pages: | baseYear: | release: | author: | lastUpdated:

enquireNow

Market Definition

Biofortification is the process of increasing the nutritional value of staple crops by enhancing essential vitamins and minerals such as iron, zinc, and vitamin A during growth. It is achieved through selective breeding, agronomic practices, and biotechnological methods. The market includes the development, production, and distribution of nutrient-enriched seeds, along with their adoption by farmers and agricultural organizations to promote healthier crop outputs.

Biofortification Market Overview

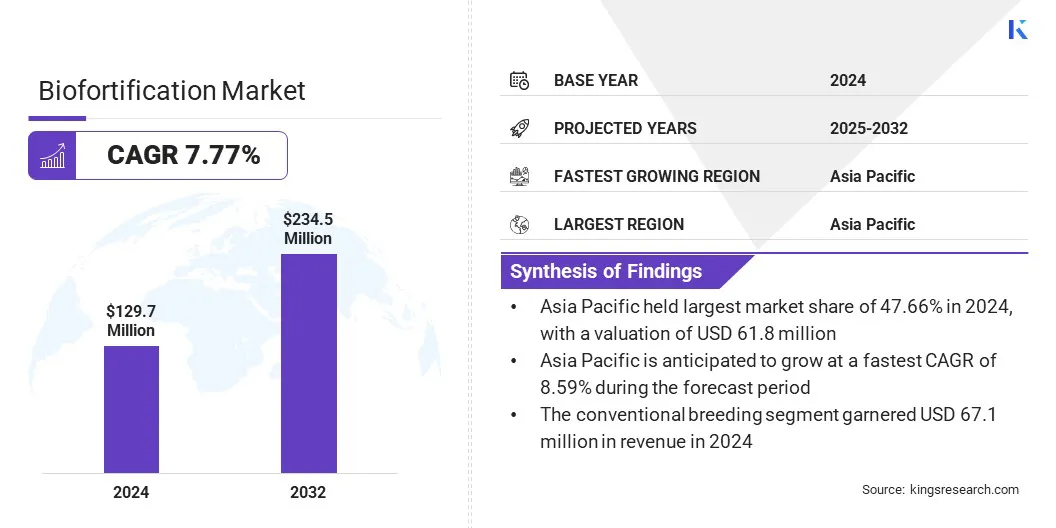

The global biofortification market size was valued at USD 129.7 million in 2024 and is projected to grow from USD 138.9 million in 2025 to USD 234.5 million by 2032, exhibiting a CAGR of 7.77% during the forecast period.

The market is expanding as rising awareness of micronutrient deficiencies creates a strong demand for nutrient-enriched staple crops. Government initiatives and public-private programs support the development and distribution of fortified seeds, while advances in plant breeding and biotechnology enhance nutrient content.

Key Highlights

- The biofortification industry size was USD 129.7 million in 2024.

- The market is projected to grow at a CAGR of 7.77% from 2025 to 2032.

- Asia Pacific held a share of 47.66% in 2024, valued at USD 61.8 million.

- The rice segment garnered USD 37.5 million in revenue in 2024.

- The vitamins segment is expected to reach USD 84.7 million by 2032.

- The conventional breeding segment is projected to reach USD 116.9 million by 2032.

- Europe is anticipated to grow at a CAGR of 7.04% over the forecast period.

Major companies operating in the biofortification market are Cargill, Incorporated, UPL, JK Agri Genetics Limited, Better Nutrition, Nestlé, CATO FOODS, Syngenta Crop Protection AG, and Quemems farms.

Companies are investing in genome-editing technologies to enhance crop productivity and nutritional quality. Collaborations between private firms and agricultural research organizations focus on herbicide-tolerant, drought-resistant, and weed-controlled varieties while increasing micronutrient content in staples such as sorghum, rice, and wheat. Integrating nutrient-enriched traits influences the market, improves food security, mitigates hidden hunger, and promotes the adoption of nutrient-rich crops.

- In June 2025, AATF and BioHeuris entered a two-year partnership to enhance the productivity of genome-edited crops such as sorghum in Africa. The collaboration focuses on R&D, regulatory approval, and commercialization, including herbicide tolerance, weed control, and potential nutrition-enhancing traits.

Market Driver

Rising Nutritional Deficiencies Globally

The biofortification market is experiencing significant growth, fueled by rising nutritional deficiencies worldwide. Inadequate intake of essential vitamins and minerals highlights a critical need for nutrient-rich crops. This shortage intensifies the demand for solutions that enhance dietary quality and support public health objectives.

Governments in countries such as India and Kenya, and organizations, including the World Health Organization and the Food and Agriculture Organization, increasingly prioritize interventions that combat malnutrition. Their support fuels investment and adoption in biofortification technologies, enabling scalable strategies to improve nutritional security and address global micronutrient gaps effectively.

- According to the World Health Organization (WHO), in 2025, anaemia affects an estimated 40% of children aged 6–59 months, 37% of pregnant women, and 30% of women aged 15–49 worldwide.

Market Challenge

Regulatory Resistance in Crop Enhancement

A significant challenge hindering the expansion of the biofortification market is the strong regulatory scrutiny and limited public acceptance of genetically modified approaches. Many regions enforce strict approval processes for GM crops, which significantly delay product launches and increase compliance costs. Additionally, consumer skepticism regarding GM foods can limit market penetration, affect adoption rates, and constrain the overall growth of biofortified crops.

