Buy Now

Aseptic Packaging Market

Aseptic Packaging Market Size, Share, Growth & Industry Analysis, By Material (Plastic, Metal, Glass, Paper & Paperboard, Others), By Type (Cartons, Bags & Pouches, Bottles & Cans, Vials & Ampoules, Others), By Application (Food, Beverages, Pharmaceutical, Others), and Regional Analysis, 2024-2031

Pages: 160 | Base Year: 2023 | Release: May 2025 | Author: Versha V.

Market Definition

The market involves filling sterilized food, beverage, and pharmaceutical products into pre-sterilized containers under sterile conditions, extending shelf life without refrigeration. The applications of aseptic packaging include dairy, juices, soups, and injectable drugs.

The process ensures contamination-free sealing by sterilizing the product, packaging materials, and environment, supporting long-term storage, reduced preservatives, and compliance with safety and regulatory standards. The report outlines the primary drivers of the market, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the market's trajectory.

Aseptic Packaging Market Overview

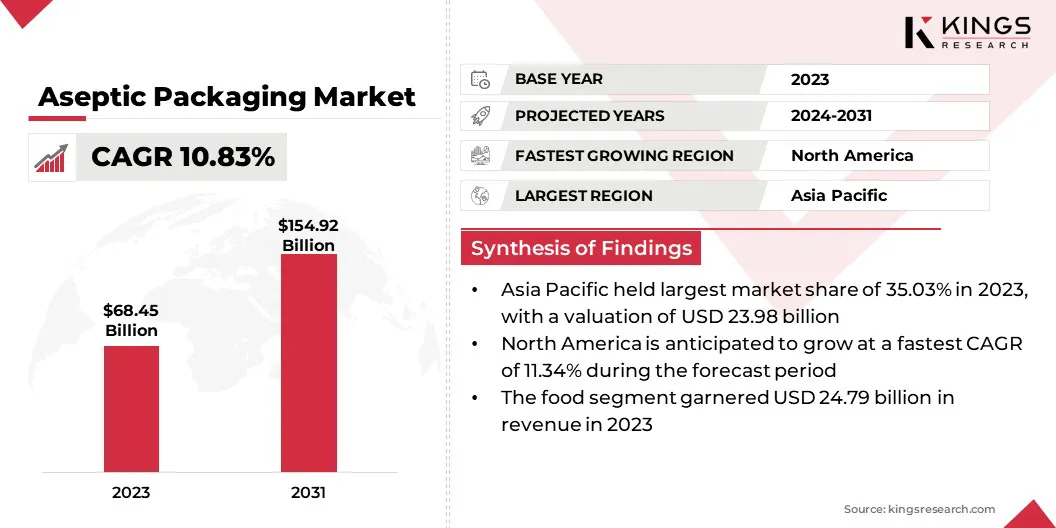

The global aseptic packaging market size was valued at USD 68.45 billion in 2023 and is projected to grow from USD 75.43 billion in 2024 to USD 154.92 billion by 2031, exhibiting a CAGR of 10.83% during the forecast period.

The market is expanding as beverage companies prioritize health-centric, preservative-free products. Technological innovations in machinery and sustainable materials are improving efficiency, safety, and shelf life. This supports scalable production and aligns with global consumer and regulatory expectations.

Major companies operating in the aseptic packaging industry are DuPont, Tetra Laval Group, Reynolds Group Ltd., Amcor plc, BD, Greatview Beijing Trading Co.Ltd., IMA S.P.A, SCHOTT Group, IPI S.r.l., SIG, DS Smith, UFlex Limited, Elopak AS, CDF Corporation, and Smurfit Westrock.

The market is growing, due to the rising demand in the pharmaceutical sector which requires sterile packaging to protect product integrity and ensure patient safety. Growth in biologics and personalized medicine is increasing the need for accurate small-batch aseptic solutions.

Modern systems provide flexibility and efficiency while minimizing product loss. These solutions support clinical trials and specialized healthcare needs within a strictly regulated environment where reliability and precision are critical.

- In February 2025, Recipharm launched a modular sterile filling system at its Wasserburg, Germany facility, enhancing clinical and pilot-scale aseptic manufacturing amid growing healthcare advancements. Operating within a Grade A isolator and compliant with good manufacturing practice, the system supports syringes and vials with batch sizes from 500 to 50,000 units. It enables cost-efficient, small-batch production for emerging therapies, rare diseases, and advanced healthcare development.

Key Highlights:

- The aseptic packaging market size was valued at USD 68.45 billion in 2023.

