5G Security Market Size

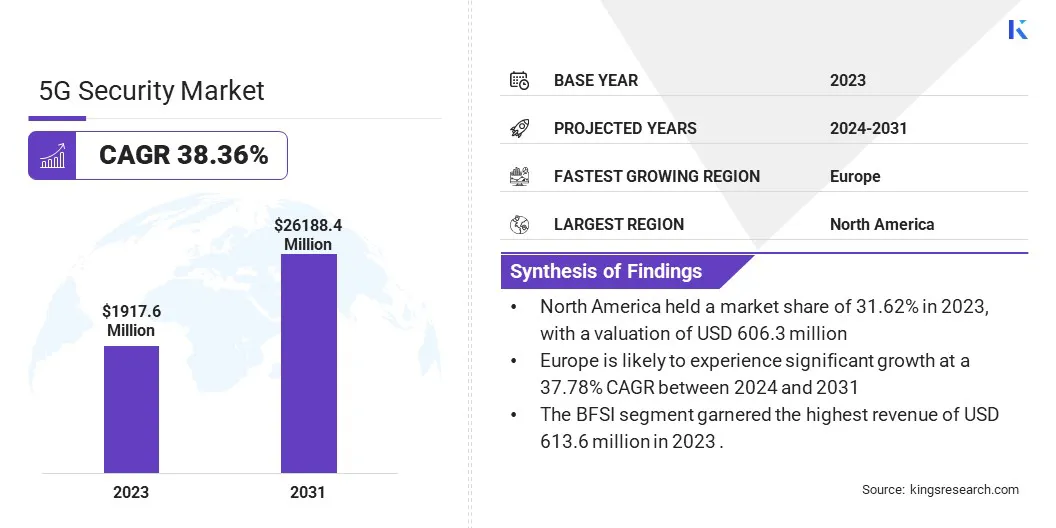

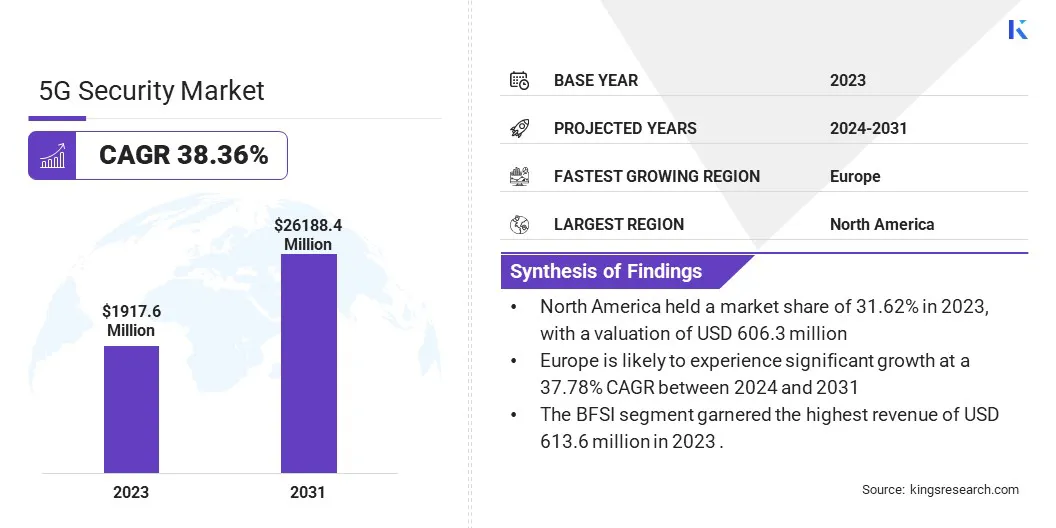

The global 5G Security Market size was valued at USD 1,917.6 million in 2023 and is projected to reach USD 26,188.4 million by 2031, growing at a CAGR of 38.66% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Telefonaktiebolaget LM Ericsson, Palo Alto Networks, Thales, Trend Micro Incorporated, AT&T, F5, Inc., Fortinet, Inc., Qualcomm Technologies, Inc., Intel Corporation, IBM Corporation, Nokia and others.

With the rapid deployment of 5G networks globally, there has been a noticeable surge in cyberattacks targeting 5G networks and infrastructure. These attacks exploit vulnerabilities inherent in the new 5G technology, posing significant threats to network integrity, data privacy, and critical infrastructure. Sophisticated attack vectors, such as DDoS attacks, ransomware, and identity theft, are utilizing the high-speed, low-latency capabilities of 5G networks to amplify their impact.

