Market Definition

The market refers to the industry focused on developing and providing technologies to remove PFAS (Per- and Polyfluoroalkyl Substances) from water, air, and soil.

Driven by environmental concerns and regulatory pressures, this market includes filtration solutions like activated carbon, reverse osmosis, and ion exchange, serving industries, municipalities, and consumers seeking to address PFAS contamination.

PFAS Filtration Market Overview

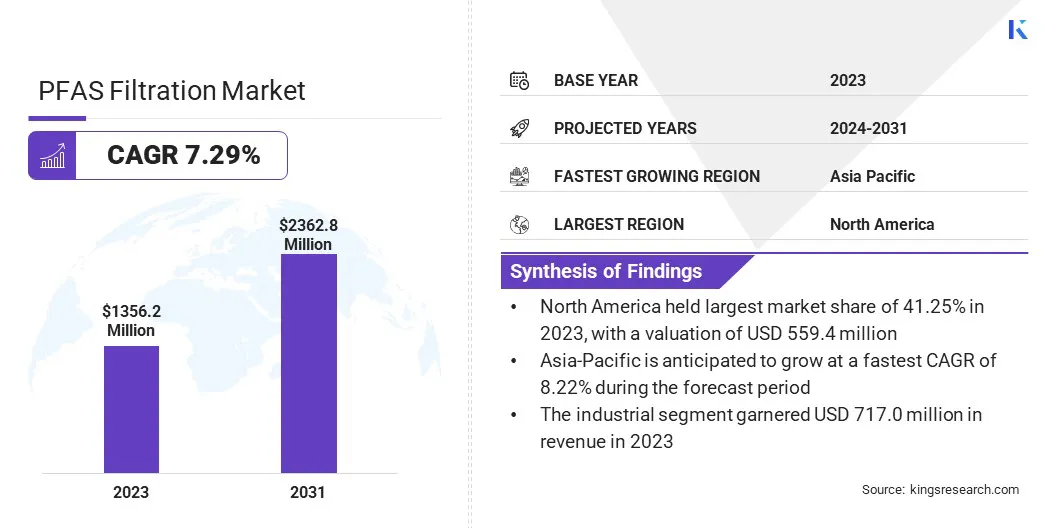

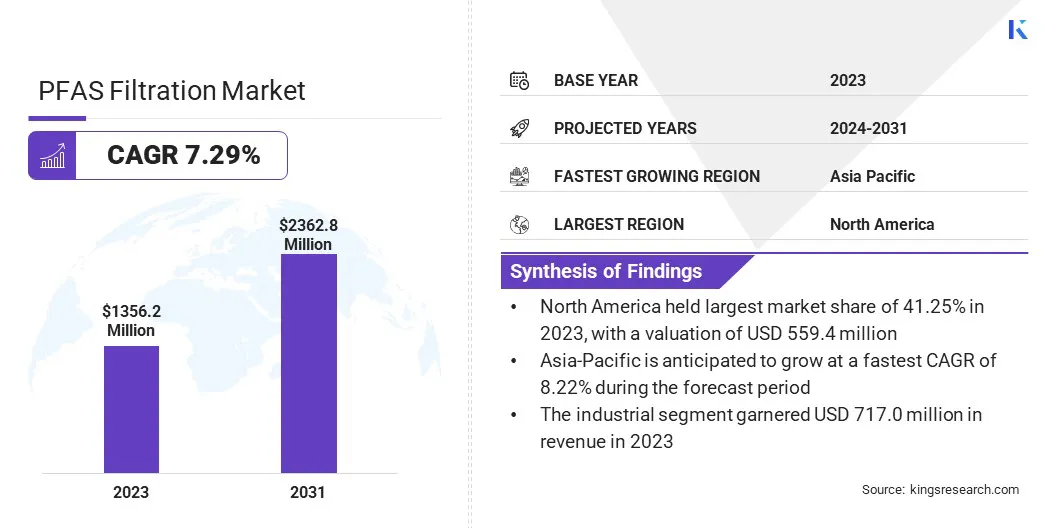

The global PFAS filtration market size was valued at USD 1356.2 million in 2023, which is estimated to be USD 1443.4 million in 2024 and reach USD 2362.8 million by 2031, growing at a CAGR of 7.29% from 2024 to 2031.

