Buy Now

Drone Software Market

Drone Software Market Size, Share, Growth & Industry Analysis, By Type (Application-based, System-based), By Architecture (Open Source, Closed Source), By Deployment (Onboard, Ground-based), By Application, By Vertical, By End Use and Regional Analysis, 2025-2032

Pages: 180 | Base Year: 2024 | Release: June 2025 | Author: Sharmishtha M.

Market Definition

The market involves algorithms that control and enhance drone operations across agriculture, defense, logistics, and construction industries. These operations include flight control, mapping, data analysis, and fleet management. Driven by automation, AI integration, and growing commercial drone use, this market supports applications like surveying, delivery, and surveillance.

The report explores key market drivers, offering detailed regional analysis and a comprehensive overview of the competitive landscape that will sculpt the market over the forecast period.

Drone Software Market Overview

The global drone software market was valued at USD 8.83 billion in 2024, is set to grow to USD 10.42 billion in 2025, and is expected to reach USD 35.46 billion by 2032, reflecting a CAGR of 18.80% from 2025 to 2032.

Advancements in AI and edge computing are driving the adoption drone software by enabling real-time data processing and autonomous decision-making directly on the drone. This reduces dependency on cloud infrastructure and enhances performance in remote, bandwidth-limited environments.

Major companies operating in the drone software industry are DroneUp LLC., Delair, DJI , DroneDeploy, Esri, Pix4D SA, AgEagle Aerial Systems Inc, Skycatch, Inc., Skydio, Inc., Yuneec, Advanced Technology Labs AG, ZenaTech, FlytBase, Chetu Inc, Sky-Drones Technologies LTD, Skylark Drones, and others.

The market is experiencing rapid growth, driven by increasing demand for advanced data collection, real-time analytics, and automation for environmental monitoring, agriculture, and disaster management. Integration of AI and quantum computing is transforming drone capabilities, enabling more precise forecasting and decision-making.

As climate change intensifies the frequency and severity of weather events, the need for innovative forecasting tools is expected to make AI-driven drone technologies critical to future-ready climate resilience strategies.

- In May 2025, ZenaTech updated its “Clear Sky” project using quantum computing and AI drone swarms to enhance extreme weather forecasting. The initiative aims to address the steep rise in billion-dollar climate disasters by providing real-time, high-resolution atmospheric data to improve predictive accuracy and emergency response.

Key Highlights:

- The drone software market size was recorded at USD 8.83 billion in 2024.

- The market is projected to grow at a CAGR of 18.80% from 2025 to 2032.

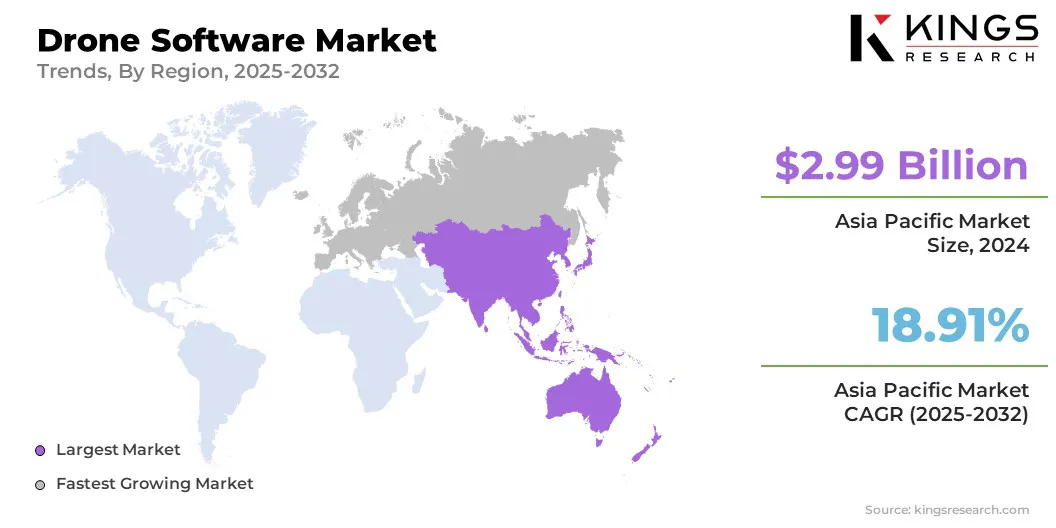

- Asia Pacific held a market share of 33.82% in 2024, with a valuation of USD 2.99 billion.

- The application-based segment garnered USD 5.48 billion in revenue in 2024.

