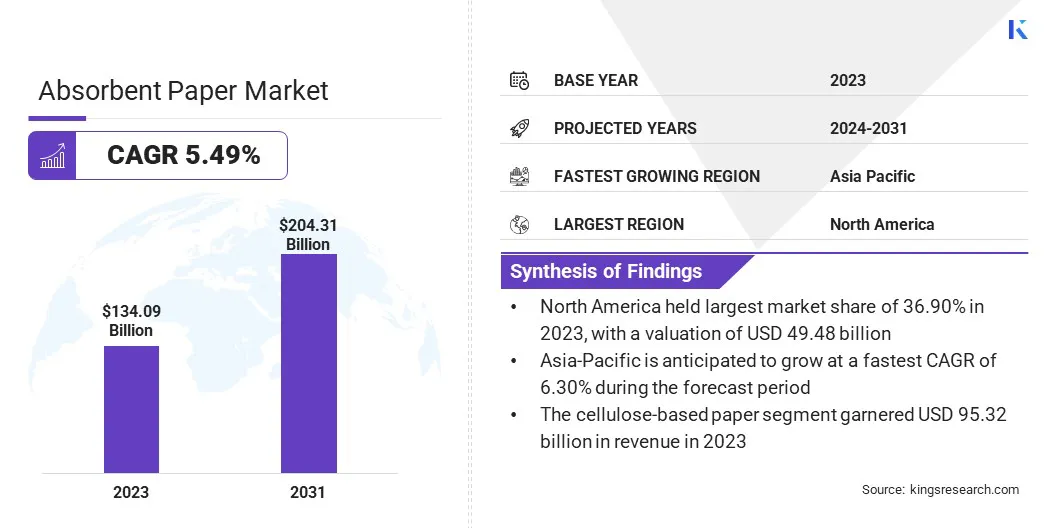

The global absorbent paper market size was valued at USD 134.09 billion in 2023 and is projected to grow from USD 140.51 billion in 2024 to USD 204.31 billion by 2031, exhibiting a CAGR of 5.49% during the forecast period.

This growth is driven by the rising demand for hygiene products like paper towels, tissues, and wipes, as well as an increasing need for absorbent materials in industries such as healthcare, food packaging, and cleaning.

Healthcare, in particular, is a key sector with more hospitals and clinics relying on absorbent papers for medical and surgical applications. At the same time, consumers are becoming more focused on sustainability, pushing the demand for eco-friendly and recycled paper options.

Major companies operating in the absorbent paper industry are KIMBERLY-CLARK CORPORATION, International Paper, UPM Global, Ahlstrom, Georgia-Pacific, Santa Cruz Animal Health, Fortune Paper Mills LLP, Smurfit Kappa, Domtar Corporation, Shitla Papers Pvt Ltd, WestRock Company, Cascades Tissue Group, SOFIDEL, GURGAON PAPER MILLS LTD, and Twin Rivers Paper Company.

Technological advancements in paper manufacturing are also helping to improve product quality and efficiency. Geographically, North America, Europe, and Asia Pacific are expected to register strong growth, especially in emerging markets where industrialization and hygiene awareness are rapidly increasing.

- In October 2024, International Paper announced the decision to review strategic options for its global cellulose fibers (GCF) business. The decision to explore alternatives for the GCF business was consistent with the company's strategy to focus on sustainable packaging solutions.

Key Highlights

- The absorbent paper industry size was valued at USD 134.09 billion in 2023.

- The market is projected to grow at a CAGR of 5.49% from 2024 to 2031.

- North America held a market share of 36.90% in 2023, with a valuation of USD 49.48 billion.

- The tissue paper segment garnered USD 63.13 billion in revenue in 2023.

- The cellulose-based paper segment is expected to reach USD 142.08 billion by 2031.

- The food & beverage segment is anticipated to register the fastest CAGR of 6.41% during the forecast period.

- The offline retail segment garnered USD 103.13 billion in revenue in 2023.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.30% during the forecast period.

How do changing trends in food and beverages market affect this market?