Environmental responsibility is a key growth driver of the market, as both private and public sectors prioritize sustainability. Efforts to mitigate pollution, protect ecosystems, and comply with environmental regulations have led to the increased demand for PFAS removal technologies.

Major companies operating in the PFAS filtration market are Veolia, Enviri Corporation., Jacobs, Cyclopure, TRC, WSP, Xylem, Battelle Memorial Institute, Calgon Carbon Corporation, REGENESIS, Minerals Technologies Inc, Newterra, Pentair, Aquasana, and LANXESS.

Research in the market has led to significant advancements in understanding and addressing PFAS contamination. Studies have focused on improving the efficiency of filtration technologies such as activated carbon, ion exchange, and reverse osmosis, as well as developing new materials for more effective removal of PFAS compounds.

This research is crucial in meeting the stringent regulatory standards and providing innovative solutions for industries and municipalities. As scientific efforts continue, the market is positioned for growth with enhanced, cost-effective PFAS removal technologies.

- In September 2024, MIT researchers developed a filtration material combining silk and cellulose to remove PFAS and heavy metals from water. This eco-friendly solution, detailed in ACS Nano, outperforms traditional filters, offering an antimicrobial, scalable alternative for water purification.

Key Highlights:

- The PFAS filtration industry size was valued at USD 1356.20 million in 2023.

- The market is projected to grow at a CAGR of 7.29% from 2024 to 2031.

- North America held a market share of 41.25% in 2023, with a valuation of USD 559.4 million.

- The activated carbon filtration segment garnered USD 693.7 million in revenue in 2023.

- The drinking water treatment segment is expected to reach USD 1139.1 million by 2031.

- The residential segment is anticipated to register the fastest CAGR of 7.57% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.22% during the forecast period.

Market Driver

"Increasing Health Concerns"

Increasing health concerns about the harmful effects of PFAS exposure are driving significant growth in the PFAS filtration market. Growing awareness regarding PFAS-linked health risks, including cancer, liver damage, and developmental issues, is boosting the demand for effective filtration technologies.

- In January 2025, a study by the Keck School of Medicine found that communities with PFAS-contaminated drinking water experience up to a 33% higher incidence of certain cancers.

Governments, industries, and consumers are prioritizing solutions to remove these "forever chemicals" from water, soil, and air. This growing health consciousness is propelling the market toward innovative filtration technologies, fueling both regulatory and consumer-driven demand for cleaner environments.

- In January 2024, Clean Earth launched the ReSolve program to address PFAS contamination. Leveraging over 30 years of expertise, the program offers innovative, customizable solutions for remediation, contributing to the growth of the market through effective, sustainable treatment options.

Market Challenge

"Lack of Public Awareness and Education"

One of the key challenges in the PFAS filtration market is the lack of public awareness and education regarding PFAS risks. While awareness is increasing, many communities remain unaware of the health dangers posed by these chemicals, leading to the slow adoption of filtration solutions.

This reaffirms the need for educational campaigns, clearer communication from regulatory bodies, and public outreach initiatives. By improving awareness through targeted messaging and community engagement, the market can drive faster adoption of PFAS filtration technologies, ultimately protecting public health.

Market Trend

"Technological Advancements"

Technological advancements are a key trend in the PFAS filtration market, with continuous innovations focused on improving the efficiency and cost effectiveness of filtration systems. New materials, such as advanced carbon-based filters, and hybrid technologies that combine multiple filtration methods are being developed.

These innovations aim to enhance the removal of PFAS from water sources, reduce operational costs, and increase the scalability of filtration solutions. As research progresses, these advancements are expected to drive better, more sustainable solutions for managing PFAS contamination globally.

- In Nov 2024, Battelle scientists are advancing PFAS science and providing innovative tools to tackle contamination. Their PFAS Signature tool uses advanced analytical chemistry and machine learning to identify PFAS sources, helping mitigate environmental damage and enabling efficient cleanup strategies.

PFAS Filtration Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Activated Carbon Filtration, Ion Exchange Resins, Others

|

|

By Application

|

Drinking Water Treatment, Industrial Water Treatment, Surface Water Treatment, Others

|

|

By End-User

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Activated Carbon Filtration, Ion Exchange Resins, Others): The activated carbon filtration segment earned USD 693.7 million in 2023, due to its effectiveness in removing PFAS compounds from water.

