Market Definition

Porcelain enamel are glassy, inorganic coatings applied to metal substrates to create a durable, corrosion-resistant, and heat-tolerant surface. Produced through a fusion process, they enhance both functional and aesthetic properties of the underlying material.

They are widely used in cookware, bakeware, sanitaryware, appliances, and heating equipment as they offer resistance to chemicals, abrasion, and high temperatures. They are also used in industrial equipment and architectural components to impart long-term durability and visual appeal.

Porcelain Enamel Coatings Market Overview

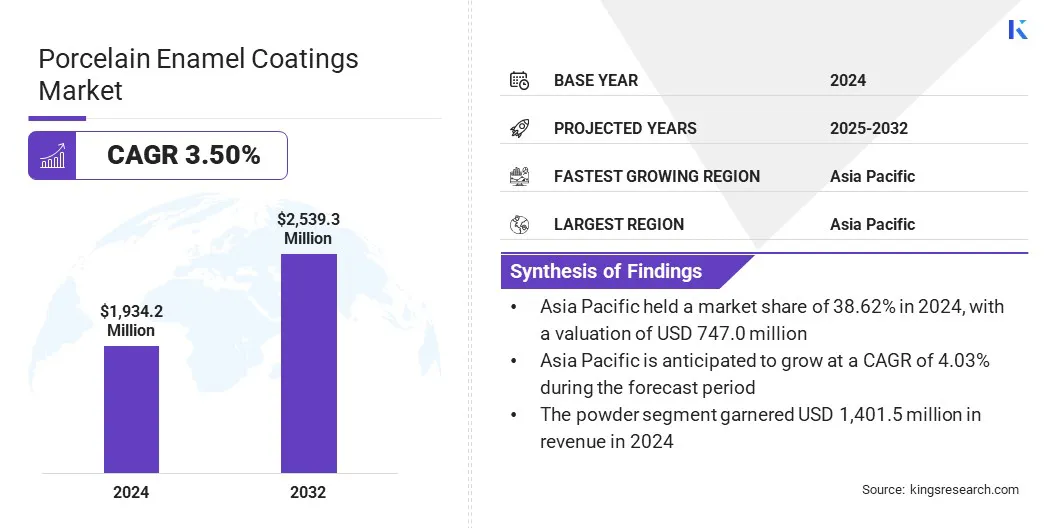

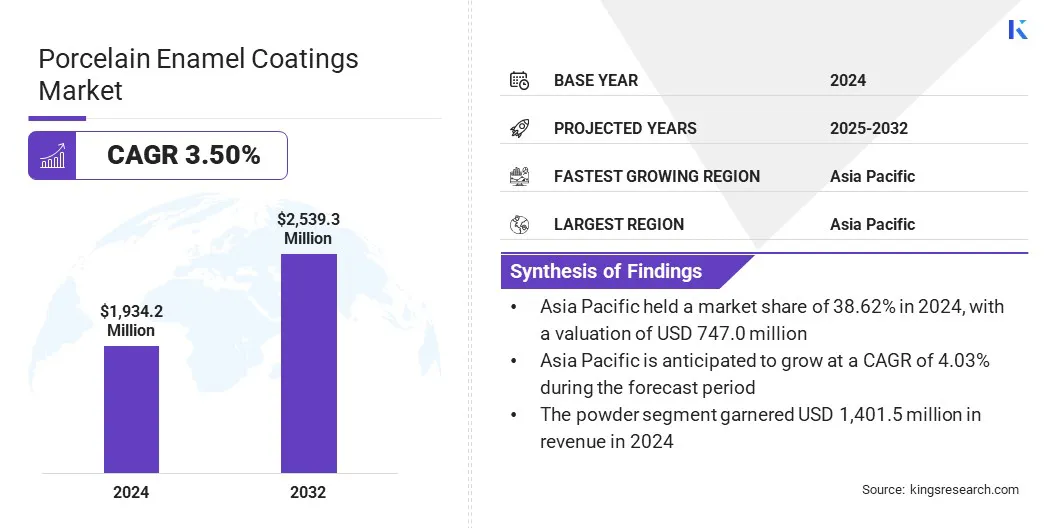

The global porcelain enamel coatings market size was valued at USD 1,934.2 million in 2024 and is projected to grow from USD 1,995.3 million in 2025 to USD 2,539.3 million by 2032, exhibiting a CAGR of 3.50% over the forecast period.

