enquireNow

Floating Production Systems Market

Floating Production Systems Market Size, Share, Growth & Industry Analysis, By Type (Floating Production, Storage & Offloading (FPSO), Tension-Leg Platform), By Water Depth (Shallow Water, Deepwater, Ultra-Deepwater), By End-Use Industry (Upstream Oil & Gas, Liquefied Natural Gas (LNG)), and Regional Analysis, 2025-2032

pages: 160 | baseYear: 2024 | release: August 2025 | author: Versha V.

Market Definition

Floating production systems (FPS) are offshore structures used for extracting, processing, storing, and offloading oil and gas directly at sea. The market encompasses floating production storage and offloading (FPSO) units, floating storage units (FSUs), tension leg platforms (TLPs), and semi-submersibles, covering both leased and owned assets deployed in deepwater and ultra-deepwater fields.

It includes engineering, procurement, construction, installation, and maintenance services, with applications spanning offshore exploration, production enhancement, and remote field development in global energy markets.

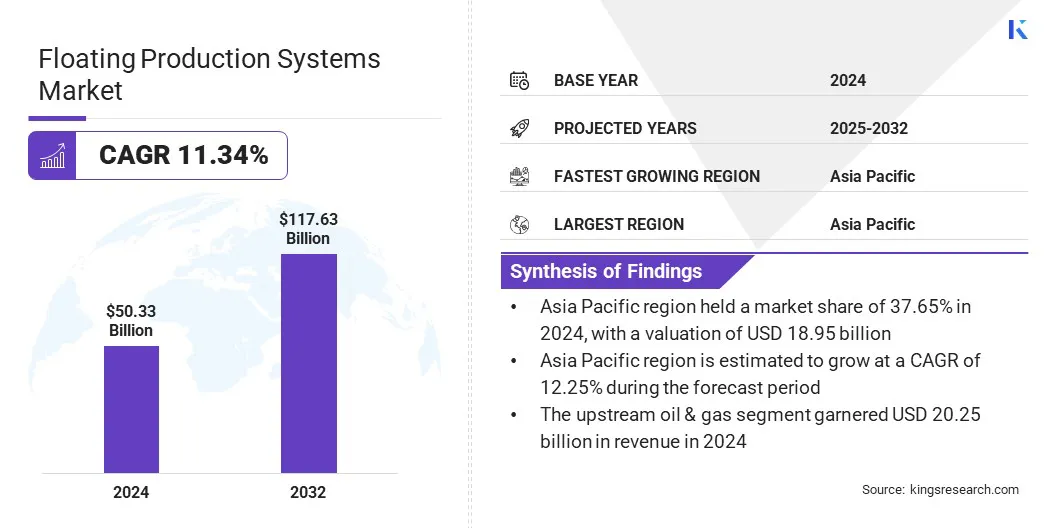

The global floating production systems market size was valued at USD 50.33 billion in 2024 and is projected to grow from USD 55.44 billion in 2025 to USD 117.63 billion by 2032, exhibiting a CAGR of 11.34% during the forecast period. Market growth is attributed to the rising deepwater and ultra-deepwater exploration activities that require advanced offshore infrastructure along with the surging adoption of FPSO units, which enhances production flexibility in remote marine environments.

Key Highlights

- The floating production systems industry size was valued at USD 50.33 billion in 2024.

- The market is projected to grow at a CAGR of 11.34% from 2025 to 2032.

- Asia Pacific held a share of 37.65% in 2024, valued at USD 18.95 billion.

- The floating production, storage & offloading (FPSO) technology segment garnered USD 17.28 billion in revenue in 2024.

- The deepwater segment is expected to reach USD 52.39 billion by 2032.

- The liquefied natural gas (LNG) segment is anticipated to witness the fastest CAGR of 13.04% over the forecast period.

- North America is anticipated to grow at a CAGR of 11.76% through the projection period.

