buyNow

Assisted Living Market

Assisted Living Market Size, Share, Growth & Industry Analysis, By Service Type (Personal Care and Assistance, Healthcare and Medical Services, Others), By Facility Type (Community-based Residential Facilities, Adult Family Homes, Residential Care Apartment Complexes), By Age Group, and Regional Analysis, 2025-2032

pages: 160 | baseYear: 2024 | release: July 2025 | author: Sunanda G.

Market Definition

Assisted living encompasses residential facilities that offer personalized support with daily activities while maintaining a homelike environment. These communities provide services such as medication management, meal preparation, and housekeeping, along with social and recreational programs.

The market scope spans seniors and adults with mild cognitive or physical impairments seeking a balance of independence and care. Families and care coordinators choose assisted living for several applications, including transitional care, enrichment programs, and social engagement, to ensure safety, well-being, and quality of life.

Assisted Living Market Overview

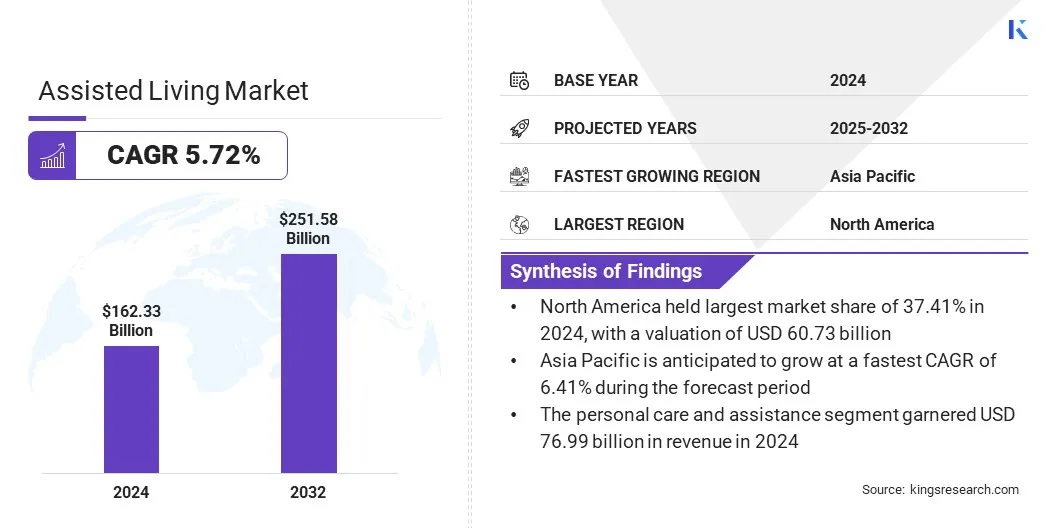

The global assisted living market size was valued at USD 162.33 billion in 2024 and is projected to grow from USD 170.42 billion in 2025 to USD 251.58 billion by 2032, exhibiting a CAGR of 5.72% during the forecast period.

The growing prevalence of chronic diseases and dementia is increasing the demand for long-term supportive care, driving the market. Additionally, advancements in remote monitoring and AI technologies are improving resident safety and enabling early intervention, making assisted living facilities more reliable and appealing for families and providers.

Key Market Highlights:

- The assisted living industry size was valued at USD 162.33 billion in 2024.

- The market is projected to grow at a CAGR of 5.72% from 2025 to 2032.

- North America held a market share of 37.41% in 2024, with a valuation of USD 60.73 billion.

- The personal care and assistance segment garnered USD 76.99 billion in revenue in 2024.

- The community-based residential facilities segment is expected to reach USD 101.27 billion by 2032.

- The 85 years and older segment secured the largest revenue share of 37.78% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.41% during the forecast period.

Major companies operating in the assisted living market are Brookdale Senior Living Inc., Sunrise Senior Living, Holiday, Atria Senior Living, Inc., Five Star Senior Living, Ensign Group, Inc., Diversicare Healthcare Services, LLC., Merrill Gardens, Genesis HealthCare, Senior Lifestyle, CHARTWELL MASTER CARE LP, Ventas, Inc., Clariane, Dussmann Group, and Athulya Senior Care.

The global aging population and increasing life expectancy are driving the demand for assisted living facilities. A sharp rise in the population aged 80 years and above further contributes to the need for long-term care and supportive living environments.

- According to the United Nations' report in 2024, the global population aged 65 years and above is expected to surpass 2.2 billion by the late 2070s, exceeding the number of children under 18 years. By the mid-2030s, the number of people aged 80 years and older is projected to reach 265 million, overtaking the population of infants.