This growth is driven by the rising demand for corrosion-resistant and heat-tolerant coatings for cookware, sanitaryware, appliances, and heating equipment. Their increasing use in industrial components and architectural applications is also supporting market expansion by offering enhanced durability and design flexibility.

Key Market Highlights:

- The porcelain enamel coatings industry size was valued at USD 1,934.2 million in 2024.

- The market is projected to grow at a CAGR of 3.50% from 2025 to 2032.

- Asia Pacific held a share of 38.62% in 2024, valued at USD 747.0 million.

- The powder segment generated USD 1,401.5 million in revenue in 2024.

- The cookware & bakeware segment is expected to reach USD 698.7 million by 2032.

- The industrial segment is anticipated to witness the fastest CAGR of 4.04% over the forecast period.

- North America is anticipated to grow at a CAGR of 3.36% through the projection period.

Major companies operating in the porcelain enamel coatings market are Vibrantz, Colorobbia Holding S.p.A, Akcoat, Hunan Noli Enamel Co., Ltd, PEMCO International, Roesch Inc., Capron Manufacturing, TOMATEC CO., LTD., HAE KWANG ENAMEL INDUSTRIAL CO., LTD., A.O. Smith Corporation, Sinopigment & Enamel Chemicals Ltd., GWIPPO, The Sherwin-Williams Company, PolyVision Corporation, and Ferro SA.

The growing focus from manufacturers and end users on long-lasting, low-maintenance, and visually appealing surfaces is strengthening integration of porcelain enamel coatings across multiple industries. Additionally, ongoing advancements in coating technologies, process innovations, and strategic collaborations are accelerating global market expansion.

Market Driver

Increasing Demand in Household Applications

The rising use of porcelain enamel coatings is fueled by the demand in household applications, particularly cookware, bakeware, sanitaryware, and home appliances. These coatings provide heat resistance, corrosion protection, and smooth finishes that enhance both functionality and appearance.

Residential appliances like ovens, washing machines, and kitchen fixtures are increasingly incorporating enamel coatings for durability and easy cleaning. Increasing consumer preference for durable, low-maintenance materials and premium household products, is making porcelain enamel a preferred choice in residential applications.

- In August 2025, MDPI Coatings published a study evaluating the chemical resistance of porcelain enamel coatings on steel in neutral, acidic, and alkaline solutions. The study found that heavy metal leaching remained below European safety limits, confirming their suitability for cookware, sanitaryware, and storage tanks.

Market Challenge

Limited Substrate Compatibility & Design Versatility

Limited substrate compatibility and design versatility hamper the growth of the porcelain enamel coatings market. These coatings are suitable for metal substrates such as steel and cast iron, while alternative materials like aluminum, composites, or plastics remain largely incompatible.

The enameling process also requires specific surface characteristics and shapes, which restricts flexibility for complex or customized components.

Industries seeking lightweight, intricately designed, or multifunctional products face additional difficulties, as the material and process restricts adoption and innovation. Shortages of compatible substrates and the technical requirements for precise coating application also add to these challenges.

To overcome these limitations, manufacturers are exploring modified formulations, hybrid coating technologies, and process innovations to improve substrate compatibility and design flexibility. These advancements aim to broaden application scope, improve product versatility, and enhance the commercial potential of porcelain enamel coatings.

Market Trend

Adoption of Advanced Coating Technologies

The porcelain enamel coatings market is undergoing a significant shift toward the implementation of next-generation coating technologies fueled by the need for higher durability, energy efficiency, and improved aesthetic performance.

Advanced techniques such as low-temperature enameling, improved pre-treatment processes, and hybrid formulations offer superior coating adhesion, corrosion resistance, and visual quality. These are particularly valuable for household appliances, industrial equipment, and architectural components, where performance and appearance are critical.

- In September 2023, a study published in Applied Sciences by MDPI examined the use of porcelain enamel coatings for building façades. These inorganic coatings provide a glossy finish, high chemical resistance, and have protective properties. The research evaluated their potential in architectural applications, combining durability with aesthetic appeal for building exteriors.

Manufacturers are increasingly using innovative coating technologies to optimize production efficiency, reduce energy consumption, and expand application possibilities.

These advancements support higher product standards, lower operational costs, and stronger market competitiveness. The focus on technological innovation positions advanced coating processes as drivers of improved product performance and sustainable market growth.

