enquireNow

Calibration Services Market

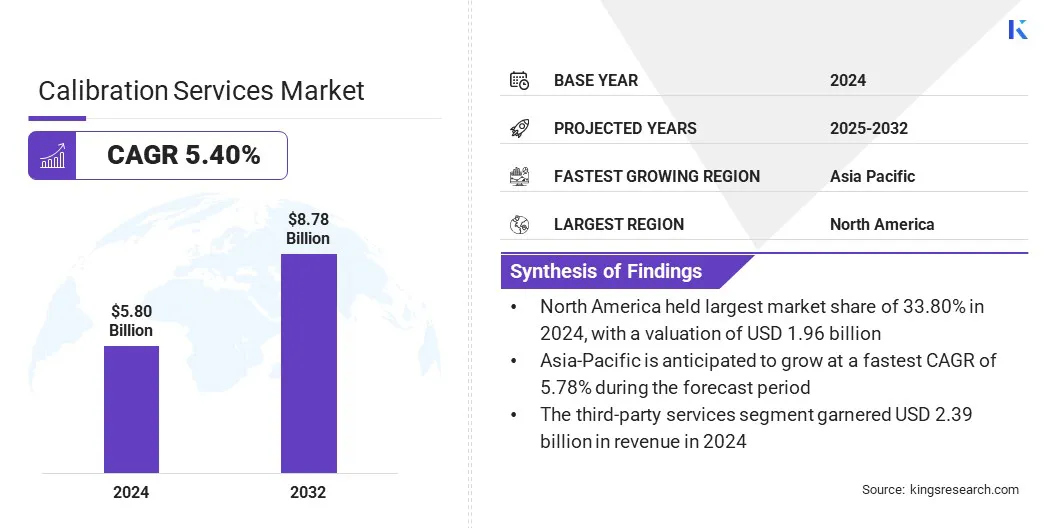

Calibration Services Market Size, Share, Growth & Industry Analysis, By Service Type (In-House Laboratory Services, OEM's, Third-Party Services), By Calibration Type (Mechanical calibration, Electrical calibration, Dimensional calibration), By End-use Industry (Aerospace & Defence, Automotive, Industrial & Automation), and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: August 2025 | author: Versha V.

Market Definition

Calibration services involve testing and adjustment of instruments to ensure accuracy against defined standards. These services are essential for maintaining measurement reliability and compliance with regulatory and quality requirements.

Covering mechanical, electrical, and thermal parameters across industries such as aerospace, automotive, pharmaceuticals, energy, and manufacturing, these services enhance operational efficiency, product quality, and safety by minimizing measurement errors and ensuring consistent equipment performance.

Calibration Services Market Overview

The global calibration services market size was valued at USD 5.80 billion in 2024 and is projected to grow from USD 6.07 billion in 2025 to USD 8.78 billion by 2032, exhibiting a CAGR of 5.40% during the forecast period.

This growth is attributed to the rising demand for reliable, accurate, and traceable measurement standards across industries such as aerospace, automotive, energy, and life sciences. Increasing regulatory pressure, quality assurance requirements, and the need for consistent product performance are prompting organizations to adopt professional calibration services.

Key Highlights

- The calibration services industry size was valued at USD 5.80 billion in 2024.

- The market is projected to grow at a CAGR of 5.40% from 2025 to 2032.

- North America held a share of 33.80% in 2024, valued at USD 1.96 billion.

- The third-party services segment garnered USD 2.39 billion in revenue in 2024.

- The electrical calibration segment is expected to reach USD 3.55 billion by 2032.

- The automotive segment is anticipated to witness the fastest CAGR of 6.85% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.78% through the projection period.

Major companies operating in the calibration services market are Trescal, Rohde & Schwarz Emirates L.L.C., TEKTRONIX, INC., Endress+Hauser Group Services AG, VIAVI Solutions Inc., Fluke Corporation, Siemens, Keysight Technologies, METTLER TOLEDO, Hexagon AB, Honeywell International Inc., Micro Precision, Sartorius AG, ALFA LAVAL, and WIKA.

The growing focus on equipment uptime, operational efficiency, and safety is fueling the demand for both in-house and third-party calibration models. Additionally, the emergence of automated and remote calibration solutions, advancements in sensor technology, and the shift toward predictive maintenance are accelerating market development.

