Market Definition

3D animation software is a computer program used to create, design, and manipulate three-dimensional digital models. It allows users to apply textures, lighting, and motion to generate realistic or stylized animations for films, games, simulations, and virtual environments. The software supports character animations, visual effects, and motion graphics using key frames, rigging, and physics-based simulations.

3D Animation Software Market Overview

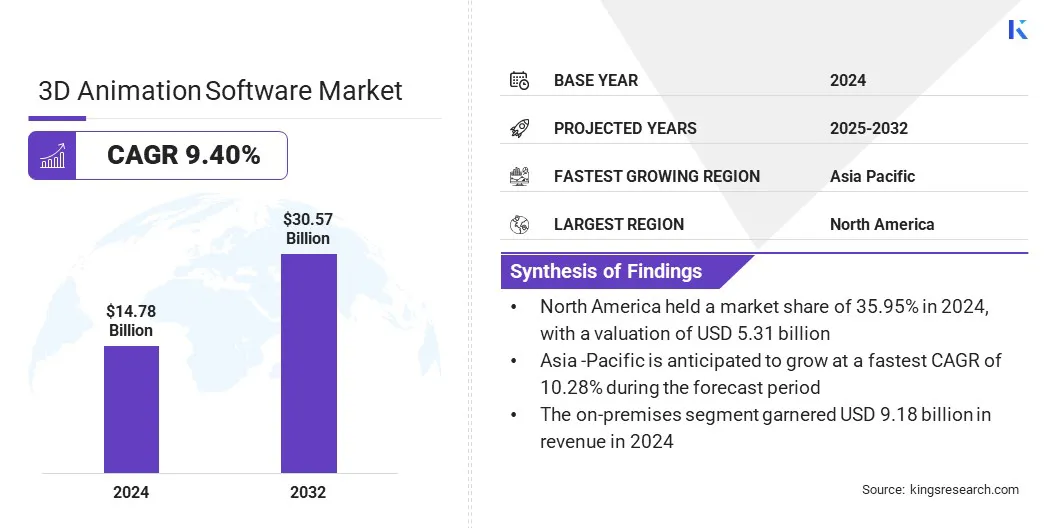

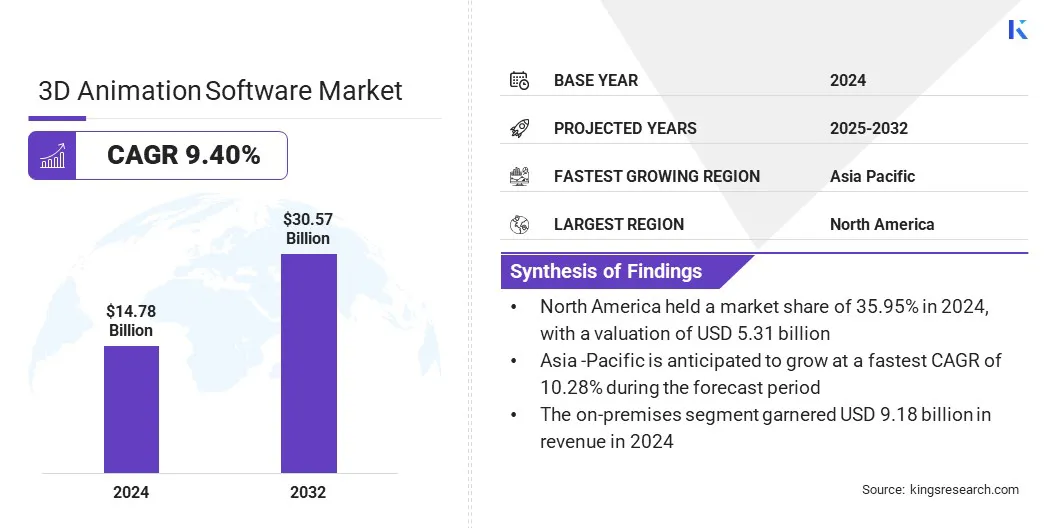

The global 3D animation software market size was valued at USD 14.78 billion in 2024 and is projected to grow from USD 16.10 billion in 2025 to USD 30.57 billion by 2032, exhibiting a CAGR of 9.40% during the forecast period.

