Market Definition

Nylon is a type of synthetic polymer, commonly used in the production of fabrics, textiles, and plastics. Known for its strength, elasticity, and resistance to abrasion, nylon is often used in clothing like stockings and activewear, as well as in products like ropes, fishing lines, and automotive parts.

Nylon Market Overview

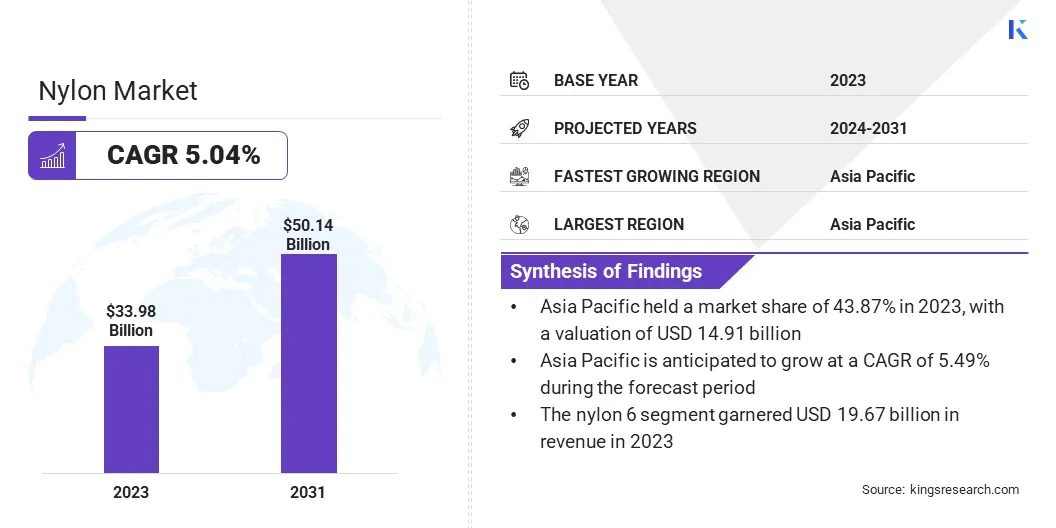

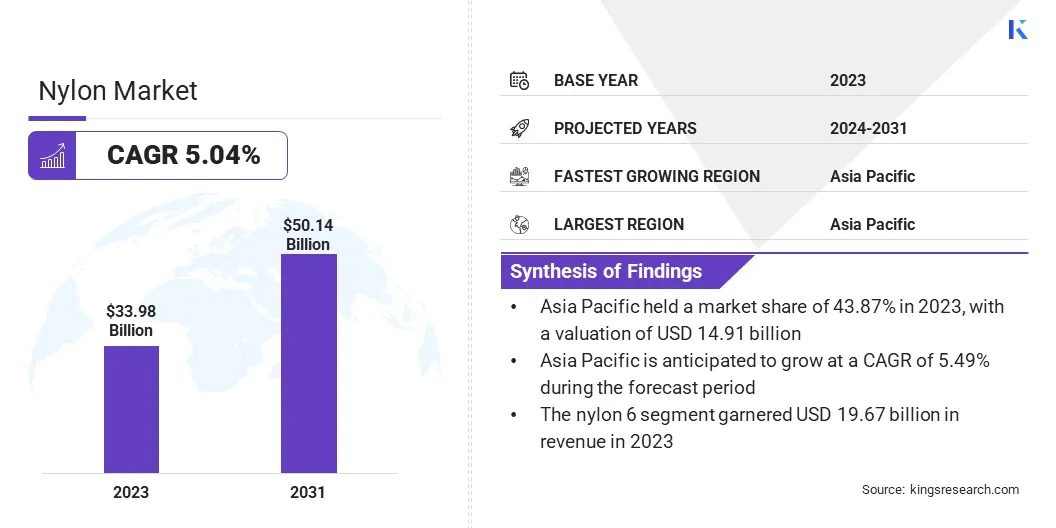

The global nylon market size was valued at USD 33.98 billion in 2023 and is projected to grow from USD 35.53 billion in 2024 to USD 50.14 billion by 2031, exhibiting a CAGR of 5.04% during the forecast period.

