enquireNow

Hydrogen Combustion Engine Market

Hydrogen Combustion Engine Market Size, Share, Growth & Industry Analysis, By Technology (Proton Exchange Membrane Fuel Cell, Solid Oxide Fuel Cell, Phosphoric Acid Fuel Cell, Others), By Application (Passenger vehicle, Commercial vehicle, Ships, Others), and Regional Analysis, 2025-2032

pages: 140 | baseYear: 2024 | release: August 2025 | author: Versha V.

Market Definition

A hydrogen combustion engine is an internal combustion engine that uses hydrogen gas as fuel to generate power through controlled ignition and combustion within engine cylinders. It encompasses components similar to conventional engines, including fuel injectors, spark plugs, pistons, and crankshafts, and is specifically adapted to handle hydrogen’s properties such as high flammability and low ignition energy.

The engine burns hydrogen with air to produce mechanical energy, emitting only water vapor and minimal nitrogen oxides as byproducts. It is applied in transportation, power generation, and industrial machinery as a low-emission alternative to fossil-fueled engines.

Hydrogen Combustion Engine Market Overview

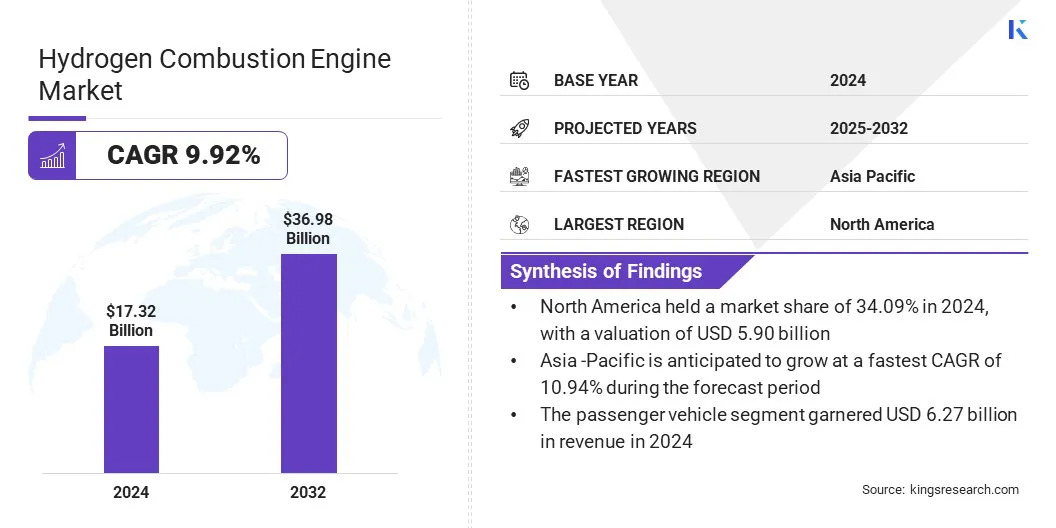

The global hydrogen combustion engine market size was valued at USD 17.32 billion in 2024 and is projected to grow from USD 19.01 billion in 2025 to USD 36.98 billion by 2032, exhibiting a CAGR of 9.92% during the forecast period.

The market is driven by increasing government investment in hydrogen infrastructure that expands refueling networks and accelerates hydrogen engine deployment. The market is further driven by the integration of hydrogen internal combustion engines in marine vessels, which supports decarbonization across commercial and industrial fleets.

Key Highlights:

- The hydrogen combustion engine industry size was recorded at USD 17.32 billion in 2024.

- The market is projected to grow at a CAGR of 9.92% from 2025 to 2032.

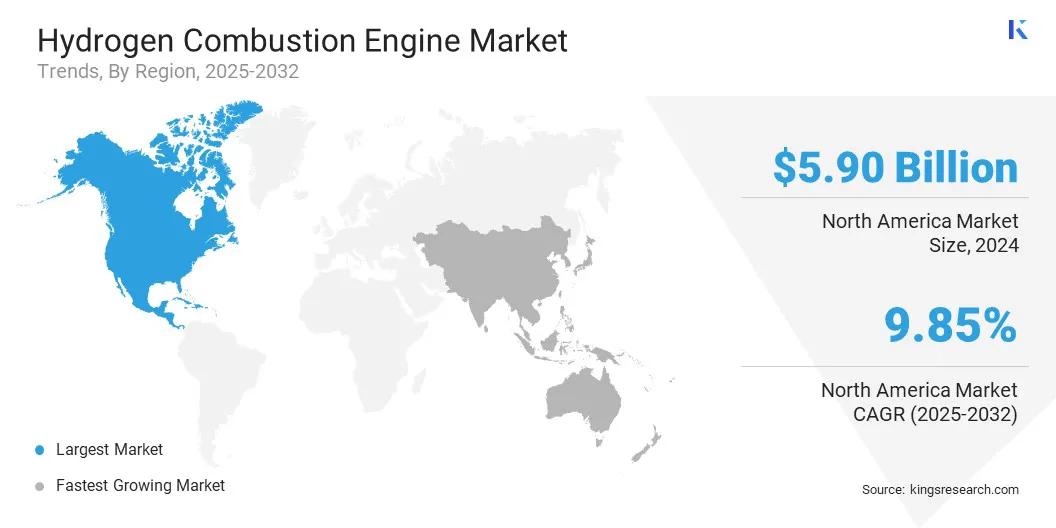

- North America held a market share of 34.09% in 2024, with a valuation of USD 5.90 billion.

