Buy Now

Microfluidics Market

Microfluidics Market Size, Share, Growth & Industry Analysis, By Type (Microfluidic-based Devices, Microfluidic Components), By Material (Polymer, Glass, Silicon, Others), By Application (Drug Delivery, Point-of-care Diagnostics, Pharmaceutical and Biotechnology Research, Clinical Diagnostics, Other Applications), and Regional Analysis, 2024-2031

Pages: 120 | Base Year: 2023 | Release: December 2024 | Author: Omkar R.

Microfluidics Market Size

The global microfluidics market size was valued at USD 20.92 billion in 2023 and is projected to grow from USD 23.18 billion in 2024 to USD 52.79 billion by 2031, exhibiting a CAGR of 12.48% during the forecast period.

The growing need for rapid and cost-efficient diagnostic solutions across healthcare settings has significantly contributed to the growth of the microfluidics market. These systems allow for portable and precise diagnostic tools that address the demand for decentralized healthcare solutions. They play a vital role in enhancing diagnostic accuracy and speed, particularly in resource-constrained environments.

In the scope of work, the report includes products and solutions offered by companies such as Abbott, Agilent Technologies, Inc., Illumina Inc., Thermo Fisher Scientific Inc., F.Hoffmann-LA Roche Ltd, Danaher Corporation, PerkinElmer, Bio-Rad Laboratories Inc., Dolomite Microfluidics, BIOMÉRIEUX, and others.

The shift toward laboratory automation has amplified the use of microfluidic devices. These systems enable the automation of complex workflows, enhancing throughput and consistency in experiments. Laboratories across pharmaceutical and biotechnology sectors are increasingly adopting microfluidics to optimize resources and streamline operations.

The rising need for reproducibility and efficiency in research has made microfluidics a critical component of automated systems, propelling market demand. Microfluidics is a multidisciplinary field that involves the precise manipulation and control of small volumes of fluids, typically in the range of microliters to picoliters, through channels with dimensions in the micrometer scale.

This technology integrates physics, engineering, chemistry, and biology to enable the development of miniaturized devices known as lab-on-a-chip systems. These devices perform complex functions such as diagnostics, chemical analysis, and drug delivery. Microfluidics offers significant advantages, including reduced reagent consumption, faster processing times, and portability, making it essential for applications in healthcare, biotechnology, and environmental monitoring.

.webp) Analyst’s Review

Analyst’s Review

The increasing focus on research and development (R&D) in greener microfabrication technologies has emerged as a pivotal factor in driving the microfluidics market.

- In August 2024, researchers at the University of Chicago unveiled an eco-friendly microfabrication technique that utilizes water as a green activation agent, replacing conventional toxic chemicals. This innovative method significantly enhances the conversion of cellulose in paper into conductive carbon, a process with far-reaching implications. The resulting carbon material demonstrates exceptional versatility, finding applications in advanced sensor technologies and complex medical devices.

This breakthrough aligns with sustainable practices and opens new pathways for developing high-performance, environmentally responsible materials in various industries.

Companies are investing heavily in innovative materials and manufacturing processes to create environmentally sustainable microfluidic devices that offer superior precision and operational efficiency. These advancements reduce environmental impact by utilizing eco-friendly materials and energy-efficient production techniques while simultaneously enhancing device functionality.

Market players are also integrating cutting-edge technologies like AI and IoT into microfluidic systems, enabling high-throughput screening and real-time analytics. These strategic developments not only address evolving regulatory requirements but also position companies as leaders in sustainable innovation, fueling market expansion.

Microfluidics Market Growth Factors

The increasing global burden of chronic and infectious diseases has driven the demand for advanced diagnostic tools, boosting the microfluidics market.

- A September 2023 report by the World Health Organization highlights that noncommunicable diseases (NCDs) cause 41 million deaths annually, representing 74% of global mortality. Cardiovascular diseases lead with 17.9 million deaths per year, followed by cancers at 9.3 million, chronic respiratory diseases at 4.1 million, and diabetes, including diabetes-related kidney disease, collectively claiming 2 million lives.

Microfluidic systems, with their ability to provide rapid and accurate test results, play a critical role in early disease detection and management. These devices streamline diagnostic workflows in hospital and clinical settings, reducing delays in treatment initiation. Their growing adoption in diagnosing conditions such as diabetes, cancer, and infectious diseases has positioned microfluidics as a cornerstone technology in modern healthcare delivery.

