enquireNow

IT Spending in Energy Market

IT Spending in Energy Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services), By Technology (IoT, Data Analytics, Cybersecurity, Business Intelligence, Others), By Deployment (On-Premises, Cloud-based, Hybrid), By Organization Size, By Application and Regional Analysis, 2025-2032

pages: 210 | baseYear: 2024 | release: August 2025 | author: Antriksh P.

Market Definition

IT spending in energy refers to investments by energy companies, utilities, and related stakeholders in information technology systems, software, infrastructure, and services to enhance operational efficiency, energy security, sustainability , and regulatory compliance.

This encompasses technologies such as cloud computing, data analytics, artificial intelligence (AI), machine learning (ML), enterprise resource planning (ERP) systems, cybersecurity solutions, and Internet of Things (IoT)-enabled devices.

It also includes expenditures on workforce training, IT consulting, and digital platforms for predictive maintenance and automation. As energy systems become more complex and decentralized, strategic IT investments are critical for ensuring adaptability, sustainability, and competitiveness in the global market.

IT Spending in Energy Market Overview

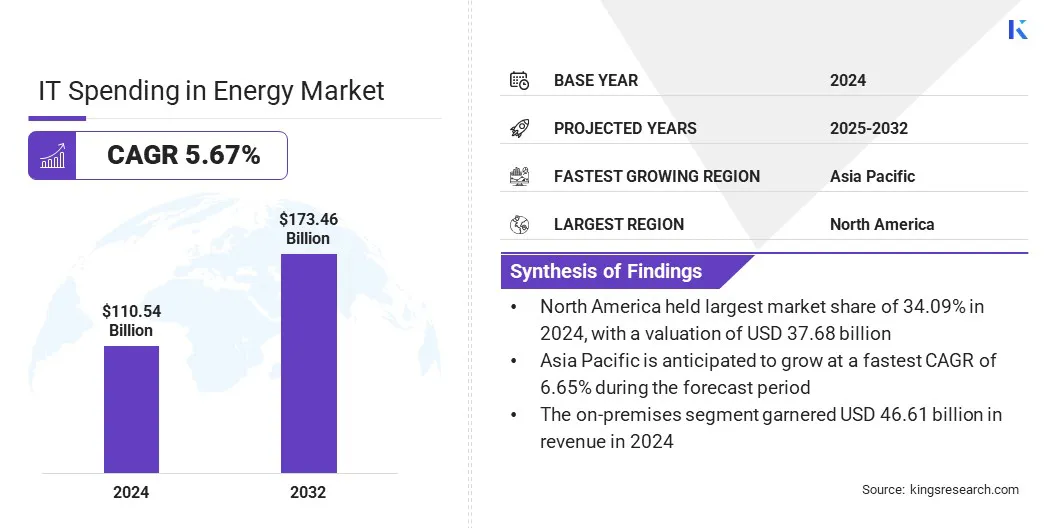

The global IT spending in energy market size was valued at USD 110.54 billion in 2024 and is projected to grow from USD 116.13 billion in 2025 to USD 173.46 billion by 2032, exhibiting a CAGR of 5.67% during the forecast period.

This growth is mainly fueled by the convergence of AI/ML and IoT in smart energy operations, as energy firms increasingly adopt scalable, data-driven solutions to improve reliability, efficiency, and cost-effectiveness across legacy and renewable infrastructures.

The adoption of digital twin technology in energy operations is influencing the market by enhancing asset performance, operational efficiency, and sustainability. Energy companies are deploying digital twins across power plants, oil rigs, wind farms, and transmission networks to simulate operations, predict failures, and optimize resource utilization.

Key Highlights:

- The IT spending in energy industry was recorded at USD 110.54 billion in 2024.

- The market is projected to grow at a CAGR of 5.67% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 37.68 billion.

- The software segment garnered USD 42.68 billion in revenue in 2024.

- The IoT segment is expected to reach USD 48.76 billion by 2032.

- The cloud-based segment is anticipated to witness the fastest CAGR of 5.78% over the forecast period.