- The proton exchange membrane fuel cell segment garnered USD 5.76 billion in revenue in 2024.

- The passenger vehicle segment is expected to reach USD 13.36 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 10.94% during the forecast period.

Major companies operating in the hydrogen combustion engine market are Toyota, Cummins Inc, Daimler Truck AG, BMW Group, Honda Motor Co., Ltd., NamX, AB Volvo, Robert Bosch GmbH, General Motors, J C Bamford Excavators Ltd., MAN Energy Solutions, Mazda Motor Corporation, DEUTZ AG, Yamaha Motor Co., Ltd., and Rolls-Royce plc.

Additionally, the increasing regulatory approval of hydrogen combustion engines for commercial use is accelerating market growth by validating the technology’s readiness and safety. It encourages broader industry adoption, stimulates investment in hydrogen-powered equipment, and opens access to region. This is supporting increased interest in hydrogen combustion engines as a potential zero-emission alternative to conventional diesel solutions across various sectors.

- In January 2025, JCB received certification from 11 European licensing authorities for its hydrogen combustion engine, marking a major milestone for hydrogen technology in construction equipment. This approval enables commercial use across Europe and reflects growing regulatory support for hydrogen-powered machinery as a viable zero-emissions alternative.

Market Driver

Increasing Government Investment in Hydrogen Infrastructure

A key driver in the hydrogen combustion engine market is the increasing government investment in hydrogen infrastructure that is accelerating the development of production, storage, and refueling networks. Major economies, including the United States, Japan and Germany are introducing national hydrogen strategies and funding programs to support clean energy transitions.

Government initiatives are advancing infrastructure development and encouraging private sector participation, thereby improving access to hydrogen fuel and reducing deployment barriers. These investments are creating a strong infrastructure for the commercial adoption of hydrogen combustion engines across transportation and industrial sectors.

- In November 2024, the U.S. Department of Energy allocated USD 2.2 billion to develop Gulf Coast and Midwest Hydrogen Hubs. These hubs are enhancing hydrogen production and distribution capacity, supporting refueling infrastructure, and promoting the adoption of hydrogen combustion engine technologies.

Market Challenge

Limited Availability of Hydrogen Refueling Stations

A key challenge in the hydrogen combustion engine market is the limited availability of hydrogen refueling stations, which significantly hinders widespread adoption. High capital costs, regulatory complexities, and fragmented investments are slowing infrastructure development. This limited refueling access reduces consumer and fleet confidence in hydrogen-powered transportation, delaying commercial deployment and limiting market growth.

To address this challenge, market players are actively investing in hydrogen refueling infrastructure through strategic partnerships with energy providers and government agencies. Companies are developing mobile and modular refueling units to support early adoption in underserved areas. Automakers are also collaborating with infrastructure firms to co-develop station networks along key transport corridors.

Market Trend

Growing Integration of Hydrogen ICE in Marine Vessels

A key trend in the hydrogen combustion engine market is the growing integration of hydrogen ICE technology in marine vessels to support decarbonization in hard-to-electrify maritime sectors.

Manufacturers are launching hydrogen-powered tugboats and auxiliary ships that combine traditional fuels with hydrogen to reduce CO₂ emissions. This is enabling cleaner port operations and aligning with zero-emission targets.

- In April 2025, TSUNEISHI SHIPBUILDING launched Japan’s first hydrogen-powered tugboat with twin hydrogen-blended ICEs and a 250 kg high-pressure hydrogen storage system. This vessel reduces CO₂ emissions by around 60% and uses JGreeX green steel to support maritime decarbonization.

Hydrogen Combustion Engine Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Proton Exchange Membrane Fuel Cell, Solid Oxide Fuel Cell, Phosphoric Acid Fuel Cell, Others |

|

By Application |

Passenger vehicle, Commercial vehicle, Ships, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Technology (Proton Exchange Membrane Fuel Cell, Solid Oxide Fuel Cell, Phosphoric Acid Fuel Cell, and Others): The proton exchange membrane fuel cell segment earned USD 5.76 billion in 2024 due to its high power density, fast start-up capability, and suitability for automotive applications.

- By Application (Passenger vehicle, Commercial vehicle, Ships, and Others): The passenger vehicle segment held 36.22% of the market in 2024, due to increasing adoption of zero-emission mobility solutions and expanding fuel cell vehicle infrastructure.