Supportive policies and financial investments from governments and private organizations have accelerated the adoption of microfluidic technologies. Funding initiatives aimed at enhancing R&D in biotechnology and diagnostics have strengthened the market landscape.

Partnerships between academia, industry, and government agencies are fostering innovation, enabling the commercialization of novel microfluidic devices. This collaborative approach is crucial in overcoming technical challenges and scaling production capabilities to meet global demand.

Microfluidics Industry Trends

Supportive policies and financial investments from governments and private organizations have accelerated the adoption of microfluidic technologies.

- In July 2023, Astraveus, a company specializing in modular microfluidic cell foundries designed to revolutionize cell and gene therapy (CGT) manufacturing, successfully secured USD 17.42 million in a Series Seed funding round. This funding is expected to support the continued development of its automated, microfluidic-based cell and gene therapy manufacturing platform.

The trend toward miniaturized diagnostic and analytical tools has fueled the microfluidics market. Compact and portable microfluidic devices are particularly valuable in point-of-care diagnostics and remote healthcare applications. This trend has broadened the market reach of microfluidics, appealing to both developed and emerging economies looking for affordable yet effective healthcare solutions.

Segmentation Analysis

The global market has been segmented based on type, material, application, and geography.

By Type

Based on type, the market has been segmented into microfluidic-based devices and microfluidic components. The microfluidic-based devices segment led the microfluidics market in 2023, reaching the valuation of USD 13.26 billion. These devices are pivotal in diagnostics, drug discovery, and personalized medicine, as they enable rapid and precise testing with minimal sample usage.

Innovations in microfluidic technology are making these devices highly efficient for high-throughput screening and real-time biological monitoring. Additionally, their compatibility with emerging technologies like AI and IoT enhances their functionality, further driving market demand.

By Material

Based on material, the market has been classified into polymer, glass, silicon, and others. The polymer segment secured the largest revenue share of 43.78% in 2023.

Polymers such as polydimethylsiloxane (PDMS) and other thermoplastics are widely used, as they offer excellent design flexibility, essential for creating complex microfluidic devices. These materials are cost-effective compared to alternatives like glass or silicon, enabling large-scale production. Additionally, polymers demonstrate superior biocompatibility, making them suitable for diverse applications in diagnostics, drug delivery, and cell analysis.

By Application

Based on application, the market has been divided into drug delivery, point-of-care diagnostics, pharmaceutical and biotechnology research, clinical diagnostics, and other applications. The pharmaceutical and biotechnology research segment is poised for significant growth at a robust CAGR of 14.82% through the forecast period.

Microfluidic devices enable efficient high-throughput screening, accelerating the identification of potential drug candidates while minimizing resource consumption, which is vital in pharmaceutical R&D.

Additionally, their precision in real-time monitoring of biological interactions supports the growing demand for targeted therapies and personalized treatment approaches. The increasing complexity of biopharmaceutical development, such as gene and cell therapies, has further strengthened the adoption of microfluidics.

Microfluidics Market Regional Analysis

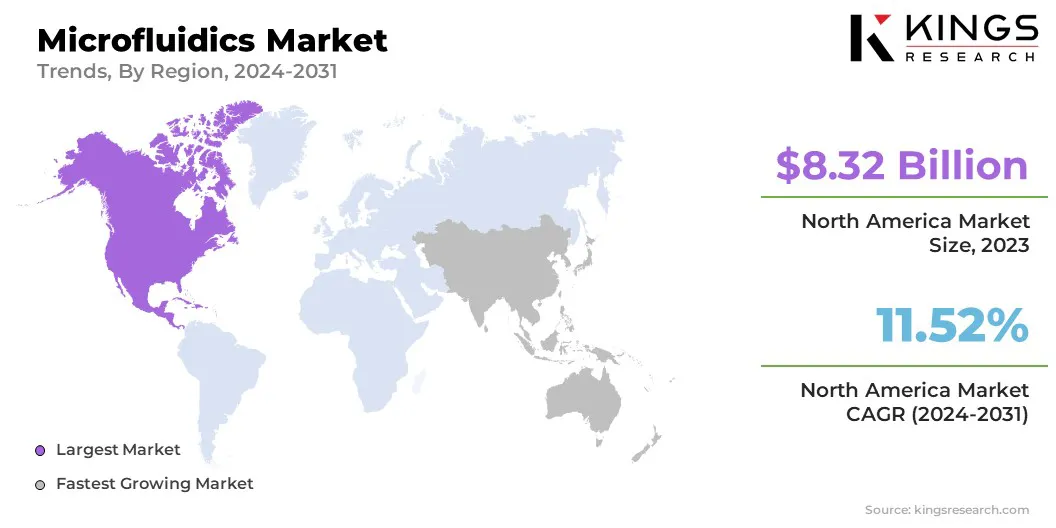

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 39.76% share of the global microfluidics market in 2023 in the global market, with a valuation of USD 8.32 billion. In North America, substantial government funding in medical and diagnostic R&D has accelerated the growth of the market.