This notable growth is driven by increasing demand for visually immersive and realistic experiences, prompting studios and media companies to adopt advanced 3D animation software for efficient, high-quality content creation. Additionally, the growth of VR and AR technologies in gaming, training, and interactive media is increasing the adoption of 3D animation tools that seamlessly integrate with immersive environments.

Key Highlights:

- The3D animation software industry size was recorded at USD 14.78 billion in 2024.

- The market is projected to grow at a CAGR of 9.40% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 5.31 billion.

- The on-premises segment garnered USD 9.18 billion in revenue in 2024.

- The large enterprises segment is expected to reach USD 17.11 billion by 2032.

- The government segment is anticipated to witness the fastest CAGR of 9.71% through the projection period.

- Asia Pacific is anticipated to grow at a CAGR of 10.28% over the forecast period.

Major companies operating in the global 3D animation software market are Adobe, Autodesk Inc, SideFX, Maxon Computer GMBH, The Foundry Visionmongers Ltd, DEEPMOTION, INC, NVIDIA Corporation, Zco Corporation, LightWave Digital Ltd, AutoDesSys, Inc, Reallusion Inc, Daz Productions Inc, Luxion, Inc, Blackmagic Design Pty. Ltd, and CLO Virtual Fashion, LLC.

Rising investments by market players in 3D animation software startups are fueling market growth by enabling companies to scale operations and expand into new regions. Increased funding supports product advancement, fosters higher-quality content creation, and accelerates market growth.

- In October 2024, Swoove Studios secured USD 7.5 million in a seed funding round to expand its presence in Europe and the U.S. and enhance its 3D animation software offerings.

Market Driver

Government Initiatives and Training Programs

A major factor fueling the expansion of the 3D animation software market is the increasing support from government initiatives to promote digital skill development and encourage professional training in animation and VFX.

An expanding pool of skilled talent allows studios to adopt advanced 3D animation software more effectively, improving productivity and content quality. This workforce supports higher-quality content across films, gaming, and digital media, fosters innovation, and boosts wider adoption of cutting-edge technologies, contributing to sustained market growth.

- In August 2025, the Ministry of Information and Broadcasting launched a fully residential 3D Animation and VFX training program for professionals from the North Eastern region to enhance skilled talent availability.

Market Challenge

High Cost of Advanced 3D Animation Software

A key challenge impeding the progress of the 3D animation software market is the high cost of advanced solutions, including premium 3D modeling, VFX, and AI-powered animation tools. These costs place financial pressure on studios, independent creators, and educational institutions, and limit access for smaller operators. The requirement for compatible hardware, workforce training, and ongoing subscription or licensing fees further increases the overall financial burden.

To address this challenge, market players are offering flexible licensing models, including subscription-based plans, freemium versions, and educational discounts. They are also providing cloud-based solutions that reduce hardware requirements and overall costs for studios, independent creators, and educational institutions.

Additionally, vendors are enhancing user experience through intuitive interfaces, training programs, and online resources to streamline learning and improve workflow efficiency.

Market Trend

Growing Adoption of AI-Powered Tools

A key trend influencing the 3D animation software market is the growing adoption of AI-powered tools that streamline animation and visual effects workflows. Studios are leveraging intelligent systems to automate complex tasks such as scene reconstruction, character animation, and visual effects integration.

These technologies enable faster production, greater creative control, higher-quality outputs, and reduced repetitive manual work. This shift fosters innovation, improves operational efficiency, and prompts broader adoption of advanced 3D animation solutions in the media and entertainment sector.

- In October 2024, Wonder Dynamics launched Wonder Animation, a beta feature leveraging Video to 3D scene technology to convert video sequences into fully animated 3D scenes. The tool enhances workflow efficiency, retains creative control, and enhances the production of high-quality animated content.

3D Animation Software Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

On-premises, Cloud-based

|

|

By Organization

|

Small & Medium Enterprises, Large Enterprises

|

|

By Vertical

|

Media & Entertainment, Construction, Automotive, Healthcare, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Deployment (On-premises and Cloud-based): The on-premises segment earned USD 9.18 billion in 2024, primarily due to the demand for data control, security, and customization in large-scale animation and VFX projects.

