enquireNow

Robotic Dentistry Market

Robotic Dentistry Market Size, Share, Growth & Industry Analysis, By Product & Services (Standalone Robots, Robot‑Assisted Systems, Services), By Application (Implantology, Endodontics, Others), By End-User (Dental Hospitals & Clinics, Dental Academic & Research Institutes, Others), and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: August 2025 | author: Swati J.

Market Definition

Robotic dentistry involves the use of advanced robotic systems to enhance precision, safety, and efficiency in dental procedures. These systems assist with implant placement, root canal navigation, and crown preparation, offering real-time feedback and improved control.

By integrating 3D imaging, AI-based planning, and guided instrumentation, they ensure consistency and accuracy across applications. Dental clinics and research institutes adopt these technologies to improve clinical outcomes, reduce procedural time, and minimize patient discomfort.

Manufacturers offer standalone robotic tools, robot-assisted surgical systems, and service-based platforms to help dental professionals modernize workflows, improve productivity, and deliver patient-specific care with greater predictability.

Robotic Dentistry Market Overview

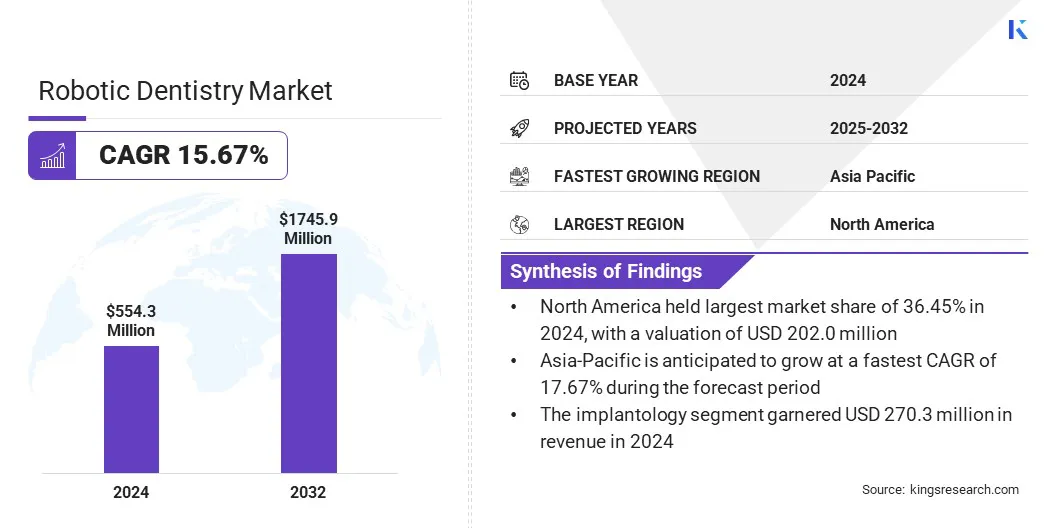

The global robotic dentistry market size was valued at USD 554.3 million in 2024 and is projected to grow from USD 630.0 million in 2025 to USD 1,745.9 million by 2032, exhibiting a CAGR of 15.67% during the forecast period.

This growth is driven by the rising demand for precision in dental surgeries, particularly in implantology, where robotic systems enhance accuracy and reduce complications. Increasing adoption of digital workflows in clinics further supports the integration of robotic technologies.

Key Highlights:

- The global robotic dentistry market size was recorded at USD 554.3 million in 2024.

- The market is projected to grow at a CAGR of 15.67% from 2025 to 2032.

- North America held a share of 36.54% in 2024, valued at USD 202.0 million.

- The standalone robots segment garnered USD 264.2 million in revenue in 2024.

- The implantology segment is expected to reach USD 818.3 million by 2032.

- The dental hospitals & clinics segment is anticipated to witness the fastest CAGR of 15.46% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 17.67% through the projection period.

Major companies operating in the global Robotic Dentistry Market are Dentsply Sirona, Planmeca Oy, Institut Straumann AG, Neocis, Inc., Zimmer Biomet, Aseptico Inc, BIOLASE, Inc., Envista, VATECH, Mectron s.p.a., Renishaw plc., PreXion Inc., Yake Wisdom (Beijing) Technology Co., Ltd, Perceptive, and Beijing Baihui Weikang Technology Co., Ltd..

Increasing emphasis on precision, efficiency, and standardization is fostering the adoption of robotic systems in dental practices, particularly in high-volume clinical settings.

Robotic dentistry platforms are enhancing procedural accuracy in implantology and endodontics through guided navigation, real-time feedback, and minimally invasive techniques. These systems enable clinicians to reduce chair time, limit complications, and improve patient recovery outcomes.