To address this challenge, market players are increasingly prioritizing non-GM routes, including conventional breeding and marker-assisted selection, to ensure regulatory compliance and maintain consumer trust. These approaches also enable faster development and wider distribution of nutrient-enriched crops, supporting market growth.

Market Trend

Advancements in Precision Breeding and Crop Enhancement

The biofortification market is witnessing a notable trend toward advancements in precision breeding and crop enhancement, leading to the development of nutrient-enriched crops. Modern techniques, including genome editing and advanced agronomic practices, streamline the modification of crop traits with greater precision and efficiency.

These innovations improve operational processes by shortening cultivation cycles and enhancing yield reliability while ensuring elevated micronutrient content in staple crops. Adoption of these technologies fosters innovation in research and development pipelines. It allows companies to respond quickly to global nutritional needs and evolving consumer demands, influencing the market.

- In May 2024, Bayer collaborated with G+FLAS to develop genome-edited tomato varieties enriched with vitamin D3 and obtained a commercial license from Pairwise for genome-edited leafy greens, simultaneously establishing an open innovation platform to advance nutrient-enhanced fruits and vegetables globally.

Biofortification Market Report Snapshot

|

Segmentation |

Details |

|

By Crop type |

Rice, Corn, Cassava, Wheat, Beans, Others |

|

By Nutrient type |

Vitamins, Iron, Zinc, Amino Acids, Others |

|

By Technology |

Conventional Breeding, Agronomic Biofortification, Genetic Modification, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Crop type (Rice, Corn, Cassava, Wheat, Beans, and Others): The rice segment earned USD 37.5 million in 2024, mainly due to its high consumption in staple diets and targeted fortification programs in regions with prevalent micronutrient deficiencies.

- By Nutrient type (Vitamins, Iron, Zinc, Amino Acids, and Others): The vitamins segment held a share of 34.67% in 2024, attributed to growing awareness of vitamin deficiencies and increased demand for nutrient-enriched food products.

- By Technology (Conventional Breeding, Agronomic Biofortification, Genetic Modification, and Others): The conventional breeding segment is projected to reach USD 116.9 million by 2032, owing to its wide acceptance, cost-effectiveness, and ability to produce nutrient-enriched crops without regulatory hurdles.

Biofortification Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific biofortification market share stood at around 47.66% in 2024, valued at USD 61.8 million. This dominance is attributed to the region’s high prevalence of micronutrient deficiencies, particularly iron, zinc, and vitamin A, which has created significant demand for biofortified staple crops. Strong government initiatives, such as the National Nutrition Strategy in India and social safety-net programs in Bangladesh, are further accelerating adoption.

According to the World Bank, hidden hunger causes annual GDP losses of USD 12 billion in India, USD 3 billion in Pakistan, and USD 700 million in Bangladesh, prompting governments to prioritize cost-effective nutritional interventions such as biofortification. These factors, combined with support from international organizations and regional agricultural research institutions, position Asia Pacific as the leading hub for biofortification.

- In June 2025, the Union Cabinet of India approved the establishment of the International Potato Centre’s South Asia Regional Centre (CSARC) in Uttar Pradesh. The initiative aims to enhance food and nutrition security, increase farmers’ income, and develop high-yield, nutrient-rich potato and sweetpotato varieties.

The Europe biofortification industry is expected to register the fastest growth, with a CAGR of 7.04% over the forecast period. This growth is propelled by substantial investments in research and development, along with the development of specialized laboratories and manufacturing facilities for biofortified crops.

Supportive policies from European governments promoting nutrition security, food quality, and sustainable agricultural practices further boost adoption. Additionally, rising consumer demand for nutrient-enriched and functional foods is prompting food manufacturers and farmers to integrate biofortified crops into supply chains, supporting regional market growth.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the safety, labeling, and approval of genetically modified and fortified crops, ensuring compliance with national food standards and protecting consumer health.

- In Europe, the European Food Safety Authority (EFSA) oversees risk assessment, safety evaluation, and environmental impact analysis of biofortified and genetically modified crops before granting market authorization.

- In China, the Ministry of Agriculture and Rural Affairs (MARA) governs the approval, cultivation, commercialization, and biosafety of genetically modified and biofortified crops under stringent regulatory guidelines.

- In Japan, the Ministry of Agriculture, Forestry and Fisheries (MAFF) evaluates crop safety, labeling, and commercialization requirements for fortified or modified agricultural products.

- In India, the Genetic Engineering Appraisal Committee (GEAC) under the Ministry of Environment, Forest and Climate Change approves, monitors, and enforces compliance for the release of biofortified and genetically engineered crops.

Competitive Landscape

Key players in the biofortification industry are focusing on partnerships and research & development (R&D) initiatives to strengthen their market position and foster innovation. Companies are investing significantly in R&D to develop high-yield, nutrient-enriched, and climate-resilient crop varieties, while also improving seed technology and crop bioavailability.

Companies are also forming strategic collaborations with government agencies, international research organizations, and agricultural institutes to enhance the development, testing, and distribution of biofortified crops. By leveraging these strategies, key players are expanding their product portfolios, accelerating commercialization, and maintaining a competitive edge.

Top Key Companies in Biofortification Market:

- Cargill, Incorporated

- UPL

- JK Agri Genetics Limited

- Better Nutrition

- Nestlé

- CATO FOODS

- Syngenta Crop Protection AG

- Quemems farms

freqAskQues