- By Organization (Small & Medium Enterprises, and Large Enterprises): The large enterprises segment held 57.51% of the market in 2024, supported by higher budgets, advanced infrastructure, and strong demand for sophisticated 3D animation solutions.

- By Vertical (Media & Entertainment, Construction, Automotive, Healthcare, Government, and Others): The media & entertainment segment is projected to reach USD 9.15 billion by 2032, fueled by rising demand for high-quality content in films, gaming, and digital media.

3D Animation Software Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America 3D animation software market share stood at 35.95% in 2024, valued at USD 5.31 billion. This dominance is reinforced by the rising demand for high-quality digital content across films, gaming, and advertising that requires advanced 3D tools.

Increasing adoption of virtual reality (VR), augmented reality (AR), and AI-powered animation solutions is enhancing workflow efficiency for studios and artists. Additionally, strategic investments and acquisitions by key players are accelerating innovation, streamlining complex production processes, and promoting wider adoption of advanced 3D animation technologies across media and entertainment sectors.

- In May 2024, Autodesk acquired Wonder Dynamics to integrate cloud-based AI into 3D animation workflows. It enables artists to create high-quality content more efficiently by simplifying complex workflows.

The Asia-Pacific 3D animation software industry is set to grow at a CAGR of 10.28% over the forecast period. This growth is attributed to the rapid expansion of the entertainment and gaming industries across the region , which is creating strong demand for localized and high-quality animated content. Increasing adoption of mobile gaming and digital streaming platforms is highlighting the need for innovative 3D animation tools.

Government initiatives such as animation and VFX training program for professionals are supporting skill development and fostering local creative talent in the region. Additionally, the integration of cutting-edge imaging and spatial content technologies is enabling more immersive and efficient 3D production, propelling regional market growth.

- In January 2025, Sony launched XYN, an integrated software and hardware solution for spatial 3D content creation. The platform leverages advanced imaging, sensing, and display technologies to capture real-world objects and motion, streamline workflows, and support diverse 3D CG production.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates digital media and software products, including 3D animation software used in broadcasting, streaming, and online platforms. It ensures compliance with communication standards, intellectual property protections, data security, and consumer privacy, promoting safe and lawful use across entertainment and commercial applications.

- In the UK , the Office of Communications (Ofcom) regulates digital content distribution and software platforms, including 3D animation applications. It oversees licensing, copyright compliance, content standards, and online safety, ensuring ethical use, protecting intellectual property, and supporting innovation while safeguarding consumers and creators.

- In China, the State Administration for Market Regulation (SAMR) regulates 3D animation software by enforcing market standards, cybersecurity rules, and intellectual property protections. It oversees licensing, distribution, and content safety.

- In India, the Ministry of Information and Broadcasting (MIB) regulates 3D animation software employed in films, gaming, and digital media. It oversees licensing, content standards, intellectual property, and broadcasting compliance.

Competitive Landscape

Major players operating in the 3D animation software industry are expanding their capabilities through strategic acquisitions of specialized 3D animation studios. They are strengthening their talent pool with skilled professionals in animation, VFX, and 3D content creation.

Companies are optimizing production workflows to deliver higher-quality outputs across media, gaming, and entertainment projects. Additionally, they are leveraging advanced VFX workflows, AI-powered animation tools, and 3D content creation systems to address the rising demand for sophisticated 3D animation solutions.

- In February 2024, Magic Media acquired Interactive Creation, a North Macedonian studio specializing in 3D, animation, and VFX. The acquisition expands Magic Media’s creative and technical capabilities, expands its talent pool, and enhances content production across games and media.

Key Companies in 3D Animation Software Market:

- Adobe

- Autodesk Inc

- SideFX

- Maxon Computer GMBH

- The Foundry Visionmongers Ltd

- DEEPMOTION, INC

- NVIDIA Corporation

- Zco Corporation

- LightWave Digital Ltd

- AutoDesSys, Inc

- Reallusion Inc

- Daz Productions Inc

- Luxion, Inc

- Blackmagic Design Pty. Ltd

- CLO Virtual Fashion, LLC.

Recent Developments (Product Launch)

- In October 2024, Adobe released major 3D and motion design upgrades for After Effects, enhancing native 3D tools and enabling seamless integration of 3D objects with 2D footage. These updates streamline workflows, improve creative efficiency, and make 3D animation more accessible.