Robotics also supports seamless integration with digital workflows, allowing for efficient treatment planning, 3D imaging, and AI-assisted execution. Dental service providers are increasingly adopting robotic solutions to optimize clinical performance, reduce manual variability, and address growing demand for consistent, high-quality dental care.

Market Driver

Growing Adoption of Digital Dentistry Technologies

The growth of the robotic dentistry market is fueled by the growing adoption of digital dentistry technologies in clinical and academic settings. Dental practices increasingly utilize cone-beam computed tomography (CBCT), CAD/CAM systems, and AI-based diagnostics to enhance treatment accuracy and operational efficiency.

Robotic dentistry platforms are engineered to align with these technologies, enabling precision-driven planning, guided navigation, and consistent execution of procedures such as implant placement and endodontic treatments.

Seamless integration into digital workflows enhances procedural predictability and reduces chair time, supporting improved patient outcomes. Rising investments in digital infrastructure and increasing practitioner familiarity with automated systems support market expansion.

- In November 2023, Dentsply Sirona introduced new 3D printing resins for producing flexible splints with its Primeprint system. This development reflects the company’s continued focus on integrating advanced materials into digital dentistry workflows, enabling dental professionals to deliver customized, precise appliances with improved patient comfort and reduced turnaround times.

Market Challenge

High Capital Costs and Limited Accessibility

A key challenge hindering the progress of the robotic dentistry market is the substantial capital investment required for system acquisition and integration. The costs of hardware, software, installation, and staff training are substantial.

Smaller dental clinics, particularly in markets with limited insurance reimbursement or low procedural volumes, often find these expenses difficult to justify. This financial barrier limits broader adoption and restricts access to advanced robotic solutions in cost-sensitive regions.

To address this challenge, manufacturers are introducing modular systems and flexible financing options to lower entry barriers. Some companies are also offering cloud-based service models and pay-per-use platforms to reduce upfront costs while enabling access to high-precision robotic technologies.

Market Trend

Integration of AI and Machine Learning in Robotic Platforms

A key trend influencing the robotic dentistry market is the increasing integration of AI and machine learning into robotic platforms. Dental professionals are turning to AI-driven systems for real-time decision-making, adaptive drilling, and intraoperative guidance to enhance clinical accuracy.

These platforms offer predictive analytics that help anticipate anatomical challenges and adjust techniques mid-procedure, contributing to greater procedural safety and personalization. This technology supports a shift toward data-driven, patient-specific treatments. Additionally, manufacturers are improving user interfaces and automating repetitive tasks to reduce clinician workload, aiding market expansion.

- In July 2024, Perceptive, a U.S.-based AI company, announced the successful completion of the world’s first fully automated dental procedure on a human using its advanced robotic dentistry platform. The system integrates AI-powered 3D imaging software with a robotic arm to perform dental treatments autonomously.

Robotic Dentistry Market Report Snapshot

|

Segmentation |

Details |

|

By Product & Services |

Standalone Robots, Robot‑Assisted Systems, Services |

|

By Application |

Implantology, Endodontics, Others |

|

By End-User |

Dental Hospitals & Clinics, Dental Academic & Research Institutes, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Product & Services (Standalone Robots, Robot‑Assisted Systems, and Services): The standalone robots segment earned USD 264.2 million in 2024, mainly due to growing demand for fully automated dental procedures, increased procedural accuracy, and rising integration of AI-driven systems in high-volume dental clinics.

- By Application (Implantology, Endodontics, and Others): The implantology segment held a share of 48.76% in 2024, attributed to rising volumes of dental implant procedures and increasing demand for precision-guided surgeries.

- By End-User (Dental Hospitals & Clinics, Dental Academic & Research Institutes, and Others): The dental hospitals & clinics segment is projected to reach USD 988.0 million by 2032, owing to growing patient preference for technologically advanced treatments and higher adoption of robotic systems for routine dental surgeries.

Robotic Dentistry Market Regional Analysis

Based on region, the global robotic dentistry market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America robotic dentistry market share stood at 36.45% in 2024, valued at USD 202.0 million. This dominance is reinforced by advanced healthcare infrastructure, high procedural volumes, and rapid adoption of digital dental technologies.

The regional market further benefits from strong reimbursement frameworks, robust investment in dental innovation, and a well-established network of dental clinics and academic institutions actively integrating robotic systems into clinical practice.