The growing food & beverage industry is boosting the absorbent paper market. Absorbent paper has become essential in maintaining food quality and hygiene as more people turn to convenience foods, takeout, and fast-casual dining. It is used in food packaging to absorb excess oils or liquids, preventing leaks and keeping the food fresh and clean.

Absorbent papers also help in keeping surfaces dry and hygienic in fast-food chains, restaurants, or catering services, benefiting both customers and staff. The demand for packaged food and dining-on-the-go rises, especially in emerging markets where incomes are increasing and cities are growing. Thus, the need for absorbent paper products, like napkins, towels, and food liners, will continue to grow.

- In December 2023, Georgia-Pacific announced a USD 150 million investment in its retail consumer tissue business at its mill in Halsey, Oregon. Investments to the Halsey mill will increase production capacity for high-quality bath tissue, with initial production expected in 2025.

How are growing environmental concerns curtailing market growth?

The production of absorbent paper involves substantial use of natural resources, including wood pulp, water, and energy, which can contribute to deforestation and environmental degradation if not sourced responsibly. Despite growing efforts toward sustainability, many paper mills still use traditional methods that have a heavy environmental impact.

Another challenge comes with the disposal of absorbent paper products, especially those used in food packaging or personal hygiene. When these papers are contaminated with oils, food waste, or chemicals, they become difficult to recycle or compost. As a result, much of this waste ends up in landfills, contributing to pollution.

Steps like using recycled paper fibers can help tackle the environmental challenges in the absorbent paper market. This reduces the need for fresh wood pulp and helps protect forests. Manufacturers can also invest in cleaner, more efficient technologies that use less energy and water, making the production process greener.

Another key approach is to develop biodegradable and compostable absorbent papers, so they break down naturally without adding to landfill waste. Moving toward plant-based materials instead of chemical-heavy alternatives can significantly lower the environmental impact.

Which product innovations are shaping the market?

Innovations in absorbency and performance are really transforming the absorbent paper market, as companies look for ways to make their products more effective and versatile. Advancements have led to the creation of ultra-absorbent papers that can soak up liquids much more efficiently, making them suitable for use in healthcare, industrial cleaning, and premium household products.

Manufacturers are also focusing on improving the softness and strength of absorbent papers, particularly in products like tissues and wipes. This makes them gentle on the skin but tough enough to handle moisture without tearing. Innovations like antimicrobial coatings or added materials are making papers not just more absorbent but also safer and more hygienic, which is advantageous in food safety and healthcare.

- In December 2023, Mondi announced its commitment to boost the production of saturating kraft paper and increase capacity to serve manufacturers of internal and external building panels, worktops, furniture, and technical films.

Absorbent Paper Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Tissue Paper, Filter Paper, Blotting Paper, Specialty Absorbent Paper

|

|

By Material

|

Cellulose-based Paper, Cotton-based Paper, Synthetic Fiber-based Paper

|

|

By End-use Industry

|

Healthcare, Personal Care & Hygiene, Food & Beverage, Industrial, Others

|

|

By Distribution Channel

|

Online Retail, Offline Retail

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Tissue Paper, Filter Paper, Blotting Paper, Specialty Absorbent Paper): The tissue paper segment earned USD 63.13 billion in 2023, due to its widespread use in hygiene products, including toilet paper, napkins, and facial tissues.

- By Material (Cellulose-Based Paper, Cotton-Based Paper, Synthetic Fiber-Based Paper): The cellulose-based paper segment held 71.09% share of the market in 2023, due to its cost-effectiveness, wide availability, and excellent absorbent properties, making it the preferred choice for most absorbent paper products.

- By End-use Industry (Healthcare, Personal Care & Hygiene, Food & Beverage, Industrial, Others): The healthcare segment is projected to reach USD 82.39 billion by 2031, owing to the increasing demand for absorbent paper in medical applications such as surgical drapes, wound care, and hygiene products in hospitals and clinics.

