buyNow

Optical Coating Market

Optical Coating Market Size, Share, Growth & Industry Analysis, By Coating Type (Anti-Reflective Coatings, High-Reflective Coatings, Filter Coatings, Transparent Conductive Coatings, Electrochromic Coatings, Beam-splitter Coatings, Partial Reflective Coatings), By Technology, By Application, and Regional Analysis, 2025-2032

pages: 164 | baseYear: 2024 | release: July 2025 | author: Ashim L.

Market Definition

The market encompasses a wide range of layered thin-film materials applied to optical components such as lenses, mirrors, and displays to enhance reflection, transmission, or polarization.

The market covers both decorative and functional coatings designed for several industries such as consumer electronics, solar energy, telecommunications, medical devices, automotive, defense, and architecture. It also encompasses various coating types and deposition technologies that improve optical system performance under diverse environmental and operational conditions.

Optical Coating Market Overview

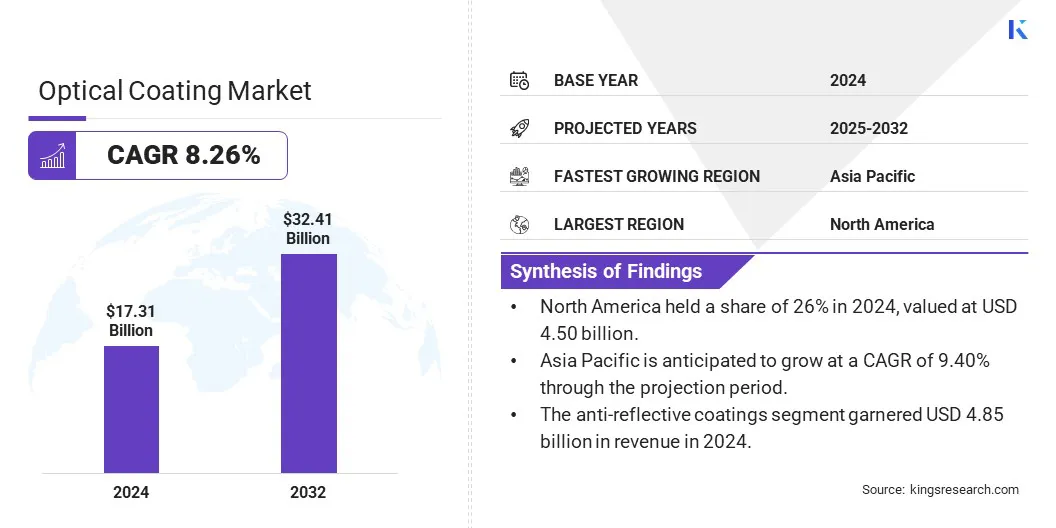

The global optical coating market size was valued at USD 17.31 billion in 2024 and is projected to grow from USD 18.59 billion in 2025 to USD 32.41 billion by 2032, exhibiting a CAGR of 8.26% during the forecast period.

The market is witnessing strong growth, mainly due to the increasing demand across consumer electronics, solar, and automotive industries. The increasing integration of optical components in smartphones, AR/VR headsets, and electric vehicles is boosting adoption across key technology sectors.

Key Highlights:

- The optical coating industry size was recorded at USD 17.31 billion in 2024.

- The market is projected to grow at a CAGR of 8.26% from 2025 to 2032.

- North America held a share of 26% in 2024, valued at USD 4.50 billion.

- The anti-reflective coatings segment garnered USD 4.85 billion in revenue in 2024.

- The sputtering process segment is expected to reach USD 11.36 billion by 2032.

- The solar segment is anticipated to witness the fastest CAGR of 9.62% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.40% through the projection period.

Major companies operating in the optical coating market are Abrisa Technologies, Beneq, Cascade Optical Corporation, Coherent Corp., DuPont, G&H Group, Lambda, Lockheed Martin Corporation, Luxium Solutions, Materion Corporation, Newport Corporation., Nippon Sheet Glass Co., Ltd, PPG Industries Ohio, Inc., Reynard Corporation, and Zeiss Group.

technological advancements in coating processes such as ion-assisted deposition, e-beam evaporation, magnetron sputtering, and atomic layer deposition have improved optical performance and durability. Additionally, the expansion of renewable energy and high-speed communication networks is boosting the widespread adoption of optical coatings.