This growth is largely fueled by its increasing demand in industries such as automotive, textiles, electronics, and industrial applications. In the textile industry, nylon's strength, flexibility, and moisture-wicking properties make it an essential material in the production of activewear, hosiery, and outdoor gear.

The increasing focus on sustainable fashion has also driven the demand for recycled nylon, as consumers and brands look for eco-friendly alternatives.

Major companies operating in the nylon market are BASF, DuPont de Nemours, Inc., Ascend Performance Materials Holdings Inc., Koch IP Holdings, LLC, Asahi Kasei Corporation, Formosa Plastics Corporation, Evonik Industries AG, UBE Corporation, Celanese Corporation, KURARAY CO., LTD., Avient Corporation, Dow Chemical Company, Indorama Ventures Mobility, LANXESS, and Aquafil S.p.A.

In the automotive sector, nylon plays a critical role in manufacturing lightweight, durable components such as connectors, airbags, and engine parts. The drive for greater fuel efficiency and the rise of electric vehicles (EVs) have further accelerated the demand for nylon in automotive applications.

- In April 2024, Avient introduced a new range of durable orange nylon colorants for high-voltage EV connectors. These colorants enhance heat and long-term color stability without compromising flame retardancy or mechanical performance, meeting the increasing demand in the EV market.

Key Highlights:

- The nylon market size was recorded at USD 33.98 billion in 2023.

- The market is projected to grow at a CAGR of 5.04% from 2024 to 2031.

- Asia Pacific held a market share of 43.87% in 2023, with a valuation of USD 14.91 billion.

- The nylon 6 segment garnered USD 19.67 billion in revenue in 2023.

- The fibers and fabrics segment is expected to reach USD 27.10 billion by 2031.

- The automotive and transportation segment is anticipated to register the fastest CAGR of 8.48% during the forecast period.

Market Driver

"Rising Demand for Sustainable Materials and Growing Adoption of Circular Economy"

The focus on sustainable materials has increased within the fashion industry, as both consumers and brands place greater emphasis on eco-conscious alternatives. This trend is fostering the adoption of recycled and bio-based nylon, aligning with the growing demand for environmentally responsible production.

This is further supported by the growing adoption of circular economy and recycling innovation, where new technologies are enabling more efficient recycling of nylon, reducing waste, and making it a key component of sustainable production practices.

- In February 2024, Samsara Eco and lululemon launched the world’s first enzymatically recycled nylon 6,6 product. Samsara Eco’s technology is used to recycle waste nylon into new apparel, like the Swiftly Tech top, marking a major step toward a circular, sustainable fashion industry.

Furthermore, the growth of Nylon 6,6 in industrial and electronics applications is driving demand, as its superior thermal stability, durability, and lightweight properties make it increasingly valuable in automotive, electrical, and electronic components.

Market Challenge

"Environmental Concerns and Recycling Innovations"

The nylon market faces several challenges, with environmental concerns and recycling difficulties being among the most significant. The production of traditional nylon relies heavily on fossil-based resources, contributing to high carbon emissions and waste.

However, solutions such as the development of bio-based nylons and recycled nylon are addressing these concerns, offering more sustainable alternatives that reduce reliance on virgin materials and lower the environmental impact. Another challenge is the difficulty in recycling nylon, especially when it is blended with other materials, which complicates its recovery and reuse.

Thus, innovations in advanced recycling technologies, such as enzymatic recycling, are emerging to improve the efficiency of nylon recycling processes, enabling the creation of a circular economy for nylon products.

Market Trend

"Bio-based Nylon Production and Technological Advancements"

A key development is the rise of bio-based nylon production, where companies are shifting toward renewable feedstocks to reduce environmental impact and align with sustainability goals. This transition caters to the growing consumer and regulatory demands for eco-friendly materials.

