The semiconductor industry is undergoing one of the most transformative phases in its history. According to the Semiconductor Industry Association (SIA), global semiconductor industry sales reached USD 53.1 million in August 2024, reflecting a 20.6% year-over-year increase (Source: https://www.semiconductors.org/). This surge underscores growing demand for advanced manufacturing systems, particularly atomic layer deposition (ALD) equipment, which is critical for producing high-performance devices. ALD technology enables ultra-thin film deposition with atomic precision, making it indispensable in next-generation semiconductor fabrication and battery production.

Beyond semiconductors, ALD equipment is becoming vital in the clean energy revolution. The U.S. Department of Energy (DOE) allocated up to USD 3.5 billion in 2023 to boost domestic production of advanced batteries and battery materials under the Bipartisan Infrastructure Law (Source: https://www.reuters.com/). This funding targets the development of next-generation battery chemistries, including traditional lithium-ion systems, where ALD systems are essential to improving performance and longevity. For industrialists, understanding ALD equipment’s role in these sectors is more than an operational matter; it is a strategic imperative.

What is ALD Equipment and Why Does It Matter?

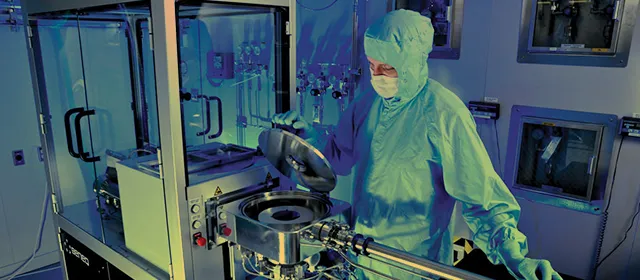

Atomic layer deposition (ALD) equipment is specialized machinery used in semiconductor manufacturing to deposit thin films with atomic-scale precision. These thin films serve a range of purposes, from insulating layers and gate dielectrics to corrosion protection in advanced batteries. ALD is distinguished by its ability to control thickness at the atomic level, ensuring high uniformity and reliability in complex micro- and nano-scale structures.

For semiconductor manufacturing, ALD equipment enables scaling down to sub-10nm nodes while maintaining signal integrity and performance. In battery production, ALD is used to coat electrodes with protective layers that extend battery life and improve energy density. Industrialists must recognize that ALD technology is not just a manufacturing tool; it is a key driver of product differentiation and competitive advantage.

How is the Global Semiconductor Landscape Driving ALD Demand?

Semiconductor manufacturing capacity is highly concentrated geographically. According to the SIA, approximately 75% of global semiconductor manufacturing capacity is concentrated in China and East Asia, with Taiwan and South Korea accounting for 100% of the world’s most advanced (sub-10 nanometer) chip production, with shares of 92% and 8%, respectively. This concentration has significant implications for ALD equipment demand. Advanced chip production requires highly sophisticated ALD tools to deliver the precision necessary for nanoscale manufacturing.

This geographic concentration also means that industrialists need to consider not only technological capabilities but also geopolitical factors when investing in ALD equipment. Supply chain resilience, proximity to manufacturing hubs, and technology partnerships become crucial factors in the strategic planning of semiconductor companies. The growth of semiconductor fabrication in the Asia-Pacific region inevitably drives demand for advanced ALD systems in these regions.

What Are the Current Technological Trends in ALD Equipment?

According to Kings Research, the global ALD equipment market is projected to register a revenue of $29,097.9 million by 2031. The demand for ALD systems is being shaped by several technological trends.

One major trend is the scaling of semiconductor nodes. As device architectures move toward sub-10nm nodes, the complexity of deposition processes increases dramatically. ALD technology provides the precision and uniformity required for these advanced nodes, enabling the fabrication of smaller, faster, and more energy-efficient chips.

In battery manufacturing, ALD equipment is enabling innovations that extend battery life, improve safety, and increase energy density. The DOE’s USD 3.5 billion funding initiative in 2023 reflects the strategic importance of ALD in the clean energy sector (Source: https://www.reuters.com/). This investment not only accelerates research and development in battery chemistries but also stimulates demand for ALD equipment in production-scale battery fabrication facilities.