- In 2024, India installed over 462,000 5G base transceiver stations, covering more than 99% of districts. This expansion supported high-speed communication services, including 5G and FTTH (Fiber to the Home), even in remote regions such as Lakshadweep. This is contributing to increased demand for advanced optical components and coatings in telecom infrastructure.

Market Driver

Rapid Expansion of Consumer Electronics and Solar Energy Sector

The growth of the optical coating market is primarily driven by the increasing adoption of consumer electronics and the expansion of the solar energy sector. Surging demand from smartphone and wearable device manufacturers for enhanced display clarity and energy efficiency is boosting the use of coatings such as anti-reflective layers.

Moreover, energy transition policies are supporting the growth of the solar industry, prompting manufacturers to use advanced coatings to maximize light absorption and improve durability, fostering market growth.

- In June 2025, Dai Nippon Printing Co., Ltd. launched a wide coating device at its Japan plant to meet the growing demand for high functional optical films used in large-screen TVs. The equipment enables multi-layer coatings that enhance display clarity and reduce reflected light, increasing production capacity by over 15%.

Market Challenge

High Costs Associated with Implementation of Advanced Deposition Technologies

A key challenge hindering the development of the optical coating market is the high cost and complexity of advanced deposition technologies such as ion-assisted deposition and e-beam evaporation. These processes demand specialized equipment and cleanroom environments, creating entry barriers for small and medium manufacturers.

To address this challenge, industry players are developing modular and automated coating systems that enhance cost efficiency, scalability, and reduce manual intervention. These advancements enable flexible production and lower operational overheads, supporting wider market participation and accelerating technology adoption among mid-tier optical component manufacturers.

Market Trend

Growing Usage of Optical Coatings in AR/VR and LiDAR Technologies

A key trend influencing the optical coating market is the increasing integration of coatings in AR/VR and LiDAR technologies in consumer electronics, autonomous vehicles, and industrial sensing systems. These applications require precise light control and minimal signal distortion, enabled by specialized coatings that improve image clarity and sensor accuracy.

Moreover, the development of multifunctional coatings with anti-scratch, hydrophobic, and UV-resistant properties is expanding their use in rugged environments, including vehicle head-up displays, smart eyewear, and field-grade optical devices.

- In January 2024, Abrisa Technologies expanded its capabilities to offer ultra-thin glass processing and advanced coatings for NVIS, imaging, sensing, and infrared applications. The updates address the growing demand for precision, multifunctional coatings in high-performance display technologies.

Optical Coating Market Report Snapshot

|

Segmentation |

Details |

|

By Coating Type |

Anti-Reflective Coatings, High-Reflective Coatings, Filter Coatings, Transparent Conductive Coatings, Electrochromic Coatings, Beam-splitter Coatings, Partial Reflective Coatings |

|

By Technology |

Vacuum Deposition Technology, E-Beam Evaporation Technology, Sputtering Process, Ion-Assisted Deposition (IAD) Technology |

|

By Application |

Consumer Electronics (Smartphones, Tablets, Laptops, Cameras), Solar (Photovoltaic Panels, Solar Thermal Systems), Automotive (HUD Displays, Mirrors, Windshields), Medical (Microscopes, Endoscopes, Imaging Devices), Telecommunications (Optical Fibers, Connectors, WDM Components), Defense & Aerospace (Sensors, Laser Systems, Optical Imaging Systems), Architecture (Glass Facades, Smart Windows, Insulating Glass Units) |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Coating Type (Anti-Reflective Coatings, High-Reflective Coatings, Filter Coatings, Transparent Conductive Coatings, Electrochromic Coatings, Beam-splitter Coatings, and Partial Reflective Coatings): The anti-reflective coatings segment earned USD 4.85 billion in 2024, mainly due to the growing demand for consumer electronics and solar panels, which require enhanced light transmission and reduced surface reflection.

- By Technology (Vacuum Deposition Technology, E-Beam Evaporation Technology, Sputtering Process, and Ion-Assisted Deposition (IAD) Technology): The sputtering process segment held a share of 34% in 2024, attributed to its precision, uniformity, and scalability in producing multilayer optical coatings.