- In November 2024, LG Chem and CJ CheilJedang signed a Heads of Agreement to create a joint venture for producing eco-friendly bio-nylon made from bio-based materials like corn and sugarcane. The bio-nylon, offering the same durability and heat resistance as petroleum-based nylon, targets textiles, automotive, and electronics while reducing carbon emissions.

Additionally, technological advancements in nylon performance are enhancing the material’s capabilities, making it increasingly suitable for a wider array of applications, particularly in high-demand sectors such as automotive and textiles.

Moreover, the development of high-performance polyamides is creating opportunities in industries that require superior durability, heat resistance, and chemical stability, such as aerospace, automotive, and electronics.

Nylon Market Report Snapshot

| Segmentation |

Details |

| By Type |

Nylon 6, Nylon 66, Others |

| By Application |

Fibers and Fabrics, Engineering Plastics, Films and Sheets, Other Applications |

| By End Use Industry |

Textile and Apparel, Automotive and Transportation, Industrial & Consumer Goods, Electronics, Others |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Nylon 6, Nylon 66, Others): The nylon 6 segment earned USD 19.67 billion in 2023, due to its versatility, durability, and widespread use in automotive, textiles, and consumer goods applications.

- By Application (Fibers and Fabrics, Engineering Plastics, Films and Sheets, and Other Applications): The fibers and fabrics segment held 56.09% share of the market in 2023, due to the increasing demand for nylon in the textile industry for apparel, home furnishings, and industrial applications.

- By End Use Industry (Textile and Apparel, Automotive and Transportation, Industrial & Consumer Goods, Electronics, and Others): The automotive and transportation segment is projected to reach USD 17.42 billion by 2031, owing to the growing demand for lightweight, durable, and high-performance materials in vehicle manufacturing, as well as the increasing adoption of nylon in EV components.

Nylon Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 43.87% share of the global nylon market in 2023, with a valuation of USD 14.91 billion. This growth is primarily driven by the robust demand for nylon across key industries such as automotive, textiles, electronics, and consumer goods, with countries like China, India, and Japan being major contributors to the market.

The region's rapid industrialization, expanding manufacturing capabilities, and growing consumer base have further accelerated the production and consumption of nylon. The region’s textile industry, in particular, plays a significant role, driven by the growing demand for durable and high-performance materials in clothing, sportswear, and home textiles.

Additionally, the automotive sector, particularly with the rise of EVs, and the expansion of sustainable practices are further accelerating the production and consumption of nylon.

- In August 2024, Samsara Eco and NILIT announced plans to build the world’s first nylon 6,6 recycling facility in South East Asia. This partnership aims to create a closed-loop system for recycling nylon 6,6 textile waste into high-quality, infinitely recyclable polymers, addressing the environmental challenges of nylon 6,6 in the fashion and performance apparel industries.

However, the nylon industry in Europe is poised for significant growth at a robust CAGR of 5.12% over the forecast period. This growth is driven by the increasing demand for high-performance nylon in industries such as automotive, textiles, electronics, and construction.

The region’s strong focus on sustainability and innovation is also playing a key role, as manufacturers adopt eco-friendly materials and production methods, including bio-based nylons and recycled nylon products. Additionally, the region’s automotive industry is expanding its use of lightweight, durable nylon materials for applications in EVs and other high-performance systems.

Europe’s focus on sustainability, coupled with ongoing advancements in nylon production technology, positions the region as a key player in meeting both environmental and industrial needs.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. regulates nylon production and use through agencies like the Environmental Protection Agency (EPA), which monitors the environmental impact of nylon production under the Toxic Substances Control Act (TSCA), and the Food and Drug Administration , which oversees its use in food packaging and medical devices.

- The EU governs nylon under the REACH Regulation (Registration, Evaluation, Authorisation, and Restriction of Chemicals), requiring manufacturers to register and ensure the safe use of nylon and its chemical precursors.