- The market is projected to grow at a CAGR of 10.83% from 2024 to 2031.

- Asia Pacific held a market share of 35.03% in 2023, with a valuation of USD 23.98 billion.

- The plastic segment garnered USD 18.69 billion in revenue in 2023.

- The cartons segment is expected to reach USD 40.56 billion by 2031.

- The pharmaceutical segment is anticipated to register the fastest CAGR of 11.18% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 11.34% during the forecast period.

Market Driver

Expansion of the Beverage Industry

The market is registering growth, due to the expansion of the beverage industry, which is increasingly prioritizing health-focused, preservative-free, and ready-to-drink products. Rising demand for functional beverages, juices, plant-based drinks, and premium teas is encouraging manufacturers to adopt aseptic technologies that ensure product safety and longer shelf life without refrigeration.

This shift supports large-scale production, sustainable packaging practices, and efficient global distribution, positioning aseptic solutions as a key driver in meeting the evolving requirements of the beverage industry.

- In January 2025, CR Beverage, a leading bottled water brand in China, expanded its production capacity by installing three high-speed aseptic complete lines from Sidel to meet the rising demand for healthy, eco-friendly beverages. Deployed at its Yixing and Chengdu plants, the lines support teas, juices, and carbonated drinks, delivering up to 54,000 bottles per hour, enhancing efficiency and portfolio diversification.

Market Challenge

Difficulty in Recycling Multi-layer Aseptic Materials

The aseptic packaging market faces a significant challenge in the recycling of multi-layer materials, which typically combine paperboard, plastic, and aluminum to preserve product integrity.

These layers are tightly bonded, making separation and material recovery difficult, thus limiting recyclability and increasing environmental concerns. This poses obstacles for companies striving to meet sustainability targets and comply with evolving regulations.

Companies are investing in material innovations, such as aluminum-free and mono-material solutions, and collaborating with recyclers to enhance infrastructure. Developing closed-loop systems and educating consumers on proper disposal practices can also support improved end-of-life management of aseptic packaging.

Market Trend

Technological Advancement in Packaging

The market is registering a significant shift, due to technological advancements in packaging machinery and materials. Innovations such as automated aseptic filling lines, smart packaging integration, and the use of eco-friendly, high-barrier materials are enhancing production efficiency, safety, and sustainability.

These advancements help manufacturers enhance production efficiency, maintain product sterility over time, and support sustainable packaging practices aligned with industry standards. As technology continues to evolve, it is reshaping how companies approach cost-effective, scalable, and flexible aseptic packaging solutions globally.

- In October 2023, SIG supplied Milky Mist Dairy with three advanced aseptic filling machines to enhance production capacity and packaging flexibility at its Tamil Nadu facility. The high-speed systems will enable Milky Mist to deliver a variety of product formats and sizes, improve operational efficiency, and meet diverse consumer needs across different price points and consumption occasions in the Indian market.

Aseptic Packaging Market Report Snapshot

|

Segmentation |

Details |

|

By Material |

Plastic, Metal, Glass, Paper & Paperboard, Others |

|

By Type |

Cartons, Bags & Pouches, Bottles & Cans, Vials & Ampoules, Others |

|

By Application |

Food (Processed Food, Dairy Food, Fruits and Vegetables), Beverages (Ready-to-drink Beverages, Dairy-based Beverages), Pharmaceutical, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Material (Plastic, Metal, Glass, Paper & Paperboard, and Others): The plastic segment earned USD 18.69 billion in 2023, due to its cost-effectiveness, durability, and widespread use in lightweight, tamper-resistant aseptic packaging solutions across food & beverage industries.

- By Type (Cartons, Bags & Pouches, Bottles & Cans, and Vials & Ampoules): The cartons segment held 26.15% share of the market in 2023, due to its ability to provide extended shelf life without refrigeration, sustainability through renewable materials, and convenience for on-the-go consumption.

- By Application (Food, Beverages, Pharmaceutical, and Others): The food segment is projected to reach USD 55.97 billion by 2031, due to the increasing consumer demand for natural and functional ingredients that enhance product quality and shelf life.

Aseptic Packaging Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for a market share of around 35.03% in 2023, with a valuation of USD 23.98 billion. Asia Pacific is a leading region in the aseptic packaging market, due to its limited cold chain infrastructure. Many areas lack consistent refrigeration during storage and transportation, increasing reliance on aseptic packaging to maintain product safety and shelf life.