- By Distribution Channel (Online Retail, Offline Retail): The online retail segment is anticipated to register the fastest CAGR of 7.82% during the forecast period, due to high internet penetration and rising usage of smartphones among the population.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 36.90% share of the absorbent paper market in 2023, with a valuation of USD 49.48 billion. This dominant position is driven by the high demand for hygiene products such as paper towels, tissues, and wipes, fueled by strong consumer spending and a well-established healthcare sector.

The region's advanced infrastructure, coupled with a growing focus on sustainability, has also spurred the adoption of eco-friendly and recycled absorbent paper products. North America is expected to maintain its leading position in the global market throughout the forecast period as the demand for disposable hygiene products and medical absorbents rises.

- In August 2024, First Quality Tissue announced plans to expand its production of ultra-premium towel and tissue products manufacturing capabilities. The expansion includes a commitment to install two new state-of-the-art Thru-Air-Dried (TAD) paper machines with associated converting facilities at a new location to be announced in the near future.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 6.30% over the forecast period. This growth can be attributed to factors such as rapid urbanization, increasing health & hygiene awareness, and growing demand for absorbent paper products in countries like China, India, and Southeast Asian nations.

The expanding healthcare sector, along with the food service industry, is also contributing to the rising demand for absorbent materials. Manufacturers are tapping into the region's large consumer base and cost-effective production capabilities, boosting both supply and consumption.

Regulatory Frameworks

- The Saudi Standards, Metrology and Quality Organization (SASO) regulates paper and cardboard products in Saudi Arabia. Their technical regulations ensure that these products meet quality, safety, and environmental standards.

- The U.S. Food and Drug Administration (FDA), under Title 21, Part 176 of the Code of Federal Regulations (CFR), sets guidelines for the use of paper and paperboard in food contact applications.

- The European Commission (EC) regulates food contact materials, including paper products, under Regulation (EC) No 1935/2004. This legislation ensures that materials used in food packaging are safe, do not release harmful substances into food, and meet specific health and safety standards.

- The European Union Ecolabel sets sustainability standards for paper products, focusing on raw material sourcing, production processes, and recyclability to ensure environmental responsibility.

Competitive Landscape

The absorbent paper market is shaped by several key players, including both global and regional manufacturers, who are constantly innovating to meet the growing demand for high-quality and eco-friendly products.

Manufacturers are increasingly focusing on enhancing the absorbency, softness, and durability of their offerings to cater to diverse consumer needs in hygiene, healthcare, and industrial applications. The rising demand for specialty products, such as antimicrobial or hypoallergenic absorbent papers, has led to the growth of the niche market.

- In June 2024, Georgia-Pacific announced the relaunch of Aria, a 100% recycled three-ply paper-wrapped bath tissue. This product is designed to offer consumers an eco-friendly option without compromising on quality and performance, reflecting the company's commitment to sustainability.

List of Key Companies in Absorbent Paper Market:

- KIMBERLY-CLARK CORPORATION

- International Paper

- UPM Global

- Ahlstrom

- Georgia-Pacific

- Santa Cruz Animal Health

- Fortune Paper Mills LLP

- Smurfit Kappa

- Domtar Corporation

- Shitla Papers Pvt Ltd

- WestRock Company

- Cascades Tissue Group

- SOFIDEL

- GURGAON PAPER MILLS LTD

- Twin Rivers Paper Company

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, Domtar Corporation announced the acquisition of Iconex Paper from Atlas Holdings. This strategic acquisition demonstrates Domtar's commitment to being an advocate for paper-based products and supporting the long-term sustainability of the paper industry.

- In November 2024, Sofidel finalized the acquisition of the tissue division of Clearwater Paper Corporation. This transaction makes Sofidel the fourth-largest tissue paper manufacturer in North America, and strengthens its leadership in the private label sector.

- In May 2023, Sofidel finalized its acquisition of the Hakle brand and other related brands in Germany. This strategic acquisition allowed Sofidel to further expand its presence in the German market, reinforcing its commitment to offering high-quality products in the tissue sector.

- In January 2023, International Paper reached an agreement to sell its 50% interest in Ilim SA, the holding company for its Ilim joint venture (JV), to its JV partners for USD 484MM (USD) equity value. The sale is subject to regulatory approvals in Russia.