- The government of China has introduced stricter environmental policies targeting nylon manufacturers, such as the National Green Manufacturing Plan, to curb pollution and promote eco-friendly alternatives. Nylon recycling has been incentivized through tax benefits and funding for circular economy projects.

- In Japan, nylon production and applications are regulated under the Chemical Substances Control Law and the Act on the Evaluation of Chemical Substances and Regulation of Their Manufacture. Japan actively promotes biodegradable alternatives and has strict limits on emissions from nylon manufacturing plants.

- On the international stage, The United Nations Environment Programme monitors the impact of synthetic materials like nylon on the environment and advocates for global standards in nylon waste management and recycling.

Competitive Landscape:

The nylon market is characterized by a number of participants, including both established corporations and rising organizations. These companies operate in a highly competitive environment, where innovation, cost-efficiency, and sustainability are key differentiators.

The established corporations benefit from economies of scale, extensive distribution networks, and strong brand recognition, while emerging players often focus on niche markets and technological advancements to carve out a competitive edge.

Both established corporations and emerging players are capitalizing on growth opportunities by expanding production capacities and entering new markets, particularly in regions with rising industrial activity.

- In August 2024, INVISTA Nylon Chemicals Co. completed the expansion of its nylon 6,6 polymer site at the Shanghai Chemical Industry Park, doubling its annual capacity to 400,000 tons. This expansion will meet the growing demand for high-quality products and enhance market responsiveness, supporting advancements in industries such as automotive, electronics, and consumer products.

List of Key Companies in Nylon Market:

- BASF

- DuPont de Nemours, Inc.

- Ascend Performance Materials Holdings Inc.

- Koch IP Holdings, LLC

- Asahi Kasei Corporation

- Formosa Plastics Corporation

- Evonik Industries AG

- UBE Corporation

- Celanese Corporation

- KURARAY CO., LTD.

- Avient Corporation

- Dow Chemical Company

- Indorama Ventures Mobility

- LANXESS

- Aquafil S.p.A.

Recent Developments (Partnerships /New Product Launch)

- In January 2025, Ascend Performance Materials introduced Nymax REC recycled nylon formulations, featuring post-industrial and post-consumer recycled content. These nylon materials provide high performance with strength, durability, and weather resistance, making them suitable for applications in transportation, consumer goods, and electronics.

- In November 2024, Aquafil Group launched the ECONYL Bespoke Collection, offering sustainable nylon yarns with finishes inspired by natural materials. The collection includes ECONYL ReLana, ReSeta, and Terra, all made from regenerated nylon 6. These yarns, designed for high-performance applications, offer durability, and stain resistance while contributing to a more sustainable textile industry.

- In September 2024, PUMA announced its first collaboration with London-based streetwear brand Aries, blending PUMA’s heritage with Aries’ luxe-streetwear esthetic. The genderless collection features experimental knitwear, double nylon pieces, and bold graphics, including water-repellent nylon jackets and pants with a skeletal "PUMA" graphic.

- In August 2024, Ascend Performance Materials announced the successful production of bio-circular nylon 6,6 using feedstocks derived from used cooking oil. This innovation expands Ascend’s Bioserve portfolio and results in a nylon 6,6 with a 25% lower carbon footprint compared to fossil-fuel-based nylon.

- In April 2024, NILIT announced a strategic joint venture with Shenma Industry Co., Ltd. to expand production capacity in China. This partnership combines NILIT’s global expertise in high-performance Nylon 6.6 fibers with Shenma’s leadership in the industrial market. The new facility is set to produce specialized products like Fully Drawn Yarns and Air Textured Yarns for industries such as home textiles and automotive.

- In January 2024, BASF and Inditex announced the launch of loopamiz, the first circular nylon 6 made entirely from 100% textile waste. Zara created a jacket made from loopamid, featuring components such as fabrics, zippers, and buttons all made from the innovative material. This collaboration marks a significant step toward sustainability and circularity in the textile industry.