This has accelerated the adoption of aseptic packaging across he food, beverage, and pharmaceutical sectors. Manufacturers are prioritizing sterile packaging formats to ensure product integrity without refrigeration, supporting regional demand. As a result, aseptic solutions are becoming essential for efficient and reliable distribution across diverse markets.

- In February 2025, SIG inaugurated its first aseptic carton packaging plant in Ahmedabad, India, following a USD 97.2 million investment. With an annual capacity of 4 billion packs, the facility supports local dairy & beverage sectors. Positioned in a high-growth industry, the plant addresses cold chain limitations by offering sustainable, preservative-free packaging and ensures faster delivery, improved industry responsiveness, and over 300 new jobs.

The aseptic packaging industry in North America is poised for significant growth at a robust CAGR of 11.34% over the forecast period. The market in North America is registering strong growth, due to the increasing adoption of smart packaging technologies that enhance operational efficiency and traceability.

The integration of Radio Frequency Identification (RFID)-enabled solutions is enabling manufacturers to streamline the fill-and-finish process, reduce errors, and improve supply chain transparency.

These advancements support compliance with stringent regulatory standards and address the growing demands for safety, accuracy, and accountability in pharmaceutical and food packaging, positioning North America as a leader in packaging innovation and process optimization.

- In October 2024, BD and ten23 health partnered to enhance aseptic manufacturing efficiency through RFID-enabled prefillable syringes. The BD iDFill solution assigns a unique identifier to each syringe, enabling full traceability across fill-finish processes. This innovation strengthens quality control, reduces product mix-ups, and supports advanced manufacturing in aseptic packaging by linking serialized data to individual units throughout production and distribution.

Regulatory Framework

- In the U.S., the Food and Drug Administration (FDA) oversees aseptic packaging for food, pharmaceuticals, and cosmetics, ensuring that materials and processes meet strict safety and quality standards. This includes the regulation of contact substances and the validation of packaging integrity to protect consumer health.

- In India, the Food Safety and Standards Authority of India (FSSAI) governs aseptic food packaging under the 2011 Packaging and Labelling Regulations, ensuring material safety and compliance. The Bureau of Indian Standards (BIS) further establishes quality standards, particularly for aseptic packaging of fruits & vegetables, supporting food safety and packaging integrity.

- In Europe, the European Medicines Agency (EMA) oversees aseptic packaging for human and veterinary medicines, ensuring compliance through scientific evaluation, regulatory supervision, and safety monitoring, thereby maintaining high standards of product quality and patient safety across the pharmaceutical sector.

Competitive Landscape

Key players operating in the aseptic packaging market are actively leveraging a range of strategic initiatives, including mergers and acquisitions, product innovation, partnerships, and geographic expansion to strengthen their market foothold and accelerate growth.

These strategies facilitate the diversification of product offerings and support expansion into new customer segments, while ensuring alignment with evolving consumer expectations and regulatory standards.

Additionally, increased investments in sustainable materials and advanced packaging technologies enable organizations to enhance production efficiency, minimize environmental impact, and maintain long-term competitiveness in a rapidly evolving global market.

- In November 2023, Tetra Pak and Lactogal launched an aseptic beverage carton with a paper-based barrier in Portugal, targeting industrial-scale production by 2025. Comprising 90% renewable content and reducing carbon emissions by 33%, this Carbon Trust certified solution supports ambient distribution while addressing key concerns such as greenhouse gases, food waste, and plastic pollution within the food & beverage packaging industry.

List of Key Companies in Aseptic Packaging Market:

- DuPont

- Tetra Laval Group

- Reynolds Group Ltd.

- Amcor plc

- BD

- Greatview Beijing Trading Co.Ltd.

- IMA S.P.A

- SCHOTT Group

- IPI S.r.l.

- SIG

- DS Smith

- UFlex Limited

- Elopak AS

- CDF Corporation

- Smurfit Westrock

Recent Developments

- In September 2024, Tetra Pak introduced the Tetra Prisma Aseptic 300 Edge carton in collaboration with a major European beverage company. This ergonomic, paper-based packaging offers a sleek, compact design ideal for on-the-go consumption. Featuring a tethered DreamCap 26 Pro closure to reduce waste and enhance recyclability, the carton meets modern consumer preferences for convenience, sustainability, and minimalism.

- In August 2023, SIG aims to increase the fiber content in its aseptic cartons to 85% by 2025 and 90% by 2030, advancing its goal of higher recyclability and eliminating aluminum layers. This initiative aligns with the company’s strategy to support a circular economy, reduce carbon emissions, and meet rising consumer and industry demand for fully recyclable, sustainable packaging made from renewable or recycled materials.