enquireNow

Simultaneous Localization and Mapping Market

Simultaneous Localization and Mapping Market Size, Share, Growth & Industry Analysis, By Type (EKF SLAM, Fast SLAM, Graph-Based SLAM, Others), By Offering (2D SLAM, 3D SLAM), By Application (UAV, Robots, AR/VR, Autonomous Vehicles), and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: August 2025 | author: Versha V.

Market Definition

Simultaneous localization and mapping (SLAM) is a computational technique that enables autonomous systems such as robots, drones, and self-driving vehicles to create a map of an unfamiliar environment and determine their position within it.

It uses data from sensors like LiDAR, cameras, and inertial measurement units (IMUs) to perform real-time mapping and localization. This supports accurate navigation and obstacle avoidance in GPS-denied or unfamiliar areas. SLAM is widely used in robotics, augmented reality, autonomous vehicles, and unmanned aerial systems.

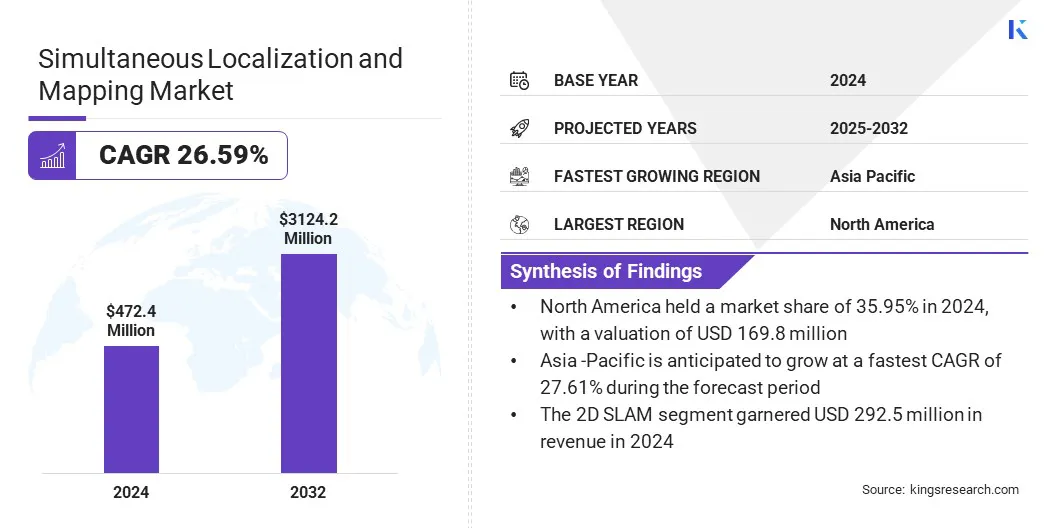

The global simultaneous localization and mapping market size was valued at USD 472.4 million in 2024 and is projected to grow from USD 597.1 million in 2025 to USD 3,124.2 million by 2032, exhibiting a CAGR of 26.59% during the forecast period.

The increasing implementation of SLAM in logistics automation and warehouse robotics is accelerating market growth by supporting autonomous navigation, optimizing workflow efficiency, and reducing operational costs in large-scale facilities. Moreover, growing SLAM integration with AR and VR is driving the market by enabling immersive experiences and improving spatial mapping.

Key Highlights:

- The simultaneous localization and mapping industry size was recorded at USD 472.4 million in 2024.

- The market is projected to grow at a CAGR of 26.59% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 169.8 million.

- The EKF SLAM segment garnered USD 171.1 million in revenue in 2024.

- The 2D SLAM segment is expected to reach USD 1,883.3 million by 2032.

- The UAV segment held a market share of 28.08% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 27.61% over the forecast period.

Major companies operating in the simultaneous localization and mapping market are Clearpath Robotics, MAXST Co., Ltd, Qualcomm Technologies, Inc, Martinez Geospatial, Slamcore Ltd, Ouster Inc, FARO, Kudan, NavVis, ABB Ltd, Boston Engineering, Intel Corporation, NVIDIA Corporation, SAMSUNG, and KUKA AG.