Moreover, the proliferation of connected devices and IoT endpoints expands the attack surface, making 5G networks more susceptible to exploitation. This surge in cyberattacks targeting 5G networks underscores the pressing need for robust security measures and proactive threat detection mechanisms to safeguard against evolving cyber threats and ensure the resilience of 5G infrastructure.

5G security involves a range of solutions and measures designed to protect 5G networks, infrastructure, and connected devices from cyber threats and vulnerabilities. These solutions include network security technologies such as firewalls, intrusion detection and prevention systems, and secure access gateways,. These technologies serve to mitigate risks and ensure the protection of sensitive data transmitted over 5G networks.

Additionally, identity and access management solutions play a crucial role in ensuring authorized access to network resources and preventing unauthorized access or data breaches. Industries such as telecommunications, healthcare, finance, and manufacturing are among the primary adopters of 5G security solutions, driven by the need to secure critical infrastructure, comply with regulatory requirements, and protect sensitive information from cyber threats.

Analyst’s Review

The 5G security market is witnessing robust growth driven by the increasing adoption of 5G technology worldwide. With the proliferation of connected devices and the exponential growth of data traffic, the need for comprehensive security solutions to protect 5G networks against cyber threats is growing.

The market is observing an upsurge in demand for advanced security solutions capable of addressing the unique challenges posed by 5G networks, such as network slicing vulnerabilities and the convergence of IT and OT environments.

Moreover, stringent regulatory mandates and industry standards are propelling the adoption of 5G security solutions across various sectors. The outlook for the market remains promising, supported by sustained investments in cybersecurity infrastructure.

5G Security Market Growth Factors

The growing demand for secure and reliable connectivity in IoT and critical applications is a significant driver propelling the expansion of the 5G security market. As organizations increasingly rely on 5G networks to support mission-critical applications and services, the need for robust security measures becomes paramount to protect against potential cyber threats and ensure uninterrupted operations.

Moreover, the proliferation of IoT devices and the deployment of 5G-enabled smart infrastructure amplify the demand for comprehensive security solutions capable of addressing the unique challenges posed by the convergence of IT and OT environments. By investing in advanced security technologies and implementing proactive threat detection mechanisms, organizations aim to mitigate risks and safeguard their networks, data, and users against evolving cyber threats.

The high initial investment costs associated with implementing comprehensive 5G security solutions present a significant restraint to market growth. Deploying robust security measures tailored to the unique needs of 5G networks requires substantial financial resources, particularly for organizations operating at scale or across multiple geographic locations.

Moreover, the complexity of 5G infrastructure and the dynamic nature of cyber threats necessitate ongoing investments in cybersecurity infrastructure, staff training, and technology upgrades to maintain effective protection against evolving threats.

These upfront costs may act as a barrier to entry for smaller organizations or those with limited budgets, potentially hindering the adoption of 5G security solutions. However, as the importance of securing 5G networks becomes increasingly apparent, organizations are likely to prioritize investments in cybersecurity to mitigate risks and ensure the resilience of their networks.

5G Security Market Trends

The increasing adoption of AI and machine learning for advanced threat detection is a prominent trend shaping the evolution of the 5G security market. As cyber threats become more sophisticated and pervasive, traditional security approaches are no longer sufficient to effectively detect and mitigate emerging threats.

AI-powered security solutions offer enhanced capabilities for proactive threat detection, anomaly detection, and behavioral analysis, enabling organizations to identify and respond to security incidents in real time.

By utilizing AI and machine learning algorithms, security teams strive to analyze vast amounts of data from diverse sources, detect patterns indicative of malicious activity, and promptly automate response actions to mitigate risks. This trend reflects a growing recognition of the importance of utilizing advanced technologies to strengthen 5G network security and effectively mitigate the evolving threat landscape.

Segmentation Analysis

The global 5G security market is segmented based on component, architecture, network security, end-user, vertical, and geography.

By Component

Based on component, the market is segmented into solution and services. The solution segment dominated the market with a share of 63.76% in 2023. Security solutions encompass a wide range of products and services designed to protect 5G networks, infrastructure, and endpoints from cyber threats and vulnerabilities. These solutions include network security technologies, endpoint security solutions, identity and access management solutions, encryption technologies, and security analytics platforms, among others.

The dominance of the solution segment underscores the critical role of security solutions in addressing the diverse security challenges posed by 5G networks and enabling organizations to safeguard their networks, data, and users against evolving cyber threats effectively.

By Architecture

Based on architecture, the market is categorized into 5G NR standalone and 5G NR non-standalone. The 5G NR non-standalone segment is anticipated to witness the highest growth of 39.20% CAGR over the forecast period.