Hydrogen Combustion Engine Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America hydrogen combustion engine market share stood at 34.09% in 2024 in the global market, with a valuation of USD 5.90 billion. This dominance is attributed to government-led funding that is advancing hydrogen combustion engine innovation and supporting research, development, and demonstration in medium- and heavy-duty vehicle.

The region supports decarbonization of commercial transport through dedicated research efforts that address technical challenges and drive early-stage deployment. These efforts are driving the adoption of hydrogen combustion engines across commercial and industrial transport sectors, thereby supporting market expansion in the region.

- In January 2024, the U.S. Department of Energy (DOE) allocated USD 10.5 million to support three projects dedicated to the research, development, and demonstration of hydrogen combustion engine technologies across the country.

Asia Pacific hydrogen combustion engine industry is set to grow at a CAGR of 10.94% over the forecast period. This growth is attributed to the increasing deployment of hydrogen combustion engines in the maritime sector, supported by strategic agreements that enable local testing and regulatory validation across the region.

Market players in the region are adapting dual-fuel and 100% hydrogen engines to meet domestic clean energy requirements in shipping operations. This adaptation is accelerating the commercial rollout of these technologies and driving rapid market growth in the region.

Additionally, government bodies and market players are contributing to market growth by establishing localized performance testing and after-sales support infrastructure that ensures safe and efficient use of hydrogen-powered engines.

The market continues to experience steady growth from initiativesthat implement national decarbonization plans and encourage the adoption of zero-emission hydrogen technologies, thereby supporting the market growth in the region.

- In June 2025, JPNH₂YDRO, BeHydro, DAIHATSU INFINEARTH, and Mizuno Marine launched a strategic collaboration to deploy hydrogen combustion engines in Japan’s maritime sector. The agreement includes local testing, regulatory validation, and installation of dual-fuel and 100% hydrogen engines on vessels, supporting Japan’s zero-emission goals and expanding the commercial presence of hydrogen engines across Asia Pacific.

Regulatory Frameworks

- In the U.S, the Environmental Protection Agency regulates hydrogen combustion engines by setting emissions standards under the Clean Air Act. It oversees permissible nitrogen oxide levels, certifies engines for compliance, and enforces fuel economy standards. The EPA also guides safe fuel handling, vehicle testing protocols, and supports hydrogen infrastructure development through regulatory frameworks.

- In the UK, the Vehicle Certification Agency regulates hydrogen combustion engines by providing type approval and ensuring compliance with UK and international emissions and safety regulations. It monitors NOx emissions, oversees hydrogen fuel system integrity, and tests vehicles for safety and environmental impact as part of its role under the Department for Transport.

- In China, the Ministry of Ecology and Environment regulates hydrogen combustion engines by enforcing vehicle emissions standards and overseeing engine certification. It monitors nitrogen oxide emissions, sets technical guidelines for hydrogen fuel use, and collaborates with industrial ministries to promote low-carbon technologies in transportation as part of national decarbonization goals.

- In India, the Ministry of Road Transport and Highways regulates hydrogen combustion engines through vehicle type approvals and emission norms under Bharat Stage (BS) standards. It oversees fuel system safety, certifies engine performance, and coordinates with agencies like ARAI to ensure hydrogen vehicles meet safety, efficiency, and environmental standards before deployment.

Competitive Landscape

Major players in the hydrogen combustion engine industry are introducing specialized turbocharging systems tailored to meet the unique demands of hydrogen-fueled engines. These innovations aim to enhance efficiency and performance in heavy-duty on-highway applications and support low-emission transportation goals.

Manufacturers are focusing on developing components that align with regional decarbonization strategies and upcoming emission regulations. Additionally, market players are forming supply agreements with original equipment manufacturers to facilitate early-stage adoption.

- In April 2025, Cummins Inc. introduced a new turbocharger engineered specifically for hydrogen internal combustion engines (H2 ICE) in heavy-duty on-highway vehicles. The technology supports Europe’s transition to low-emission transportation and marks a milestone in hydrogen innovation. The company also secured a supply contract with a major European OEM for these H2 ICE turbochargers.

Key Companies in Hydrogen Combustion Engine Market:

- Toyota

- Cummins Inc

- Daimler Truck AG

- BMW Group

- Honda Motor Co., Ltd.

- NamX

- AB Volvo

- Robert Bosch GmbH

- General Motors

- J C Bamford Excavators Ltd.

- MAN Energy Solutions

- Mazda Motor Corporation

- DEUTZ AG

- Yamaha Motor Co., Ltd

- Rolls-Royce plc.

Recent Developments (Product Launch)

- In December 2024, HORIBA India launched its first hydrogen internal combustion engine (H2-ICE) test bed at its Technical Center in Chakan, Pune. The facility enables localized testing of hydrogen engines and supports India's transition to sustainable mobility.

- In July 2024, Triton EV launched a hydrogen internal combustion engine (ICE) for vehicles from compact cars to heavy trucks. Developed in India, the engine uses hydrogen and emits only water vapor, eliminating major pollutants.

freqAskQues