Buy Now

Electric Aircraft Market

Electric Aircraft Market Size, Share, Growth & Industry Analysis, By Technology (Battery-powered, Hybrid-electric, and Hydrogen-powered), By Type (Light & Ultralight Aircraft, Business Jets, and Regional Transport Aircraft), By Range, By Application, and Regional Analysis, 2024-2031

Pages: 120 | Base Year: 2023 | Release: June 2024 | Author: Versha V.

Electric Aircraft Market Size

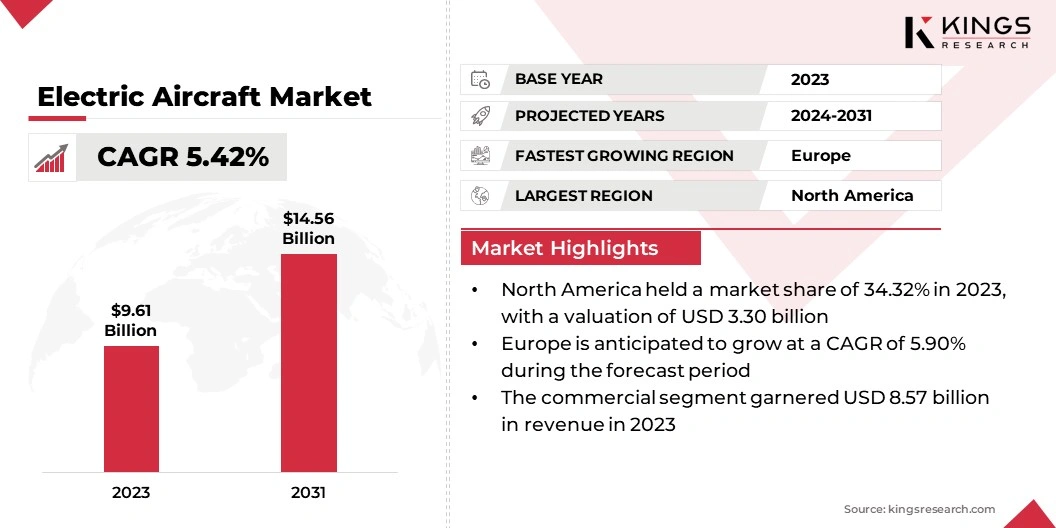

Global Electric Aircraft Market size was recorded at USD 9.61 billion in 2023, which is estimated to be valued at USD 10.06 billion in 2024 and is projected to reach USD 14.56 billion by 2031, growing at a CAGR of 5.42% from 2024 to 2031.

The electric aircraft market is witnessing growth driven by increasing environmental concerns and stringent carbon emission regulations. Governments and regulatory bodies worldwide are promoting the use of sustainable aviation solutions, fostering the adoption of electric propulsion systems. Advances in battery technology, such as higher energy densities and improved charging capabilities, are enhancing the feasibility of electric aircraft for short-haul and regional flights.

Investments in infrastructure, including charging stations at airports and partnerships between aviation and technology firms, are further propelling market expansion. In the scope of work, the report includes services offered by companies such as AIRBUS, Boeing, Heart Aerospace, Embraer, PIPISTREL, Rolls-Royce plc, Diamond Aircraft Industries, Electra.Aero, Joby Aviation, Inc., Vertical Aerospace, and others.

The electric aviation sector is experiencing a surge in investments due to its potential to revolutionize air travel with sustainable and cost-effective solutions. Venture capitalists and major aerospace corporations are investing heavily in electric aviation startups, recognizing their disruptive potential.

Companies such as Joby Aviation, Lilium, and Vertical Aerospace are leading the market, with the development of innovative electric vertical takeoff and landing (eVTOL) aircraft and regional electric planes.

- In July 2024, Joby Aviation, Inc. successfully demonstrated a hydrogen-electric air taxi, completing a 523-mile flight. The aircraft, which takes off and lands vertically, produced only water as a by-product, highlighting hydrogen's potential for emissions-free regional travel without the need for runways. This milestone builds on Joby’s successful battery-electric air taxi development program.