- The open source segment is expected to reach USD 20.89 billion by 2032.

- The onboard segment held a market share of 53.33% in 2024

- The mapping & surveying segment is anticipated to grow at a robust CAGR of 18.96% during the forecast period.

- The defense & government segment is forecasted to have a market share of 25.11% in 2032.

- The military segment is anticipated to have a CAGR of 18.95% during the forecast period.

- Europe is anticipated to grow at a CAGR of 19.22% during the forecast period.

Market Driver

Artificial Intelligence and Edge Computing

The integration of artificial intelligence and edge computing is a significant factor driving the growth of the market. By processing data and making decisions autonomously in real time, these technologies eliminate the need for constant cloud connectivity, making operations more reliable in remote, communication-restricted areas.

This is particularly valuable for applications like defense, search and rescue, and environmental monitoring, where fast, local data processing is crucial. AI-powered edge computing improves responsiveness, reduces latency, and allows efficient multi-drone coordination in complex missions.

- In May 2025, Palladyne AI and Red Cat completed a cross-platform collaborative drone flight using three autonomous, heterogeneous drones. This breakthrough showcases real-time, multi-drone coordination without centralized infrastructure, advancing autonomous mission capabilities and enhancing situational awareness for defense and commercial drone operations.

Market Challenge

Data Security and Privacy Concerns

Data security and privacy concerns are a significant challenge in the drone software market, particularly in surveillance and defense operations where sensitive information is collected and transmitted. Risks include unauthorized access, data breaches, and non-compliance with regulations.

To address this, developers implement end-to-end encryption, secure data storage, and real-time threat detection protocols. Additionally, adopting blockchain for data integrity and adhering to international cybersecurity standards enhances trust, ensuring data is protected throughout its lifecycle and across interconnected systems.

Market Trend

Real-Time Data Analysis

Real-time data analysis has become a major trend in the market due to the need for rapid processing of large data volumes collected by drones. This technology offers faster decision-making and more effective responses in critical situations such as disaster relief, environmental monitoring, and security operations.

Using AI, edge computing, and cloud infrastructure, drone software can now deliver near-instant insights, which improves situational awareness and operational efficiency. As industries prioritize speed and accuracy, real-time analytics is driving innovation in drone applications and driving market growth.

- In February 2025, Safe Pro and Ukraine’s Kyiv Polytechnic Institute signed a multi-year MOU to advance AI and drone technology. The collaboration focuses on developing demining, environmental safety, and infrastructure solutions using SpotlightAI, combining AI-powered drone image analysis with training and research for real-world humanitarian and reconstruction applications.

Drone Software Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Application-based, System-based |

|

By Architecture |

Open Source, Closed Source |

|

By Deployment |

Onboard, Ground-based |

|

By Application |

Filming & Photography, Inspection & Maintenance, Mapping & Surveying, Precision Agriculture, Surveillance & Monitoring, Search & Rescue, Others |

|

By Vertical |

Agriculture, Construction, Defense & Government, Energy & Utilities, Media & Entertainment, Logistics & Transportation, Others |

|

By End Use |

Commercial, Consumer, Military |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Application-based and System-based): The application-based segment earned USD 5.48 billion in 2024, driven by rising adoption across agriculture, surveillance, delivery, and infrastructure inspection applications.

- By Architecture (Open Source and Closed Source): The open source segment held 59.93% of the market in 2024, fueled by increasing developer collaboration, customization needs, and cost-effective deployment in commercial and research sectors.

- By Deployment (Onboard and Ground-based): The onboard segment is projected to reach USD 18.10 billion by 2032, owing to advancements in edge computing and autonomous real-time decision-making capabilities.

- By Application (Filming & Photography, Inspection & Maintenance, Mapping & Surveying, Precision Agriculture, Surveillance & Monitoring, Search & Rescue, and Others): The mapping & surveying segment is anticipated to grow at a CAGR of 18.96% during the forecast period, driven by demand for precise geospatial data and 3D modeling.

- By Vertical (Agriculture, Construction, Defense & Government, Energy & Utilities, Media & Entertainment, Logistics & Transportation, and Others): The defense & government segment is expected to hold a market share of 25.11% in 2032 due to rising investments in surveillance, border security, and tactical operations.

- By End Use (Commercial, Consumer, and Military): The commercial segment is projected to reach USD 14.22 billion by 2032, owing to expanding use in logistics, agriculture, media, and infrastructure monitoring industries.

Drone Software Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and South America.