- The small and medium enterprises segment garnered USD 66.26 billion in revenue in 2024.

- The oil & gas segment is expected to reach USD 45.55 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.65% through the projection period.

Major companies operating in the IT spending in energy market are Accenture, TATA Consultancy Services Limited, Infosys Limited, Capgemini, IBM Corporation, Wipro, HCL Technologies Limited, CGI Inc., Cognizant, Siemens, Microsoft, Schneider Electric, Oracle, Amazon Web Services, Inc., and Google LLC.

By creating a digital counterpart of complex infrastructure, operators can test scenarios, monitor conditions, and perform predictive maintenance without physical intervention, minimizing downtime and operational costs. Additionally, the technology support renewable energy integration by simulating grid behavior under varying load and generation conditions. Furthermore, it aids in regulatory compliance and sustainability reporting through accurate, data-driven insights.

- At the 2025 Hannover Messe, Siemens showcased its progress in industrial AI, software-defined automation, and digital twin technology, supported by a strong partner ecosystem. As part of its ONE Tech Company transformation, it aligned its portfolio and investments to scale innovation, reinforcing its leadership in industrial innovation and global competitiveness.

Market Driver

Growing Demand for Grid Modernization and Smart Infrastructure

The growing demand for grid modernization and smart infrastructure is fueling the growth of the IT spending in energy market. Rising adoption of renewable energy sources, electric vehicles (EVs), and distributed energy resources (DERs) is straining aging infrastructure, requiring a shift toward smarter adaptive systems.

Moreover, grid modernization involves upgrading control systems, communication networks, and automation technologies to enable real-time monitoring, predictive maintenance, and efficient load balancing.

Smart infrastructure, powered by IoT, big data analytics, and AI, allows utilities to respond quickly to faults, reduce transmission losses, and enhance customer service through real-time feedback and dynamic pricing models. Energy companies are increasing IT investments in grid automation, smart meters, digital substations, and AI-based control platforms to build resilient and future-ready energy systems.

- In March 2025, Siemens presented its latest grid modernization innovations at DISTRIBUTECH 2025 in Dallas, Texas. The company emphasized its commitment to accelerating the digital transformation of energy infrastructure with solutions aimed at improving efficiency, reliability, and sustainability.

Market Challenge

High Initial Investment and Integration Complexity

High initial investment and integration complexity continue to hinder widespread IT adoption in the energy industry. Transitioning from legacy infrastructure to modern digital systems such as cloud-based platforms, AI tools, and IoT-enabled devices involves substantial capital outlay for hardware, software, consulting, training, and cybersecurity.

Additionally, integrating new digital systems into existing operational workflows poses challenges related to system incompatibility, regulatory requirements, and potential operational disruption. Budget limitations and risk aversion further deter utilities and energy producers, particularly in developing regions, from adopting digital transformation.

To mitigate this challenge, energy firms are adopting phased implementation strategies, forming strategic vendor partnerships, leveraging government incentives, and opting for scalable, modular IT solutions to reduce upfront costs and integration risks.

Market Trend

Increasing Adoption of Cloud-Based Energy Management Solutions

The growing adoption of cloud-based energy management solutions is a notable trend influencing the IT spending in energy market. These platforms offer real-time visibility, scalability, and remote access to energy operations, enabling organizations to monitor consumption, manage assets, and optimize energy distribution from centralized dashboards. These solutions reduce the need for costly on-premises infrastructure while providing robust data storage, advanced analytics, and seamless updates.

Moreover, cloud-based systems support rapid deployment of AI, ML, and IoT technologies, which are essential for smart grid operations, predictive maintenance, and energy efficiency initiatives. Energy companies are increasingly turning to hybrid or multi-cloud architectures to ensure system resilience, cybersecurity, and compliance with data sovereignty laws.

- In March 2025, Carrier Global Corporation partnered with Google Cloud to advance grid flexibility and intelligent energy management by integrating its battery-enabled HVAC and HEMS solutions with Google Cloud’s AI-driven analytics and WeatherNext AI models from DeepMind and Google Research.