Electric aircraft are powered by electric motors that run on energy stored in batteries or other electrical sources, representing a significant shift from traditional fossil fuel-powered engines. The core technology involves electric propulsion systems, comprising electric motors, power electronics, and energy storage systems, which collectively convert electrical energy into thrust for flight.

Electric aircraft are categorized into three types: electric vertical takeoff and landing (eVTOL) aircraft for urban air mobility, regional electric aircraft for short to medium-haul flights, and hybrid-electric aircraft that integrate electric propulsion with conventional engines to extend range and efficiency.

Electric aircraft offer varying ranges, from about 50 miles for small eVTOLs to several hundred miles for advanced regional models, depending on battery capacity and energy efficiency.

Their applications include urban air mobility services, regional passenger transport, cargo delivery, and specialized tasks such as aerial surveying and agricultural. By offering a cleaner, quieter alternative, electric aircraft hold the potential to transform aviation and significantly reduce its environmental impact.

Analyst’s Review

Analyst’s Review

Key players in the electric aircraft market are implementing several strategies to capitalize on growth opportunities and navigate prevalent challenges. Strategic partnerships are critical for combining aerospace engineering expertise with cutting-edge battery and electric propulsion technologies. By forming alliances with technology firms, aviation companies can accelerate R&D and launch innovative products.

- In October 2024, Eviation Aircraft, a leading all-electric aircraft manufacturer, announced that UrbanLink Air Mobility, a South Florida-based leader in Advanced Air Mobility (AAM), signed a Letter of Intent (LOI) to purchase 10 Alice commuter aircraft, with an option to acquire an additional 10 planes.

Moreover, rising investments in R&D are essential to address the technical limitations of current battery technologies and improving overall aircraft performance. Companies are further focusing on vertical integration to strengthen supply chain control and ensure the availability of critical components.

Additionally, electric aircraft market players are exploring new business models, including air taxi services and leasing electric aircraft to operators, to generate additional revenue and enhance market penetration. Moreover, environmental and social governance (ESG) strategies are becoming increasingly important, with companies striving to demonstrate their sustainability efforts and reduce carbon footprints, attracting eco-conscious consumers and investors.

Electric Aircraft Market Growth Factors

Government incentives and funding are supporting the growth of the electric aircraft market. Many governments are recognizing the environmental and economic benefits of electric aviation and are implementing policies to support its advancement.

These include grants for research and development, subsidies for manufacturing and infrastructure, tax incentives for companies investing in electric aviation technologies, and favorable regulatory environments to accelerate the certification and deployment.

- For instance, programs such as the European Union's Clean Sky initiative and the United States' Advanced Research Projects Agency-Energy (ARPA-E) provide substantial funding aimed at reducing greenhouse gas emissions and fostering innovation in the aviation sector.

The limited energy density of batteries is a significant restraint in the electric aircraft market, impeding the widespread adoption of electric aviation. Current battery technologies, primarily lithium-ion, offer insufficient energy storage capacity to support long-haul flights or carry heavy payloads efficiently.

This limitation restricts the operational range and performance of electric aircraft, making them less competitive compared to traditional fuel-powered aircraft, particularly in commercial aviation. For instance, while electric aircraft effectively serve short regional routes or urban air mobility applications, their limited range hinders broader market penetration.

The weight of batteries necessary to store sufficient energy increases aircraft mass, reducing efficiency and payload capacity. Addressing this restraint requires significant advancements in battery chemistry and energy management systems.

Research into alternative energy storage solutions, such as solid-state batteries or hydrogen fuel cells, is ongoing, though these technologies are still in development and face significant challenges. Overcoming battery energy density limitations is crucial for reducing aviation’s carbon footprint.

Electric Aircraft Market Trends

The increasing adoption of urban air mobility (UAM) solutions is a prominent trend in the electric aircraft market, supported by the need to reduce urban congestion and improve transportation efficiency in densely populated areas.