Porcelain Enamel Coatings Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Powder, and Liquid

|

|

By Application

|

Cookware & Bakeware, Sanitaryware, Appliances, Heating & Cooling Equipment, Industrial Equipment, and Others

|

|

By End Use

|

Residential, Commercial, and Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Powder, and Liquid): The powder segment earned USD 1,401.5 million in 2024 mainly due to its superior durability, corrosion resistance, and widespread use in household and industrial applications.

- By Application (Cookware & Bakeware, Sanitaryware, Appliances, Heating & Cooling Equipment, Industrial Equipment, and Others): The cookware & bakeware held a share of 28.37% in 2024, propelled by strong consumer demand for durable, heat-resistant, and easy-to-clean kitchen products.

- By End Use (Residential, Commercial, and Industrial): The residential segment is projected to reach USD 1,015.8 million by 2032, owing to increasing consumer preference for durable, low-maintenance, and aesthetically appealing household products.

Porcelain Enamel Coatings Market Regional Analysis

The global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America, by region.

The Asia Pacific porcelain enamel coatings market share stood at 38.62% in 2024, valued at USD 747.0 million. This leadership is supported by rapid urbanization, rising incomes, and a strong demand for household appliances, cookware, and industrial equipment.

Construction and infrastructure growth, along with local manufacturing and advanced technologies, are increasing the use of durable and aesthetically appealing coatings. Additionally, continuous improvements in enameling processes, pre-treatment techniques, and hybrid formulations make Asia Pacific a leading hub for innovation and market growth.

The North America porcelain enamel coatings industry is projected to grow at a CAGR of 3.36% over the forecast period. This growth is fueled by steady demand for high-quality products, increasing usage in industrial applications, and the expansion of advanced manufacturing capabilities.

Technological advancements, process innovations, and investments in durable and efficient enameling techniques are also promoting the sector.

The preference for low-maintenance, long-lasting, and aesthetically appealing products is creating strong opportunities for porcelain enamel applications. In addition, improvements in hybrid formulations, pre-treatment processes, and energy-efficient coating technologies positions North America as a key contributor to global market growth.

Regulatory Frameworks

- In the European Union, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulates the production and use of chemical substances. It ensures safe handling of chemicals used in enamel coatings, mitigating risks to human health and the environment.

- In the U.S., the Toxic Substances Control Act (TSCA) regulates the manufacturing, import, and use of chemical substances. It mandates pre-market notification, safety evaluation, and reporting for chemicals in coatings, supporting environmental and consumer safety.

- In Japan, the Chemical Substances Control Law (CSCL) regulates the manufacture and import of chemical substances. It requires risk assessment and notifications for coating chemicals, supporting safe production practices and environmental protection.

Competitive Landscape

Companies operating in the porcelain enamel coatings industry are maintaining competitiveness through investments in advanced coating technologies, process innovations, and hybrid formulations. They are focusing on developing products with enhanced durability, corrosion resistance, and aesthetic appeal to meet growing demand across household, industrial, and architectural applications.

Key players are expanding their portfolios to include powder and liquid coatings, decorative finishes, and functional enamel solutions, supported by strategic collaborations, acquisitions, and joint ventures. They are strengthening partnerships with research institutions and equipment suppliers to improve process efficiency and product quality.

Additionally, companies are enhancing technical expertise, customer support, and integrated service offerings, using automation and digital tools to optimize production and sustain a competitive advantage.

Key Companies in Porcelain Enamel Coatings Market:

- Vibrantz

- Colorobbia Holding S.p.A

- Akcoat

- Hunan Noli Enamel Co., Ltd

- PEMCO International

- Roesch Inc.

- Capron Manufacturing

- TOMATEC CO., LTD.

- HAE KWANG ENAMEL INDUSTRIAL CO., LTD.

- O. Smith Corporation

- Sinopigment & Enamel Chemicals Ltd.

- GWIPPO

- The Sherwin-Williams Company

- PolyVision Corporation

- Ferro SA

Recent Developments

- In August 2025, NCP Coatings LLC acquired Glyptal Inc. to expand its expertise in specialty enamel coatings for electrical insulation and automotive engines. The acquisition enhances NCP’s portfolio while supporting continued operations of the Glyptal brand under NCP’s Michigan headquarters.