IT Spending in Energy Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Hardware, Software, Services |

|

By Technology |

IoT, Data Analytics, Cybersecurity, Business Intelligence, Others |

|

By Deployment |

On-Premises, Cloud-based, Hybrid |

|

By Organization Size |

Large Enterprises, Small and Medium Enterprises |

|

By Application |

Oil & Gas, Power Generation, Renewable Energy, Grid Modernization, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Hardware, Software, and Services): The software segment captured the largest share of 38.61% in 2024, largely attributed to growing demand for energy management, grid automation, and cybersecurity platforms. Energy firms increasingly invested in SCADA systems, enterprise asset management (EAM), and real-time monitoring software to support predictive maintenance, regulatory compliance, and integration of renewable energy sources.

- By Technology (IoT, Data Analytics, Cybersecurity, Business Intelligence, and Others): The data analytics segment is poised to record a CAGR of 6.19% through the forecast period, due to rising demand for real-time decision-making, anomaly detection, and energy forecasting. Utilities are leveraging analytics to optimize grid operations, manage DERs, and enhance sustainability reporting, prompting substantial investment in advanced analytics platforms.

- By Deployment (On-Premises, Cloud-based, and Hybrid): The cloud-based segment is anticipated to grow at a CAGR of 5.78% over the forecast period, fueled by increased adoption of flexible, scalable solutions that support remote monitoring, disaster recovery, and multi-site integration. Cloud platforms enable faster deployment, lower upfront costs, and seamless integration with AI, ML, and IoT technologies in energy operations.

- By Organization Size (Large Enterprises and Small and Medium Enterprises): The large enterprises segment is set to grow at a CAGR of 5.99% through the forecast period as global energy companies advance digital transformation initiatives. Their substantial IT budgets support investments in automation, data governance, and smart infrastructure to manage complex global operations and meet decarbonization and regulatory goals.

- By Application (Oil & Gas, Power Generation, Renewable Energy, Grid Modernization, and Others): The oil & gas segment secured the largest revenue share of 40.06% in 2024, propelled by investment in digital technologies to enhance upstream and downstream operations. Key focus areas included asset tracking, reservoir management, pipeline monitoring, and cybersecurity to boost efficiency and mitigate operational risks.

IT Spending in Energy Market Regional Analysis

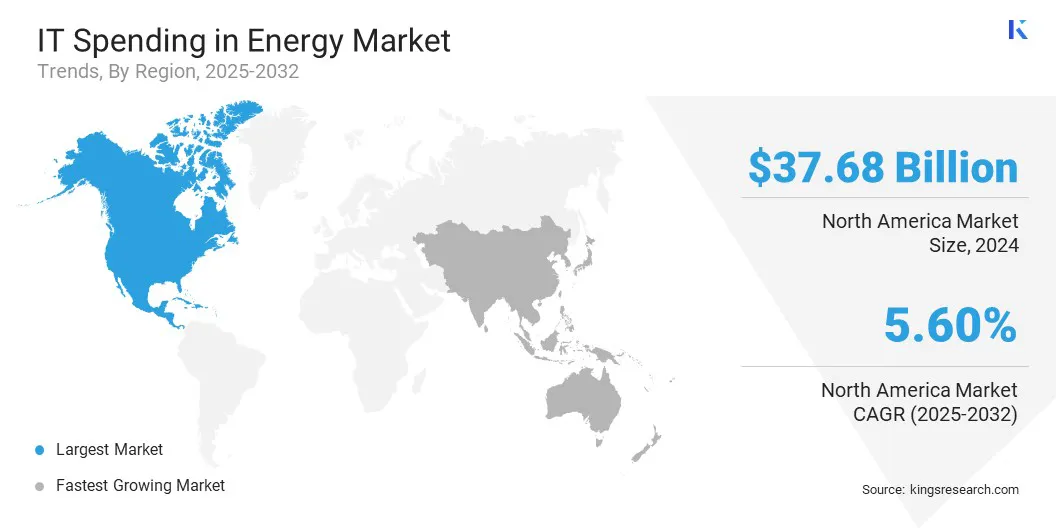

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America IT spending in energy market accounted for a share of 34.09%, with a valuation of USD 37.68 billion in 2024. This dominance is reinforced by the early adoption of advanced digital technologies across utilities and energy producers in the U.S. and Canada. The region has shown significant investment in smart grid implementation, cybersecurity infrastructure, and predictive analytics to modernize grid systems and enhance operational resilience.

