buyNow

Autonomous Underwater Vehicle Market

Autonomous Underwater Vehicle Market Size, Share, Growth & Industry Analysis, By Type (Small AUVs, Medium AUVs, Large AUVs), By Payload Type (Sensor-based AUVs, Intervention AUVs), By Application (Military & Defense, Search & Salvage Operation, Archaeology & Exploration, Others) and Regional Analysis, 2024-2031

pages: 120 | baseYear: 2023 | release: March 2024 | author: Antriksh P.

Autonomous Underwater Vehicle Market Size

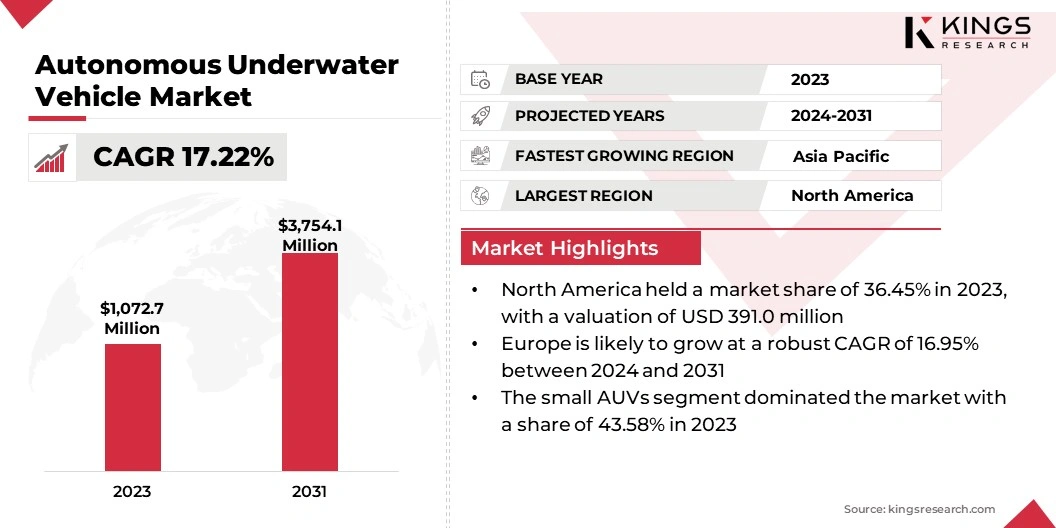

The global Autonomous Underwater Vehicle Market size was valued at USD 1,072.7 million in 2023 and is projected to reach USD 3,754.1 million by 2031, growing at a CAGR of 17.22% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Kongsberg Gruppen ASA, Oceaneering International, Inc., Fugro, Lockheed Martin Corporation, Saab AB, L3Harris Technologies, Inc., Boeing, General Dynamics Mission Systems, Inc., ECA GROUP and Others.

The global market is experiencing robust growth and presents a promising outlook for the foreseeable future. With advancements in technology and increasing applications across various sectors, the market for AUVs is expanding significantly.

The current market scenario is characterized by a growing demand for AUVs, driven by their ability to perform complex tasks autonomously in underwater environments. Factors such as rising exploration activities, increasing emphasis on maritime security, and advancements in AUV capabilities are contributing to market growth.

- Moreover, the outlook for the AUV market remains positive, with projections indicating sustained growth over the coming years as the technology continues to evolve and find new applications across industries.

Analyst’s Review

The adoption of artificial intelligence-enabled autonomy is poised to significantly fuel the demand for autonomous underwater vehicles (AUVs) in the forthcoming years. As industries increasingly utilize AI for autonomous operations, the market for AUVs is expected to witness substantial growth over the forecast period.

AI-enabled autonomy enhances the capabilities of AUVs by enabling them to navigate complex underwater environments, collect and analyze data, and execute tasks with greater precision and efficiency. This trend is anticipated to drive demand for AUVs across various sectors, including marine research, offshore oil and gas exploration, defense, and environmental monitoring, thereby contributing to autonomous underwater vehicle market growth over the forecast years.

Market Definition

An autonomous underwater vehicle (AUV) is a type of robotic system designed to operate underwater without direct human intervention. These vehicles are equipped with various sensors and navigation systems that enable them to navigate autonomously and perform predefined tasks. AUVs can vary in size, with smaller vehicles typically ranging from a few feet to several meters in length, while larger models can be several meters long.

They are powered by electric propulsion systems and can carry payloads such as cameras, sonars, sensors, and manipulators for data collection, mapping, inspection, and other applications. AUVs find applications in various industries, including marine research, offshore oil and gas, defense, environmental monitoring, and underwater exploration.

Autonomous Underwater Vehicle Market Dynamics

The rising demand for autonomous underwater vehicles (AUVs) for border and coastal security is expected to significantly boost market growth in the coming years. With increasing security concerns related to maritime borders and coastal regions, governments and maritime agencies are increasingly turning to AUVs for surveillance, reconnaissance, and monitoring purposes.

AUVs offer several advantages for border and coastal security, including their ability to operate autonomously for extended periods, gather real-time data, and navigate complex underwater environments. The growing demand from defense and security agencies is driving the adoption of AUVs, thereby fueling autonomous underwater vehicle market growth over the forecast period.