- In June 2024, Element Metech introduced a new 40 m² mobile calibration lab equipped with five workstations to perform on-site calibration of high-frequency instruments (DC to 50 GHz), including signal generators and spectrum/network analyzers. The lab offers modular configurations to address customer requirements. Additionally, its existing mobile unit in Arboga is being upgraded to handle low-frequency instruments (DC to 1 GHz), enhancing nationwide service flexibility across Sweden.

Market Driver

Rising Demand from High-Precision Manufacturing Sectors

The growth of the calibration services market is supported by rising demand from high-precision manufacturing sectors that rely heavily on accurate measurement and testing. Industries such as aerospace, automotive, pharmaceuticals, and electronics require strict adherence to dimensional tolerances and performance specifications, which necessitate routine calibration of critical instruments.

As production processes become more automated and technologically advanced, the margin for error continues to shrink, highlighting the importance of reliable calibration practices.

This demand is further reinforced by quality assurance frameworks, industry certifications, and customer expectations that emphasize measurement consistency and compliance. Organizations are increasingly integrating calibration into preventive maintenance strategies to ensure equipment uptime and operational efficiency, fueling the adoption of professional calibration services.

Market Challenge

Shortage of Skilled Technicians and Metrology Experts

The calibration services market faces a critical challenge due to the shortage of skilled technicians and metrology experts required to perform high-precision calibration across diverse industries.

Sectors such as aerospace, pharmaceuticals, and electronics require in-depth technical knowledge, practical expertise, and adherence to industry standards. This talent gap constrains service capacity, increases turnaround times, and affects calibration accuracy and reliability. This gap in workforce readiness delays certification processes, disrupts production schedules, and impacts compliance efforts for end users.

To overcome this challenge, calibration service providers are investing in technician training, workforce development, and partnerships with technical institutions to build a skilled talent pool. They are also integrating automation and digital tools to reduce manual intervention and improve efficiency. Additionally, remote support models and knowledge-sharing platforms are being adopted to extend service reach and better utilize existing expertise.

Market Trend

Integration of Calibration with Predictive Maintenance Programs

Advancements in predictive maintenance strategies are reshaping the calibration services market by enabling more proactive, data-driven asset management. Integration of sensor technologies, condition monitoring, and analytics allows organizations to anticipate calibration needs based on equipment usage patterns and performance drift rather than relying on fixed schedules.

This approach enhances operational efficiency, reduces unplanned downtime, and extends the lifespan of critical instruments across the aerospace, manufacturing, and energy sectors.

Real-time monitoring tools and diagnostic software enable smarter calibration planning aligned with production demands. Automated alerts and cloud-based systems enable timely service interventions, improve traceability, and simplify audit readiness. These capabilities position calibration as a strategic component of maintenance frameworks, aiding long-term value and performance reliability.

Calibration Services Market Report Snapshot

|

Segmentation |

Details |

|

By Service Type |

In-House Laboratory Services, OEM's, Third-Party Services |

|

By Calibration Type |

Mechanical calibration, Electrical calibration, Dimensional calibration, Thermodynamic calibration, and Others |

|

By End-use Industry |

Aerospace & Defence, Automotive, Industrial & Automation, Electronics & Semiconductors, Telecommunications, Healthcare & Medical Devices, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Service Type (In-House Laboratory Services, OEM's, and Third-Party Services): The third-party services segment earned USD 2.39 billion in 2024 , mainly due to increasing demand for cost-effective, accredited calibration solutions across multiple industries.

- By Calibration Type (Mechanical calibration, Electrical calibration, Dimensional calibration, Thermodynamic calibration, and Others): The electrical calibration segment held a share of 35.90% in 2024, primarily fueled by the widespread use of electronic testing equipment in sectors such as aerospace, telecommunications, and automotive.

- By End-use Industry (Aerospace & Defence, Automotive, Industrial & Automation, Electronics & Semiconductors, Telecommunications, Healthcare & Medical Devices, and Others): The healthcare & medical devices segment is projected to reach USD 3.01 billion by 2032, owing to strict regulatory standards and the critical need for precise calibration of diagnostic and monitoring equipment.