- For instance, in March 2025, Schneider Electric announced a planned investments of over USD 700 million in its U.S. operations by 2027. This initiative supports national energy infrastructure goals, focusing on AI-driven growth, domestic manufacturing expansion, and enhanced energy security to meet increasing demand from data centers, utilities, and industrial sectors.

Government incentives, favorable regulations, and robust R&D spending from both public and private sectors have fueled IT investment. Additionally, the region’s focus on decarbonization and renewable energy integration is prompting energy companies to adopt cloud computing, AI/ML, and IoT solutions.

The presence of leading technology providers and consulting firms further strengthens the digital transformation ecosystem across power generation, transmission, and oil & gas sectors.

The Asia-Pacific IT spending in energy industry is projected to grow at the highest CAGR of 6.65% over the forthcoming years. This growth is primarily bolstered by rapid urbanization, industrialization, and increasing energy demand across developing economies. Countries such as China, India, Japan, and South Korea are increasingly investing in smart energy infrastructure, including grid automation, renewable energy systems, and digital asset management.

- According to the International Energy Agency (IEA), China committed USD 442 billion from 2021 to 2025 to modernize and expand its power grids, aiming to enhance infrastructure capacity and meet future energy demand.

Furthermore, the rise of decentralized energy systems and the integration of DERs are prompting utilities to adopt cloud platforms, AI-based forecasting tools, and advanced data analytics. Low digital maturity in certain markets presents significant growth opportunities, and as energy companies prioritize modernization and cybersecurity, the regional market is expected to witness substantial growth in the coming years.

Competitive Landscape

Key players operating in the IT spending in energy industry are investing heavily in cloud computing, AI-driven energy analytics, cybersecurity solutions, and digital twin technologies to enhance operational efficiency and gain a competitive edge.

Strategic collaborations with energy utilities, government-backed smart grid projects, and partnerships with technology providers have become central to their growth approach. Many are focusing on vertical-specific solutions tailored for renewable energy, oil & gas, and grid modernization, aligning their offerings with industry decarbonization goals.

Mergers and acquisitions are being leveraged to expand geographic presence and acquire specialized digital capabilities. A strong emphasis is placed on offering integrated platforms that unify automation, data analytics, and IoT.

- In July 2025, Hitachi Energy signed a long-term agreement worth up to USD 700 million with E.ON to supply transformers for Germany’s energy grid. The agreement supports a national grid expansion initiative to enhance energy security and address global transformer shortages through strategic capacity reservations and partnerships.

Key Companies in IT Spending in Energy Market:

- Accenture

- TATA Consultancy Services Limited

- Infosys Limited

- Capgemini

- IBM Corporation

- Wipro

- HCL Technologies Limited

- CGI Inc.

- Cognizant

- Siemens

- Microsoft

- Schneider Electric

- Oracle

- Amazon Web Services, Inc.

- Google LLC

Recent Developments (Partnership/Investment/New Product Launch)

- In April 2025, Google introduced its AI-powered Grid Teams tool to the U.S. electricity grid, significantly reducing connection times for renewable energy projects and improving grid efficiency to support clean energy expansion.

- In March 2025, Accenture and Siemens launched a business group aimed at transforming engineering and manufacturing through digital innovation and sustainable solutions, with substantial investments to accelerate the country’s energy transition.

- In October 2024, Hitachi Energy announced a USD 250 million investment to expand its capacity, portfolio, and workforce, aiming to meet rising global demand for clean energy and advance India’s energy transition.

freqAskQues