Older adults increasingly require assistance with daily activities, medical supervision, and social engagement to maintain the quality of life. Consumers and healthcare systems are adopting assisted living facilities as a solution for aging-in-place challenges. The market is expanding steadily as senior populations grow and longevity becomes a defining factor in global healthcare planning.

- In January 2025, Masonicare, a major non-profit senior-living provider in Connecticut, merged with United Methodist Homes and acquired Atria Greenridge Place, increasing its service capacity from 4,500 to 7,500 daily residents and growing its staff by over 30 %.

Market Driver

Prevalence of Chronic Disease and Dementia

The rising prevalence of chronic diseases and dementia among older adults is driving the demand for assisted living facilities that provide constant care and supervision. A significant portion of the senior population is dealing with multiple long-term health conditions, which require daily medical attention and personal assistance.

Common issues such as cardiovascular disease, diabetes, and mobility limitations are increasing the need for structured and supportive living arrangements. Alzheimer’s and other forms of dementia are also contributing to the need for specialized memory care within assisted living environments.

Families are increasingly relying on these facilities to ensure that their loved ones receive safe, professional, and consistent care. The assisted living market is growing as healthcare demands increase with age-related physical and cognitive decline.

- In August 2024, the U.S. Centers for Disease Control and Prevention (CDC) reported that 44% of residents in residential care communities had been diagnosed with Alzheimer’s or other dementias, and 58% had high blood pressure. These chronic conditions highlight the increasing demand for assisted living environments capable of offering continuous care and supervision.

Market Challenge

Staffing Shortages and Turnover

A key challenge in the assisted living market is the ongoing difficulty in hiring and retaining qualified caregiving personnel. High turnover rates and persistent recruitment challenges are disrupting care delivery and placing pressure on the existing staff. These workforce constraints are limiting service quality, reducing operational efficiency, and hindering efforts to expand capacity.

Market players are enhancing employee engagement programs, offering career development opportunities, and improving workplace conditions to boost retention. Companies are also adopting scheduling tools and workforce planning solutions to manage staffing levels and maintain consistent care standards.

Market Trend

Improving Resident Safety with Remote Monitoring and AI

A key trend in the assisted living market is the use of remote monitoring systems and AI-powered safety tools to support resident well-being. Assisted living facilities are deploying wearables, motion sensors, and health-monitoring devices to track vital signs, movement patterns, and daily routines.

AI algorithms are analyzing this data to detect early signs of health issues, falls, or medication-related errors. These systems are enabling more proactive and predictive care, allowing staff to respond before conditions escalate.

Real-time alerts and continuous monitoring help reduce emergency interventions and improve overall care quality. The market is adopting technology-driven solutions to enhance safety, responsiveness, and resident independence.

- In September 2024, the Bristal Assisted Living communities deployed the Foresite Fall Detection & Health Monitoring system. The system uses passive wireless sensors, depth sensors, and under-bed sensors combined with AI-based predictive analytics to detect changes in residents' fall risk and health status.

Assisted Living Market Report Snapshot

|

Segmentation |

Details |

|

By Service Type |

Personal Care and Assistance, Healthcare and Medical Services, Others |

|

By Facility Type |

Community-based Residential Facilities, Adult Family Homes, Residential Care Apartment Complexes, Continuing Care Retirement Communities |

|

By Age Group |

Below 65 Years Old, 65-74 Years Old, 75-84 Years Old, 85 Years and Older |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Service Type (Personal Care and Assistance, Healthcare and Medical Services, and Others): The personal care and assistance segment earned USD 76.99 billion in 2024, due to the high demand for daily support services such as bathing, dressing, and mobility assistance.

- By Facility Type (Community-based Residential Facilities, Adult Family Homes, Residential Care Apartment Complexes, and Continuing Care Retirement Communities): The community-based residential facilities segment held 43.11% share of the market in 2024, due to its cost-effective care model, homelike environment, and ability to provide personalized support.

- By Age Group (Below 65 Years Old, 65-74 Years Old, 75-84 Years Old, and 85 Years and Older): The 85 years and older segment is projected to reach USD 99.48 billion by 2032, owing to their higher dependency on daily care, increased prevalence of chronic conditions, and the greater need for supervised living environments.

Assisted Living Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America assisted living market share stood at around 37.41% in 2024, with a valuation of USD 60.73 billion. This dominance is attributed to the rising preference for community-based assisted living over traditional nursing homes in the region.

The shift is largely influenced by evolving expectations among older adults and their families, who place greater importance on independence, personalized support, and a home-like setting. Consequently, facilities that provide flexible care options and opportunities for social interaction are registering stronger demand, driving the market.