5G NR non-standalone refers to a deployment model where 5G radio access technology is integrated with existing 4G infrastructure, enabling operators to leverage their existing network assets while transitioning to 5G. This deployment model offers a cost-effective approach to deploying 5G networks and accelerating the rollout of advanced services and applications.

As operators increasingly adopt 5G NR non-standalone deployments to meet the growing demand for high-speed connectivity and innovative services, the demand for security solutions tailored to this deployment model is expected to surge substantially. This surge is poised to contribute significantly to the growth of the 5G NR non-standalone segment over the estimated timeframe.

By Vertical

Based on vertical, the market is classified into manufacturing, BFSI, retail, energy & utilities, public safety, automotive & transportation, and others. The BFSI segment garnered the highest revenue of USD 613.6 million in 2023. The BFSI sector is a prime target for cyber-attacks due to the sensitive nature of financial data and the high value of assets at risk.

As financial institutions increasingly adopt digital transformation initiatives and integrate 5G technology to enhance customer experience and operational efficiency, the need for robust security solutions becomes paramount to protect against cyber threats and ensure regulatory compliance.

Moreover, stringent regulatory mandates and industry standards are driving investment in 5G security solutions within the BFSI sector, as organizations are seeking to safeguard customer data, prevent fraud, and maintain trust and credibility in the marketplace.

5G Security Market Regional Analysis

Based on region, the global 5G security market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America 5G Security Market share stood around 31.62% in 2023 in the global market, with a valuation of USD 606.3 million. This dominance can be attributed to several factors, including the early adoption of 5G technology, the presence of leading technology vendors and cybersecurity firms, and robust regulatory frameworks governing data privacy and security.

Moreover, the region's highly developed telecommunications infrastructure, strong focus on innovation and R&D, and increasing investments in cybersecurity are contributing to its leading position in the global 5G security market.

Additionally, North America boasts a mature cybersecurity ecosystem, characterized by a wealth of expertise in the development and deployment of advanced security solutions to effectively address evolving cyber threats. With a large market size and a conducive business environment, North America remains a key market for vendors and stakeholders in the 5G security space, offering lucrative opportunities for growth and innovation.

Europe is likely to experience significant growth at a 37.78% CAGR between 2024 and 2031 owing to the increasing adoption of 5G technology across various industry verticals, including telecommunications, healthcare, manufacturing, and transportation. This widespread adoption is expected to drive demand for advanced security solutions to protect against cyber threats and ensure the resilience of 5G networks.

Moreover, Europe's stringent regulatory environment, particularly regarding data privacy and security, is prompting organizations to invest in robust cybersecurity measures to comply with regulatory mandates and safeguard sensitive information.

Additionally, initiatives such as the European Commission's 5G Action Plan and Digital Single Market Strategy aim to accelerate the deployment of 5G networks and foster digital transformation across the region, thereby fueling regional market growth.

With favorable market conditions, strong government support, and increasing collaboration between industry stakeholders, Europe presents significant opportunities for vendors and investors in the 5G security market to capitalize on the region's growing demand for innovative security solutions.

Competitive Landscape

The global 5G security market will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in 5G Security Market

- Telefonaktiebolaget LM Ericsson

- Palo Alto Networks

- Thales

- Trend Micro Incorporated

- AT&T

- F5, Inc.

- Fortinet, Inc.

- Qualcomm Technologies, Inc.

- Intel Corporation

- IBM Corporation

- Nokia

Key Industry Developments

- February 2024 (Launch): Fortinet unveiled a new rugged appliance designed to bolster secure networking and 5G connectivity in operational technology (OT) environments. Supported by the latest Fortinet Security Processing Unit (SP5), the FortiGate Rugged 70G with 5G Dual Modem delivered exceptional networking performance and advanced security services, catering to diverse applications, including remote ATMs in the banking industry.

- May 2023 (Expansion): Turk Telekom, the integrated telecommunication operator, chose A10 Thunder TPS from A10 Networks to provide DDoS protection services to its business clientele. This service ensured the protection of critical infrastructure against DDoS attacks, thereby improving service access reliability for subscribers through A10 Networks' on-premises DDoS protection solution.

The Global 5G Security Market is Segmented as:

By Component

By Architecture

- 5G NR Standalone

- 5G NR Non-Standalone

By Network Security

- RAN Security

- Core Security

By End-User

- Enterprises

- Telecom Operators

By Vertical

- Manufacturing

- BFSI

- Retail

- Energy & Utilities

- Public Safety

- Automotive & Transportation

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America