Buy Now

Automotive Robotics Market

Automotive Robotics Market Size, Share, Growth & Industry Analysis, By Component (Robotic Arm, End Effector, Controller, Drive System, Software), By Robot Type (Articulated Robots, SCARA Robots, Cartesian Robots, Cylindrical Robots), By Function (Welding, Material Handling), By Application Area and Regional Analysis, 2025-2032

Pages: 250 | Base Year: 2024 | Release: May 2025 | Author: Versha V.

Market Definition

The market involves the development, production, and integration of robotic systems within the automotive manufacturing and assembly processes. These robotic systems are primarily used to automate various tasks such as welding, painting, assembling, material handling, and quality inspection, enhancing production efficiency, precision, and worker safety.

The report provides insights into the core factors of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Automotive Robotics Market Overview

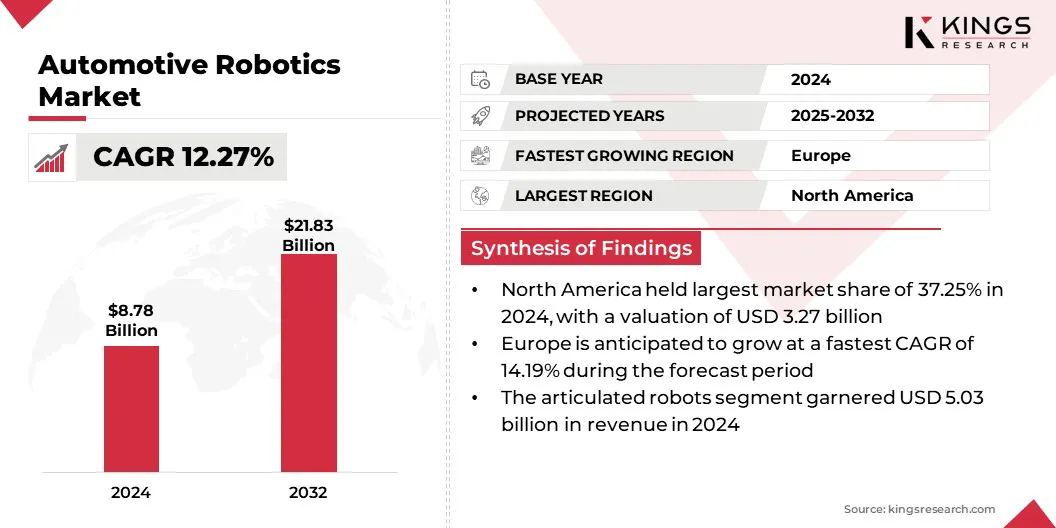

The global automotive robotics market size was valued at USD 8.78 billion in 2024 and is projected to grow from USD 9.71 billion in 2025 to USD 21.83 billion by 2032, exhibiting a CAGR of 12.27% during the forecast period.

The market is influenced by the rising demand for automation in vehicle manufacturing, where automotive robotics are widely used to improve efficiency, precision, and workplace safety. Advancements in robotic technologies, such as artificial intelligence, machine vision, and sensor integration, are enhancing operational capabilities and enabling smarter manufacturing processes.

Major companies operating in the automotive robotics industry are Omron Corporation, Kawasaki Heavy Industries, Ltd., Yaskawa Inc., FANUC Corporation, Nachi Robotic Systems, Inc., Comau S.p.A., DENSO Robotics, KUKA AG, Epson Inc., ABB, Acieta, Universal Robots A/S, Stäubli International AG., Rockwell Automation, and NEURA Robotics GmbH.

The increasing production of electric vehicles and the need for high-speed, high-accuracy assembly lines are significantly fueling the growth of the market. As Industry 4.0 adoption accelerates and labor shortages persist, manufacturers are increasingly turning to automotive robotics to enhance productivity, consistency, and cost-efficiency in their operations.

- In February 2025, Dassault Systèmes and KUKA announced a partnership to enhance robotics and automation efficiency in manufacturing. By integrating Dassault's 3DEXPERIENCE platform with KUKA’s mosaixx digital ecosystem, the collaboration aims to improve the design, simulation, and optimization of robotic systems in automotive production, boosting manufacturing efficiency and flexibility.

Key Highlights

- The automotive robotics industry size was valued at USD 8.78 billion in 2024.

- The market is projected to grow at a CAGR of 12.27% from 2025 to 2032.

- North America held a market share of 37.25% in 2024, with a valuation of USD 3.27 billion.

- The robotic arm segment garnered USD 2.56 billion in revenue in 2024.

- The articulated robots segment is expected to reach USD 12.53 billion by 2032.

- The material handling segment is anticipated to witness the fastest CAGR of 14.52% over the forecast period.

- The body-in-white (BIW) segment garnered USD 2.94 billion in revenue in 2024.

- The OEMs segment is expected to reach USD 10.83 billion by 2032.