Major companies operating in the global floating production systems market are TechnipFMC plc, SBM, MITSUBISHI HEAVY INDUSTRIES, LTD., Bumi Armada Berhad, HD Hyundai Heavy Industries Co., Ltd., SHI-MCI FZE, BW Offshore, MODEC, Aker Solutions, Sembcorp Industries, CHINA COSCO SHIPPING, Mitsui E&S Holdings Co., Ltd., Baker Hughes Company, Fluor Corporation, and SLB.

Floating Production Systems Market Report Scope

|

Segmentation |

Details |

|

By Type |

Floating Production, Storage & Offloading (FPSO), Tension-Leg Platform, Spar Platform, Barges |

|

By Water Depth |

Shallow Water, Deepwater, Ultra-Deepwater |

|

By End-Use Industry |

Upstream Oil & Gas, Liquefied Natural Gas (LNG), Oil Storage & Offloading |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Floating Production Systems Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific floating production systems market share stood at 37.65% in 2024, valued at USD 18.95 billion. This dominance is attributed to the advancement of offshore field development projects in Southeast Asia. National oil companies across Malaysia, Indonesia, and Vietnam are transitioning from exploration to large-scale offshore infrastructure development.

These developments, which involve the construction of floating production facilities, subsea installations, and offshore drilling platforms, require high-performance hydraulic cylinders for reliable operation in harsh marine environments. Increasing capital deployment in such developments continues to reinforce Asia-Pacific’s position as the leading market for floating production systems.

- In December 2024, Yinson Production and PTSC Asia Pacific signed a contract to provide, charter, operate, and maintain a floating storage and offloading (FSO) vessel for Vietnam’s Lac Da Vang project, ensuring efficient offshore production, storage, and operational reliability.

North America floating production systems industry is poised to grow at a CAGR of 11.76% over the forecast period. This growth is driven by expanding deepwater projects in the Gulf of Mexico. The region remains a strategic hub for offshore oil and gas development, with large-scale exploration and production activities led by key operators such as Chevron, Shell, BP, and ExxonMobil.

These projects require complex subsea infrastructure and floating production systems that heavily depend on high-performance hydraulic cylinders for drilling, lifting, and control functions. This continued investment led by major international oil companies is accelerating the demand for hydraulic equipment.

- In August 2024, Chevron Corporation reported the commencement of oil and natural gas production from the Anchor project located in the deepwater U.S. Gulf of Mexico. The semi-submersible floating production unit (FPU) deployed for the project is designed to process up to 75,000 gross barrels of oil per day and 28 million gross cubic feet of natural gas per day.

Floating Production Systems Market Overview

Rising energy requirements in developing economies are a key factor driving offshore oil and gas development. These requirements reflect growing power needs, rapid industrial expansion, and increasing fuel consumption in the transportation sector.

As onshore reserves decline and domestic supplies prove insufficient, exploration is shifting toward offshore deepwater and ultra-deepwater basins. FPS units enable efficient production in these offshore areas, and sustained energy needs continue to support long-term growth in the market.

- In January 2025, the Gas Exporting Countries Forum (GECF) published a report by Energy Maritime Associates, projecting approximately 120 new Floating Production System (FPS) orders over the next five years. This growth outlook is attributed to increasing global gas demand and the rising need for flexible offshore infrastructure, particularly in export-oriented economies.

Market Driver

Rising Deepwater and Ultra-Deepwater Exploration

Increasing investments by major international oil companies, national oil companies, and financial institutions are driving the demand for floating production systems (FPS). These systems are essential for oil and gas production in offshore locations beyond the technical limits of fixed platforms.

Major companies are allocating substantial capital toward deepwater and ultra-deepwater exploration. These activities require advanced FPS technologies, including floating production storage and offloading units (FPSOs), floating liquefied natural gas (FLNG) units, and tension leg platforms (TLPs), to operate effectively in remote and high-pressure environments. This ongoing shift toward developing deeper offshore reserves is supporting long-term growth of the floating production systems market.