North America accounted for 39.76% share of the global microfluidics market in 2023 in the global market, with a valuation of USD 8.32 billion. In North America, substantial government funding in medical and diagnostic R&D has accelerated the growth of the market.

- The S. government’s 2024 budget allocates over USD 3.4 billion to support R&D for the Cancer Moonshot initiative, emphasizing advances in healthcare. Of this, USD 2.9 billion is directed to the Department of Health and Human Services through discretionary and mandatory resources, advancing research via the National Cancer Institute and ARPA-H. These investments target clinical, public health, and environmental research across five key areas, reflecting strong commitment to innovation and breakthroughs in cancer prevention and treatment.

This support enables the creation of advanced microfluidic platforms tailored for high-precision applications, such as drug discovery, molecular diagnostics, and real-time disease monitoring. Investments in public health initiatives and innovation programs encourage the development of cost-effective, scalable solutions, addressing critical healthcare challenges in the region.

The robust healthcare infrastructure in North America provides a fertile ground for the growth of microfluidics. Hospitals, diagnostic labs, and research institutions in the region are adopting microfluidic systems to enhance efficiency and reduce costs, aligning with the increasing focus on precision medicine and patient-centric care.

The microfluidics market in Asia Pacific is poised for significant growth at a robust CAGR of 13.87% over the forecast period. The wearable health devices market is expanding rapidly in Asia Pacific, driven by growing health awareness and technological innovation.

Devices such as smartwatches and biosensors equipped with microfluidic technology are becoming integral to real-time health monitoring. The demand for wearable health devices is particularly high in nations such as China, Japan, and South Korea, where consumer health trends and technological adoption are rapidly evolving.

Additionally, the pharmaceutical and biotechnology sectors are thriving in Asia Pacific, driven by increasing healthcare investments and a need for innovative solutions.

- According to data from the India Brand Equity Foundation (IBEF), the Indian pharmaceutical industry's total market size is projected to reach USD 130 billion by 2030 and expand to USD 450 billion by 2047. Between FY18 and FY23, the industry demonstrated a compound annual growth rate (CAGR) of 6-8%.

With pharmaceutical companies in China, India, and Southeast Asia ramping up drug development efforts, microfluidics applications are witnessing higher demand for their ability to support innovative drug research and production methods.

Competitive Landscape

The global microfluidics market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for market growth.

List of Key Companies in Microfluidics Market

- Abbott

- Agilent Technologies, Inc.

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- Hoffmann-LA Roche Ltd

- Danaher Corporation

- PerkinElmer

- Bio-Rad Laboratories Inc.

- Dolomite Microfluidics

- BIOMÉRIEUX

Key Industry Developments

- March 2024 (Expansion): bioMérieux announced a NOK 115 million investment in SpinChip Diagnostics, a platform leveraging microfluidic technology combined with nanotechnology-based cartridge assays. Through this agreement, bioMérieux will acquire 17% to 20% stake in SpinChip, becoming the company’s second-largest shareholder.

- June 2023 (Launch): Sciex, a Danaher Corporation company, unveiled the Intabio ZT system, an innovative microfluidic chip-based platform that seamlessly integrates imaged capillary isoelectric focusing (icIEF) separation and UV detection with mass spectrometry (MS) on the ZenoTOF 7600 system. Designed to address challenges in early drug development, the Intabio ZT system enables researchers to streamline the selection of promising drug candidates with unprecedented efficiency.

The global microfluidics market has been segmented as:

By Type

- Microfluidic-based Devices

- Microfluidic Components

By Material

- Polymer

- Glass

- Silicon

- Others

By Application

- Drug Delivery

- Point-of-care Diagnostics

- Pharmaceutical and Biotechnology Research

- Clinical Diagnostics

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America