- According to the American Association of Endodontists, over 15 million root canal procedures are performed annually in the U.S., equating to more than 41,000 procedures per day. This high demand has accelerated the need for precision-driven and time-efficient treatment modalities, bolstering the adoption of robot-assisted systems for endodontics and implantology.

Leading U.S.-market players are further reinforcing regional dominance through product innovation, AI integration, and clinical collaborations. Favorable regulatory frameworks and early access to cutting-edge technologies are expected to further contribute to regional market expansion.

The Asia-pacific robotic dentistry market is set to grow at a robust CAGR of 17.67% over the forecast period. This notable expansion is stimulated by rising dental tourism, growing healthcare investments, and the broader adoption of digital technologies in dentistry.

Countries such as China, Japan, South Korea, and India are actively upgrading their dental infrastructure and promoting the use of advanced robotic systems in clinical and academic settings. The increasing prevalence of dental disorders, rising disposable incomes, and a growing middle-class population seeking high-quality dental care are further fueling demand for precision-based treatments.

Regional governments are supporting technological modernization through favorable policies and funding for healthcare digitization, particularly in urban centers. Local manufacturers and international players are forming strategic partnerships to expand market access and tailor robotic solutions to cost-sensitive markets, further propelling domestic market growth.

- In July 2025, Align Technology launched the Invisalign System with mandibular advancement and occlusal blocks in India, expanding its advanced orthodontic portfolio. This innovation targets Class II skeletal and dental malocclusions in patients aged 10–16. By combining mandibular advancement and teeth alignment in a single appliance, the system enhances treatment efficiency and patient comfort by eliminating the need for multiple devices.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) classifies robotic dental systems as medical devices, requiring 510(k) premarket notification or PMA depending on the device class. Compliance with software validation, electrical safety, and clinical efficacy standards is mandatory before market entry. HIPAA regulations govern the use of AI-driven systems involving patient data.

- In the EU, the European Medicines Agency (EMA) and national authorities regulate robotic dental devices under the EU Medical Device Regulation (MDR 2017/745). CE marking is required, along with clinical evaluation, post-market surveillance, and data security compliance aligned with the GDPR.

- In the Asia-Pacific region, countries such as China have implemented stricter review processes for medical robots following increased use of AI in healthcare. Robotic systems must be approved by the National Medical Products Administration (NMPA), with additional oversight for devices incorporating patient diagnostics or treatment planning.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees robotic dental technologies under rigorous clinical trial and safety standards. Use of AI-assisted systems must comply with national guidelines for medical device software and hardware integration.

- Globally, the World Health Organization (WHO) advocates for global standards for AI-powered robotic medical systems, including dental robotics. Recommendations emphasize ethical use, patient safety, and equitable access and harmonized clinical validation through cross-border cooperation.

Competitive Landscape

Leading players in the robotic dentistry market are prioritizing AI integration, precision robotics, and imaging technologies to streamline dental workflows and expand access to high-quality care. Strategic efforts are focused on developing intelligent systems that enable minimally invasive, accurate, and repeatable procedures.

These innovations are addressing key industry demands for efficiency, consistency, and reduced clinical burden. Companies are also emphasizing interoperable platforms that support real-time diagnostics and automated treatment planning, positioning robotic systems as vital tools in modernizing dental practice operations and improving patient outcomes.

- In January 2025, the Dental Innovation Alliance (DIA) announced an investment in Perceptive, a start-up leveraging advanced imaging, AI, and robotics to enhance precision in dental care. The initiative aims to help dental professionals improve procedural efficiency and expand patient access through technology-driven solutions.

Key Companies in Robotic Dentistry Market:

- Dentsply Sirona,

- Planmeca Oy

- Institut Straumann AG

- Neocis, Inc.

- Zimmer Biomet

- Aseptico Inc

- BIOLASE, Inc.

- Envista

- VATECH

- Mectron s.p.a.

- Renishaw plc.

- PreXion Inc.

- Yake Wisdom (Beijing) Technology Co., Ltd

- Perceptive

- Beijing Baihui Weikang Technology Co., Ltd.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- Neocis, a leader in robotic dental implant surgery, secured $20 million in funding led by Mirae Asset Capital and NVIDIA’s NVentures. The investment will accelerate growth and support its FDA-cleared Yomi® surgical system, which has performed over 40,000 implant procedures to date.

- In March 2025, Straumann Group partnered with Carestream Dental to enhance workflow integration in digital dentistry. The collaboration focuses on the seamless integration of Carestream Dental’s CBCT systems with Straumann’s digital platform, Straumann AXS, enabling more efficient implant planning and guided surgery.

freqAskQues