Simultaneous Localization and Mapping Market Report Scope

|

Segmentation |

Details |

|

By Type |

EKF SLAM, Fast SLAM, Graph-Based SLAM, Others |

|

By Offering |

2D SLAM, 3D SLAM |

|

By Application |

UAV, Robots, AR/VR, Autonomous Vehicles, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Simultaneous Localization and Mapping Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America simultaneous localization and mapping market share stood at around 35.95% in 2024, with a valuation of USD 169.8 million. This dominance is attributed to the growing integration of AI-powered mapping and spatial data services across the region. Enterprises in the region are investing in real-time localization and cloud-based mapping infrastructure to support the advancement of automated driving technologies.

The development of navigation systems designed for virtual testing and validation of automated driving features is accelerating SLAM deployment in automotive and mobility sectors by lowering testing costs, shortening development cycles, and enhancing safety, thereby contributing to market expansion in the region.

Moreover,organizations in the region are adopting advanced location and mapping platforms that can handle large volumes of real-time spatial data to support connected and automated vehicle systems, including autonomous driving and driver assistance applications. Regional enterprises continue to invest in localization technologies to enable precise navigation and spatial awareness, further supporting market expansion in the region.

- In January 2025, HERE Technologies partnered with AWS to support AI-driven mapping and location services for software-defined vehicles. The collaboration focuses on enabling real-time navigation and spatial data processing, contributing to SLAM-related applications in automated driving systems.

The Asia Pacific simultaneous localization and mapping industry is set to grow at a robust CAGR of 27.61% over the forecast period. This growth is attributed to the increasing adoption of visual SLAM technologies across emerging applications such as augmented reality broadcasting and advanced perception systems in the region.

Key players are deploying SLAM solutions for live event coverage, augmented reality content delivery, and immersive digital experiences. This is leading to wider adoption across sectors such as sports, entertainment, and digital media, in addition to established use in industrial robotics. The growing application scope is accelerating commercial deployment and technological advancement in the region.

Simultaneous Localization and Mapping Market Overview

Additionally, the integration of visual SLAM and edge AI in autonomous mobile robotics is driving the market by enabling cost-effective and scalable robotic solutions. It reduces reliance on expensive sensors such as LiDAR and supports real-time navigation in dynamic environments. This advancement is expanding SLAM adoption across logistics, manufacturing, and healthcare industries.

- In January 2025, NexAIoT launched its NexMOV-2 autonomous mobile robot at CES, featuring visual SLAM, AI-powered 3D vision, and Kneron’s KL730 NPU. Designed for industrial use, it enables precise navigation without LiDAR, offering scalable and efficient deployment.

Market Driver

Rising Adoption of SLAM in Logistics Automation and Warehouse Robotics

A key driver in the SLAM market is the rising adoption of SLAM technology in logistics automation and warehouse robotics. Logistics and warehouse operators are increasingly adopting autonomous mobile robots (AMRs) powered by SLAM technology to address growing supply chain complexity and labor shortages. These systems support efficient navigation and real-time decision-making which helps businesses to maintain high productivity and adaptability.

SLAM provides accurate localization and mapping within dynamic warehouse settings and reduces the need for fixed infrastructure. This shift drives greater efficiency and scalability for SLAM technology in modern intralogistics.

- In November 2024, Geek+ introduced its Vision-Only Robot Solution in partnership with Intel, featuring V-SLAM technology and Intel’s Visual Navigation Modules. The system enables autonomous mobile robots to navigate without external sensors, aiming to improve accuracy and efficiency in logistics operations.

Market Challenge

Integration Difficulties across Heterogeneous Hardware Platforms

Integration difficulties across heterogeneous hardware platforms present a significant challenge for the SLAM market. SLAM-enabled systems devices often use varying sensors, processors, operating systems, and communication protocols, making it complex to achieve seamless interoperability.

Ensuring compatibility between components such as LiDAR, cameras, IMUs, and embedded processors requires extensive calibration and customization. These inconsistencies can lead to performance lags, inaccurate localization, or system failures. Additionally, the lack of standardized interfaces and middleware increases development costs and slows down deployment across diverse robotic, automotive, and AR/VR applications.