UAM encompasses innovative air transport services such as air taxis and on-demand flights using electric vertical takeoff and landing (eVTOL) aircraft, offering advantages such as reduced travel times and lower environmental impact compared to traditional ground-based transportation.

- In March 2024, Airbus introduced the fully electric CityAirbus NextGen prototype at the opening of its new CityAirbus test center in Donauwörth, Germany. The center, designed for eVTOL system testing, reflects Airbus’ commitment to advancing Advanced Air Mobility (AAM) initiatives.

Companies and municipalities are investing heavily in UAM infrastructure, including vertiports and charging stations, to support advanced air mobility solutions. Integrating UAM into urban transportation networks is expected to transform cityscapes, making commuting faster, more efficient, and environmentally friendly.

Additionally, the adoption of UAM is bolstered by advancements in autonomous flight technology, enhancing safety and operational efficiency. This shift offers a viable alternative to conventional urban transport and contributes to the growth of the electric aircraft market.

Segmentation Analysis

The global electric aircraft market has been segmented based on technology, type, range, application, and geography.

By Technology

Based on technology, the market has been categorized into battery-powered, hybrid-electric, and hydrogen-powered. The hybrid-electric segment captured the largest revenue share of 74.36% in 2023.

Hybrid-electric aircraft combine conventional combustion engines with electric propulsion systems, balancing extended range and reduced fuel consumption. This dual propulsion approach addresses the limitations of battery energy density, enabling longer flights and heavier payloads than fully electric aircraft. The flexibility and reliability of hybrid systems make them ideal for commercial and regional aviation, where range and performance are critical.

Additionally, hybrid-electric aircraft offer significant reductions in greenhouse gas emissions and operational costs, making them more environmentally friendly and economically viable.

The growing emphasis on sustainable aviation practices and stringent emission regulations are further propelling the adoption of hybrid-electric technology. Moreover, advancements in hybrid propulsion systems, supported by extensive research and development investments, are accelerating the commercialization of these aircraft.

By Type

Based on type, the electric aircraft market has been classified into light & ultralight aircraft, business jets, and regional transport aircraft. The regional transport aircraft segment is anticipated to grow at the highest CAGR of 6.36% over the forecast period. Regional transport aircraft, typically used for short to medium-haul flights, are ideal for electrification due to their lower energy demands compared to long-haul aircraft.

The shift toward sustainable and cost-effective aviation solutions is boosting the adoption of electric and hybrid-electric regional aircraft. These aircraft offer significant operational cost savings through reduced fuel and maintenance costs, benefitting regional airlines with thinner profit margins.

- In July 2024, Skyports Infrastructure, Lilium N.V., and SEA Milan Airports signed a MoU to develop an eVTOL passenger network in Italy's Lombardy region. The partnership focuses on building infrastructure for Regional Air Mobility, advancing sustainable aviation and eVTOL services in Europe.

Additionally, advancements in battery technology and electric propulsion systems are making electric aircraft viable for regional routes. Government incentives and subsidies for green transportation projects, and environmental regulations aimed at reducing carbon emissions further support this growth.

Expected improvements in regional air mobility infrastructure, including charging stations and regional airports, are likely to facilitate the adoption of these aircraft. The regional transport aircraft segment is set to observe robust growth, reflecting the industry's broader shift toward sustainable aviation solutions.

By Application

Based on application, the electric aircraft market has been divided into commercial and military. The commercial segment garnered the highest revenue of USD 8.57 billion in 2023. The increasing demand for sustainable and cost-effective transportation solutions has led to the widespread adoption of electric and hybrid-electric aircraft in commercial aviation.

Airlines are increasingly investing in these technologies to reduce operational costs, lower fuel consumption, and meet stringent environmental regulations. The growth in passenger air travel, particularly in emerging markets, has contributed to the growth of the commercial segment.

Furthermore, advancements in electric propulsion technology have enabled the design and production of larger electric aircraft capable of serving commercial routes, supporting segmental expansion.