The Asia Pacific drone software market share stood at 33.82% in 2024 in the global market, with a valuation of USD 2.99 billion. The Asia Pacific region dominates the market due to its large and rapidly expanding commercial and defense sectors.

Rising investments in drone technology across China, Japan, India, and South Korea fuel strong demand for advanced drone software solutions. The region benefits from increasing adoption of drones for agriculture, infrastructure, logistics, and surveillance applications, led by government initiatives promoting innovation and smart city development.

Additionally, the availability of cost-effective manufacturing and skilled workforce accelerates market growth, making Asia-Pacific a leader in the global drone software industry.

Europe is expected to witness the fastest growth at a CAGR of 19.22% over the forecast period. Europe is emerging as the fastest-growing region in the drone software industry, fueled by significant investments in artificial intelligence, machine learning, and edge computing.

Strong government support, favorable regulations, and surging adoption across key sectors, such as defense, agriculture, and infrastructure, are driving this growth. The region also benefits from robust research collaborations and innovation hubs that promote the development of advanced drone applications.

These factors collectively enhance operational efficiency and situational awareness, positioning Europe as a leading market for next-generation drone software solutions.

- In December 2024, Safe Pro AI launched the SpotlightAI ONSITE in Ukraine, enabling real-time AI-powered detection of 150+ landmine types using drone imagery. The software processes data locally on portable devices, supporting critical humanitarian and military operations with enhanced situational awareness and offline capability.

Regulatory Frameworks

- In India, the Drone (Amendment) Rules, 2022 updated the Drone Rules, 2021 by replacing pilot licenses with Remote Pilot Certificates, simplifying certification, and exempting government bodies from certain data requirements, improving regulatory clarity and operational efficiency in drone usage.

- In the U.S., the Federal Aviation Administration (FAA) works with industries and communities to safely integrate drones into national airspace, providing rules, resources, and tools for recreational and commercial drone operators to ensure safe and compliant flight operations.

- In the EU, the European Union Aviation Safety Agency (EASA) regulates drone operations across member states, ensuring safety, standardization, and compliance with data protection and privacy laws for commercial and recreational drone use.

Competitive Landscape

Companies in the drone software market are focusing on developing advanced autonomous capabilities, integrating AI and machine learning for enhanced data processing, and improving real-time situational awareness. They are investing in cross-platform interoperability, edge computing, and scalable cloud solutions to meet diverse operational needs across defense, commercial, and civil sectors.

Strategic partnerships and collaborations are commonly used to utilize complementary strengths, accelerate innovation, and expand market reach. Additionally, companies prioritize security, compliance, and user-friendly interfaces to address regulatory requirements and customer demands.

- In May 2025, C-Astral Aerospace and Auterion unveiled their collaboration at AUVSI Xponential in Houston, showcasing the Red Dot Award-winning SQA2 eVTOL blended wing UAS and a cutting-edge, radar-invisible delivery drone. Both drones feature Auterion’s advanced autonomous software platform, offering enhanced mission integration, extended flight endurance, and secure payload delivery. This partnership sets a new standard in UAS technology for military, first responder, and civilian applications worldwide.

List of Key Companies in Drone Software Market:

- DroneUp LLC.

- Delair

- DJI

- DroneDeploy

- Esri

- Pix4D SA

- AgEagle Aerial Systems Inc

- Skycatch, Inc.

- Skydio, Inc.

- Yuneec, Advanced Technology Labs AG

- ZenaTech

- FlytBase

- Chetu Inc

- Sky-Drones Technologies LTD

- Skylark Drones

Recent Developments (M&A/Partnerships/Product Launch)

- In May 2025, ZenaTech announced a strategic initiative combining quantum computing and AI-powered drones to improve wildfire detection and response across the U.S. Western and Coastal states. This project leverages drone swarms and quantum analytics for rapid, high-precision environmental monitoring, enhancing wildfire forecasting and emergency management with unprecedented speed and accuracy.

- In Feb 2025, Unusual Machines announced its agreement to acquire Aloft Technologies, a leading FAA-approved provider of unmanned aerial system (UAS) services. This acquisition, valued at USD 14.5 million, strengthens the U.S. drone industry by combining fleet and airspace management expertise, supporting the growing demand for real-time drone traffic coordination and enhancing national security and economic integration.

- In Dec 2024, Rheinmetall and Auterion collaborated to develop standardized software components for unmanned drone systems across aerial, land, and naval platforms. This partnership aims to create a unified operating system, enhancing interoperability, reducing training costs, and enabling efficient, scalable deployment of military drones for defense applications worldwide.