- In December 2024, the Nigerian government and Shell approved the Final Investment Decision (FID) for the Bonga North deep-water project. The development involves modifying the existing Bonga FPSO, located in approximately 1,000 meters of water. It includes the drilling of 16 new wells and the installation of upgraded subsea systems, with the aim of reaching a production capacity of 110,000 barrels per day.

Market Challenge

High Capital Investment and Project Complexity

High capital costs and long project timelines present a key challenge to the progress of the floating production systems (FPS) market. The development and deployment of FPS units involve complex engineering, strict regulatory approvals, and substantial upfront investment. These factors often delay project decisions, increase financial risk, and limit access for smaller operators, particularly in uncertain price environments.

To address these challenges, manufacturers are focusing on modular system designs, digital project planning, and streamlined construction methods. These efforts aim to lower costs, shorten schedules, and improve project reliability, supporting continued market development.

Market Trend

Surging Adoption of FPSO Units

The floating production systems (FPS) market is experiencing a rising trend toward the adoption of floating production storage and offloading (FPSO) units. These systems integrate production, storage, and offloading functions, allowing efficient operation in deepwater and remote offshore locations without fixed installations.

This shift highlights the industry’s growing preference for flexible, scalable, and cost-effective offshore solutions, positioning FPSOs as the leading choice in new FPS developments across key oil and gas regions.

- In May 2025, SBM Offshore reported that the floating production, storage, and offloading (FPSO) vessel Alexandre de Gusmão commenced operations following a successful 72-hour continuous production test and first oil. The unit, operating under a 22.5-year charter, has a daily processing capacity of 180,000 barrels of oil and 12 million cubic meters of gas.

Market Segmentation

- By Type (Floating Production, Storage & Offloading (FPSO), Tension-Leg Platform, Spar Platform, and Barges): The floating production, storage & offloading (FPSO) segment earned USD 17.28 billion in 2024, due to its cost-effective deployment, operational flexibility, and suitability for deepwater and remote offshore developments.

- By Water Depth (Shallow Water, Deepwater, and Ultra-Deepwater): The deepwater segment held a share of 45.66% in 2024, due to increasing investments in mid-depth offshore reserves that require advanced floating infrastructure for efficient extraction and production.

- By End-Use Industry (Upstream Oil & Gas, Liquefied Natural Gas (LNG), and Oil Storage & Offloading): The upstream oil & gas segment is projected to reach USD 46.29 billion by 2032, owing to the growing need for efficient offshore extraction solutions to access untapped deepwater and ultra-deepwater reserves.

Regulatory Frameworks

- In China, the Ministry of Natural Resources (MNR) regulates offshore oil and gas resource development, ensuring alignment with national policies, environmental standards, and sustainable resource management.

- In the U.S., the Bureau of Ocean Energy Management (BOEM) manages offshore leasing, resource evaluation, and environmental assessments on the U.S. Outer Continental Shelf (OCS).

Competitive Landscape

The competitive landscape of the floating production systems industry is defined by targeted launches and acquisitions aimed at enhancing offshore infrastructure portfolios. Key industry participants are introducing high-capacity units incorporating advanced production technologies.

Moreover, acquisitions are riving the expansion of engineering capabilities and securing offshore assets. These actions support increased efficiency in project execution, reduce operational risk, and strengthen competitive positioning in key offshore regions experiencing rising development activity.

Key Companies in Floating Production Systems Market:

- TechnipFMC plc

- SBM

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Bumi Armada Berhad

- HD Hyundai Heavy Industries Co., Ltd.

- SHI-MCI FZE

- BW Offshore

- MODEC

- Aker Solutions

- Sembcorp Industries

- CHINA COSCO SHIPPING

- Mitsui E&S Holdings Co., Ltd.

- Baker Hughes Company

- Fluor Corporation

- SLB

Recent Developments (Expansion)

- In October 2024, Obayashi Corporation successfully installed Japan’s first Tension Leg Platform (TLP) type floating structure for offshore wind, located approximately 3 kilometers off the coast of Iwaya.

freqAskQues