- Europe is anticipated to grow at a CAGR of 14.19% over the forecast period.

Market Driver

Rising Demand for Automation in Vehicle Production

The rising demand for automation in vehicle production is contributing significantly to the growth of the automotive robotics market. Widely used for tasks such as welding, painting, assembly, and material handling, robotics enhances manufacturing efficiency, improves precision, and reduces operational costs.

As automakers face increasing pressure to meet high production volumes while maintaining quality and safety standards, they are accelerating the integration of robotics into their operations.

This shift supports consistent product output while also addressing labor shortages and enabling flexible manufacturing systems that can adapt to varying model designs and production demands.

- In October 2024, Horizon Robotics received a strategic investment from Chery Automobile, finalizing the funding agreement. The investment will be directed toward the research, development, and mass production of Horizon's next-generation automotive-grade computing solutions. The partnership focuses on advanced assisted driving capabilities, with Chery’s new E0X smart electric vehicle platform using Horizon's Journey 3 chip as its core computing component, building on their previous collaboration on in-cabin technology.

Market Challenge

Complexity of Integration and Customization

A significant challenge hindering the growth of the automotive robotics market is the complexity of integration and customization required for diverse manufacturing environments. Unlike standard automation solutions, automotive robotics needs to integrate seamlessly with existing production systems, which can include legacy machinery and varied workflows.

The integration process often involves adapting software, reconfiguring production lines, and aligning with unique operational requirements. This complexity demands significant engineering effort, extensive testing, and continuous adjustments as vehicle designs or production volumes change, leading to increased costs and longer implementation timelines.

To overcome this challenge, manufacturers are turning to flexible and modular robotic platforms that can be quickly reprogrammed and scaled across operations. The use of simulation technologies and digital twins helps optimize robot deployment in virtual settings, reducing integration risks and improving efficiency.

Collaborations with specialized system integrators and adoption of open-architecture robotics are further streamlining the integration process. As automotive companies invest in upskilling their workforce and adopt smarter automation strategies, the ability to customize and deploy robotics is becoming more efficient and accessible across global production networks.

Market Trend

Increasing Adoption of Articulated Robots

Articulated robots are increasingly being adopted in automotive manufacturing due to their precision, flexibility, and ability to handle complex tasks in production lines, emerging as a key trend in the automotive robotics market.

For instance, articulated robots are commonly employed for automated welding processes, ensuring consistent, high-precision joins in vehicle body parts. Moreover, they are being used to handle delicate or heavy components with greater flexibility than traditional fixed automation.

This trend is further supported by the surging demand for more adaptable production systems that can accommodate a range of vehicle models, including electric vehicles (EVs) and hybrid models, which require specialized manufacturing processes.

Articulated robots enhance production efficiency by reducing cycle times and human error, contributing to cost reduction and increased throughput. Advancements in AI and machine learning are enhancing these robots' intelligence and task optimization capabilities, establishing them as vital components in next-generation automotive manufacturing.

Automotive Robotics Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Robotic Arm, End Effector, Sensors, Controller, Drive System, Software |

|

By Robot Type |

Articulated Robots, SCARA Robots, Cartesian Robots, Cylindrical Robots, Collaborative Robots |

|

By Function |

Welding, Material Handling, Assembly, Painting, Inspection & Testing |

|

By Application Area |

Body-in-White (BIW), Painting Shop, Assembly Line, Logistics & Material Handling |

|

By End Users |

OEMs, Tier 1 & Tier 2 Suppliers, Automation Integrators |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Robotic Arm, End Effector, Sensors, Controller, Drive System, and Software): The robotic arm segment earned USD 2.56 billion in 2024 due to its essential role in performing precise and complex tasks across automotive manufacturing processes.

- By Robot Type (Articulated Robots, SCARA Robots, Cartesian Robots, Cylindrical Robots, and Collaborative Robots): The articulated robots segment held a substantial share of 57.30% in 2024, fueled by their versatility, precision, and ability to perform complex tasks in automotive manufacturing processes.

- By Function (Welding, Material Handling, Assembly, Painting, and Inspection & Testing): The material handling segment is projected to reach USD 6.98 billion by 2032, propelled by the increasing demand for automation in transporting and managing components efficiently across automotive production lines.

- By Application Area (Body-in-White (BIW), Painting Shop, Assembly Line, and Logistics & Material Handling): The painting shop segment is anticipated to grow at a CAGR of 15.48% over the forecast period, attributed to the increasing demand for automation in high-precision painting processes and the need for improved quality and consistency in vehicle finishes.

- By End Users (OEMs, Tier 1 & Tier 2 Suppliers, and Automation Integrators): The OEMs segment earned USD 4.44 billion in 2024, fostered by the increasing adoption of robotic automation to enhance production efficiency, quality control, and meet the growing demand for electric and autonomous vehicles.