- In April 2025, StoneRidge Senior Living announced a USD 40 million expansion, adding 14 enhanced assisted living and memory care units to its existing campus. This expansion reflects the growing need for structured and supportive environments that can manage chronic illnesses and cognitive conditions. The project also includes new common spaces to support residents with mobility or health challenges.

The assisted living industry in Asia Pacific is poised for significant growth at a CAGR of 6.41% over the forecast period. This growth is attributed to increased involvement from private sector players, including hospital chains, senior housing startups, and real estate developers in the region. These businesses are actively investing in modern, purpose-built assisted living communities.

The developments integrate healthcare services with comfortable and residential-style living, appealing to local seniors and returning expatriates. Growing presence of these businesses is enhancing the visibility and accessibility of assisted living, contributing significantly to the market’s expansion in the region.

- In May 2024, Keppel, a Singapore-based real estate and asset manager, launched its first assisted living facility in Asia at Nanjing. The 400-bed purpose-built community integrates healthcare services with a residential-style environment and features technology-driven chronic disease management and personalized care plans.

Regulatory Frameworks

- In the U.S., assisted living is regulated at the state level through licensing that addresses care plans, medication management, staffing, safety, and building standards. The Americans with Disabilities Act (ADA) mandates accessible designs in new or modified facilities. Training requirements, inspection routines, and enforcement vary widely across states.

- In England and Wales, assisted living and care homes are regulated under the Care Standards Act 2000 and are enforced by the Care Quality Commission. It mandates registration, regular inspections, and adherence to standards covering resident care, staffing, and safety. Similar frameworks apply in Scotland and Northern Ireland. All care providers must register, undergo assessment, and meet social care worker training and care delivery standards.

Competitive Landscape

Major players in the assisted living industry are adopting AI-powered platforms, investing in remote health monitoring technologies, and partnering with healthcare providers and tech companies to enhance care delivery in assisted living settings.

Several players are focusing on research and development to create non-invasive and real-time monitoring systems that support proactive intervention and improve resident outcomes. These advancements are contributing to the market’s growth by enabling more efficient, personalized, and safer care for seniors in independent and assisted living environments.

- In February 2025, Electronic Caregiver, Inc. launched Addison Care, an AI-powered virtual care solution for independent and assisted living. Addison Care uses non-invasive Wi‑Fi monitoring, wearables, voice and app interfaces to track vital signs, daily routines, falls, and medication adherence. The platform provides real-time alerts for issues like infections or non-adherence, and supports emergency responses via voice, touchscreen, wearables, and GPS, enhancing proactive, predictive resident care.

Key Companies in Assisted Living Market:

- Brookdale Senior Living Inc.

- Sunrise Senior Living

- Holiday

- Atria Senior Living, Inc.

- Five Star Senior Living

- Ensign Group, Inc.

- Diversicare Healthcare Services, LLC.

- Merrill Gardens

- Genesis HealthCare

- Senior Lifestyle

- CHARTWELL MASTER CARE LP

- Ventas, Inc.

- Clariane

- Dussmann Group

- Athulya Senior Care

Recent Developments (Expansions)

- In June 2025, Pegasus Senior Living reopened Pegasus Landing of Tanglewood as Houston’s first NASA-themed assisted living and memory care community. The facility features space‑inspired amenities such as the Gemini Bistro Cafe, Apollo Theater, and Launch Pad Courtyard, along with authentic NASA memorabilia displays. The community aims to create an engaging environment for residents by honoring Houston’s space legacy.

- In April 2025, Cedarhurst Senior Living opened a 12-bed dedicated Memory Care unit in Bethalto, Illinois. Facility enhancements include secure access to prevent wandering, 24-hour staffing, and tailored daily excursions. The new facility is built to meet the increased demand for dementia-specific services and continuous oversight for residents exhibiting cognitive decline.

- In April 2025, Geri Care Health Services launched its first assisted living centre in Bengaluru. The 100‑bed facility on St. John's Road provides medically supervised eldercare and skilled nursing services. The company plans to introduce additional centres in Sarjapur, Coimbatore, Hyderabad, and Kochi as part of a national expansion strategy.

- In March 2025, The Ensign Group acquired six skilled nursing and senior living facilities across Arizona, Alaska, Oregon, and Washington. The acquisition includes two facilities in Mesa, Arizona, and four additional campuses in Alaska, Oregon, and Washington that encompass skilled nursing and senior living units.

- In February 2025, The Ensign Group’s real estate arm, Standard Bearer Healthcare REIT, acquired five skilled nursing facilities in Texas. These facilities will be operated by Ensign-affiliated subsidiaries under long-term triple-net leases.

freqAskQues