- By Application (Consumer Electronics, Solar, Automotive, Medical, Telecommunications, Defense & Aerospace, and Architecture): The consumer electronics segment is projected to reach USD 9.67 billion by 2032, owing to increasing use of high-performance coated lenses and displays in smartphones, wearables, and AR devices.

Optical Coating Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific optical coating market share stood at 38% in 2024, valued at USD 6.58 billion. This dominance is reinforced by large-scale electronics manufacturing hubs in major countries such as China, Japan, and South Korea. The regional market further benefits from well-established supply chains, robust infrastructure, and sustained investments in optical technologies.

Increasing use of optical coatings in automotive displays, consumer electronics, and solar applications further boosts this demand. Additionally, favorable government policies and expanding R&D activities continue to attract global manufacturers. Asia Pacific is expected to maintain its dominance through innovation and industrial integration across key end-use sectors.

The North America optical coating industry is poised to grow at a CAGR of 8.01% over the forecast period. This growth is mainly bolstered by advancements in defense optics, increased R&D in photonics, and expansion of 5G and satellite communication infrastructure.

Furthermore, the regional market benefits from strong regulatory frameworks, funding support, and a well-established innovation ecosystem. These factors are promoting industry–academia collaborations and accelerating the commercialization of optical technologies, fueling regional market expansion and supporting long-term investment and manufacturing growth.

- According to 5G Americas, global 5G connections reached approximately 2 billion in Q3 2024, marking a 48% year-over-year increase with over 170 million new additions. In North America, 5G connections totaled 264 million, representing 32% of the region's wireless connections, indicating the rapid adoption of next-generation wireless networks.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates emissions from optical coating processes under the Clean Air Act, specifically through NESHAP (National Emission Standards for Hazardous Air Pollutants) standards.

- In the European Union, optical coatings fall under REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), which mandates safety in chemical usage across coating formulations.

- In China, environmental compliance for vacuum deposition and sputtering systems used in optical coating is governed by the Ministry of Ecology and Environment under national air pollution standards.

Competitive Landscape

The optical coating industry is characterized by strategic investments in advanced thin-film deposition technologies such as ion-assisted deposition, e-beam evaporation, magnetron sputtering, and atomic layer deposition. Key players are expanding production capacities and enhancing coating performance through proprietary multilayer and nanostructured techniques.

Partnerships between OEMs and optical component manufacturers are promoting the development of application-specific coatings, particularly in the electronics, automotive, and aerospace sectors. Additionally, manufacturers are adopting sustainable practices such as low-emission vacuum processes and recyclable coating materials to comply with environmental regulations and industry demands for greener production.

- In January 2025, MLD Technologies, LLC enhanced its coating capabilities to accommodate large, heavy optical components for high-energy laser systems. The company used ion beam sputtering to deposit reflective coatings with high damage thresholds and low optical losses. The coatings were applied to optics up to 50 cm in diameter and 70 kg in weight, meeting the performance standards needed for defense, aerospace, and other high-power optical applications.

Key Companies in Optical Coating Market:

- Abrisa Technologies

- Beneq

- Cascade Optical Corporation

- Coherent Corp.

- DuPont

- G&H Group

- Lambda

- Lockheed Martin Corporation

- Luxium Solutions

- Materion Corporation

- Newport Corporation.

- Nippon Sheet Glass Co., Ltd

- PPG Industries Ohio, Inc.

- Reynard Corporation

- Zeiss Group

Recent Developments (Expansion/Launch)

- In January 2025, Coburn Technologies and SDC Technologies, subsidiaries of Mitsui Chemicals Group, launched a compact tabletop lens coating system for small to medium-sized labs. The system offers space-efficient, high-quality anti-abrasion coating, boradening access to advanced optical coating technologies.

- In January 2025, ZEISS introduced the DuraVision Gold UV lens coating, featuring ZEISS CleanGuard technology for improved clarity, durability, and maintenance. The coating offers anti-static, oil-, and water-repellent properties, and makes lenses up to three times easier to clean than previous versions.

freqAskQues