- By Application (Drinking Water Treatment, Industrial Water Treatment, Surface Water Treatment, Others): The drinking water treatment segment held 46.53% share of the market in 2023, due to the increasing consumer demand for PFAS-free water.

- By End User (Residential, Commercial, Industrial): The industrial segment is projected to reach USD 1266.9 million by 2031, owing to rising regulations on PFAS contamination and water treatment needs.

PFAS Filtration Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America acounted for a share of around 41.25% in 2023 in the global market, with a valuation of USD 559.4 million. North America is the dominant region in the PFAS filtration market, due to stringent environmental regulations and growing public awareness of PFAS contamination. The region’s high demand for effective water purification solutions, particularly in drinking and industrial water treatment, contributes to its market leadership.

Additionally, advancements in filtration technologies, coupled with increased government investments in water treatment infrastructure, further strengthen North America's position. The region's proactive stance on environmental issues continues to drive the adoption of PFAS filtration systems.

- In April 2024, Veolia marked a significant milestone in treating PFAS contamination, having treated 2.1 billion gallons of water across 30 sites in New York, New Jersey, and Pennsylvania. With innovative technologies, Veolia is providing regulated PFAS-free water to over 140,000 people.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 8.22% over the forecast period. Asia Pacific is the fastest-growing region in the PFAS filtration industry, driven by rapid industrialization, urbanization, and increasing concerns over water pollution.

Countries like China, India, and Japan are adopting advanced filtration technologies to address the rising PFAS contamination levels in water sources. Additionally, the growing industrial sector in Asia Pacific is leading to higher demand for water treatment solutions.

As regulatory frameworks strengthen and environmental awareness rises, the region is expected to register significant growth in PFAS filtration adoption and market expansion.

Regulatory Frameworks:

- In the U.S., the Environmental Protection Agency (EPA) protects people and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

- The Regulation on the registration, evaluation, authorisation and restriction of chemicals (REACH) is the main EU law to protect human health and the environment from the risks that can be posed by chemicals.

Competitive Landscape:

Recent advancements in the PFAS filtration industry have led to the introduction of innovative technologies aimed at improving efficiency and cost-effectiveness. These new solutions focus on enhancing the removal of PFAS compounds, addressing growing environmental concerns, and meeting evolving regulatory standards, thus supporting broader efforts to mitigate contamination.

- In October 2023, LANXESS expanded its PFAS removal solutions with the launch of Lewatit MonoPlus TP 109, a macroporous anion exchange resin for efficient water purification. This innovation, unveiled at Aquatech, enhances PFAS removal with sustainable regeneration capabilities, addressing growing environmental concerns.

List of Key Companies in PFAS Filtration Market:

- Veolia

- Enviri Corporation.

- Jacobs

- Cyclopure

- TRC

- WSP

- Xylem

- Battelle Memorial Institute

- Calgon Carbon Corporation

- REGENESIS

- Minerals Technologies Inc

- Newterra

- Pentair

- Aquasana

- LANXESS

Recent Developments (Launch/Partnership)

- In July 2024, Xylem introduced its MitiGATOR Mobile System for PFAS treatment. This mobile filtration solution, demonstrated during a construction project in Muskegon, Michigan, successfully treated 21 million gallons of water, achieving non-detectable PFAS levels, showcasing Xylem’s advanced water purification technology.

- In August 2024, Global Industrial introduced its GlobalPure PFAS water filter to address contamination from "forever chemicals" and microplastics in drinking water. The high-capacity filter, capable of filtering up to 3,600 gallons, is designed to reduce the frequency of filter replacements and ensure cleaner water. It is available as a replacement filter and standard feature on Global Industrial’s drinking fountains and bottle fillers, offering a practical solution for public and commercial spaces.

- In December 2023, Cyclopure introduced the Purefast Home80 and Purefast Home20 whole-home filters, utilizing DEXSORB adsorbent to remove PFAS to non-detect levels. These high-capacity systems offer affordable PFAS removal at one penny per gallon, with easy filter replacement and eco-friendly regeneration.

- In January 2024, Clean Earth, part of Enviri Corporation, partnered with the U.S. Department of Defense to advance PFAS remediation technologies. This collaboration aims to develop effective treatment options for PFAS contamination, leveraging Clean Earth’s expertise and facilities across the U.S.