Buy Now

Offshore Support Vessel Market

Offshore Support Vessel Market Size, Share, Growth & Industry Analysis, By Type (Anchor Handling Tug & Supply, Platform Supply, Crew, Seismic, Others), By Depth (Shallow Water, Deepwater, Ultra-Deepwater), By Application (Oil & Gas, Offshore Wind, Patrolling, Others), and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: June 2025 | Author: Versha V.

Market Definition

The market encompasses specialized ships designed to support offshore oil and gas exploration, production, and renewable energy projects. These vessels provide essential services such as supply transport, crew transfer, anchor handling, and platform maintenance.

It includes various vessel types such as platform supply vessels (PSVs), anchor handling tug supply (AHTS) vessels, and crew boats. The report offers a thorough assessment of the key factors driving market expansion, along with a detailed regional analysis and the competitive landscape influencing the market dynamics.

Offshore Support Vessel Market Overview

The global offshore support vessel market size was valued at USD 21.63 billion in 2024 and is projected to grow from USD 23.14 billion in 2025 to USD 37.57 billion by 2032, exhibiting a CAGR of 7.11% during the forecast period.

The market is experiencing strong growth driven by the rising offshore oil and gas exploration activity, fueled by the increasing global energy demand. The expansion of offshore infrastructure projects, including subsea pipelines, floating platforms, and underwater installations, is driving the demand for offshore support vessels.

Major companies operating in the offshore support vessel industry are BOURBON, Tidewater Inc, SEACOR Marine, Solstad, Galliano Marine Service, Havila Shipping ASA, Sea1 Offshore, DOF, SWIRE SHIPPING, Vroon, China Shipbuilding Industry Trading Co Ltd, Hornbeck Offshore, Jackson Offshore Operators, Glomar Offshore and McDermott.

Additionally, the expansion of offshore wind projects is significantly contributing to the growth of the offshore support vessel (OSV) market. As countries invest in renewable energy to meet sustainability goals, offshore wind farms are rapidly increasing in number and scale.

These projects require a variety of OSVs for installation, cable laying, maintenance, and crew transfer which is creating a strong demand for OSVs to support the development of offshore wind infrastructure.

- According to a 2023 report by The National Renewable Energy Laboratory (NREL), the U.S. offshore wind pipeline grew by 53% to 80.5 GW, sufficient to power about 28 million homes. Moreover, the global offshore wind capacity reached 68 GW in 2023, with project pipelines totaling 453.6 GW.

Key Highlights:

- The offshore support vessel market size was valued at USD 21.63 billion in 2024.

- The market is projected to grow at a CAGR of 7.11% from 2025 to 2032.

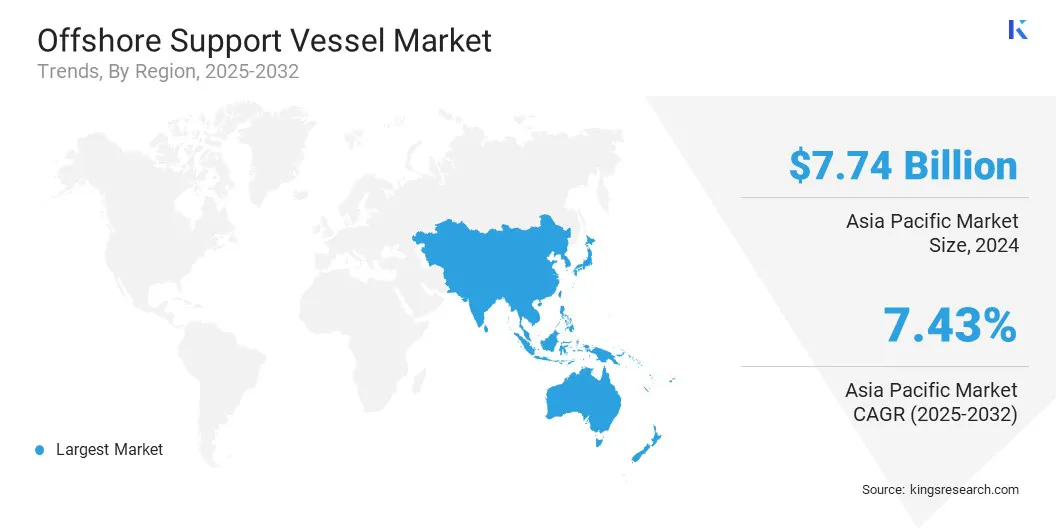

- Asia Pacific held a market share of 35.77% in 2024, with a valuation of USD 7.74 billion.

- The anchor handling tug & supply segment garnered USD 6.07 billion in revenue in 2024.

- The deepwater segment is expected to reach USD 14.03 billion by 2032.

- The offshore wind segment is anticipated to witness the fastest CAGR of 7.64% over the forecast period.

- Europe is anticipated to grow at a CAGR of 7.03% over the forecast period.

Market Driver

Growing Offshore Oil and Gas Exploration Activities

Rising offshore oil and gas exploration is driving the expansion of the market. As global energy demand is increasing, oil companies are investing heavily in offshore projects, particularly in deepwater and ultra-deepwater regions.

These complex environments require a wide range of specialized vessels for transporting equipment, managing anchors, and supporting drilling operations. The growing number of offshore rigs and exploration activities is significantly boosting the demand for modern, efficient OSVs.