Furthermore, the trend toward integrating ALD with other advanced manufacturing techniques, such as atomic precision etching and in-situ monitoring, is reshaping how fabrication lines operate. Industrialists need to consider these trends when evaluating ALD equipment investments, as they directly impact productivity, cost efficiency, and product innovation.

Where is ALD Equipment Most Critical?

ALD equipment plays a pivotal role across several industries. In semiconductors, it is essential to produce microprocessors, memory devices, and logic chips with extremely fine geometries. In the energy sector, ALD systems are critical for producing high-performance battery materials, including advanced cathode and anode coatings. In other sectors, such as optics and MEMS (Micro-Electro-Mechanical Systems), ALD provides conformal coatings that enhance durability and functionality.

For industrialists, understanding where ALD systems are most critical enables better strategic decisions on technology investment and capacity planning. As industries such as automotive electronics and clean energy continue to grow, the need for high-performance ALD systems will expand accordingly.

ALD Equipment Adoption Challenges

Despite the benefits, ALD equipment adoption has challenges. First, ALD systems are highly specialized and expensive, a big capital expense for manufacturers. Companies need to justify that investment in terms of performance, yield, and product differentiation.

Second, ALD processes are complex and require skilled operators and integration into highly automated production lines. For industrialists, workforce training and process optimization are key to getting the most out of ALD technology.

Lastly, the geopolitical concentration of semiconductor manufacturing affects ALD equipment supply chains. Being dependent on Asia-Pacific manufacturing hubs means one needs to plan for potential disruptions, whether from geopolitical tensions or trade restrictions. Strategic partnerships and diversified supply chains will be the key to mitigating those risks.

How is ALD Equipment Fostering Innovation in Batteries and Clean Energy?

ALD equipment is increasingly central to innovations in the battery sector, particularly for electric vehicles (EVs) and energy storage systems. The International Energy Agency (IEA) reported in 2024 that new electric car registrations in the United States reached 1.4 million in 2023, marking an increase of over 40% compared to 2022. This rapid EV adoption is driving demand for batteries with higher energy density, longer cycle life, and improved safety.

ALD technology enables the deposition of ultra-thin, uniform coatings that protect battery electrodes and improve performance. For industrialists in battery manufacturing, integrating ALD systems into production lines can be a strategic differentiator, helping to meet both performance requirements and sustainability goals. DOE funding programs further encourage adoption of ALD-enabled battery production, providing both financial incentives and a competitive edge.

What’s Next for ALD Equipment?

ALD equipment is looking good, driven by demand in semiconductors, batteries, and emerging tech. As chip architectures get more complex and battery performance requirements increase, ALD will remain a core enabler. Industrialists should expect growth in demand for ALD tools that can do more, cost less, and be more flexible.

And as sustainability becomes the key driver of industrial investment, ALD equipment will be key to reducing waste, improving energy efficiency, and green manufacturing. Companies that get in early with ALD will be ahead of the curve in innovation and sustainability.

Why Industrialists Should Invest in ALD Now

For industrialists, the decision to invest in ALD equipment is a technological and strategic one. ALD is at the forefront of innovation in semiconductors and batteries with proven benefits in performance, reliability, and sustainability. With the semiconductor industry growing fast and clean energy investments accelerating, it’s time to integrate ALD into your manufacturing process.

Investing in ALD means a competitive advantage and being ready for the next big breakthrough. For industrial leaders, ALD equipment is not just a tool – it’s the path to high-performance manufacturing.

Final Thoughts

ALD equipment is changing manufacturing across high-tech industries. From sub-10nm semiconductors to next-gen battery materials, it’s the precision and versatility that make it essential. The concentration of semiconductor capacity in Asia-Pacific, government investment in battery tech, and the surge in EVs all point to a big growth trajectory for ALD systems. For industrialists, understanding this landscape and acting to get ALD equipment will be key to staying competitive in the next decade.