Calibration Services Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America calibration services market share stood at 33.80% in 2024, valued at USD 1.96 billion. This dominance is reinforced by the presence of precision-driven industries, widespread implementation of quality management systems, and a widespread network of accredited calibration laboratories.

Furthermore, the regional market benefits from continuous investments in advanced manufacturing, aerospace innovation, and pharmaceutical research, highlighting the need for regular and highly accurate calibration services.

The region’s emphasis on regulatory compliance, equipment reliability, and operational efficiency supports sustained service adoption. Growing integration of predictive maintenance strategies, automation in industrial processes, and digital calibration technologies further strengthens North America's position as a key region for calibration service innovation and delivery.

- In May 2025, Pickering Interfaces partnered with Trescal to offer ISO/IEC 17025-accredited calibration services for its PXI and LXI switching modules in the U.S. The partnership enables localized support, reducing lead times and eliminating international shipping to the UK.

The Asia-Pacific calibration services industry is set to grow at a CAGR of 5.78% over the forecast period. This growth is propelled by accelerating industrial development, rising export-oriented manufacturing , and the increasing need for standardized measurement practices.

Expanding sectors such as electronics, automotive, and pharmaceuticals are fueling consistent demand for precise and traceable calibration services to meet international compliance and quality benchmarks. Government-led initiatives aimed at enhancing industrial automation, metrology infrastructure, and workforce skills are further supporting regional market growth.

Moreover, the shift toward digital calibration technologies, along with rising adoption of predictive maintenance and in-house quality systems, is boosting the demand for advanced calibration capabilities. The presence of cost-competitive service providers and the growing penetration of global calibration firms are further contributing to regional market expansion.

Regulatory Frameworks

- Globally, the ISO/IEC 17025 standard governs the general requirements for the competence of testing and calibration laboratories worldwide. It establishes uniform criteria for laboratory quality systems, technical proficiency, and traceability of measurements, enabling internationally recognized test results and certificates.

- In China, the National Institute of Metrology (NIM) oversees calibration standards under the Metrology Law of the People’s Republic of China. NIM ensures traceability and enforces regular calibration of measurement equipment.

Competitive Landscape

Companies operating in the global calibration services industry are actively enhancing their competitiveness by expanding service portfolios, adopting automation and digital tools, and priortizing strategic collaborations. Key players are investing in advanced calibration technologies, remote service capabilities, and cloud-based data management systems to improve accuracy, efficiency, and traceability across sectors.

They are also broadening their industry-specific offerings, including multi-parameter and on-site calibration services, to meet the evolving needs of aerospace, automotive, electronics, and life sciences sectors.

Additionally, firms are partnering with OEMs, industrial manufacturers, and accredited laboratories to strengthen global service networks, ensure regulatory compliance, and secure long-term service agreements in both developed and high-growth regions.

- In November 2024, Quadsat partnered with mmt under its new global Service Partner Network to expand access to its drone-based RF calibration and electromagnetic emulation services. Through this collaboration, mmt will deliver in-situ testing for teleport and user terminal antennas, satellite networks, and RF instruments across both civil and defense sectors.

Key Companies in Calibration Services Market:

- Trescal

- Rohde & Schwarz Emirates L.L.C.

- TEKTRONIX, INC.

- Endress+Hauser Group Services AG

- VIAVI Solutions Inc.

- Fluke Corporation

- Siemens

- Keysight Technologies

- METTLER TOLEDO

- Hexagon AB

- Honeywell International Inc.

- Micro Precision

- Sartorius AG

- ALFA LAVAL

- WIKA

Recent Developments (M&A)

- In September 2024, Aldinger Company acquired Michigan-based Servo Innovations, a provider of high-precision calibration and repair services for the automotive, aerospace, and manufacturing sectors. The deal strengthens Aldinger’s technical capabilities, broadens its service portfolio, and supports expansion into key industrial markets.

- In July 2024, NMi Group acquired Minerva Metrology and Calibration, an ISO/IEC 17025-accredited calibration provider in the Benelux region. The acquisition expands NMi’s footprint in Benelux , while strengthening its service offerings through Minerva’s technical expertise, Fluke reseller status, and training capabilities.

freqAskQues