- For instance, in August 2023, Fugro conducted the inaugural remotely operated subsea inspection in the Middle East. Commissioned by Chinese operator Atlantis, the inspection encompassed the UAQ3 platform in the Umm Al Quwain gas field was conducted utilizing the Fugro Pegasus Uncrewed Surface Vessel (USV).

The high operational costs of autonomous underwater vehicles (AUVs) are hampering market growth. While AUVs offer numerous benefits, including autonomous operation, data collection capabilities, and versatility in various underwater applications, their high upfront and operational costs pose a significant challenge to market expansion.

The complexity of AUV systems, including sophisticated sensors, navigation equipment, propulsion systems, and maintenance requirements, contributes to their high costs. Additionally, factors such as research and development expenses, regulatory compliance, and infrastructure investment add to the overall operational costs of AUVs. Despite the benefits they offer, the high costs associated with AUVs remain a key restraint impacting market growth.

Segmentation Analysis

The global market is segmented based on type, payload type, application, and geography.

By Type

Based on type, the market is segmented into small AUVs, medium AUVs, and large AUVs. The small AUVs segment dominated the autonomous underwater vehicle market with a share of 43.58% in 2023 due to their compact size, maneuverability, and versatility in various underwater applications.

Small AUVs are typically used for tasks such as underwater mapping, environmental monitoring, research, and inspection in confined spaces where larger vehicles cannot operate efficiently. Their smaller size further contributes to lower operational costs compared to larger AUVs, making them a preferred choice for several applications across industries.

By Payload Type

Based on payload type, the autonomous underwater vehicle market is bifurcated into sensor-based AUVs and intervention AUVs. The intervention AUVs segment is expected to grow at the highest CAGR of 17.91% over the forecast period on account of the increasing demand for AUVs capable of performing intervention tasks such as maintenance, repair, and inspection in underwater infrastructure and offshore installations.

Intervention AUVs are equipped with manipulators and specialized tools that enable them to perform complex tasks autonomously in challenging underwater environments, making them essential for various industries, including offshore oil and gas, renewable energy, and marine research.

By Application

Based on application, the market is classified into military & defense, search & salvage operation, archaeology & exploration, and others. The military & defense segment garnered the highest revenue of USD 443.9 million in 2023, mainly fueled by the increasing adoption of autonomous underwater vehicles (AUVs) for defense and security applications.

Military and defense agencies worldwide are utilizing AUVs for tasks such as underwater surveillance, reconnaissance, mine countermeasures, and anti-submarine warfare. AUVs offer advantages such as stealth operation, long endurance, and the ability to operate in hazardous environments, making them valuable assets for defense and security operations.

Autonomous Underwater Vehicle Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Autonomous Underwater Vehicle Market share stood around 36.45% in 2023 in the global market, with a valuation of USD 391.0 million, driven by factors such as significant investments in marine research and exploration, technological advancements, and a strong presence of key players in the region.

The region is home to several leading manufacturers and users of autonomous underwater vehicles (AUVs), thereby contributing to its dominance in the market. Additionally, government initiatives to enhance maritime security and surveillance capabilities support the growth of the regional market.

Europe is likely to grow at a robust CAGR of 16.95% between 2024 and 2031, mainly fostered by the increasing investments in marine research, offshore energy exploration, and defense applications. The region is witnessing a growing demand for autonomous underwater vehicles (AUVs) across various sectors, including marine science, offshore oil and gas, renewable energy, and defense.

Factors such as technological advancements, supportive government initiatives, and collaborations between industry players and research institutions are expected to drive market growth in Europe through the projected period.

Competitive Landscape

The autonomous underwater vehicle market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Autonomous Underwater Vehicle Market

- Kongsberg Gruppen ASA

- Oceaneering International, Inc.

- Teledyne Marine Technologies Incorporated

- Fugro

- Lockheed Martin Corporation

- Saab AB

- L3Harris Technologies, Inc.

- Boeing

- General Dynamics Mission Systems, Inc.

- ECA GROUP

- HII

Key Industry Developments

- February 2024 (Testing): Oceaneering International revealed that its Aerospace and Defense Technologies (ADTech) division secured a contract from the Defense Innovation Unit (DIU), under the U.S. Department of Defense, for the development and testing of the Freedom Autonomous Underwater Vehicle (AUV).

- December 2023 (Expansion): Boeing handed over the initial Orca Extra Large Uncrewed Undersea Vehicle (XLUUV) to the U.S. Navy, marking the advent of a new class capable of prolonged critical missions. This development ensures undersea maritime dominance in dynamic and contested waters.

- July 2023 (Collaboration): L3Harris achieved a significant milestone as the first company to successfully conduct a fully autonomous launch and recovery of an AUV from a moving submarine, leveraging its established Iver4 AUV technology. This innovative solution, known as Torpedo Tube Launch and Recovery, enhances operational capabilities for underwater missions.

The global Autonomous Underwater Vehicle Market is segmented as:

By Type

- Small AUVs

- Medium AUVs

- Large AUVs

By Payload Type

- Sensor-based AUVs

- Intervention AUVs

By Application

- Military & Defense

- Search & Salvage Operation

- Archaeology & Exploration

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.