Government incentives and subsidies for green aviation technologies have further supported this progress. Additionally, strategic partnerships and collaborations between aerospace companies and technology firms have accelerated the commercialization of electric aircraft, enhancing their market penetration.

Electric Aircraft Market Regional Analysis

Based on region, the global electric aircraft market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America electric aircraft market accounted for a share of around 34.32% in 2023, with a valuation of USD 3.30 billion. This dominance is attributed to the presence of several key players and innovative startups in the U.S. and Canada, which are at the forefront of developing and commercializing electric aircraft technologies.

The North America electric aircraft market accounted for a share of around 34.32% in 2023, with a valuation of USD 3.30 billion. This dominance is attributed to the presence of several key players and innovative startups in the U.S. and Canada, which are at the forefront of developing and commercializing electric aircraft technologies.

North America's strong aerospace infrastructure, extensive research and development capabilities, and favorable regulatory environment have significantly contributed to regional market growth.

Additionally, substantial government funding and incentives aimed at reducing carbon emissions and promoting sustainable aviation have propelled the adoption of electric aircraft. advancements in battery technology and electric propulsion systems, supported by collaborations between aerospace companies and tech firms, have accelerated the development of viable electric aircraft solutions.

The region's robust investment climate, combined with increasing demand for eco-friendly transportation options are fostering innovation and sustainability in the aerospace industry.

Europe electric aircraft market is poised to grow at the highest CAGR of 5.90% over 2024-2031. The European Union's strong commitment to reducing carbon emissions and achieving climate neutrality by 2050 has led to stringent environmental regulations and significant investments in green aviation technologies.

Programs such as Horizon Europe and the European Green Deal provide substantial funding and support for research and development in electric and hybrid-electric aircraft. Additionally, Europe's well-established aerospace industry, comprising leading manufacturers and innovative startups, is driving the development of cutting-edge electric aviation solutions.

The region's focus on enhancing urban air mobility and the integration of electric aircraft into existing transportation networks further fueling regional market growth.

- In June 2024, Airbus and Avincis, a leading European helicopter operator, signed a Memorandum of Understanding (MoU) to collaborate on the development of Advanced Air Mobility (AAM). The partnership aims to explore opportunities for operating electric vertical take-off and landing (eVTOL) aircraft across Europe.

Collaborative efforts between governments, research institutions, and private sector companies are fostering advancements in battery technology, propulsion systems, and infrastructure development, including charging stations and vertiports.

Competitive Landscape

The global electric aircraft market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Electric Aircraft Market

- AIRBUS

- Boeing

- Heart Aerospace

- Embraer

- PIPISTREL

- Rolls-Royce plc

- Diamond Aircraft Industries

- Aero

- Joby Aviation, Inc.

- Vertical Aerospace

Key Industry Developments

- May 2024 (Launch): Electra announced the successful execution of the initial high-performance ultra-short flight operations of its piloted blown-lift hybrid-electric short takeoff and landing (eSTOL) demonstrator aircraft, the EL-2 Goldfinch.

- April 2024 (Expansion): Eve Air Mobility appointed Korea Aerospace Industries Ltd. (KAI) as the supplier for the pylons of its electric vertical takeoff and landing aircraft. KAI is renowned for quality, technology, and business performance, supplying numerous aerostructure components, including for Embraer’s E-Jet E2 model.

- June 2023 (Collaboration): Airbus and STMicroelectronics collaborated for investments in R&D for efficient and lighter power electronics, particularly for future hybrid-powered aircraft and full-electric urban air vehicles. This partnership built on the two companies’ evaluations of wide bandgap semiconductor materials for aircraft electrification.

The global electric aircraft market is segmented as:

By Technology

- Battery-powered

- Hybrid-electric

- Hydrogen-powered

By Type

- Light & Ultralight Aircraft

- Business Jets

- Regional Transport Aircraft

By Range

- Less than 200 km

- 201-500 km

- More Than 500km

By Application

- Commercial

- Military

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America