- According to the Bureau of Ocean Energy Management (BOEM), offshore federal production in fiscal year 2024 reached approximately 668 million barrels of oil and 700 billion cubic feet of natural gas, originating from the Gulf of Mexico. This accounted for about 14% of total U.S. oil production and 2% of natural gas production.

Market Challenge

High Operating Costs

High operating cost is a significant challenge for the offshore support vessel market as OSVs require substantial expenditures for fuel, crew salaries, maintenance, insurance, and compliance with maritime regulations. Operating in harsh offshore environments also leads to faster wear and tear, increasing the need for frequent repairs and downtime.

To address this challenge, the companies in the market are adopting fuel-efficient technologies such as hybrid and LNG-powered engines to reduce fuel expenses.

They are also investing in digital tools for predictive maintenance and route optimization, minimizing downtime and operational waste. Additionally, firms are focusing on automation to enhance productivity and lower labor costs.

Market Trend

Adoption of Green and Hybrid Propulsion

Green and hybrid propulsion systems are becoming an important focus in the offshore support vessel (OSV) market. Operators are increasingly investing in vessels equipped with battery energy storage systems and hybrid engines to reduce fuel consumption and emissions.

These systems enhance energy efficiency, support compliance with stricter environmental regulations, and lower long-term operating costs.

- In December 2024, SEACOR Marine signed a contract with EnTrust Global to build two hybrid platform supply vessels (PSVs) with battery energy storage systems, for USD 82 million. These new vessels will be designed to reduce fuel consumption and enhance the environmental performance of offshore energy operations.

Offshore Support Vessel Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Anchor Handling Tug & Supply, Platform Supply, Crew, Seismic, Others |

|

By Depth |

Shallow Water, Deepwater, Ultra-Deepwater |

|

By Application |

Oil & Gas, Offshore Wind, Patrolling, Research & Surveying, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Anchor Handling Tug & Supply, Platform Supply, Crew, Seismic, and Others): The anchor handling tug & supply segment earned USD 6.07 billion in 2024 due to its critical role in towing and positioning offshore rigs.

- By Depth (Shallow Water, Deepwater and Ultra-Deepwater): The deepwater segment held 37.74% of the market in 2024, due to increasing offshore exploration and production activities in deeper waters.

- By Application (Oil & Gas, Offshore Wind, Patrolling, and Research & Surveying): The oil & gas segment is projected to reach USD 9.87 billion by 2032, owing to sustained demand for energy and ongoing exploration projects.

Offshore Support Vessel Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific offshore support vessel market accounted for a share of 35.77% in 2024, with a valuation of USD 7.74 billion. This dominance is primarily driven by the region's abundant offshore oil and gas reserves, which are supporting the growth of exploration and production activities.

Moreover, the rising energy demands in countries such as China and India is further fuelling the growth of the market. Additionally, the presence of major players developing technologically advanced vessels is further accelerating the adoption of offshore support vessels across the region.

The Europe offshore support vessel industry is set to grow at a robust CAGR of 7.03% over the forecast period. This growth is fueled by strong demand for advanced and reliable vessels supporting expanding offshore oil, gas, and renewable energy projects across Europe.

Moreover, a well-established maritime infrastructure and increasing investments by key players in offshore wind farms is further driving market growth. Continuous fleet modernization and strategic partnerships by the key players are enhancing operational efficiency and service capabilities in the region, threby contributing to the market growth. .

- In November 2024, DOF Group ASA completed the acquisition of Maersk Supply Service A/S. This is expected to enhance DOF’s global fleet capabilities and expand its service offerings in the offshore support segment.

Regulatory Frameworks

- In the UK, the Maritime and Coastguard Agency (MCA) regulates the offshore support vessels (OSVs). MCA ensures that OSVs under the UK flag comply with international and national standards for safety, pollution prevention, and securit

- In India, Directorate General of Shipping (DGS) is responsible for maritime policy, safety, and ensuring the implementation of the Merchant Shipping Act, 1958 includes regulations for OSVs.

- At the global level, the International Maritime Organization (IMO) sets international standards for maritime safety and environmental protection. These standards address key areas such as vessel design, fire safety, stability, and the handling of hazardous materials.

Competitive Landscape

Major players in the offshore support vessel market are focusing on fleet modernization by integrating autonomous surface vessels and advanced remotely operated technologies.

They are leveraging robotic automation and artificial intelligence to enhance operational efficiency, reduce emissions, and support offshore wind activities. Additionally, market players are focusing on creating eco-friendly solutions that support the global transition to renewable energy.

- In September 2024, Beam expanded its fleet by adding two autonomous surface vessels (ASVs), with an investment of USD 19.8 million. This is to support offshore wind services through robotic automation and AI to enhance efficiency and sustainability.

List of Key Companies in Offshore Support Vessel Market:

- BOURBON

- Tidewater Inc

- SEACOR Marine

- Solstad

- Galliano Marine Service

- Havila Shipping ASA

- Sea1 Offshore

- DOF

- SWIRE SHIPPING

- Vroon

- china shipbuilding industry trading co ltd

- Hornbeck Offshore

- Jackson Offshore Operators

- Glomar Offshore

- McDermott

Recent Developments

- In October 2024, Solstad Offshore secured contracts for two anchor handling tug supply (AHTS) vessels Normand Topazio and Normand Turmalina. The total contract value is approximately USD 53 million, with both vessels contracted for one-year terms.