To address this challenge, market players are developing modular and platform-agnostic SLAM solutions. They are focusing on building standardized middleware, APIs, and sensor fusion frameworks that support seamless compatibility with various sensors and processors.

Market players are investing in cross-platform SLAM libraries and leveraging open-source ecosystems such as ROS (Robot Operating System). Strategic collaborations with hardware manufacturers and adoption of AI-driven auto-calibration tools further help simplify integration, reduce development time, and ensure robust performance across diverse environments and devices.

Market Trend

Growing Use of Visual SLAM in Mobile Robotics

A major trend in the SLAM market is the growing use of visual SLAM in mobile robotics to enable real-time perception and autonomous navigation in complex environments. Robotics developers are integrating vision-based systems that combine camera data with AI algorithms to generate detailed spatial maps and track movement without relying on external infrastructure.

This prompts the deployment of intelligent robots across warehouses, factories, and service environments. These advancements are improving localization accuracy and environmental awareness, enabling mobile robots to achieve greater flexibility, scalability, and decision-making capabilities in industrial environments.

- In May 2024, ABB launched its Flexley Tug T702 autonomous mobile robot, featuring AI-enabled Visual SLAM technology and the AMR Studio software suite. The robot combines 3D vision and AI to differentiate between dynamic and static objects, operate independently in complex environments, and reduce commissioning time. The launch supports broader adoption of intelligent, scalable SLAM systems in logistics and manufacturing sectors.

Market Segmentation:

- By Type (EKF SLAM, Fast SLAM, Graph-Based SLAM, and Others): The EKF SLAM segment earned USD 171.1 million in 2024 due to its computational efficiency and widespread use in low-power embedded systems.

- By Offering (2D SLAM and 3D SLAM): The 2D SLAM segment held 61.92% of the market in 2024, due to its simplicity, lower processing requirements, and suitability for structured indoor environments.

- By Application (UAV, Robots, AR/VR, and Autonomous Vehicles): The UAV segment is projected to reach USD 878.2 million by 2032, owing to increasing deployment of SLAM-enabled drones for mapping, surveillance, and delivery operations.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates wireless communication and radio frequency spectrum used in SLAM-enabled devices. It ensures that sensors like LiDAR, radar, and wireless modules operate within authorized frequency bands to avoid interference.

- In China, the Ministry of Industry and Information Technology (MIIT) regulates SLAM devices by overseeing licensing, spectrum use, and compliance with cybersecurity and industrial standards.

- In India, the Telecommunication Engineering Center (TEC) under the Department of Telecommunications regulates technical standards for wireless sensors and communication interfaces used in SLAM systems. It certifies equipment for safety and electromagnetic compatibility.

Competitive Landscape

Major players in the simultaneous localization and mapping (SLAM) industry are integrating AI-powered 3D vision technologies to enhance spatial awareness and autonomous navigation in mobile robotic systems. They are focusing on improving the flexibility, accuracy, and scalability of SLAM solutions to support operations in dynamic, real-world environments.

Additionally, they are optimizing mapping systems for faster setup, developing algorithms that adapt to changing conditions and refining real-time data processing to ensure uninterrupted performance.

- In January 2024, ABB acquired Swiss startup Sevensense, a developer of AI-enabled Visual SLAM technology for autonomous mobile robots. The acquisition strengthens ABB’s position in next-generation AMRs by integrating 3D vision navigation into its robotics portfolio.

Key Companies in Simultaneous Localization and Mapping Market:

- Clearpath Robotics.

- MAXST Co., Ltd

- Qualcomm Technologies, Inc

- Martinez Geospatial

- Slamcore Ltd

- Ouster Inc

- FARO

- Kudan

- NavVis

- ABB Ltd

- Boston Engineering

- Intel Corporation

- NVIDIA Corporation

- SAMSUNG

- KUKA AG.

Recent Developments (Product Launch)

- In March 2025, Meta introduced the Aria Gen 2 smart glasses as a research-oriented device equipped with 6DOF SLAM cameras, real-time on-device processing, and multimodal sensors. Aimed at advancing machine perception, robotics, and accessibility research, the device serves as a platform for testing spatial awareness and AI-driven interaction.

freqAskQues