Automotive Robotics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America automotive robotics market share stood at around 37.25% in 2024, valued at USD 3.27 billion. This dominance is attributed to North America's established automotive manufacturing industry, the presence of leading robotics companies, and a strong focus on technological innovation in automation.

Furthermore, substantial investments in research and development, along with government incentives supporting the adoption of robotics in manufacturing, are fueling regional market expansion.

The region’s emphasis on enhancing manufacturing efficiency, coupled with the increasing demand for electric and autonomous vehicles, further propels regional market growth.

- In April 2025, FANUC America announced its participation in Automate 2025, showcasing innovations, including cobots with payloads up to 50 kg and advanced vision technologies. Highlights include automotive applications such as the CRX-10iA/L Cobot mounted on an autonomous robot for automated picking and delivery of side-view mirror components, and a CRX-10iA/L Cobot integrated with a 7th axis rail for flexible, efficient welding in automotive manufacturing.

The Europe automotive robotics industry is estimated to grow at a robust CAGR of 14.19% over the forecast period. This growth is supported by the increasing demand for automation in automotive manufacturing, the push for sustainable vehicle production, and the adoption of cutting-edge robotics technology by European automakers.

The region is witnessing rising investments in AI-driven robotics, machine learning, and smart factory solutions, which are accelerating the integration of robotics in vehicle assembly.

Additionally, collaborations between automotive manufacturers and robotics companies are fostering innovation and enhancing production efficiency, thereby propelling regional market growth.

Regulatory Frameworks

- In the European Union, the Machinery Directive (2006/42/EC) regulates the design and use of robotic systems in the automotive sector, emphasizing safety standards to protect operators and ensuring that robotics systems are CE-marked for compliance.

- In the United States, the Robotics Industry Association's ANSI/RIA R15.06-2012 standard governs the safety requirements for industrial robots and robot systems. This standard emphasizes the importance of risk assessment and establishing personnel safety protocols.

- The International Organization for Standardization ISO 10218-1:2025 establishes safety requirements for industrial robots, addressing them as partly completed machinery. It mandates that manufacturers incorporate essential safety measures into robot design, ensuring risk reduction and proper information dissemination to operators.

Competitive Landscape

The automotive robotics industry is characterized by a competitive landscape, featuring a mix of established robotics companies and emerging technology firms. Leading players are prioritizing innovation, AI integration, and strategic partnerships to develop advanced robotic solutions for the automotive industry.

Major companies are heavily investing in R&D to enhance the precision, flexibility, and adaptability of robotic systems, particularly for use in vehicle manufacturing, including electric and autonomous vehicle production.

Collaborations with automotive manufacturers and acquisitions of technology firms specializing in automation are enabling companies to expand their capabilities and market presence.

- In August 2024, TKH Group acquired Liberty Robotics, a company specializing in 3D vision guidance systems for robotics. This acquisition strengthens TKH’s factory automation capabilities, particularly in the automotive sector, by combining Liberty's expertise in robotic guidance with TKH's advanced 3D vision sensor technology.

The increasing demand for automation to improve efficiency, reduce costs, and meet the rising need for sustainable manufacturing practices is intensifying competition. Market participants are focusing on tailored robotic solutions to meet the specific requirements of automotive production lines, fostering growth and innovation in the sector.

List of Key Companies in Automotive Robotics Market:

- Omron Corporation

- Kawasaki Heavy Industries, Ltd.

- Yaskawa Inc.

- FANUC Corporation

- Nachi Robotic Systems, Inc.

- Comau S.p.A.

- DENSO Robotics

- KUKA AG

- Epson Inc.

- ABB

- Acieta

- Universal Robots A/S

- Stäubli International AG.

- Rockwell Automation

- NEURA Robotics GmbH

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In March 2025, Hexagon introduced its new Robotics division, focused on advancing next-generation autonomous systems. Leveraging its expertise in AI, spatial intelligence, and measurement technologies, the division targets innovative robotic solutions across automotive, manufacturing, logistics, energy, and agriculture sectors to enhance efficiency and address workforce challenges.

- In January 2024, Figure AI Inc. announced a commercial agreement with BMW Manufacturing to introduce general-purpose humanoid robots into automotive production. These robots will support assembly and material handling. The partnership aims to improve productivity, reduce labor costs, and enhance workplace safety, with phased deployment starting at BMW's Spartanburg facility.

- In December 2023, ABB formed a partnership with Volvo Cars to deliver more than 1,300 robots and functional packages to improve electric vehicle production. ABB’s energy-efficient robots and OmniCore controllers are anticipated to reduce energy consumption by up to 20% at manufacturing facilities in Sweden and China, supporting the company's sustainability goals.

- In October 2023, Rockwell Automation acquired Clearpath Robotics and its industrial division, OTTO Motors. This acquisition strengthens Rockwell's capabilities in autonomous material handling, specifically through OTTO Motors' autonomous mobile robots (AMRs), which are designed to enhance efficiency and safety in automotive manufacturing by automating material transport on production floors.